A VALUATION OF A U.S. REGIONAL BANK’S COMMOM STOCK Sheau-wen Jou

advertisement

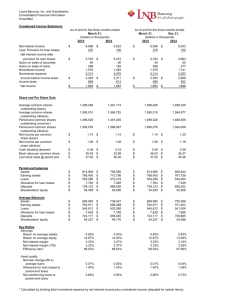

A VALUATION OF A U.S. REGIONAL BANK’S COMMOM STOCK Sheau-wen Jou B.S., National Taiwan University, Taiwan, 1995 M.S., National Taiwan University, Taiwan, 1997 PROJECT Submitted in partial satisfaction of the requirement for the degree of MASTER OF BUSINESS ADMINISTRATION (Finance) at CALIFORNIA STATE UNIVERSITY, SACRAMENTO FALL 2009 A VALUATION OF A U.S. REGIONAL BANK’S COMMOM STOCK A Project by Sheau-wen Jou Approved by: _____________________________, Committee Chair Hao Lin, Ph.D., CFA __________________________ Date ii Student: Sheau-wen Jou I certify that this student has met the requirements for format contained in the University format manual, and that this Project is suitable for shelving in the Library and credit is to be awarded for the Project. _____________________________________________ Monica Lam, Ph.D. Associate Dean for Graduate and External Programs College of Business Administration iii _____________________ Date Abstract of A VALUATION OF A U.S. REGIONAL BANK’S COMMOM STOCK by Sheau-wen Jou Statement of the Problem This report analyzes a mid-west regional bank in the U.S. that provides various banking and financial services to individuals and businesses. We call the bank ABC Bank for the purposes of confidentiality. To determine the appropriate investment recommendation for this company, I have applied discounted cash flow valuation and relative valuation approaches to determine whether its stock is undervalued, overvalued, or fair valued. In addition, in order to evaluate ABC Bank’s financial strength against unexpected losses, I have utilized its tier 1 capital and tangible common equity (TCE) ratios to judge its future viability. Source of Data I have analyzed the five-year historical data of ABC Bank’s 10Ks to determine the range and performance of the major items, such as loan balance, deposit balance, net interest margin, and efficiency ratios. Then, based on different assumptions of the economy, we iv have developed four scenarios to forecast financial performance over six years to determine the company’s earning capability and financial position. In addition, from ABC Bank’s proxy statements, we select other five mid-west regional banks to estimate ABC Bank stock’s fair value by the price-earnings and the price-tobook values ratios. The companies’ current stock prices, past year earnings, forecasted earnings, and book values of their common equities were required for the relative valuation approach. Conclusions Based on the residual income valuation for different scenarios, I estimate ABC Bank’s weighted average intrinsic value to be $15.87 per share and its target stock price to be $14.77 per share based on the review of PE multiples. As the economy showed signs of stabilization as of August 2009, ABC Bank is expected to improve its profitability in 2010. Accordingly, I would suggest that investors buy and hold at the current price of $10.29 per share and sell when it reaches the target price of $14.77 to $15.87 per share. Moreover, by forecasting ABC Bank’s tangible common equity ratio under different scenarios, I determine that the bank has enough financial strength to confront the unexpected loan losses. _____________________________, Committee Chair Hao Lin, Ph.D., CFA __________________________ Date v ACKNOWLEDGEMENTS I would like to express my appreciation to all those who helped me to complete this project. I would like to thank Jonathan E. Lederer, President of Lederer Private Wealth Management, LLC for giving me the opportunity to initiate this analysis. He also gave me a very thorough instruction about the nature of the banking sector and helped me develop the scenarios for different economic assumptions. I deeply appreciate my supervisor Prof. Hao Lin at the College of Business Administration of California State University, Sacramento. He taught the asset valuation class which stimulated my interests and enhanced my knowledge in this area. He always gave me very useful suggestions and encouraged me throughout this project. My English writing tutor, Ann Shadden, and my classmate, Jesse Dias, supported me in my research work for English style and grammar, correcting both and offering suggestions for improvement. My best classmate, Rula Shaban, supported me in the formatting of the document and encouraged me when I was stressed. I would like to thank them for all their help, support, interest and valuable suggestions. Finally, I would like to give my special gratitude to my husband David who sponsored me for the MBA education. Especially, his patience and love helped me to complete this work. vi TABLE OF CONTENTS Page Acknowledgements ............................................................................................................ vi List of Tables ................................................................................................................... viii List of Figures .................................................................................................................... ix Chapter 1. INTRODUCTION ........................................................................................................ 1 Purpose of the Study ............................................................................................... 1 Background of ABC Bank ...................................................................................... 1 2. METHODOLOGY ....................................................................................................... 3 Fundamental Valuation Approach .......................................................................... 3 Relative Valuation Approach .................................................................................. 5 3. ASSUMPTIONS ........................................................................................................... 7 Key Items ................................................................................................................ 7 Scenarios ............................................................................................................... 11 4. FUNDAMENTAL VALUATION.............................................................................. 16 Pro forma Financial Statements ............................................................................ 16 Intrinsic Value Estimation .................................................................................... 17 The Tangible Common Equity Ratio .................................................................... 19 5. RELATIVE VALUATION ........................................................................................ 21 Price-earnings (PE) ratio ....................................................................................... 21 Price-to-book value (PBV) ratio ........................................................................... 21 6. FINDINGS AND INTERPRETATIONS ................................................................... 23 Bibliography ..................................................................................................................... 41 vii LIST OF TABLES Page 1. Table 1 Assumptions for loan growth rate and interest rate for each of the four scenarios ....................................................................................................... 24 2. Table 2 Assumptions for deposit growth rate and interest rate for each of the four scenarios ....................................................................................................... 25 3. Table 3 Assumptions to estimate provision for loan losses ........................................ 26 4. Table 4 Predicted earnings summary and selected financial data for scenario 1 ........ 27 5. Table 5 Predicted earnings summary and selected financial data for scenario 2 ........ 