INTERNATIONAL FEDERATION OF ACCOUNTANTS PROFESSIONAL ACCOUNTANTS IN BUSINESS (PAIB) COMMITTEE

advertisement

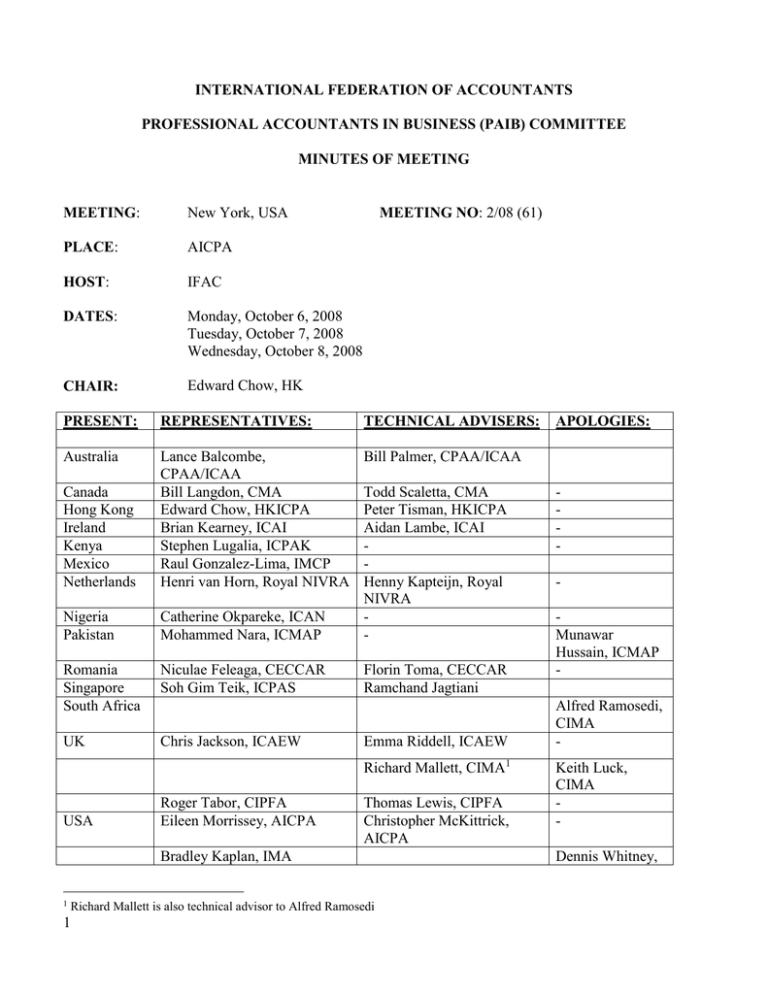

INTERNATIONAL FEDERATION OF ACCOUNTANTS PROFESSIONAL ACCOUNTANTS IN BUSINESS (PAIB) COMMITTEE MINUTES OF MEETING MEETING: New York, USA PLACE: AICPA HOST: IFAC DATES: Monday, October 6, 2008 Tuesday, October 7, 2008 Wednesday, October 8, 2008 CHAIR: Edward Chow, HK MEETING NO: 2/08 (61) PRESENT: REPRESENTATIVES: TECHNICAL ADVISERS: Australia Bill Palmer, CPAA/ICAA Canada Hong Kong Ireland Kenya Mexico Netherlands Lance Balcombe, CPAA/ICAA Bill Langdon, CMA Edward Chow, HKICPA Brian Kearney, ICAI Stephen Lugalia, ICPAK Raul Gonzalez-Lima, IMCP Henri van Horn, Royal NIVRA Nigeria Pakistan Catherine Okpareke, ICAN Mohammed Nara, ICMAP Todd Scaletta, CMA Peter Tisman, HKICPA Aidan Lambe, ICAI Henny Kapteijn, Royal NIVRA - Romania Singapore South Africa Niculae Feleaga, CECCAR Soh Gim Teik, ICPAS Florin Toma, CECCAR Ramchand Jagtiani UK Chris Jackson, ICAEW Emma Riddell, ICAEW Richard Mallett, CIMA1 USA Roger Tabor, CIPFA Eileen Morrissey, AICPA Thomas Lewis, CIPFA Christopher McKittrick, AICPA Bradley Kaplan, IMA 1 Richard Mallett is also technical advisor to Alfred Ramosedi 1 APOLOGIES: Munawar Hussain, ICMAP Alfred Ramosedi, CIMA Keith Luck, CIMA Dennis Whitney, Vietnam OTHER: IFAC Staff 1. Huong Lang Trinh Mai, ACCA Roger Adams, ACCA IMA - Ian Ball Stathis Gould Alta Prinsloo Vincent Tophoff Stephen Walker WELCOME AND AGENDA 1.1 Chairman’s introduction The chairman welcomed Ramchand Jagtiani, Aidan Lambe, Todd Scaletta and Peter Tisman as new technical advisors to the meeting. The chair explained that the PAIB Committee typically held two full meetings per year, one in April, normally hosted by one of the members, and another in October, normally in New York. Additionally, there were two technical Task Force meetings, typically one in North America in January and one in July in London or elsewhere in Europe. The Chair thanked Lance Balcombe and Brad Kaplan, who will be leaving the committee at end 2008, for their services to the committee and wished them well for the future. 1.2 Minutes of last meeting The minutes of the last PAIB Committee meeting, number 60, held on April, 2008 in Johannesburg were approved. 1.3 Notes of the July Task Force meeting. No comments. 2. THE IFAC BOARD REVIEW OF ACTIVITIES RELATED TO PAIB 2.1 The proposed project plan and progress report of the work of the IFAC Board’s review group. Ian Ball presented the review of the IFAC activities related to PAIBs as an opportunity to determine, prioritize and manage these activities. While the emphasis would be on better understanding the needs of professional accountants in business and how IFAC could clearly benefit member bodies in supporting their PAIBs, the review would also evaluate IFAC’s current activities and consider the vehicles for delivery, which would include the PAIB Committee, and options for alternative and/or complementary vehicles for helping IFAC to determine the appropriate services for professional accountants in business and to manage the process of development. The review was in response to the board’s willingness, particularly in the light of the IMA’s decision to resign its membership of IFAC, to reflect on what IFAC should do in relation to the PAIB constituency. It would also help IFAC management to deal with the question, What does IFAC do for PAIBs? The answer 2 to this question, in Ian Ball’s view, was much more than about what percentage of the total IFAC budget was spent on PAIB Committee activity. Rather, it was important to identify what IFAC could and should do for PAIBs. Ian Ball allayed the concerns of some committee members on the strategic intent of the review. It was the IFAC Board’s intention to ensure that resources were allocated to doing the most valuable things for PAIBs. The recent discussions with IMA were focused on what IFAC was not doing that it could usefully do rather than on lessening the importance of PAIBs. The review would be an opportunity for developing the IFAC objectives in relation to PAIBs and areas of service delivery in IFAC’s Strategic and Operational Plan for 2009-2012. Edward Chow highlighted that the Review Group was being chaired by an experienced PAIB (also IFAC Board member), and reinforced his role on the Group (and that of Chris Jackson) as links to the committee. Stathis Gould also stated that the PAIB Committee’s active work plan and deliberations on future topic selection would act as an input into the Review Group’s investigation. Lance Balcombe highlighted the dangers of trying to be all things to all people. Therefore, IFAC should take care not to raise expectations but rather focus its activities on those areas of thought leadership that clearly benefit many PAIBs. It would also be essential to ensure that the review would not distract attention and resource from the recent high quality work coming out of the committee. Roger Tabor emphasized that the review could establish and recognize the importance of PAIBs as value creators for all kinds of organizations. He suggested that it would useful if the survey would collect information of the various constituencies in which PAIBs work: industry, commerce, public sector etc, and took the opportunity of gaining a better understanding of these constituencies and their needs. However, it was agreed that the survey should not be over complicated at this stage, and that the survey should focus on what information was required now. Further information on the roles and domains of PAIBs could be sought as part of that project (agenda item 7). Brian Kearney suggested that IFAC’s predominantly audit perspective made it difficult for it to connect to PAIBs. For example, in his view, PAIBs had not been central in the considerations of the International Ethics Standards Board for Accountants. It would also be useful to examine why PAIBs remained member of their respective professional bodies – most only remained connected to the profession and paid their membership subscriptions to retain their professional title – as well as the rate of PAIBs leaving the profession. Aidan Lambe suggested that understanding what PAIBs do would be more important than where they work. The ICAA had around 65 per cent of its membership outside of practice and, like other member bodies represented around the table, they were continually evaluating how to deliver benefit of membership to this constituency. Ian Ball reminded the committee that most IFAC public interest activity committees/boards had half of their membership as non-practitioners (i.e. from outside the audit profession). Bill Langdon stressed that one of the most significant considerations and challenges for IFAC was effectively communicating the existence and value of its outputs for PAIBs. It would be inevitable that IFAC would need to consider spending more of its effort in promoting and disseminating existing publications, and proactively helping member bodies (as ‘retailers’) to use IFAC output to help them support their PAIBs. Bill also felt that the roles and domains project would be an opportunity to complement the review and help ascertain the similarities of PAIBs i.e. those competencies that distinguish them from other professionals. 