Efficient Portfolios with no short-sale restriction ch. 11 MGT 4850 Spring 2007

Efficient Portfolios with no short-sale restriction ch. 11

MGT 4850

Spring 2007

University of Lethbridge

Overview

• CAPM and the risk-free asset

– CAPM with risk free asset

– Black’s (1972) zero beta CAPM

• The objective is to learn how to calculate:

– Efficient Portfolios

– Efficient Frontier

Notation

• Weights – a column vector Γ (Nx1); it’s transpose Γ T is a row vector (1xN)

• Returns - column vector E (Nx1); it’s transpose E T is a row vector (1xN)

• Portfolio return E T Γ or Γ T E

• 25 stocks portfolio variance Γ T S Γ

Γ T (1x 25 )*S( 25 x25)* Γ(25x1)

• To calculate portfolio variance we need the variance/covariance matrix S .

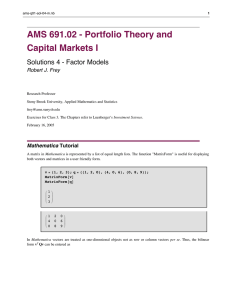

Simultaneous Equations

• Solve simultaneously for x and y: x + y=10 x − y=2

Calculating the efficient frontier

• Only four risky assets

Find efficient portfolios

• Minimum Variance

• Market portfolio

• You can not establish the frontier from only two efficient portfolios when there are no short sale restrictions

• CML

• SML