Canadian Wheat Board University Of Lethbridge

advertisement

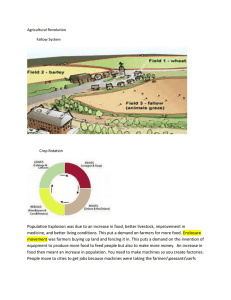

Canadian Wheat Board University Of Lethbridge 1 CWRS 13.5 vs. DNS 14 US$ /bu Average Price Received (USDA) MT Average Elevator Bid DNS ND ND DPC Offered DPC Paid PRO US$/bu Aug $ 5.46 $ 5.61 $ 5.84 $ 6.06 $ 4.85 $ 4.83 $ 5.08 Sep $ 6.42 $ 6.09 $ 7.03 $ 7.45 $ 6.43 $ 6.39 $ 6.59 Oct $ 6.69 $ 7.55 $ 7.98 $ 8.50 $ 6.99 $ 7.12 $ 6.50 Nov $ 6.81 $ 7.08 $ 8.24 $ 8.59 $ 7.22 $ 7.57 $ 6.33 Dec $ 7.60 $ 7.29 $ 10.07 $ 10.31 $ 8.70 $ 8.58 $ 7.32 Jan $ 8.50 $ 8.40 $ 11.46 $ 11.67 $ 10.02 $ 10.20 $ 7.99 $ 17.23 $ 17.83 $ 15.63 $ 16.97 $ 8.97 $ 9.69 $ 10.06 $ 7.37 $ 6.70 Feb to date Weighted Average 2 $ 6.50 $ 6.56 MT 1 CWAD 12.5 vs 1 HAD US$/bu Average Price Received (USDA) MT Average Elevator Bid Durum ND ND Aug $ 6.93 $ 6.64 $ 7.32 $ 7.31 $ 6.65 Sep $ 9.73 $ 7.05 $ 9.66 $ 10.58 $ 10.47 Oct $ 12.30 $ 9.50 $ 14.54 $ 15.18 $ 11.26 Nov $ 12.50 $ 9.13 $ 15.07 $ 15.38 $ 11.09 Dec $ 13.00 $ 10.60 $ 16.78 $ 17.63 $ 11.10 Jan $ 14.50 $ 11.90 $ 18.78 $ 19.18 $ 11.63 $ 21.45 $ 22.29 $ 12.65 $ 14.80 $ 15.36 Feb to date Weighted Average 3 $ 10.45 $ 8.15 MT PRO US$/bu SS CW Two-Row vs US Malt Barley US$/bu Average Price Received (USDA) MT Average Elevator Bid Malt Barley ND ND Aug $ 3.38 $ 3.65 $ 3.15 $ 3.20 $ 4.15 Sep $ 3.86 $ 3.73 $ 4.40 $ 4.19 $ 5.07 Oct $ 4.42 $ 4.02 $ 4.96 $ 4.81 $ 5.09 Nov $ 4.53 $ 3.22 $ 4.62 $ 4.62 $ 5.02 Dec $ 4.16 $ 5.15 $ 4.88 $ 4.61 $ 4.90 Jan $ 5.30 $ 4.13 $ 5.39 $ 4.77 $ 4.92 $ 4.89 $ 4.64 $ 5.00 $ 4.61 $ 4.41 Feb to date Weighted Average 4 $ 4.27 $ 4.12 MT PRO US$/bu Global Commercial Storage 110 U.S. 219 26 33 Argentina Australia 21 Canada 23 9 0 41 50 100 150 Millions of Tonnes Storage 5 Exports 200 250 Producer Cars 14,000 12,000 12,500 11,969 10,912 Railcars 10,000 7,933 8,000 6,000 4,000 2,883 2,342 2,320 2,000 0 '07/08 '06/07 '05/06 Crop Year Annual 6 To Nov 17 1,797 '04/05 Railway Service Performance Country Loading Performance for CWB Grain on CN/CP Lines 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Nov-07 Oct-07 Sep-07 CP Loading Percent Aug-07 Jul-07 Jun-07 7 May- Apr-07 Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Sep-06 Aug-06 CN Loading Percent 2006-07 Logistical Issues • Incremental Capacity – – • Lowering Supply Chain Costs – – – – • Churchill Producer cars Commercial agreements Tendering New rail allocation system introduced by CN Feb. 1, 2008 – – 8 Maximizing use of BN and trucking directly to the U.S. Taking advantage of lower freight rates a system where grain is “pushed” from origin, instead of being “pulled” to destination 6 grain shippers have applied to CTA for emergency relief Railway Costing Review • Freight cost on grain movement single largest marketing cost to farmers • Prior to the railway revenue cap – transportation costing review every four years • • Need to reduce farmer freight costs 9 CWB requesting that the CTA pursue the continuation of regular costing reviews to ensure productivity gains are shared with farmers Costing study • What is fair and adequate railway compensation? – July 2007 Travacon Costing Study reviewed 05-06 and 06-07 rail compensation Result: railways have been earning more than $6 per tonne in excess of fair and reasonable levels (50 per cent contribution rate versus 20 per cent) 10 Global agriculture • 11 World-wide, the agriculture industry is consolidating: – Four firms control over 70 per cent of world grain trade – A handful of companies dominate agriculture input production and sales – Farmers must vertically integrate to succeed Global concentration World wheat trade is controlled by a handful of very large players Annual company revenue (2006) 90.00 80.00 70.00 $CND Billions Billions of dollars Canadian 60.00 50.00 40.00 30.00 20.00 10.00 0.00 Cargill ADM Bunge L.Dreyfus Conagra AWB Annual company revenue (2006 available data) 12 CWB Domestic concentration • Viterra, Cargill and JRI – – 5 of 6 terminals in Vancouver and Prince Rupert 3 of 5 terminals Thunder Bay • Rationalization of CN’s and CPR’s networks increases captivity of farmers • Malting, milling, crushing, foreign owned 13 Concentration • • Canadian Industry – Millers – Maltsters – Handling companies 4,947 elevators (1970) 1,300 elevators (1998) 950 elevators (2000) 376 elevators (2005) 284 delivery points Transportation – – 14 6 major North American Railways Short lines Growing Region Distance from Water (kms from center of growing region to port) W. Canada 1,450 USA 650 - 1450 Argentina 350 15 France 320 Russia Ukraine 675 340 Australia 160-280 Always a Wheat Harvest Somewhere January February March April May June July August September October November December 16 World Wheat Harvests Argentina Mexico, India, Pakistan, U.S.