3 Eileen Morrissey suggested that the review should focus on a clear definition of PAIBs, and considered whether IFAC should accept the full diversity of the constituency or narrow it down to address only the needs of those working in ‘core’ PAIB roles. Eileen Morrissey also suggested that the survey of member bodies could be an opportunity to identify those issues of high importance to PAIBs, rather than being merely a report card on how useful past IFAC outputs had been. Stathis Gould undertook to consider how the survey could be used for identifying PAIB needs and also explained that the survey would be complemented with focus groups of PAIBs to specifically consider their needs and to follow-up with them specific lines of inquiry revealed by the results of the survey of member bodies. Soh Gim Teik welcomed the review (as being an important governance mechanism, even when things seems to be going well) and the strategic intent for the review should be to ensure IFAC would be in a position to promote a leadership role for PAIBs, and therefore raising their perceived value in organizations. Stathis Gould confirmed that the survey of member bodies would be sent out in time to allow for feedback of results to the IFAC Board in November 2008. A final report of the review group would be delivered to the IFAC Board in February 2009. Agreed: The committee would be kept updated on the progress of the IFAC Board Review of activities related to PAIBs and involved at appropriate junctures. 3. COMMITTEE PLANS FOR FUTURE TOPIC SELECTION 3.1 Report from the former IFAC president, René Ricol, to the President of the French Republic on the Financial Crisis Ian Ball summarized the purpose of the report as to provide advice to the French government on a potential response to the credit crisis. Ian Ball’s contribution to the report was mainly to highlight the importance of convergence to International Auditing Standards and to contribute to the debate on fair value (mark-to-market) and to promote the importance of consistency between US GAAP and IFRS. He also felt that the uniform enforcement of international and US accounting standards also required attention, particularly around the rules to account for securitization-related commitments. 3.2 Plenary round table discussion: The financial crisis - the implication for member bodies and PAIBs, and activities being undertaken by member bodies in relation to the financial crisis. Ian Ball informed the committee that IFAC was working on a news release related to the credit crisis and the committee’s views and commentary was welcome. Ian explained that if IFAC decided to respond, the response would be fairly general, would not allocate blame and would not support a reversal of the IFRS requirements in relation to fair value accounting2. The committee discussed the current global financial crisis to determine its impact on professional accountants in business and how it related to current committee projects and future project selection. The committee welcomed the recent René Ricol (former IFAC President) report for the President of the French Republic on the crisis. This covered the alleged main causes of the financial crisis, its implications and possible measures to deal with some of the most important issues relating to the accountancy profession. The committee felt that the report provided useful background and relevant 2 See IFAC press release from October 17, 2008 at www.ifac.org/MediaCenter 4 discussion points to support all senior PAIBs in their roles in delivering effective oversight, governance, risk and internal control and ethical practice in organizations. Generally, the committee felt that the main issues and themes arising from the crisis connected to several recent and current projects on ethics, governance and control as well as business reporting. The following comments on the crisis were made during the discussion: 5 A difficulty in dealing with the crisis was that the scale of the problem was unknown (and deteriorating), and the size of the problems could only be determined when the banks had a transparent dialogue with regulators. To allow measurement, the nature (and interactions) of the problem also needed to be defined – was it the state of company balance sheets and/or the illiquidity in money markets? ; SOX internal control requirements had been ineffectual to prevent or counter this crisis, and at worst, provided management with a false sense of security. The management of financial services firms had overlooked or ignored strategic and macroeconomic risk, and in some cases had not properly understood the organization’s risk profile and exposure. Therefore, more regulation and control would not necessarily be the solution; Governance was less well developed in some financial services firms. Furthermore, finance functions in these companies tended to be less developed, and with PAIBs having less influence at a strategic level; The financial crisis was broadly attributable to a range of factors that included a financial industry that was innovative in developing new products (mainly derivatives) and poor oversight. Since the 1970s, there had been a revolution in how financial services companies understood as they bought and sold risk. With their emphasis on mark-to market, financial reporting standards highlighted economic reality as soon as the credit crunch took effect. The way out for the industry and the market-based system was to restore confidence so to unfreeze the money markets. However, the distressed prices of assets as highlighted by fair value measurement was not necessarily helping the restoration of confidence; The root cause of the crisis had been down to attitude rather than any specific accounting related issue. Many organizations in the financial services industry were highly leveraged, and despite regulatory oversight and banking supervision, there was a complacency from many that led them to not adequately question their business models; Investors expected transparency on organization performance, and fair value accounting was designed to deliver economic reality (under normal circumstances). The profession had generally been supporting greater transparency in financial