28 6. Table 6 Predicted earnings summary and selected financial data for scenario 3 ........ 29 7. Table 7 Predicted earnings summary and selected financial data for scenario 4 ........ 30 8. Table 8 Predicted intrinsic value of scenario 1 ........................................................... 31 9. Table 9 Predicted intrinsic value of scenario 2 ........................................................... 32 10. Table 10 Predicted intrinsic value of scenario 3 ....................................................... 33 11. Table 11 Estimated intrinsic values and assigned weight of average for different required rate of return and scenarios ............................................................ 34 12. Table 12 Tier 1 capital ratios and TCE ratios from 2004~2008 ............................... 35 13. Table 13 Predicted TCE Ratios for each of the four scenarios ................................. 36 14. Table 14 ABC Bank’s PE ratio compared to its peer companies ............................. 37 15. Table 15 ABC Bank’s PBV and price-to-tangible-book value ratios compared to its peer companies............................................................................................. 38 viii LIST OF FIGURES Page 1. Figure 1 Relationship between ABC Bank’s provision for loan losses and Milwaukee ISM rolled forward one quarter (Inverse scale) from 2003 Q1 to 2009 Q2. ...................................................................................................................... 39 2. Figure 2 Stock performance comparison of ABC Bank, S&P 500 index and regional bank index from 5/1/2009 to 9/1/2009 ........................................................ 40 ix 1 Chapter 1 INTRODUCTION Purpose of the Study Due to the financial crisis and economic recession in 2008, U.S. bank failures have increased dramatically in 2009 as financial institutions continue to work through nonperforming loans that were made during the credit boom. In order to stabilize the financial sector after the 2008 subprime mortgage crisis, the U.S. government proposed the Troubled Asset Relief Program (TARP). This report analyzed a midcap, mid-west regional bank that received bailout funds from the TARP program, which will be referred to by the pseudonym, ABC Bank. I have applied a discounted cash flow valuation approach to determine ABC Bank’s intrinsic value so that recommendations can be made to buy, hold, or sell its stock. In addition, I compared its price-earnings ratio and price-to-book value ratio to those of other banks of its peer group and have analyzed its historical data to determine whether its stock is undervalued, overvalued, or fair valued. Finally, in order to evaluate the ability of ABC Bank to pay its debts of all types, I have analyzed its tier 1 capital and tangible common equity (TCE) ratio to judge its future viability. Background of ABC Bank ABC Bank is a mid-west regional bank in the U.S. providing various banking and financial services to individuals and businesses primarily in Wisconsin, Illinois, and Minnesota. Banking and wealth management are its two major segments. Banking includes lending and deposits services to consumers, businesses, and governments and wealth management includes investment management and advisory services. Its net 2 income is the result of net interest income plus noninterest income, and then subtracts provisions for loan losses, noninterest expenses, and income taxes. In November 2008, it sold 525,000 shares of preferred stock to the Capital Purchase Program (CPP) under the Troubled Asset Relief Program (TARP). ABC Bank is listed on NASDAQ and its market capitalization is $1.32 billion on September 09, 2009. 3 Chapter 2 METHODOLOGY In order to assess an appropriate range of ABC Bank’s equity value, I have conducted a fundamental valuation approach and a relative valuation approach to determine whether the ABC Bank’s stock is overvalued, undervalued, or fair valued. The fundamental valuation approach, also referred to as the discounted cash flow valuation, estimates the intrinsic value of an asset by evaluating the present value of its expected future cash flows. In contrast, the relative valuation approach evaluates the value of an asset by examining the pricing of comparable assets relative to common variables such as earnings and book value. Fundamental Valuation Approach In a fundamental valuation, the intrinsic value of an asset is expressed by the present value of its future cash flows at an appropriate discount rate. The future cash flows of equity can be defined as expected dividends paid to shareholders, expected free cash flows to equity, or projected excess returns by different situations. The appropriate discount rate is the required rate of return of shareholders or the cost of equity. For a financial institution, expected dividends and expected residual income are more appropriate than expected free cash flow to estimate the intrinsic value because it is difficult to estimate the reinvestment of capital expenditures and working capitals. However, because of the financial crisis in 2008, ABC bank has faced a significant decrease of its profit, which caused its management to change its dividend policy. Therefore, I have employed the residual income model to evaluate ABC Bank’s intrinsic value. 4 Residual income, also referred to as excess returns, is calculated by subtracting the company’s equity costs from its net income. Using the residual income model, I first estimated ABC Bank’s earnings and equity book value from 2009 to 2014 based upon different economic conditions. The equity costs is the equity book value times the required rate of return. After subtracting the equity costs from the net income, we can calculate the residual income for each year from 2009 to 2014. Then, ABC Bank’s intrinsic value was determined by adding the beginning equity book value to the sum of the present value of residual income for the forecasted time horizon. The expected future residual income was estimated according to the following steps: 1. Analyzed the five-year historical data of ABC Bank’s 10Ks from U.S. Securities and Exchange Commission (SEC) filings to determine the range and performance of the major items, such as loan balance, deposit balance, net interest margin, and efficiency ratios. The financial statements were downloaded from SEC website <http://www.sec.gov/>. 2. Set four scenarios to project financial performance over six years to determine the company’s earning capability under different economic conditions. Assumptions have been made for interest rates, loan growth, deposit growth, and the provision for loan losses. 3. Completed interlinked income statements, balance sheet statements, and the statements of cash flows to estimate the earnings and to make sure the predicted financial earnings and financial positions are consistent. 4. Subtracted the capital charge from the estimated net income to get the residual income for each year. 5. According to Dechow, Hutton, and Sloan (1999), residual income fades over time, so 5 to determine the value after the forecasted time horizon, a persistence factor was used to estimate the continuing residual income. Dechow et al. (1999) suggests the following equation to estimate the intrinsic value by the residual income model: 5 Vo B0 t 1 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 (Equation 2.1) Where B0 is the book value of equity at the beginning time of the analysis, NIt is the net income earned during the time period t, Bt-1 is the book value of equity at the beginning period of time t, r is the required rate of return for the equity, and ω is the persistence factor which is between 0 and 1. Because over time the firm’s net income regresses toward its equity cost, the persistence factor implies an annual decaying rate of residual income. Dechow et al. (1999) suggested that the persistence factor equaled 0.62 based on their research in a large sample of company data from 1976 to 1995. Relative Valuation Approach The relative valuation approach is an alternative to evaluate whether an asset is fairly valued, undervalued, or overvalued when compared to its benchmark or its historical average. Since operating income and sales or revenues are not easily measurable for a financial institution, the price-earnings (PE) ratio and the price-to-book value (PBV) ratio are more appropriate for valuing a financial service firm. These two ratios can be expressed as below: PE ratio = Price per share / Earnings per share (Equation 2.2) PBV ratio = Price per share / Equity book value per share (Equation 2.3) 6 In the PE ratio analysis, I used both trailing and forward PE ratios to estimate ABC Bank’s price range. The earnings per share (EPS) of trailing PE ratio is the accumulated EPS for the past twelve months while the EPS of forward PE ratio is the estimated future earning performance. By referring ABC Bank’s proxy statements, I have selected five regional, mid-west banks to estimate ABC Bank’s fair value by the PE and the PBV ratios. 