Chapter 8 Fundamentals of the Futures Market 1

advertisement

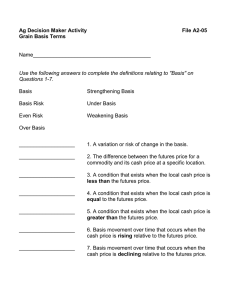

Chapter 8 Fundamentals of the Futures Market 1 © 2004 South-Western Publishing Outline 2 The concept of futures contracts Market mechanics Market participants The clearing process Principles of futures contract pricing Spreading with commodity futures Introduction 3 The futures market enables various entities to lessen price risk, the risk of loss because of uncertainty over the future price of a commodity or financial asset As with options, the two major market participants are the hedger and the speculator Introduction 4 A futures contract is a legally binding agreement to buy or sell something in the future Introduction (cont’d) 5 The person who initially sells the contract promises to deliver a quantity of a standardized commodity to a designated delivery point during the delivery month The other party to the trade promises to pay a predetermined price for the goods upon delivery Futures Compared to Options 6 Both involve a predetermined price and contract duration The person holding an option has the right, but not the obligation, to exercise the put or the call With futures contracts, a trade must occur if the contract is held until its delivery deadline Futures Compared to Forwards A futures contract is more similar to a forward contract than to an options contracts A forward contract is an agreement between a business and a financial institution to exchange something at a set price in the future – 7 Most forward contracts involve foreign currency Futures Compared to Forwards (cont’d) Forwards are different from futures because: – Forwards are not marketable – Forwards are not marked to market – 8 Once a firm enters into a forward contract there is no convenient way to trade out of it The two parties exchange assets at the agreed upon date with no intervening cash flows Futures are standardized, forwards are customized Futures Regulation In 1974, Congress passed the Commodity Exchange Act establishing the Commodity Futures Trading Commission (CFTC) – 9 Ensures a fair futures market Futures Regulation (cont’d) A self-regulatory organization, the National Futures Association was formed in 1982 – 10 Enforces financial and membership requirements and provides customer protection and grievance procedures Trading Mechanics Most futures contracts are eliminated before the delivery month – – 11 The speculator with a long position would sell a contract, thereby canceling the long position The hedger with a short position would buy a contract, thereby canceling the short position Ensuring the Promise is Kept The Clearing Corporation ensures that contracts are fulfilled – – – 12 Becomes party to every trade Ensures the integrity of the futures contract Assumes responsibility for those positions when a member is in financial distress Ensuring the Promise is Kept (cont’d) 13 Good faith deposits (or performance bonds) are required from every member on every contract to help ensure that members have the financial capacity to meet their obligations Ensuring the Promise is Kept (cont’d) Selected Good Faith Deposit Requirements Data as of January 2, 2004 14 Contract Size Value Initial Margin per Contract Soybeans 5,000 bushels $39,700 $1,620 Gold 100 troy ounces $41,600 $2,025 Treasury Bonds $100,000 par $108,000 $2,565 S&P 500 Index $250 x index $278,500 $20,000 Heating Oil 42,000 gallons $38,346 $3,375 Market Participants 15 Hedgers Processors Speculators Scalpers Hedgers A hedger is someone engaged in a business activity where there is an unacceptable level of price risk – 16 E.g., a farmer can lock into the price he will receive for his soybean crop by selling futures contracts Processors A processor earns his living by transforming certain commodities into another form – – 17 Putting on a crush means the processor can lock in an acceptable profit by appropriate activities in the futures market E.g., a soybean processor buys soybeans and crushes them into soybean meal and oil Speculators 18 A speculator finds attractive investment opportunities in the futures market and takes positions in futures in the hope of making a profit (rather than protecting one) The speculator is willing to bear price risk The speculator has no economic activity requiring use of futures contracts Speculators (cont’d) 19 Speculators may go long or short, depending on anticipated price movements A position trader is someone who routinely maintains futures positions overnight and sometimes keep a contract for weeks A day trader closes out all his positions before trading closes for the day Scalpers Scalpers are individuals who trade for their own account, making a living by buying and selling contracts – 20 Also called locals Scalpers help keep prices continuous and accurate Delivery Delivery can occur anytime during the delivery month Several days are of importance: – – – Several reports are associated with delivery: – 21 First Notice Day Position Day Intention Day – Notice of Intention to Deliver Long Position Report Principles of Futures Contract Pricing 22 The expectations hypothesis Normal backwardation A full carrying charge market Reconciling the three theories The Expectations Hypothesis The expectations hypothesis states that the futures price for a commodity is what the marketplace expects the cash price to be when the delivery month arrives – 23 Price discovery is an important function performed by futures There is considerable evidence that the expectations hypothesis is a good predictor Normal Backwardation Basis is the difference between the future price of a commodity and the current cash price – – 24 Normally, the futures price exceeds the cash price (contango market) The futures price may be less than the cash price (backwardation or inverted market) Normal Backwardation (cont’d) John Maynard Keynes: – – 25 Locking in a future price that is acceptable eliminates price risk for the hedger The speculator must be rewarded for taking the risk that the hedger was unwilling to bear Thus, at delivery, the cash price will likely be somewhat higher than the price predicated by the futures market A Full Carrying Charge Market A full carrying charge market occurs when the futures price reflects the cost of storing and financing the commodity until the delivery month The futures price is equal to the current spot price plus the carrying charge: F St C 26 A Full Carrying Charge Market (cont’d) 27 Arbitrage exists if someone can buy a commodity, store it at a known cost, and get someone to promise to buy it later at a price that exceeds the cost of storage In a full carrying charge market, the basis cannot weaken because that would produce an arbitrage situation Reconciling the Three Theories 28 The expectations hypothesis says that a futures price is simply the expected cash price at the delivery date of the futures contract People know about storage costs and other costs of carry (insurance, interest, etc.) and we would not expect these costs to surprise the market Reconciling the Three Theories (cont’d) 29 Because the hedger is really obtaining price insurance with futures, it is logical that there be some cost to the insurance Spreading with Commodity Futures 30 Intercommodity spreads Intracommodity spreads Why spread in the first place? Intercommodity Spreads An intercommodity spread is a long and short position in two related commodities – – 31 E.g., a speculator might feel that the price of corn is too low relative to the price of live cattle Risky because there is no assurance that your hunch will be correct Intercommodity Spreads (cont’d) With an intermarket spread, a speculator takes opposite positions in two different markets – 32 E.g., trades on both the Chicago Board of Trade and on the Kansas City Board of Trade Intracommodity Spreads An intracommodity spread (intermonth spread) involves taking different positions in different delivery months, but in the same commodity – 33 E.g., a speculator bullish on what might buy September and sell December Why Spread in the First Place? 34 Most intracommodity spreads are basis plays Intercommodity spreads are closer to two separate speculative positions than to a spread in the stock option sense Intermarket spreads are really arbitrage plays based on discrepancies in transportation costs or other administrative costs