reporting for many years, and it was perhaps not the time to consider suspending accounting standards that had arisen over time from a rigorous due process. Both the IASB and FASB were considering allowing a certain flexibility in applying fair value in illiquid markets and this should be supported. When an active market for a security did not exist (and it is clear fair value did not work in a distressed market situation), the use of management estimates that incorporate current market participant expectations of future cash flows, and include appropriate risk premiums, could be acceptable (if properly explained in narrative reporting); The way management and other employees of failing organizations have been incentivized is often the root cause of later problems. Bonuses were often associated with excessive risk taking and over-emphasized short term performance. Organizations could also make better use of predictive analytics to help ensure that there were forward looking insights and measures of risk; The committee’s work program covered a number of topics of relevance to the crisis – including governance, risk and internal control. It would be important to shape its existing work plan in a way that could respond to current issues. It could also be important for the committee to further consider supporting PAIBs in effectively managing risk and aligning governance and risk in a way that a company’s key risks are properly understood. Balance sheets need to be stressed tested as part of risk management, and risks should be managed on a proactive basis so that the exposure to emerging risks can be identified and assessed. This would particularly be the case in the financial services industry; Acting too quickly in response to the crisis could mean tackling symptoms instead of underlying causes. IFAC should be tempered in its response and consider the impact for its work program in a measured way; In Nigeria and Kenya, organizational failure occurred despite the introduction of more regulation and auditors were in the spotlight for providing clean audit opinions immediately prior to an organizational failure. Regulating the natural human tendency for creating excess could be challenging. Therefore, it would be important to reflect the importance of strong governance arrangements and traditional values. Agreed: The committee would be kept updated on any IFAC media releases related to the crisis. As the crisis unfolded and as financial institutions started to regain some semblance of stability, the committee would consider how to incorporate lessons learned into the planning of its forward work program. 3.3 Feedback on committee members’ responses on topic selection Stathis Gould presented some background context for the group discussions, including the comments that had been received by the Technical Managers from committee members and TAs in response to the Chair’s request in August. The key themes from the Task Force meeting in July included: Momentum for the IGPG program; Focused (few) projects dealing with emerging issues to support IGPG program; Structured process for topic and project selection at the New York meeting; Recognition that projects require a continued commitment over time to effectively disseminate; Consideration of the committee’s objectives and operations in 2009. The active (immediate) work program consisted of: IGPG development: EDs on governance and costing Cost of capital – project proposal Link to the Board project on business reporting 6 Other project development: Roles /domain/competencies of PAIBs - project proposal Other significant projects for completion in 2008: Sustainability framework Public sector performance survey report The committee’s feedback could be broadly summarized as: Governance and ethics: particularly important for developing nations (and also for all those financial institutions who apparently had governance in name rather than in spirit) and continues to be topical. Effective governance was a performance issue and conformance dominates (therefore, the conformance – performance balance continued to be a valid concept); Business reporting: Important for many PAIBs but should avoid duplication with e.g. the IASB pronouncements; Sustainability: Remains current & the committee should build on existing efforts; Performance management: an important topic for many PAIBs and poor planning, budgeting and/or forecasting often causes business failure; Risk & controls: important and current topics, and needs committee consideration; Cost of capital (as a reference framework for good practice) should be pursued; Promoting PAIBs: should be part of everything we do. The role of PAIBs often undersold and the committee was in a good position to take a global leadership position for the roles and competencies of PAIBs. Other comments: General: Current agenda big business focused/investor centric Pay more attention to needs of SMEs (private businesses) Raise profile of public sector applicability of existing output and ensure that future development of output considers public sector Specific: Preparer/auditor interface – has potential but needs to be further defined Improving technology: business intelligence The roles of PAIB in mergers and acquisition (note Enterprise Governance report) Financial analysis from an investor perspective Financial statement analytical tools International taxation Management of cash flow & cash generation Cost containment/expense control Commodity hedging. 3.4 Group session discussions on topic selection. In August, the Chair invited the committee to respond to the Task Force’s discussion on topic selection held at its July meeting. The Task Force’s straw man was intended to provide the committee with a target to facilitate the input of members and technical advisors, and to ultimately enable the technical managers to effectively structure committee discussions on topic selection. The responses mostly provided a useful 7 indication of committee members’ interests, and some provided preferences for the topics and issues the committee should consider pursuing in its work plan. The analysis of responses indicated four broad areas in which members most consistently suggested topics and issues. These formed the basis of four breakout groups covering: Governance and ethics; Business reporting; Performance management (including financial management topics); and Sustainability. Groups were provided six questions to help filter thoughts and ideas. Group feedback in plenary: Business reporting Group: Niculae Feleaga, Roger Adams, Richard Mallett, Florin Toma, Ramchand Jagtiani, Peter Tisman, Raul Gonzalez-Lima, Vincent Tophoff. Presenter: Florin Toma. Consider topic areas in business reporting: Financials Risk Remuneration