7 Chapter 3 ASSUMPTIONS Key Items Net Interest Income Net interest income is the major source of ABC Bank’s revenue. It is the difference between interest income on interest-earning assets and the interest expense on interestbearing deposits and other borrowings used to fund the company’s capital. Banks usually borrow short term funds and lend long term loans. When the shape of the yield curve is steep, the net interest margin would be higher which would be favorable to the net interest income. However, if the shape of the yield curve is flat or inverse, the net interest margin would be lower, which would be unfavorable to the net interest income. The categories to be analyzed in net interest income are interest income and interest expenses. Interest income is the sum of interest on loans and interest on investments. Commercial loan interest, residential mortgage interest and retail loan interest are the major components of interest on loans. Interest expenses are divided into interest on deposits and interest on short term borrowing. The interest on loans or deposits in forecasted time horizon is calculated by the annually average loan balance or deposits balance times the forecasted interest rates. The average loan/deposit balance can be simplified as the beginning loan/deposit balances plus the ending loan/deposit balances, and then divided by two. To project the net interest income, the loan balances and deposit balances from 10-K in 2008 have been utilized as the base data and the assumed interest rate and loan/deposit growth rate have been employed for the next six years for each of the four scenarios. Table 1 presents the assumptions of loan growth rate and interest rate on loans for each of the four scenarios from 2009 to 2014. When the 8 economy is expanding, we assume that the commercial loans, residential mortgages, and retail loans would grow and the interest rates would gradually increase. In contrast, when the economy is contracting, we expect that the loans would decrease and the interest rates would stay low or increase slowly. Table 2 demonstrates the assumptions of deposit growth rate and interest rate on deposits for each of the four scenarios. In a recovered and health economy, we assume that the deposits would grow and the interest rates would gradually increase. On the opposite side, in a contracted economy, we expect the deposits would stay at the same level of 2008 and the interest rate on deposits would decrease or stay low. Provision for Loan Losses The provision for loan losses is a non-cash charge to earnings which represents the credit risks for loan portfolios. It is the sum of the change in the allowance for loan losses and net charge offs. It can be expressed by equation 3.1. Provision for loan losses(t) = Allowance for loan losses(t) - Allowance for loan losses at the beginning of the period(t-1) + Net charged off(t) (Equation 3.1) The allowance for loan losses is the management’s estimate of an amount sufficient to cover possible credit losses in the loan portfolio on the balance sheet date. It can be represented as a function of a number of factors, including changes in the loan portfolio, net charge offs, and nonperforming loans. Net charge offs are the gross amount of loans charged off as bad debt, less recoveries collected from earlier charge-offs which means that poor credit quality loans that are not worth keeping on the books are eliminated from the loan portfolio. 9 Because of the financial crisis in 2008, ABC Bank’s provision for loan losses increased significantly compared to previous years which notably impacted the earnings for 2008 and 2009 first and second quarters. Thus, it is essential to determine the provision for loan losses to forecast earnings. Before estimating the provision for loan losses, the allowances for loan losses at the beginning of the period and the ending of the period and the net charge offs during the period must be determined. The allowance for loan losses and the net charge offs can be represented as equations below: Allowance for loan losses = Allowance for loan losses to total loans * total loans (Equation 3.2) Net charge offs = Net charge offs as a percentage of nonperforming loans * Nonperforming loans (Equation 3.3) As a result, the ratio of the expected nonperforming loans to total loans, net charge offs as a percentage of nonperforming loans, and the allowance for loan losses to total loans are utilized to predict the provision for loan losses. Table 3 presents the expected allowance for loan losses to total loans, nonperforming loans to total loans, and net charge offs to nonperforming loans for each of the four scenarios. Noninterest Income and Noninterest Expenses The major components of ABC Bank’s noninterest income are trust service fees, service charges on deposit accounts, card-based and other non-deposit fees, retail commissions, mortgage banking, bank owned life insurance income, and other income. By observing ABC Bank’s 10-K, the noninterest income is approximately 40% to 50% of the net 10 interest income from 2004 to 2008. Therefore, we assumed that the predicted noninterest income would be in between 40% to 50% from 2009 to 2014. ABC Bank’s noninterest expenses include personnel, occupancy, equipment, data processing, business development and advertising, stationery and supplies, other intangible asset amortization, courier, legal and professional, foreclosure/OREO, and other expenses. The efficiency ratio, which is noninterest expense divided by the sum of taxable equivalent net interest income and noninterest income, is used to evaluate the operating competence of a bank. By studying ABC Bank’s 10-K, the efficiency ratio is approximately 48% to 54% from 2004 to 2008. Therefore, we expected that the noninterest expense from 2009 to 2014 would fluctuate between of 50% to 60% for each of the four scenarios. Preferred Stock In November 2008, ABC Bank sold $525 million of Senior Preferred Stock to the Capital Purchase Program under the Troubled Asset Relief Program. The investment will have a dividend rate of 5% per year for the first five years and 9% annually thereafter. While any Senior Preferred Stock is outstanding, all of its dividends have to be fully paid before paying out the dividends on the common stock. Therefore, $26,250,000 must be paid annually from 2009 to 2013 and $47,250,000 must be paid annually from 2014 and thereafter before any dividends on common stock being distributed. 