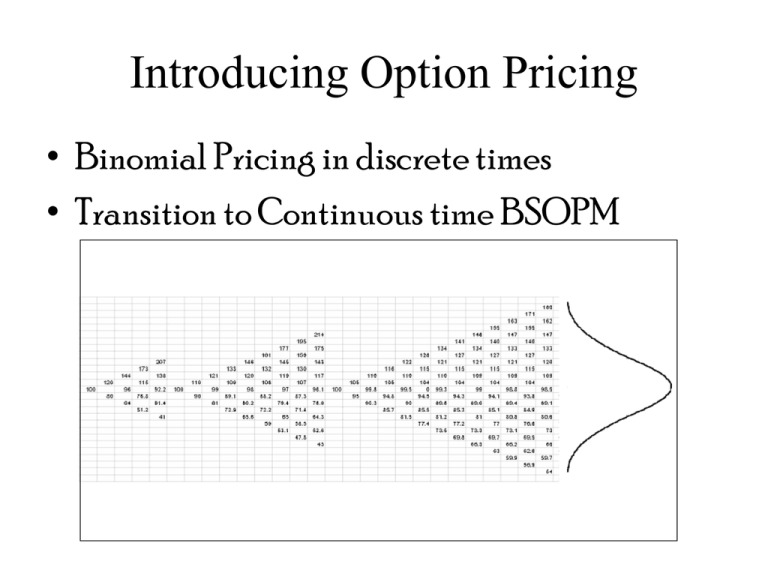

Introducing Option Pricing • Binomial Pricing in discrete times

advertisement

Introducing Option Pricing • Binomial Pricing in discrete times • Transition to Continuous time BSOPM Simple Heuristics on the Black-Scholes Option Pricing Model Rossitsa Yalamova University of Lethbridge Objective and Goal • Develop passion for creative solution and intuition of the variables relationships in the model • Develop instructional design and educational technology for the foundations of derivative valuation and the basic principles of risk management and hedging. Problem Solving • Algorithms do not necessarily lead to comprehension but promise a solution, while heuristics are understood but do not always guarantee solutions. • PDE for the solution of the BSOPM Visualization heuristics • Graphs, drawings and other visualization tools meet specific learning needs. Discounted Cash flow Valuation • European option pays only at expiration=S-K Log Returns and call intrinsic value • Continuous Compounding/Discounting • Discrete vs. Continuous return Review of Probability and Return Calculations • Lognormal prices • Return Probability calculations Stock price at expiration? • Crystal bowl or probability The Black-Scholes model: rt C SN (d1 ) Ke N (d 2 ) where d1 2 S t ln r 2 K t and d 2 d1 t Concrete example technique • Option at the money (S=K) risk free rate is 0: Option at the money (S=K); R=0 (S=K); risk free rate positive • Risk free rate moves the area to the right by and increases the value as K is discounted Adding positive instantaneous return (S>K) • The moves to the right by Option “out-of-the-money”; r=0 • The area moves to the left by Option “out-of-the-money”; r>0