Governance Strategy Human and intellectual capital CSR/sustainability (=) Business review Consider the following outputs/services in business reporting: Comment on business reporting issues in the current developments (credit crisis) Provide a response to the forthcoming IASB exposure draft on narrative reporting Implementation guidance on the IASB narrative reporting guidance IGPG on evaluating and improving (the behavioral aspects) of business reporting Business reporting framework (similar to the sustainability framework, bringing together the various relevant parts, with many links and references to other sources) Environmental scan of the industry specific KPI’s Information paper in specific financial and non-financial KPI’s Information paper on helping PAIBs effectively engage with financial auditors (the process of auditing financial statements / business reports) Consider the following vehicles (for our products) in business reporting: IGPG 20 Questions Framework 8 Interviews Why IFAC: Bringing together and forward the various national perspectives to a global view. Governance Group: Soh Gim Teik, Steve Lugalia, Bradley Kaplan, Henri van Horn, Aidan Lambe, Mohammed Nara, Brian Kearney, Stathis Gould. Presenter: Bradley Kaplan. General observations: Governance is an important area for positioning PAIBs at a strategic level. Any potential projects in this area should be relevant/topical to gain the buy-in/support of PAIBs and member bodies; Enterprise Governance project was pervasive and is still highly relevant and useful. It has been followed-up with the IGPG that would need continuous review and affirmation; In the governance area, there are many available codes at a international and national level, and the committee’s focus would be best placed on facilitating learning, and emphasizing the importance of mindset/values in ensuring effective governance, strategy and risk management; PAIBs and/or the finance function in both developed and developing nations, and in many sectors is key in promoting strong governance & oversight in organizations and therefore would benefit from global leadership. This could also help the financial services industry, in which the governance culture can be relatively weak, and checks and balances do not always work as they should. Furthermore, PAIBs tend to have relatively lower status in this industry. Consider the following outputs/services in governance (covering risk and internal control): Way forward: re-run of Enterprise Governance case study research undertaken in 2004. In order to test the Enterprise Governance framework and to explore what goes right or wrong in companies, IFAC (in association with CIMA) undertook a series of 27 short international case studies. These were drawn from Australia, Canada, France, Hong Kong, Italy, Malaysia, the Netherlands, Thailand, the United Kingdom and the United States. A wide range of industries was covered including telecoms, retailing, financial services, transportation, energy and manufacturing. Each case study focused on corporate governance practices and strategic issues such as the process of strategy development and the resulting choice of strategy. Material was drawn from published sources. The approach was enough to develop case studies that were sufficient to generate broad conclusions. A re-run of this approach would allow this work to be updated and allow the committee to test the principles in the IGPG on Evaluating and Improving Governance in Organizations, identify gaps and further learning points. A revised and updated Enterprise Governance report could also be possible. Why IFAC: IFAC is a unique position to run this exercise and to provide international perspective. How: member body involvement in case analysis is critical and it takes time to do and to analyze. To be relevant a quick turnaround would be desirable although an IFAC response could not be immediate, and it would be important to recognize that the current financial crisis still had not run its course. The current crisis could also lead to a paradigm shift in the way the financial services industry conducted its business and this was difficult to predict at this stage. 9 Performance management Group: Roger Tabor, Eileen Morrissey, Chris Jackson, Christopher McKittrick, Emma Riddell, Huong Lang Trinh Mai, Catherine Okpareke. Presenter: Eileen Morrissey. Balance of measures. The group felt that there were three perspectives to consider: Basic performance management, public sector performance management and advancing performance management topics. Their assumption was that the committee was already undertaking projects on the cost of capital, and any discussions on profitability analysis should be reserved until the costing IGPG is completed. General observations: Who is the audience: there was a broad audience of people impacted by performance management and it is a relevant topic for many PAIBs; IFAC could not necessarily be in the best position to undertake a project on the “basics” as there is much information already available. However, IFAC adds “expert credibility”, particularly in developing IGPGs. The group felt that the committee would have to be clear whether it was dealing with emerging issues in performance management or fundamental issues; Public sector performance management: there could be scope to build on the completed survey report. Further analysis and investigation would be necessary. However, developing nations in particular could value a push by IFAC to professionalize public sector organizations and to promote the importance of PAIBs. There was some useful CIPFA work on performance measurement in the public sector organizations (see http://learning.cipfa.org.uk/default.asp?content_ref=408) which could also help the committee, and there could be scope for an IGPG. Advancing performance management topics: 10 General observations: the key issues were predictive accounting, tying incentives to long-term performance, and IT. Predictive accounting (or being forward looking with performance measurement) was a thought leadership topic where good practice was not always clearly identifiable. It was important to understand the difference between short-term and long-term measures, and avoiding incentive schemes that tied incentives to short-term performance targets. Potential projects could be formed in the following areas: predictive measurement; typical performance measures/KPIs required to manage organizations; aligning incentives/remuneration to the long-term; business intelligence systems to support performance management. The issue of tying incentives to long-term measures of performance was a particular issue highlighted by the current crisis as needing further attention, and could be a priority