11 Scenarios To determine the excess returns of ABC Bank, the following four scenarios have been established to predict the operation performance and equity cost from 2009 to 2014. Scenario 1 Scenario 1 is the most optimistic case based on the assumption that the economy would begin to recover starting in the fourth quarter of 2009. In a recovered and healthy economy businesses would be encouraged to start to borrow for investments, so commercial loans could be assumed to start growing in 2010. We expected that residential loan would decrease in 2009 because of refinancing, and then grow at 5% annually from 2010 to 2014. Retail loans were expected to decrease 5% in 2009 and then it should grow at 5% annually from 2010 to 2014. Because people have more money to save, we assumed that deposits would grow gradually and the growth rate of total deposits would remain from 2% to 3% until 2014. The yield curve would be steep, which means the spread between long term and short term Treasuries is more than three percent. Therefore, we predicted that interest rates on both loans and deposits would gradually increase. Because we expected solvency of borrowers would be better starting from the fourth quarter of 2009, the provision for loan losses would gradually drop. We assumed the allowance for loan losses as a percentage of total loans would increase to 3.00% in 2009, decrease 0.5% annually for 2010 and 2011, and then stay at the level of 1.5% for the following year. Nonperforming loans as a percentage of total loans were predicted to decrease over the forecasted time horizon. Net charge offs to nonperforming loans were 12 expected to be 40% in 2009, start to drop annually, and then reach to the level of 20% in 2014. Scenario 2 Scenario 2 is the moderate case based on the assumption that the economy would begin to recover starting in 2010. Businesses would start to borrow for investments, so loans would be assumed to start to grow in 2011. It is assumed that deposits would grow slowly over the next six years. We expected that residential loan growth rates would decrease 6% in 2009 because of refinancing, and then gradually grow from 2010 to 2014. Retail loans were expected to decreases 7% in 2009 and then it should grow at 3% annually from 2010 to 2014. Because people have more money to save, we assumed that deposits would grow gradually and that the growth rate of total deposits would remain at 2% to 3% until 2014. However, because people are more conservative during the recession year, deposits grow 9.00% in 2009. As the economic prediction gets more optimistic, deposits are assumed to grow slowly at 0.75% for the following years. The yield curve would be steep, but both short term and long term interest rates would increase more slowly than scenario one. We assumed the commercial loan interest rates would be 6.00% in 2009, and then step up a quarter of percentage to 6.25% in 2010, and then stay at 6.50% until 2014. Residual loan interest rates are assumed to be 5.5% in 2009, and then increase a quarter of percentage to 5.75% in 2010, and keep at 6.00% until 2014. We expected retail loan interest rate would be 6.20% in 2009, 6.50% in 2010, and keep at 6.75% for the following years. We assumed that the interest rates on deposits would be approximately 1.50% in 2009, 1.75% in the 2010, and then stay at the 2.00% level from 2011 to 2014. 13 Because the solvency of borrowers was expected to be better in 2010 or later, the provision for loan losses would stay similar for the next two years then start to decrease. We assumed that the allowance for loan losses as a percentage of total loans would increase to 3.50% in 2009, then gradually decrease from 2010 to 2014. Nonperforming loans as a percentage of total loans were predicted to be 5.00%, 4.50%, 4.00%, 3.00%, 3.00%, and 2.00% from 2009 to 2014. We expected that net charge offs to nonperforming loans would be in the range of 40% to 45% in this scenario. Scenario 3 Scenario 3 is the slow recovery case based on the assumption that the economy begin to recover in 2011. Businesses would be still conservative about borrowing for investment so the loan growth would be negative then start to grow in 2011. We assumed that commercial loans would decrease 7% in 2009, 5% in 2010, and then grow at 2% annually from 2011 to 2014. We expected that residential loans and retail loans would decrease in 2009 and 2010, and then grow slowly from 2011 to 2014. Deposits were expected to stay at the same level for three more years and then start to grow in 2012. The yield curve was expected to be normal and both short term and long term interest rates would continue to drop then slowly increase starting in 2011. We assumed that interest rates on commercial loans and residual loans would drop in 2009 and 2010, and then gradually increase from 2011 to 2014. Retail loans interest rates were assumed to drop from 2009 to 2011, then gradually increase from 2012 to 2014. We expected that interest rates on deposits would decrease from 2009 to 2011, and then reach 3% in 2014. Because the solvency of borrowers would be still unfavorable in 2009 and 2010, the provision for loan losses would stay at a higher level until 2011 then start to decline. We 14 assumed that the allowance for loan losses as a percentage of total loans would increase to 4.00% in 2009 and 2010, decrease 0.5% annually from 2011 to 2013, and reach 1.75% in 2014. Nonperforming loans as a percentage of total loans were predicted to plateau at 5.5% in 2009 and 2010, and then gradually decrease to 2.5% in 2014. We expected that net charge offs to nonperforming loans would be 40% in 2009, jump to 60% in 2010, decrease to 50% in 2011, and then stay at 40% for the following years. Scenario 4 Scenario 4 is the most pessimistic case based on the assumption that the economy would not recover for at least six years. This scenario was designed to examine under the worst condition, how long the company could survive without raising extra funds. We assumed that businesses would still be conservative concerning borrowing for investments, so there would be no loan growth from 2009 to 2014. We assumed that commercial loans would decrease 9% in 2009, 5% in 2010, and then continue to decrease 3% annually until 2014. Residential loans were expected to decline 10% in 2009, and then continue to decrease 5% annually until 2014. We predicted that retail loans would decreases 10% in 2009, and continue to decrease 5% annually for the following years. Deposits were assumed to stay at the current level from 2009 to 2014. We assumed that the yield curve would be flat and both short term and long term interest rates would continue to drop and stay low. Therefore, we expected that interest rates on commercial loans, residual loans, and retail loans would continue to drop through the forecasted time horizon. Interest rates on deposit were expected to be 1.50% in 2009, 1.25% in 2010 and stay at the 1.00% level for the following years. 15 As we assumed that the solvency of borrowers would still be unfavorable through the forecasted time horizon, the provision for loan losses would continually increase over the next six years. We expected that the allowance for loan losses as a percentage of total loans would jump to 5.00% in 2009, and increase 1% annually for the following years. We also assumed that nonperforming loans as a percentage of total loans would continue to increase from 2009 to 2014. Net charge offs to nonperforming loans were expected to be 40% in 2009, jump to 60% and 70% in 2010 and 2011, and then remain at 75% for the following years. 