(HRW), China, North Africa, Middle East U.S.(SRW), Eastern Europe Canada (CWRW), Russia, Ukraine, EU U.S.(HRS), Canada (CWRS), Kazakhstan, Australia, Brazil Argentina, South Africa Bilateral and Regional Free Trade Agreements • Canada’s key agriculture competitors are aggressively pursuing bilateral trade deals with key customers for Canadian grain. Canada is negotiating with: – Colombia, – South Korea, – Singapore, – Dominican Republic, – and Central America - 4. • Canada has 6 concluded agreements, 2 pending implementation and 6 under negotiation. • Continue to lobby the government for additional agreements with markets such as Morocco, Japan and South-East Asian nations. 17 Northern plains percent soil moisture: February 20, 2008 18 U.S. HRW February 2008 19 Western Canada Soil Moisture (November 1, 2007) Millimeters of Available Soil Water 0 mm to 25 mm (Very Dry) 25 mm to 50 mm (Dry) 50 mm to 100 mm (Moist) >100 mm (Wet) 20 CWRS Pool Returns to Farmers In store Vancouver or St. Lawrence Cdn$/tonne 400 375 350 325 300 275 250 225 200 175 150 125 100 6 -8 5 8 $390 $360 8 -8 7 8 0 -9 9 8 2 -9 1 9 4 -9 3 9 6 -9 5 9 8 -9 7 9 1CWRS 13.5 21 0 -0 9 9 2 -0 1 0 3CWRS 4 -0 3 0 6 -0 5 0 8 -0 7 0 P World Durum Production vs Consumption 45 40 35 Million Tonnes 30 25 20 15 10 5 0 2003-04 22 2004-05 2005-06 2006-07 Production Consumption 2007-08E 2008-09P Major Exporters Durum Wheat Exports (July-June) Million Tonnes 5 4 3 2 1 0 Canada U.S. 2006-07 23 EU-27 2007-08E Australia 2008-09P Others Source: CWB, IGC Durum Wheat Pool Returns to Farmers In store Vancouver or St. Lawrence Cdn$/tonne 550 500 450 400 350 300 250 200 150 100 50 0 8 87 6 $468 $439 $125 8 90 9 9 93 2 9 96 5 9 99 8 1CWAD 13% 24 0 02 1 3CWAD 0 05 4 0 08 7 P Pricing Alternatives • The following pricing alternatives are available to farmers: – Early Payment Option – prices based on Pool Return Outlook (PRO), best used as a cash flow tool for earlier payment. – Basis Price Contract – can price basis or futures separately. – Fixed Price Contract – provides a locked-in price. – Daily Price Contract – similar to the FPC except that it offers a spot basis and cash spreads based on the U.S. market. Note: Pricing contracts only – not delivery contracts PPO contracts require 100% application of tonnage 25 Direction and Planning • July 2007 board of directors planning session – unanimous agreement to focus on improving the flexibility and control farmers have in pricing and delivery • Goal to increase farmer flexibility and choice with more options within the single desk • A complete overhaul of programs to be considered where appropriate • Consider different programs for different crops / classes to address their specific marketing circumstances 26 Objectives • • • • Flexible and easy for farmers to use Provide farmers fair, reasonable and timely access to delivery Provide more predictable timing of delivery Better match farmers’ deliveries with CWB sales requirements – – – • • 27 Improved logistical efficiency Increased ability to capture sales opportunities Better overall return Farmers want a daily cash price Program risks must be manageable (price and basis risk) Improvements to existing programs for 2007-08 Changes approved by board of directors in October 28 • Enhanced guaranteed delivery contracts • Delivery exchange contract (DEC) expansion • Early payment option improvements • Expanded direct selection (malt barley) • Cash buying (feed barley) Moving Forward • • Consultations with farmers on new programs and program amendments for malting barley, CWRS and durum Programs approved by the board of directors in Nov. and Jan. board meetings: • CashPlus for malting barley • Pricing option year round on tonnage declared up front – CWRS pilot program to begin this July for 2008-09 • Defined delivery contracts – pilot program to begin • August 2008 for CWRS • Churchill specific contract Consultations on minor classes (CWRW, CPSR, CPSW, CWES, CWSWS) 29 Future Programs in the works for 2009-10 Lock in grade & protein spreads To enable farmers to lock in grade & protein spreads that are more reflective of market conditions – – Based on the PRO For FPC/BPC contracts Additional EPO lock-in options To provide more payment values to choose from (e.g. 75, 85, 95 per cent of PRO) 30