project. What should be the scope of the project: should performance measures reflect changing economic/industry conditions? What are the human behavior implications of changing performance measures? How are performance measures tied to incentive compensation? Can performance measurement be a predictor of outcomes? How successful have balanced scorecards, etc. been? Evaluation of balance of financial and non-financial measures; Getting the right balance of KPI’s (long & short term); Measurement of the performance of support functions like IT and Finance. The audience would include board level, compensation/remuneration Committees, CFOs, and CEOs. Start with information/discussion paper and move to IGPG at a later stage. Sustainability (and other topics) Group: Todd Scaletta, Tom Lewis, Bill Langdon, Bill Palmer, Henny Kapteijn, Lance Balcombe. Presenter: Todd Scaletta The group suggested that a sustainability maturity model could help PAIBs and organizations use the sustainability framework and help with implementing the appropriate processes for their business context. A maturity model recognizes that organizations are at different stages of their development. Such a model could act as a roadmap helping organizations assess where they were on a scale from awareness to being embedded. At one end of the scale, awareness would involve understanding (minimum) compliance requirements. A transition stage could involve using metrics and measurement to improve sustainability performance. A more advanced embedded phase involved the integration of sustainability issues into strategic processes. The group felt that there was potential for a maturity model to form the basis of a practical implementation toolkit for assisting PAIBs to use the sustainability framework. The development of a maturity model would have to be linked to the role of PAIBs so that they understood how they could usefully help the organizations they were working with. While some PAIBs would be working at an operational level and could help with measuring energy consumption, and changing working practices to improve efficiency, others could be working at board level and wishing to take a leadership position. Other topics discussed by the group as being relevant: How to manage cash? How finance is changing and how it will impact PAIBs? 4. PUBLIC SECTOR SURVEY REPORT 4.1 To approve: an information paper based on the committee’s recent public sector survey The survey was originally intended to be a fact-finding project to help indicate the public sector issues that could be included on the committee’s agenda and in other committee projects. The results, however, provided a good temperature check on the current situation of public sector performance measurement in the various sectors and countries, which made the report interesting for a public sector audience. Therefore, the results were converted into an information paper that would help professional accountants in business and others in the public sector in the evaluation and further improvement of their own financial and non financial performance measurement systems. Roger Tabor explained that the full analysis of the results had taken considerable effort, and the project team was happy to present the analysis in a form that would be suitable for publication soon after the committee meeting. He explained that skewed response to the UK probably reflected the developed state of the public sector, and he added that the countries with the most responses were generally those who had committee members actively promoting the survey. 11 Edward Chow suggested that for future surveys and investigations, there should be a special request to BRIC countries for their participation. As a next phase, the committee may want to do more detailed profiling, for example researching regional comparisons, and exploring specific issues by country (such as the implementation of accrual based accounting and budgeting). The IPSAASB would be approached if the committee decided to explore further the adoption of accrual accounting in the public sector. The committee voted unanimously to: Approve the document subject to fine-tuning for publication in 2008. 4.2 To consider: the potential for a follow-up work program in the public sector area. See agenda item 3.4 and the last paragraph of 4.1 above. 5. SUSTAINABILITY 5.1 To approve: the proposed Sustainability Framework (and plans for dissemination). At its July meeting, the Task Force felt that the approach and content would work most effectively as a web-based resource on the IFAC website. The key reason for this was that the content was not best presented in a linear way. Many PAIBs would be interested in specific aspects of the framework according to their own role and will want to navigate directly to the relevant material. Few PAIBs would read the content from beginning to end. Additionally, a web-based format would allow the technical staff to easily update the content over time. Over the last few months, a few links had already become redundant and needed to be replaced. Good practice examples can also be added as and when appropriate. Helene Kennedy demonstrated the web-based tool which offered the committee an insight into how it would look and how the content would be accessible. This was well received. Helene Kennedy was excited that a different approach was being attempted to enable a more interactive and accessible approach to delivering IFAC output. The content had been reviewed by both the project team and IFAC Sustainability Experts Advisory Panel, and the feedback had generally been positive and constructive. Lance Balcombe said it was a good paper and Tom Lewis said it was readable and useful. The committee’s recommendations were: To keep climate change reporting in part D (Wider Stakeholder perspective) – according to some SEAP members, climate change reporting could feature in Part C as it was increasingly an investor (as well as a wider stakeholder) concern. Arguably, climate change was such a pervasive current issue, it could be featured in all levels of the framework. One SEAP member captured the challenge: “climate change is tricky as it is one substantive issue that is prominent now and needs to be addressed at each level”. Henny Kapteijn argued to keep climate change reporting in Part D on the basis that it was not a mainstream investor issue. The committee agreed and recommended to emphasize the crosscutting nature of the topic early in the introduction to the framework and appropriate places in other parts. 