16 Chapter 4 FUNDAMENTAL VALUATION Pro forma Financial Statements To predict future financial earnings and the book value of equity, we have completed interlinked income statements, balance sheet statements, and the statements of cash flows. By observing the historical income statements, the effective tax rate was assumed to be in the range of 25% to 30%. We also assumed that the investment securities as 35% of loan balances, other assets as 3.5% of total assets, and accrued expenses and other liabilities are as 2.00% of total liabilities. In addition, in order to eliminate the effect of changing dividend policy, dividend payouts were assumed to be $0.20 per share for the forecasted time horizon for each of the four scenarios. Table 4 represents the selected forecasted earnings summary and financial data for scenario 1. Even though the net interest income was predicted to increase in 2009, because of the rising of provision for loan losses, the net income was predicted to decrease. However, as the economy was expected to recover from the fourth quarter of 2009, the net income was forecasted to increase in 2010. The EPS was expected to be $0.02, $2.18, $2.77, $2.95, $2.67, and $2.95, and the book value per share was predicted to be $18.39, $20.38, $22.96, $25.71, $28.17, and $30.92 from 2009 to 2014. Table 5 corresponds to the selected forecasted earnings summary and financial data for scenario 2. Because the economic condition in 2009 was assumed to be weaker, the increased provision for loan losses would impair the profitability and ABC Bank was expected to face a net loss. As the economy is assumed to be recovering, the provision for loan losses was expected to decrease and the net income is expected to be positive 17 from the 2010. The EPS was expected to be -$0.51, $1.14, $1.42, $2.24, $2.31, and $2.35, and the book value per share was predicted to be $17.86, $18.80, $20.02, $22.07, $24.17, and $26.32 from 2009 to 2014. Table 6 describes the selected forecasted earnings summary and financial data for scenario 3. The economy was assumed to be recovering starting from 2011, so ABC Bank was expected to confront a net loss for 2009 and 2010. We expected that the provision for loan losses would decrease and the net income would be positive from 2011. The EPS was expected to be-$1.79, -$0.68, $1.12, $1.69, $1.88, and $1.43, and the book value per share was predicted to be $16.59, $15.71, $16.63, $18.12, $19.79, and $21.02 from 2009 to 2014. Table 7 represents the selected forecasted earnings summary and financial data for scenario 4. The economy was assumed to deteriorate over the forecasted time horizon. We expected that the provision for loan losses would destroy the profitability and equity value of ABC Bank. In this scenario, it is predicted that ABC Bank would fail to meet the minimum capital requirement of 8% in 2011 or 2012 during the forecasted time horizon. Intrinsic Value Estimation The intrinsic value of residual income was calculated by Equation 2.1, which represents the beginning book value plus the summation of the present value of net income less the equity charge. This figure is then added to the present value of terminal value. The beginning book value of equity is the value at the end of 2008. Net incomes for each period of the forecasted time horizon for each of the scenarios were derived from the pro forma income statements. Equity charges for each period were determined by multiplying the estimated book value of equity at the beginning of the period by the cost 18 of equity or the required rate of return. The terminal value was calculated by subtracting the equity charge from the net income of the last period. This figure was then divided by one plus required rate of return less the persistence factor. Because of the financial crisis in 2008, ABC Bank’s stock prices fluctuated from the previous twelve months, so the market required rate of return has been utilized instead of the company’s required rate of return. By referring to Damodaran’s analysis of historical equity risk premium and the current ten year U.S. Treasury Bonds rate, the required rate of return to analyze ABC Bank’s equity value was estimated to be in the range of 8% to 10%. Table 8 demonstrates the calculation of the intrinsic values of ABC Bank at various discount rates for scenario 1 and the suggested range of intrinsic value is $18.36 to $20.94. Table 9 demonstrates the calculation of the intrinsic values of ABC Bank at various discount rates for scenario 2 and the suggested range of intrinsic value is $15.63 to $17.80. Table 10 demonstrates the calculation of the intrinsic values of ABC Bank at various discount rates for scenario 3 and the suggested range of intrinsic value is $12.30 to $14.00. In scenario 4, because the negative earnings were expected to continue over the forecasted time horizon which was projected to erode the equity value, the intrinsic value was estimated to be $0. According to the Summary of Commentary on Current Economic Conditions of August 2009 by the Federal Reserve District, overall economic activity in the Minneapolis area was transformed from contracted to flat. Therefore, the economy is expected to begin to recover starting at the end of 2009 or the starting of 2010. In addition, the current shape of the yield curve is steep sloped, which is favorable to ABC Bank’s net interest margin. Moreover, Figure 1 demonstrates that ABC Bank’s provision for loan losses and the 19 ISM-Milwaukee index rolled forward one quarter are highly negative correlated with a correlation coefficient of -0.81. The ISM-Milwaukee index is the manufacturing index for Milwaukee which indicates the business activity in the Milwaukee, Wisconsin region. As the ISM-Milwaukee index started to rally from the second quarter of 2009, I expected the provision for loan losses of ABC Bank would gradually decrease from the end of 2009 or the beginning of 2010. Based on the observations above, the weight assigned to scenario 2 is 50%. The weight for scenario 1 and scenario 3 are 25% and 20%. The probability of the economy remaining contracted for more than six years is extremely low, so the weight assigned to the scenario 4 is 5%. The assigned weight for each scenario and discount rate were given in Table 11 and the weighted average of ABC Bank’s intrinsic value is $15.87 per share. The Tangible Common Equity Ratio ABC Bank is subject to regulatory capital requirements administered by the federal regulators. The regulation defines the tier 1 capital ratio as the measure of a bank’s ability to provide protection against unexpected losses, which is represented as the ratio of a banks equity capital to its total assets. Failure to meet minimum tier 1 capital requirements could result in certain mandatory actions by regulators, which could have a direct material effect on the rights of its common shareholders. ABC Bank’s minimum requirement for the tier 1 risk-based capital ratio is 8%. In Table 12, the historical tier 1 risk-based capital ratios are 9.64%, 9.73%,9.42%, 9.06%, and 11.91% from 2004 to 2008, which suggests ABC Bank may have the enough financial strength to confront the unexpected losses. However, since common equity provides a cushion against credit losses, the tangible common equity (TCE) ratio is a better measure of solvency than the tier 1 capital ratio. 20 The TCE ratio is tangible common equity divided by tangible assets. For a regional bank, a ratio of the level at 5% is suggested to be adequate. In Table 12, ABC Bank’s TCE ratio is in between 5.86% to 6.36% from 2004 to 2008. We also calculated the TCE ratio for each of the four scenarios in order to predict ABC Bank’s future solvency. In the most optimistic scenario, the TCE ratios are expected to maintain at a higher level for the following six years. In the moderate recovery scenario, the TCE ratios are expected to decrease in 2009 and then start to improve and maintain at a higher level from 2010. In the slow recovery scenario, the TCE ratios are expected to fall below 5% in the first three years and then start to improve after 2012. In the most pessimistic scenario, the TCE ratios are expected to fall below 5% for every year of the forecasted time horizon and the tangible common equity is expected to be negative, so ABC Bank is not expected to be viable in this scenario. From the analysis of the four scenarios, it is suggested that except the extremely unfavorable economic condition, ABC Bank would have enough cushion against its credit losses. 