12 Retain overall 4-part structure: Another option put forward by a few SEAP members was to reorganize the framework structure. They suggested variations on the framework that would reduce it to three parts/levels – strategy, implementation, and reporting, or four parts if assurance was added separately. However, there had not been universal support for moving away from the current approach. The project team felt that some issues such as climate change would fall awkwardly irrespective of the structure adopted and the committee agreed that the framework should remain with the four part approach, which at least ensured that each was of a manageable size. Other recommendations were: In section D, reinforce the importance of independent assurance as a means to providing credibility to sustainability reporting. Revisit examples/case studies for appropriateness to ensure they continued to be appropriate, for example BP had a poor reputation in the US market. In part A, Rio Tinto’s targets for improvements were small and perhaps unimpressive. In some areas, more examples on social related issues could be included. Add a glossary of terms. Use the ‘fuller’ definition of sustainability on page 9 earlier on in the introduction. The Brudtland Commission’s definition was overly broad and lacked detail. It should also be clear early on that sustainability was about focusing on long-term value considerations. Reinforce the relevance and importance of the topic in the introduction. Do not confuse the term sustainable development with sustainability. Consider placing energy efficiency/waste management to the back of part B. Ensure the introduction states clearly that the framework was helpful to all organization types. Perhaps rename the internal management perspective so that it was immediately obvious as being the most useful section for a majority of PAIBs. Part B was also clearly linking sustainability to resource depletion and this could be perhaps highlighted in the introduction to the section. Add a reference in Part C on how investors include environmental, social and ethical issues in their investment criteria. Accompanying CFO questions could be more detailed. The committee voted unanimously to: Approve the document subject to amendments for publication in 2008. It would be circulated for a fatal flaw review before launch. Ideally, the launch would be before the (UK based) Prince of Wales Accounting for Sustainability project meeting in December involving a number of accountancy bodies from various parts of the globe convening to discuss their sustainability projects. IFAC would be involved. The executive summaries and other related dissemination material would be circulated to the committee to help their promotion of the web-based framework. 5.2 To receive: Information on the web-based delivery of the Framework. Helene Kennedy also presented on the IFAC communications plans and communication activities related to PAIBs – the presentation would be placed on the Intranet. 13 6. PLENARY SESSION - COMMITTEE PLANS FOR FUTURE TOPIC SELECTION: GROUP FEEDBACK See 3.4. 7. PROMOTING THE ROLE OF PAIBs 7.1 To consider: a project proposal for a project investigating what employers expect of PAIBs, and for subsequently reviewing the roles and domain information paper. Chris Jackson suggested that the number of members/TAs involved on the project team (9 so far) indicated the level of interest in the project and the perceived importance of the committee work in promoting the status of PAIBs. The main proposed outputs were an IFAC discussion paper on what employers expect of PAIBs in the next five to ten years and an updated IFAC information paper on the roles, domain and competencies of PAIBs. Chris Jackson emphasized that the project objective was focused on helping all IFAC member bodies to align their syllabi and training to what is required by the market. The committee was supportive of the proposed plan and offered the following suggestions: Although many PAIBs do progress their careers to CFO level, the discussion paper should recognize and include reference to the diversity of PAIB roles and clearly indicate that many work outside of finance. The career progression for many PAIBs was to work towards a role at a strategic level. Career progression also varied depending on country, for example in Germany people typically entered the workforce at a later stage; The discussion paper should look no further than 5 years ahead (10 years was too much); Public and not-for-profits sectors need good coverage. However, the project team should focus on the tasks that public sector PAIBs do that are different (of which there were some); Considering the views and perceptions of non-accountants. For example, a non-PAIB CFO could have a different view of the role of the PAIB. The project could canvass the view of non-member CFOs, particularly in economies such as Germany, Japan and China. At a minimum, the project team should recognize the how the profession was structured in countries where PAIBs do not exist; Considering how organization size impacts the view of the PAIB role. For example, and SME often requires a PAIB to have a broader remit; In some jurisdictions, educational background and skills acquired was considered more important than experience (such as in Latin countries). In others it was the other way around. The project could reflect the balance of skills/knowledge versus experience required in different parts of the world; The project should help member bodies to distinguish PAIBs from other para-professional types such as MBAs, CFAs etc. The project should recognize that the focus on audit was in long-term decline (as audit exemption thresholds rose around the world). Therefore, member bodies were looking to develop their markets and pursue growth strategies based on increasing PAIB numbers and support. Bill Langdon suggested that the committee be cautious on the way it viewed PAIBs and the labels used. At the end of the day, a CFO would broadly rely on a similar set of competencies whether they were initially trained as an accountant, lawyer, economist or scientist. The expectations of employers would be on the competencies of typical roles that PAIBs fulfill, although the paper should recognize that in many 14 cases AIBs (accountants in business – non-members) could fill the same role (i.e. so not to appear exclusive). It was the case that many non-members performed public interest roles. Chris Jackson asked members to submit links to all relevant papers their institutes had published related to the roles and domain of PAIBs. The committee voted unanimously to: Approve the project for further development. The project team consisted of: Chris Jackson (Chair): Richard Mallett, Bill Langdon, Soh Gim Teik, Henny Kapteijn, Huong Lang Trinh Mai, Eileen Morrissey, Steve Lugalia and Brian Kearney 8. BUSINESS REPORTING 8.1 To receive: a progress report on the IFAC Board project. The committee discussed the progress of the IFAC Business Reporting Board Project that would provide a global overview of the (regulatory) developments in the areas of governance, reporting, auditing and the usefulness of financial reports. Additional interviews with investors, preparers, auditors and regulators should influence participants in the financial reporting supply chain by providing good and inspiring examples (and explanations) on what should further be done, how and why in the area of business reporting. 