21 Chapter 5 RELATIVE VALUATION Price-earnings (PE) ratio Table 14 lists ABC Bank and its peer companies’ price on September 09, 2009, the EPS from third quarter of 2008 to second quarter of 2009, the estimated EPS for 2009 and 2010, and the corresponding price-earnings (PE) multiples. First, the average trailing PE ratio of peer companies was 19.64x with a median of 17.78x while ABC Bank’s trailing PE was 20.58x, which indicated that the price of $10.29 was overvalued based on the past four quarter’s earnings. Based on its past EPS, ABC Bank’s price was suggested to be $9.8 per share. However, since the stock price reflects the investors’ expectation of its future profitability, the forward PE ratio is also an important indicator. According to the estimation data on September 09, 2009 of analysts’ expected EPS at the end of 2010 <http://finance.yahoo.com>, the average forward PE ratio of peer companies was 16.41x with a median of 15.93x. Based on the scenario analysis, ABC Bank’s weighted average estimated EPS at the end of 2010 was expected to be $0.90, so its target price was suggested to be $14.77 per share to reflect the potential of future earnings. Price-to-book value (PBV) ratio Table 15 lists ABC Bank and its peer companies’ price on September 09, 2009, the book value per share, the tangible book value (the book value less goodwill and other intangible assets) per share, and the corresponding price-to-book value (PBV) multiples. The book values and tangible book value per share of the second quarter of 2009 were acquired from company SEC 10-Q filings. The average PBV ratio of peer companies was 1.14x with a median of 1.09x while ABC Bank’s PBV ratio was 0.55x. In addition, 22 the average price-to-tangible-book value ratio of peer companies was 1.96x with a median of 1.62x while ABC Bank’s PBV ratio was 0.95x. Based on both the PBV and price-to-tangible-book value ratios, ABC Bank was undervalued and the suggested price was approximately $21.20. One reason for ABC Bank’s underestimated price may be its low return on equity (ROE) because the PBV ratio of a firm in a stable growth stage can be determined by the differential between its ROE and its required rate of return. 23 Chapter 6 FINDINGS AND CONCLUSIONS Based on the residual income valuation, I estimate ABC Bank’s intrinsic value to be $15.87 per share, and its target stock price to be $14.77 per share based on the review of PE multiples. During the research period of this project (5/1/2009 to 9/9/2009), ABC Bank’s stock price ranged from $8.92 to $19.09 per share and the current price was $10.29 per share on 9/9/2009. As Figure 2 demonstrates, ABC Bank’s stock price performance was relatively weaker than the S&P 500 index and the KRE (regional bank index) during the period of this project. The possible reasons could be the announcement of a net loss in the second quarter and the high turnover rate of top management in August 2009. In addition, according to the Summary of Commentary on Current Economic Conditions of August 2009 by the Federal Reserve District, the commercial real estate markets continued to soften and investors may also have questioned whether the bank had allocated a sufficient allowance or declared an adequate provision for loan losses. However, as the economy showed signs of stabilization as of August 2009, it is anticipated to rebound from the state of recession. As long as ABC Bank can fulfill its capital requirements, it is expected to improve its profitability in 2010. And though profitability should greatly improve from 2009 conditions, it is not expected to reach the level of 2008 performance until 2011 or later. Accordingly, I would suggest that investors buy and hold at the current price of $10.29 per share and sell when it reaches the target price of $14.77 to $15.87 per share. 24 Table 1 Assumptions for loan growth rate and interest rate for each of the four scenarios 2009 2010 2011 2012 2013 2014 Scenario 1 -4.00% 5.00% 5.00% 5.00% 5.00% 5.00% Scenario 2 -5.00% 3.00% 2.00% 2.00% 2.00% 2.00% Scenario 3 -7.00% -5.00% 2.00% 2.00% 2.00% 2.00% Scenario 4 -9.00% -5.00% -3.00% -3.00% -3.00% -3.00% Scenario 1 6.00% 7.00% 8.00% 8.50% 9.00% 9.50% Scenario 2 6.00% 6.25% 6.50% 6.50% 6.50% 6.50% Scenario 3 5.50% 5.25% 6.00% 6.25% 6.50% 6.50% Scenario 4 5.50% 5.25% 5.00% 4.75% 4.50% 4.25% Scenario 1 -4.00% 3.00% 3.00% 3.00% 3.00% 3.00% Scenario 2 -6.00% 1.00% 2.00% 3.00% 3.00% 3.00% Scenario 3 -8.00% -3.00% 2.00% 2.00% 3.00% 3.00% Scenario 4 -10.00% -5.00% -5.00% -5.00% -5.00% -5.00% Scenario 1 5.50% 6.00% 6.50% 7.50% 8.50% 9.50% Scenario 2 5.50% 5.75% 6.00% 6.00% 6.00% 6.00% Scenario 3 5.00% 4.75% 5.00% 5.50% 6.00% 6.50% Scenario 4 5.00% 4.75% 4.50% 4.25% 4.00% 3.75% Scenario 1 -5.00% 5.00% 5.00% 5.00% 5.00% 5.00% Scenario 2 -7.00% 3.00% 3.00% 3.00% 3.00% 3.00% Scenario 3 -8.00% -3.00% 3.00% 3.00% 3.00% 3.00% Scenario 4 -10.00% -5.00% -5.00% -5.00% -5.00% -5.00% Scenario 1 6.20% 7.00% 8.00% 8.50% 9.00% 9.50% Scenario 2 6.20% 6.50% 6.75% 6.75% 6.75% 6.75% Scenario 3 6.20% 6.00% 5.80% 6.50% 6.75% 6.75% Scenario 4 6.20% 6.00% 5.80% 5.60% 5.40% 5.20% Commercial Loans Growth rate Interest rate Residential Mortgages Growth rate Interest rate Retail Loans Growth rate Interest rate 25 Table 2 Assumptions for deposit growth rate and interest rate for each of the four scenarios 2009 2010 2011 2012 2013 2014 Scenario 1 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% Scenario 2 8.00% 1.00% 1.00% 1.00% 1.00% 1.00% Scenario 3 0.00% 0.00% 0.00% 3.00% 3.00% 3.00% Scenario 4 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Scenario 1 1.50% 2.00% 3.00% 4.00% 5.00% 5.50% Scenario 2 1.50% 1.75% 2.00% 2.00% 2.00% 2.00% Scenario 3 1.50% 1.25% 1.00% 1.25% 2.00% 3.00% Scenario 4 1.50% 1.25% 1.00% 1.00% 1.00% 1.00% Scenario 1 0.00% -10.00% -10.00% -5.00% -5.00% -5.00% Scenario 2 50.00% -3.00% -3.00% -3.00% -3.00% -3.00% Scenario 3 0.00% 0.00% 0.00% -5.00% -5.00% -5.00% Scenario 4 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Scenario 1 2.50% 3.50% 4.50% 5.50% 6.50% 7.00% Scenario 2 2.50% 2.75% 3.00% 3.00% 3.00% 3.00% Scenario 3 2.00% 1.50% 2.00% 2.50% 3.50% 4.50% Scenario 4 2.00% 1.50% 1.50% 1.50% 1.50% 1.50% Interest-bearing Deposits, exclude brokered CDs Growth rate Interest rate Brokered CDs Growth rate Interest rate 26 Table 3 Assumptions to estimate provision for loan losses 2009 2010 2011 2012 2013 2014 Allowance for loan losses to total loans Scenario 1 3.00% 2.50% 2.00% 1.50% 1.50% 1.50% Scenario 2 3.50% 3.25% 3.00% 2.50% 2.00% 1.75% Scenario 3 4.00% 4.00% 3.00% 2.50% 2.00% 1.75% Scenario 4 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% Nonperforming loans to total loans Scenario 1 4.50% 3.50% 3.00% 2.50% 2.00% 1.50% Scenario 2 5.00% 4.50% 4.00% 3.00% 3.00% 2.00% Scenario 3 5.50% 5.50% 4.50% 3.50% 3.00% 2.50% Scenario 4 6.00% 6.50% 7.00% 7.50% 8.00% 8.00% Net charge offs to nonperforming loans Scenario 1 40.00% 35.00% 30.00% 30.00% 25.00% 20.00% Scenario 2 40.00% 45.00% 45.00% 40.00% 40.00% 40.00% Scenario 3 40.00% 60.00% 50.00% 45.00% 40.00% 40.00% Scenario 4 40.00% 60.00% 70.00% 75.00% 75.00% 75.00% 27 Table 4 Predicted earnings summary and selected financial data for scenario 1 2008 2009 2010 2011 2012 2013 2014 $1,776 $1,934 $2,105 Earnings summary Interest income $1,127 $1,144 $1,325 $1,576 -$431 -$355 -$475 -$641 $696 $789 $850 $935 $941 $915 $965 -$202 -$489 -$136 -$84 -$58 -$104 -$71 $494 $300 $714 $851 $883 $811 $894 $286 $316 $340 $374 $376 $366 $386 -$557 -$574 -$618 -$681 -$685 -$653 -$675 Pretax Income $223 $42 $436 $544 $574 $523 $604 Income tax expense -$54 -$12 -$130 -$163 -$172 -$157 -$181 Net income $169 $30 $306 $381 $402 $366 $423 -3 -$26 -$26 -$26 -$26 -$26 -$47 $164 $4 $280 $355 $376 $340 $376 128 128 128 128 128 128 128 $1.30 $0.02 $2.18 $2.77 $2.95 $2.67 $2.95 Interest expenses Net interest income Provision for loan losses Net interest income after provision for loan losses Noninterest income Noninterest expenses Preferred dividends Net income to common equity Shares outstanding EPS -$835 -$1,019 -$1,140 Selected financial data Year end balance Loans Allowance for loan losses $16,284 $15,595 $16,332 $17,105 $17,914 $18,763 $19,653 -$265 -$468 -$408 -$342 -$269 -$281 -$295 Loans, net $16,019 $15,127 $15,924 $16,763 $17,646 $18,482 $19,358 Total Assets $24,192 $24,711 $25,387 $26,166 $27,024 $27,868 $28,768 Deposits $15,155 $15,586 $15,951 $16,337 $16,776 $17,230 $17,701 Total Liabilities $21,316 $21,858 $22,281 $22,731 $23,239 $23,768 $24,318 Senior preferred stock $508 $508 $508 $508 $508 $508 $508 Common shareholder’s equity $2,368 $2,345 $2,598 $2,927 $3,277 $3,592 $3,942 Total shareholders’ equity $2,876 $2,853 $3,106 $3,435 $3,785 $4,100 $4,450 Book Value per share $18.53 $18.39 $20.38 $22.96 $25.71 $28.17 $30.92 $438 $555 $477 $502 $497 $508 $531 Cash flows data Cash flow from operating (In millions dollars, except per share data) 28 Table 5 Predicted earnings summary and selected financial data for scenario 2 2008 2009 2010 2011 2012 2013 2014 Earnings summary Interest income $1,127 $1,139 $1,195 $1,269 $1,288 $1,308 $1,330 -$431 -$361 -$419 -$470 -$472 -$475 -$478 $696 $778 $776 $799 $816 $833 $852 -$202 -$589 -$291 -$258 -$125 -$126 -$102 $494 $189 $485 $541 $691 $707 $750 $286 $286 $295 $312 $326 $333 $341 -$557 -$533 -$535 -$555 -$571 -$583 -$596 Pretax Income $223 -$58 $245 $298 $446 $457 $495 Income tax expense -$54 $17 -$73 -$89 -$134 -$137 -$148 Net income $169 -$41 $172 $209 $312 $320 $347 -3 -$26 -$26 -$26 -$26 -$26 -$47 Net income equity $166 -$67 $146 $183 $286 $294 $300 shares outstanding 128 128 128 128 128 128 128 $1.30 -$0.51 $1.14 $1.42 $2.24 $2.31 $2.35 Interest expenses Net interest income Provision for loan losses Net interest income after provision for loan losses Noninterest income Noninterest expenses Preferred dividends EPS Selected financial data Year end balance Loans Allowance for loan losses $16,284 $15,373 $15,792 $16,144 $16,525 $16,915 $17,315 -265 -538 -513 -484 -413 -338 -303 Loans, net $16,019 $14,835 $15,279 $15,660 $16,112 $16,577 $17,012 Total Assets $24,192 $25,484 $25,767 $26,089 $26,518 $26,958 $27,405 Deposits $15,155 $16,501 $16,627 $16,755 $16,885 $17,018 $17,153 Total Liabilities $21,316 $22,699 $22,862 $23,028 $23,197 $23,368 $23,542 Senior preferred stock $508 $508 $508 $508 $508 $508 $508 Common shareholder’s equity $2,368 $2,277 $2,397 $2,553 $2,813 $3,082 $3,355 Total shareholders’ equity $2,876 $2,785 $2,905 $3,061 $3,321 $3,590 $3,863 Book Value per share $18.58 $17.86 $18.80 $20.02 $22.07 $24.17 $26.32 $438 $587 $498 $503 $474 $483 $485 Cash flows data Cash flow from operating (In millions dollars, except per share data) 29 Table 6 Predicted earnings summary and selected financial data for scenario 3 2008 2009 2010 2011 2012 2013 2014 Earnings summary Interest income $1,127 $1,064 $977 $1,058 $1,148 $1,248 $1,350 -$431 -$348 -$287 -$271 -$361 -$491 -$678 $696 $716 $690 $787 $787 $757 $672 -$202 -$683 -$461 -$193 -$143 -$115 -$124 $494 $33 $229 $594 $644 $642 $548 $286 $272 $248 $299 $299 $295 $269 -$557 -$593 -$563 -$652 -$597 -$557 -$489 Pretax Income $223 -$288 -$86 $241 $346 $380 $328 Income tax expense -$54 $86 $25 -$72 -$103 -$114 -$98 Net income $169 -$202 -$60 $169 $243 $266 $230 -3 -$26 -$26 -$26 -$26 -$26 -$47 Net income equity $164 -$228 -$86 $143 $217 $240 $183 shares outstanding 128 128 128 128 128 128 128 $1.30 -$1.79 -$0.68 $1.12 $1.69 $1.88 $1.43 Interest expenses Net interest income Provision for loan losses Net interest income after provision for loan losses Noninterest income Noninterest expenses Preferred dividends EPS Selected financial data Year end balance Loans Allowance for loan losses $16,284 $15,085 $14,440 $14,762 $15,091 $15,449 $15,815 -$265 -603 -578 -443 -377 -309 -277 Loans, net $16,019 $14,481 $13,862 $14,319 $14,714 $15,140 $15,538 Total Assets $24,192 $24,050 $23,803 $23,920 $24,552 $25,229 $25,868 Deposits $15,155 $15,155 $15,155 $15,155 $15,545 $15,953 $16,374 Total Liabilities $21,316 $21,427 $21,292 $21,292 $21,734 $22,197 $22,680 Senior preferred stock $508 $508 $508 $508 $508 $508 $508 Common shareholder’s equity $2,368 $2,115 $2,003 $2,120 $2,310 $2,524 $2,680 Total shareholders’ equity $2,877 $2,623 $2,511 $2,628 $2,818 $3,032 $3,188 Book Value per share $18.53 $16.59 $15.71 $16.63 $18.12 $19.79 $21.02 $438 $518 $438 $399 $422 $418 $390 Cash flows data Cash flow from operating (In millions dollars, except per share data) 30 Table 7 Predicted earnings summary and selected financial data for scenario 4 2008 2009 2010 2011 2012 2013 2014 Earnings summary Interest income $1,127 $1,059 $967 $911 $863 $819 $779 -$431 -$348 -$288 -$231 -$221 -$221 -$221 $696 $711 $679 $678 $642 $598 $558 -$202 -$845 -$665 -$778 -$840 -$852 -$816 $494 -$134 $14 -$100 -$198 -$254 -$258 $286 $355 $340 $340 $321 $299 $279 -$557 -$608 -$612 -$612 -$578 -$538 -$502 Pretax Income $223 -$387 -$258 -$372 -$455 -$493 -$481 Income tax expense -$54 $115 $76 $111 $136 $148 $144 Net income $169 -$272 -$182 -$261 -$319 -$345 -$337 -3 -$26 -$26 -$26 -$26 -$26 -$47 Net income equity $164 -$298 -$208 -$287 -$345 -$371 -$384 shares outstanding 128 128 128 128 128 128 128 $1.30 -$2.33 -$1.61 -$2.24 -$2.70 -$2.91 -$3.01 Interest expenses Net interest income Provision for loan losses Net interest income after provision for loan losses Noninterest income Noninterest expenses Preferred dividends EPS Selected financial data Year end balance Loans Allowance for loan losses $16,284 $14,759 $14,021 $13,499 $12,997 $12,515 $12,053 -$265 -738 -841 -945 -1,040 -1,126 -1,205 Loans, net $16,019 $14,021 $13,180 $12,554 $11,957 $11,389 $10,848 Total Assets $24,192 $23,981 $23,615 $23,180 $22,697 $22,198 $21,695 Deposits $15,155 $15,155 $15,155 $15,155 $15,155 $15,155 $15,155 Total Liabilities $21,316 $21,427 $21,297 $21,168 $21,055 $20,953 $20,860 Senior preferred stock $508 $508 $508 $508 $508 $508 $508 Common shareholder’s equity $2,368 $2,046 $1,810 $1,504 $1,134 $737 $327 Total shareholders’ equity $2,877 $2,554 $2,318 $2,012 $1,642 $1,245 $835 Book Value per share $18.53 $16.05 $14.23 $11.80 $8.89 $5.78 $2.57 $438 $612 $522 $556 $559 $544 $516 Cash flows data Cash flow from operating (In millions dollars, except per share data) 31 Table 8 Predicted intrinsic value of scenario 1 2009 2010 2011 2012 2013 2014 Required rate of return = 8%, Persistence factor = 0.62 Beginning book value $18.53 $18.34 $20.31 $22.89 $25.63 $28.09 Net income $0.02 $2.18 $2.77 $2.94 $2.66 $2.94 Cost of equity $1.48 $1.47 $1.63 $1.83 $2.05 $2.25 Excess return -$1.46 $0.71 $1.15 $1.11 $0.61 $0.69 PV of excess return -$1.35 $0.61 $0.91 $0.81 $0.41 PV of terminal value 5 Vo B0 t 1 $1.02 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $20.94 Required rate of return = 9%, Persistence factor = 0.62 Beginning book value $18.53 $18.34 $20.31 $22.89 $25.63 $28.09 Net income $0.02 $2.18 $2.77 $2.94 $2.66 $2.94 Cost of equity $1.67 $1.65 $1.83 $2.06 $2.31 $2.53 Excess return -$1.65 $0.52 $0.95 $0.88 $0.35 $0.41 PV of excess return -$1.51 $0.44 $0.73 $0.62 $0.23 PV of terminal value 5 Vo B0 t 1 $0.57 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $19.60 Required rate of return = 10%, Persistence factor = 0.62 Beginning book value $18.53 $18.34 $20.31 $22.89 $25.63 $28.09 Net income $0.02 $2.18 $2.77 $2.94 $2.66 $2.94 Cost of equity $1.85 $1.83 $2.03 $2.29 $2.56 $2.81 Excess return -$1.83 $0.34 $0.74 $0.65 $0.10 $0.13 PV of excess return -$1.67 $0.28 $0.56 $0.44 $0.06 PV of terminal value 5 Vo B0 t 1 $0.17 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $18.36 (Per share data) 32 Table 9 Predicted intrinsic value of scenario 2 2009 2010 2011 2012 2013 2014 Required rate of return = 8%, Persistence factor = 0.62 Beginning book value $18.53 $17.81 $18.74 $19.96 $22.00 $24.10 Net income -$0.51 $1.13 $1.42 $2.24 $2.30 $2.34 Cost of equity $1.48 $1.42 $1.50 $1.60 $1.76 $1.93 Excess return -$1.99 -$0.29 -$0.08 $0.64 $0.54 $0.41 PV of excess return -$1.85 -$0.25 -$0.06 $0.47 $0.37 PV of terminal value 5 Vo B0 t 1 $0.61 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $17.8 Required rate of return = 9%, Persistence factor = 0.62 Beginning book value $18.53 $17.81 $18.74 $19.96 $22.00 $24.10 Net income -$0.51 $1.13 $1.42 $2.24 $2.30 $2.34 Cost of equity $1.67 $1.60 $1.69 $1.80 $1.98 $2.17 Excess return -$2.18 -$0.47 -$0.27 $0.44 $0.32 $0.17 PV of excess return -$2.00 -$0.40 -$0.21 $0.31 $0.21 PV of terminal value 5 Vo B0 t 1 $0.23 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $16.67 Required rate of return = 10%, Persistence factor = 0.62 Beginning book value $18.53 $17.81 $18.74 $19.96 $22.00 $24.10 Net income -$0.51 $1.13 $1.42 $2.24 $2.30 $2.34 Cost of equity $1.85 $1.78 $1.87 $2.00 $2.20 $2.41 Excess return -$2.36 -$0.65 -$0.45 $0.24 $0.10 -$0.07 PV of excess return -$2.15 -$0.54 -$0.34 $0.16 $0.06 PV of terminal value 5 Vo B0 t 1 -$0.09 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $15.63 (Per share data) 33 Table 10 Predicted intrinsic value of scenario 3 2009 2010 2011 2012 2013 2014 Required rate of return = 8%, Persistence factor = 0.62 Beginning book value $18.52 $16.54 $15.66 $16.58 $18.06 $19.73 Net income -$1.78 -$0.68 $1.11 $1.68 $1.87 $1.42 Cost of equity $1.48 $1.32 $1.25 $1.33 $1.44 $1.58 Excess return -$3.26 -$2.00 -$0.14 $0.36 $0.43 -$0.16 PV of excess return -$3.02 -$1.71 -$0.11 $0.26 $0.29 PV of terminal value 5 Vo B0 t 1 -$0.23 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $14.00 Required rate of return = 9%, Persistence factor = 0.62 Beginning book value $18.52 $16.54 $15.66 $16.58 $18.06 $19.73 Net income -$1.78 -$0.68 $1.11 $1.68 $1.87 $1.42 Cost of equity $1.67 $1.49 $1.41 $1.49 $1.63 $1.78 Excess return -$3.45 -$2.16 -$0.30 $0.19 $0.25 -$0.35 PV of excess return -$3.16 -$1.82 -$0.23 $0.14 $0.16 PV of terminal value 5 Vo B0 t 1 -$0.49 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $13.11 Required rate of return = 10%, Persistence factor = 0.62 Beginning book value $18.52 $16.54 $15.66 $16.58 $18.06 $19.73 Net income -$1.78 -$0.68 $1.11 $1.68 $1.87 $1.42 Cost of equity $1.85 $1.65 $1.57 $1.66 $1.81 $1.97 Excess return -$3.63 -$2.33 -$0.45 $0.03 $0.07 -$0.55 PV of excess return -$3.30 -$1.93 -$0.34 $0.02 $0.04 PV of terminal value 5 Vo B0 t 1 -$0.71 ( NI t rBt 1 ) NI 6 rB5 t (1 r ) (1 r )(1 r ) 5 = $12.30 (Per share data) 34 Table 11 Estimated intrinsic values and assigned weight of average for different required rate of return and scenarios Intrinsic value Scenario 1 Scenario 2 Scenario 3 Scenario 4 Assigned weight Scenario 1 (25%) Scenario 2 (50%) Scenario 3 (20%) Scenario 4 (5%) R=8% R=9% R=10% $20.94 $17.80 $14.00 N/A $19.60 $16.67 $13.11 N/A $18.36 $15.63 $12.30 N/A 5% 10% 4% 1% 15% 30% 12% 3% 5% 10% 4% 1% 35 Table 12 Tier 1 capital ratios and TCE ratios from 2004~2008 2004 Tier 1 risk-based capital ratio TCE Ratio 2005 2006 2007 2008 9.64% 9.73% 9.42% 9.06% 11.91% 6.18% 6.29% 6.36% 6.36% 5.86% (In millions dollars, except ratio data) 36 Table 13 Predicted TCE Ratios for each of the four scenarios 2009 2010 2011 2012 2013 2014 Scenario 1 Tangible common equity Tangible assets $1,343 $1,603 $1,939 $2,296 $2,618 $2,975 $23,709 $24,392 $25,178 $26,043 $26,893 $27,801 TCE Ratio 5.66% 6.57% 7.70% 8.82% 9.73% 10.70% Scenario 2 Tangible common equity Tangible assets $1,275 $1,401 $1,564 $1,832 $2,108 $2,388 $24,482 $24,771 $25,100 $25,536 $25,983 $26,438 TCE Ratio 5.21% 5.66% 6.23% 7.17% 8.11% 9.03% Scenario 3 Tangible common equity Tangible assets $1,113 $1,008 $1,132 $1,329 $1,549 $1,713 $23,048 $22,808 $22,931 $23,571 $24,254 $24,901 TCE Ratio 4.83% 4.42% 4.93% 5.64% 6.39% 6.88% Scenario 4 Tangible common equity Tangible assets $1,044 $819 $516 $153 - - $22,979 $22,619 $22,192 $21,716 - - 4.54% 3.62% 2.32% 0.70% - - TCE Ratio (In millions dollars, except ratio data) 37 Table 14 ABC Bank’s PE ratio compared to its peer companies EPS Company Price on Name 09/09/09 P/E Multiple Forward Forward P/E P/E (CY’09) (CY’10) 20.58x NA 9.44x $1.44 26.2x 25.59x 15.10x $0.43 $0.55 17.78x 25.44x 19.07x $1.20 $1.00 $1.22 14.93x 17.92x 14.69x $16.09 -$1.19 -$0.75 $0.96 NA NA 16.76x $10.55 -$4.02 $0.79 -$0.17 NA 13.35x NA Peer Group Mean of P/E Multiple 19.64x 20.58x 16.41x Peer Group Median of P/E Multiple 17.78x 21.68x 15.93x Q308 ~ Estimated Estimated Trailing Q209 CY’09(1) CY’10(1) P/E $10.29 $0.50 -$0.72(2) $0.90(2) U*B $21.75 $0.83 $0.85 O*B $10.49 $0.59 F**R $17.92 M**I F**B ABC Bank (1) The estimated EPS is the analysts estimate data in Yahoo! Finance on 09/09/09. http://finance.yahoo.com/ (2) The estimated EPS for ABC Bank is the weighted average EPS by the four scenarios. 38 Table 15 ABC Bank’s PBV and price-to-tangible-book value ratios compared to its peer companies Company Price on Name 09/09/09 Book value per share on 2Q09(1) Tangible PBV book value Multiple per share on 2Q09(1) PBV (Tangible) ROE Multiple ABC Bank $ 10.29 $ 18.68 0.55x $ 10.84 0.95x 2.2% U*B $ 21.75 $ 10.37 1.91x $ 5.16 4.21x 8.25% O*B $ 10.49 $ 9.59 1.09x $ 6.47 1.62x 3.96% F**R $ 17.92 $ 11.85 1.51x $ 10.12 1.77x 9.76% M**I $ 16.09 $ 24.01 0.67x $ 12.19 1.32x -4.23% F**B $ 10.55 $ 13.61 0.54x $ 8.58 0.86x -10.72% Peer Group Mean - 1.14x - 1.96x - Peer Group Median - 1.09x - 1.62x - (1) The book values per share and the tangible book value per share on 2Q09 were acquired from SEC filing 10-Q for second quarter of 2009 document of the companies. <http://www.sec.gov/> 39 Figure 1 Relationship between ABC Bank’s provision for loan losses and Milwaukee ISM rolled forward one quarter (Inverse scale) from 2003 Q1 to 2009 Q2. ISM-Milwaukee index (Rolled Forward One Quarter) $180 30 $160 35 $140 40 $120 45 $100 50 $80 55 $60 60 $40 65 $20 70 $0 75 1Q 2003 2Q 2003 3Q 2003 4Q 2003 1Q 2004 2Q 2004 3Q 2004 4Q 2004 1Q 2005 2Q 2005 3Q 2005 4Q 2005 1Q 2006 2Q 2006 3Q 2006 4Q 2006 1Q 2007 2Q 2007 3Q 2007 4Q 2007 1Q 2008 2Q 2008 3Q 2008 4Q 2008 1Q 2009 2Q 2009 3Q 2009 4Q 2009 ABC Bank's Provision for Loan Losses Loss Provisions * The ISM-Milwaukee index data were obtained from The Institute for Supply Management-Milwaukee (ISMMilwaukee). (http://www.ismmilwaukee.org/) 40 Figure 2 Stock performance comparison of ABC Bank, S&P 500 index and regional bank index from 5/1/2009 to 9/1/2009 ABC Bank S&P 500 KRE 140% 120% 100% 80% 60% 40% 20% 0% 2009/5/1 2009/6/1 2009/7/1 2009/8/1 2009/9/1 41 BIBLIOGRAPHY 1. Aswath Damodaran. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, 2nd ed. Wiley, 2002. 2. Aswath Damodaran. Equity Risk Premiums (ERP): Determinants, Estimation and Implications. Stern School of Business, 2008 3. Patricia M. Dechow, Amy Hutton, and Richard Sloan. “An Empirical Assessment of the Residual Income Valuation Model.” Journal of Accounting and Economics, (1999):1-34. 4. Frank J. Fabozzi, Franco Modigliani, and Frank J. Jones. Foundations of Financial Markets and Institutions, 4th ed. Prentice Hall, 2009. 5. Matthias Rieker, “Revamp Would Help Banks Boost Reserves: Provision Seeks to Avert Thin Capital Cushions That Helped to Worsen the Financial Crisis”, The Wall Street Journal, June 24, 2009 6. Maurice Tamman and David Enrich, “Local Banks Face Big Losses: Journal Study of 940 Lenders Shows Potential for Deep Hit on Commercial Property”, The Wall Street Journal, May 19, 2009 7. John D. Stowe, Thomas R. Robinson, R. Elaine Henry, and Jerald E. Pinto. Residual Income Valuation. CFA Program Level II Curriculum. Vol. 4. Equity (2009): 527576. 8. James M. Wahlen. “The Nature of Information in Commercial Bank Loan Loss Disclosures.” The Accounting Review, July 1994: 455-478 9. Marsha Wallace, "Is Fair-Value Accounting Responsible for the Financial Crisis?" Bank Accounting & Finance, December 2008-January 2009,9-18 10. Federal Reserve District, Summary of Commentary on Current Economic Conditions, 9 September 2009 42 11. Board of Governors of the Federal Reserve System, The Supervisory Capital Assessment Program: Design and Implementation, 24 April, 2009 < http:// www.federalreserve.gov/> 12. International Monetary Fund, World Economic and Financial Surveys: Global Financial Stability Report, Oct, 2009 <http://www.imf.org/>