9. COST OF CAPITAL 9.1 To consider: a project proposal for an IGPG on calculating and using the cost of capital. Richard Mallett explained that the project rational was based primarily on (a) the need to gather momentum on the development of IGPGs (cost of capital complemented the IGPG on Project Appraisal Using DCF), and (b) recognizing that the cost of capital was an important topic for those PAIBs, and nonaccountants, working in ‘technical’ roles in the finance area, and in ‘strategic’ roles involving investment decisions. This IGPG would particularly serve as a checklist for CFOs, treasurers and those PAIBs involved in investment appraisal and serve as the principal reference for professional accountants in business. The development and publication of an IGPG could highlight principles covering issues and areas that reflected common challenges and mistakes in organizations. Because it was such a complex topic, in which there was often no right answers, the Task Force had felt that the project team would need outside expert participation and advice. The Task Force had started to develop a ‘straw man’ of principles to be discussed with a number of experts in the field to ensure that the key challenges and mistakes made in practice had been adequately covered. This could also lead to an interview-led approach to developing the IGPG, and therefore providing it greater legitimacy and perhaps interest. It was the aim to have discussions with a couple of investors, several PAIBs (including an FD, someone involved in project appraisal, a treasurer), and at least one academic. These interviews could lead to a separate output – perhaps an article for use by member bodies, or an information paper. 15 Henri Van Horn suggested that a risk area for many organizations was that the models used to calculate the cost of capital, and the associated assumptions, could often remain unchecked and unchallenged for long periods. Therefore, these models and the underpinning assumptions should be transparent and revisited regularly. However, Lance Balcombe pointed out that reviewing the cost of capital, and in particular the measure of beta used to reflect risk, was not always best conducted in a distressed market. Roger Adams inquired whether there was a concept like “cost of funding” that needed consideration so that the paper could also apply to public sector organizations. Roger Tabor indicated that in some jurisdictions, the cost of capital to be used in the appraisal of government projects was provided. That said, there was government guidance in countries such as the UK, New Zealand and Australia that would have to be taken into account and referenced. The committee voted 17 in favor and one abstention to: Approve the project for development. Tom Lewis volunteered to join the project team – to be chaired by Richard Mallett. 10. ARTICLES OF MERIT AWARD UPDATE 10.1 To receive: A project update In total, 25 submissions had been received and the quality was generally high. The 5 judges were: Emma Riddell, Bill Langdon, Huong Lang Trinh Mai, Dennis Whitney and Mohammed Nara. The next stage was to place the articles on the IFAC website for reader review. If this took place in November, the final top ten could be announced by the end of 2008. 11. GOVERNANCE/COSTING 11.1 To consider: key themes arising from the responses to the proposed IGPG on Evaluating and Improving Governance in Organizations. So far, 10 responses had been received to the proposed IGPG in addition to three useful online responses. A brief summary was distributed among the committee. Seven responses originated from IFAC member or associate bodies. This demonstrated that there was still a challenge to engage other groups and solicit feedback from them. Henny Kapteijn highlighted that NIVRA, as was the case for many other member bodies, would engage PAIBs in preparing their response to an ED, but would submit only one common response. The responses were broadly supportive, offering some major and a large number of other suggestions to enhance the guidance. However, the principles in the IGPG were well supported. Therefore, the committee was of the view that the IGPG could be refined and published by the end of 2008 i.e. before the next committee meeting. The committee raised the following issues: As principles-based guidance, practical guidance should be limited and readers should be directed to other appropriate reference material; 16 Risk appetite was a difficult and nebulous concept for many PAIBs and organizations, and the IGPG should either expand its explanation or refer to another document for more useful guidance. Risk appetite could also be better communicated by many organizations; Explain the relationship between enterprise risk management and the concept of conformance and performance; Although the importance of values, mindset and culture featured in the IGPG (principle F), it should be checked whether it could not be highlighted further; The definition of governance in para 2.1 was inconsistent with principle A. Principle A could be enhanced with further explanation that emphasized the importance of how good governance supports stakeholder value, and what increasing stakeholder value actually meant; Enhance principle G to stress the importance of board members understanding their business, and having appropriate access to the business. Good practice examples of organizational success often show that board members have receive timely information and have good access to the business and its operations (so to understand the business from a business unit perspective). Failed companies often have had controlling CEOs who had limited the supply of information to board members, and their access to senior management; The specific role of internal audit would not require additional explanation. Edward Chow stressed that the dissemination of the IGPG would be an essential part of the committee’s work for 2009 and urged the committee members and TAs to consider how they promote and utilize the IGPG. The committee voted 17 for with one abstention to: Approve the IGPG for publication subject to amendments discussed at the meeting. It would be circulated for a fatal flaw review before publication. Also the pilot-project with the online feedback was briefly discussed. Although the number of responses was not high, this approach was generally viewed as useful to solicit additional feedback in a highly structured way from others than the usual respondents. 11.2 To consider: policy issues arising from the responses to the proposed IGPG on Costing to Drive Organizational Performance. Thirteen responses were received to the proposed IGPG (with more expected). Of the thirteen responses received, only four originated from member bodies. There was much interest from India and Pakistan (seven responses from individuals or groups of cost and management accountants), one response solicited from the Resource Consumption Accounting Institute, and a response from the Financial Management Standards Board (of the Association of Government Accountants in the US). The responses were mixed. Ten responses were broadly supportive with most offering relatively minor suggestions for additions to enhance the guidance. However, the response from the Resource Consumption Accounting Institute (RCA) contended that the IGPG could only succeed in its aim to support costing for management decisions if it was based on a set of principles that focused on costing for decisions to the exclusion of costing for external reporting purposes. The RCA response was underpinned by three management accounting philosophy papers published in the Journal of Cost Management that were available to the committee. These were being translated into an IMA Statement on Management Accounting on Foundational Principles for Management Accounting, and will almost certainly be useful to the committee in a wider context than this IGPG. 17 Henri Van Horn warned that the RCA’s methodology could largely be old wine in new bottles. Roger explained that some of the confusion captured in some of the suggestions of other respondents indicated that the committee had not done an adequate job in distinguishing between costing for decisions and costing for external reporting. The RCA response had reinforced this view. The Task Force had significant work to do in considering how to decouple the existing content so to prepare an IGPG that clearly differentiated between costing for decisions and costing for reporting. The project team would revisit the existing principles and guidance and consider additional principles so that it was clear that there were two separate applications of costing and each required a different mindset and approach. Eileen Morrissey also recommended that causality should be elevated, perhaps to principle status as this was the basis of understanding resource consumption. The redrafting process could be extensive although as Eileen suggested, the committee should not be sidetracked from the purpose of the IGPG which was to provide fundamental principles of costing. Therefore the IGPG would have to cater for both costing to support decisions and financial reporting and regulatory purposes. As with the governance IGPG, the committee reaffirmed that the IGPG’s purpose was to provide overarching principles to guide professional judgment in applying good practice rather than providing expansive practical guidance. Roger Tabor suggested that this IGPG could need some more detailed supporting guidance relative to other IGPGs to help provide adequate context to the principles. However, as was the case with all IGPGs, professional judgment would prevail. The ICAEW response noted that “we feel that it is a good example of what a IGPG should be, in that rather than a tutorial on basic techniques it focuses on principles and how they should be applied whilst exercising professional judgment”. The committee also supported the project team’s view that cost accounting and costing were not the same. At least one response proposed that the term costing should be replaced with cost accounting. The definition of cost accounting systems that was suggested for inclusion was: Preparation and presentation of accounting information based on classification and coding of data on cost centres and cost units either through integration of type-wise expenditures appearing in financial ledgers, through mapping them to cost centres or maintaining cost ledgers separately. However, the IGPGs primary purpose was intended to support PAIBs in applying a costing approach to better support management decisions. The use of the term cost accounting will provide the IGPG with a narrower scope that overly focuses on the collection and recording of cost data, which was only one part of an overall approach to costing, and principally of importance to supporting costing for external reporting. The committee agreed to: Consider a revised IGPG in April 2009. Assistance from other committee members and specialists would be sought. volunteered for the project team. 12. PAIB COMMITTEE OPERATIONAL PLAN 12.1 Revisit operational plan in light of discussions. In light of committee discussions, the active work plan was: • 18 IGPG development: – Publish IGPG on governance in 2008 – Redraft IGPG on costing for publication in 2009 Eileen Morrissey • • • – Development to begin on IGPG on cost of capital Information/discussion paper: – Roles /domain/competencies of PAIBs Other significant projects for completion in 2008: – Sustainability framework – Public sector performance survey report – And related dissemination activities (to continue in 2009) IFAC Board projects – Review of PAIB – Business reporting The pipeline development work from group discussions would be taken forward for further discussion by the Task Force. Committee members would be contacted about various projects. Reflecting on the discussions on day one in relation to the financial crisis, Brian Kearney felt that the committee would be perceived as irrelevant if it was not covering issues relating to the financial crisis. Henny Kapteijn suggested that IFAC should prepare an opinion on fair value accounting. However, some committee members were uncomfortable for IFAC to suggest suspending financial reporting standards. It was suggested that IFAC could play a useful role in highlighting what member bodies were doing in relation to the crisis. Edward Chow stressed that in view of the imminent issue of a number of IGPGs an important part of committee members’ (and their member bodies) work for 2009 outside the committee meetings would be the promotion of them to PAIBs and others in their organizations and urged committee members and TAs to give detailed thought on how they promote and utilize the various IGPGs and survey reports. He felt that the IGPG on Evaluating and Improving Governance covered many of the governance related issues that seemed to have gone wrong in organizations in the financial services industry. 13. FUTURE MEETINGS Hong Kong, April 22-24, 2009 19