Ch. 11 Outline

advertisement

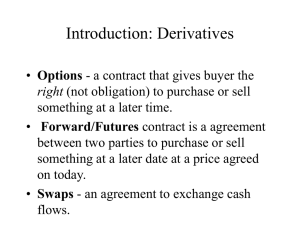

Ch. 11 Outline 1 Interest rate futures – yield curve Discount yield vs. Investment Rate %” (bond equivalent yield): Pricing interest rate futures contracts Spreading with interest rate futures Speculation Example The ED futures contract has a face value of $1 million. Suppose the discount yield at the time of purchase was 2.74%. In the middle of March 2005, interest rates have risen to 7.00%. What is the speculator’s dollar gain or loss? 2 Speculating With Eurodollar Futures – Initial price Face value - $1 million; Disc yield-2.74% (price of 97.26; or 100-97.26) Discount Yield 90 Price Face Value 1 360 .0274 90 Price $1,000,0001 $993,150 360 3 Speculating With Eurodollar Futures (cont’d) The price with the new interest rate of 7.00% is: Discount Yield 90 Price Face Value 1 360 .0700 90 Price $1,000,000 1 $982,500.00 360 4 Speculating With Eurodollar Futures (cont’d) Speculation Example (cont’d) The speculator’s dollar loss is therefore: $982,500.00 $993,150.00 $10,650.00 5 Hedging With Eurodollar Futures Hedging Example Face value 10 mil, Disc Yield – 1.24 (at 98.76; or 100- 98.76) 6 . Hedging With Eurodollar Futures (cont’d) Hedging Example (cont’d) When you receive the $10 million in three months, assume interest rate have fallen to 1.00%. $10 million in T-bills would then cost: .01 90 Price $10,000,0001 $9,975,000.00 360 This is $6,000 more than the price at the time you established the hedge. 7 Hedging With Eurodollar Futures (cont’d) Hedging Example (cont’d) In the futures market, you have a gain that will offset the increased purchase price. When you close out the futures positions, you will sell your contracts for $6,000 more than you paid for them. 8 Pricing Interest Rate Futures Contracts Interest rate futures prices come from the implications of cost of carry: Ft S (1 C0,t ) where Ft futures price for delivery at time t C0 , t 9 S spot commodity price cost of carry from time zero to time t Computation Cost of carry is the net cost of carrying the commodity forward in time (the carry return minus the carry charges) – 10 If you can borrow money at the same rate that a Treasury bond pays, your cost of carry is zero Solving for C in the futures pricing equation yields the implied repo rate (implied financing rate) Implied Repo or Financing rate 11 Arbitrage With T-Bill Futures If an arbitrageur can discover a disparity between the implied financing rate and the available repo rate, there is an opportunity for riskless profit – 12 If the implied financing rate is greater than the borrowing rate, then he/she could borrow, buy Tbills, and sell futures NOB spread (trading the yield curve) slope increases (long term R increases more than short term or short term even decreases) buy notes sell bonds 13 The NOB Spread The NOB spread is “notes over bonds” Traders who use NOB spreads are speculating on shifts in the yield curve – 14 If you feel the gap between long-term rates and short-term rates is going to narrow ( yield curve slope decreases or flattens), you could sell Tnote futures contracts and buy T-bond futures Trading Spreads 15 TED spread (different yield curves) The TED spread is the difference between the price of the U.S. T-bill futures contract and the eurodollar futures contract, where both futures contracts have the same delivery month (T-bill yield<ED yield) – 16 If you think the spread will widen, buy the spread (buy T-bill, sell ED) Chapter 12 Futures Contracts and Portfolio Management 17 © 2004 South-Western Publishing Outline 18 The concept of immunization Altering portfolio duration with futures Duration as a convex function as opposed to market risk measure beta Introduction An immunized bond portfolio is largely protected from fluctuations in market interest rates – – – 19 Seldom possible to eliminate interest rate risk completely A portfolio’s immunization can wear out, requiring managerial action to reinstate the portfolio Continually immunizing a fixed-income portfolio can be time-consuming and technical Bond Risks A fixed income investor faces three primary sources of risk: – – – 20 Credit risk Interest rate risk Reinvestment rate risk Bond Risks (cont’d) 21 Credit risk is the likelihood that a borrower will be unable or unwilling to repay a loan as agreed – Rating agencies measure this risk with bond ratings – Lower bond ratings mean higher expected returns but with more risk of default – Investors choose the level of credit risk that they wish to assume Bond Risks (cont’d) Interest rate risk is a consequence of the inverse relationship between bond prices and interest rates – 22 Duration is the most widely used measure of a bond’s interest rate risk Bond Risks (cont’d) 23 Reinvestment rate risk is the uncertainty associated with not knowing at what rate money can be put back to work after the receipt of an interest check – The reinvestment rate will be the prevailing interest rate at the time of reinvestment, not some rate determined in the past Duration Matching 24 Bullet immunization Change of portfolio duration with interest rate futures Introduction Duration matching selects a level of duration that minimizes the combined effects of reinvestment rate and interest rate risk Two versions of duration matching: – – 25 Bullet immunization Bank immunization Bullet Immunization 26 Seeks to ensure that a predetermined sum of money is available at a specific time in the future regardless of interest rate movements Bullet Immunization (cont’d) Objective is to get the effects of interest rate and reinvestment rate risk to offset – – 27 If interest rates rise, coupon proceeds can be reinvested at a higher rate If interest rates fall, proceeds can be reinvested at a lower rate Bullet Immunization (cont’d) Bullet Immunization Example A portfolio managers receives $93,600 to invest in bonds and needs to ensure that the money will grow at a 10% compound rate over the next 6 years (it should be worth $165,818 in 6 years). 28 Bullet Immunization (cont’d) Bullet Immunization Example (cont’d) The portfolio manager buys $100,000 par value of a bond selling for 93.6% with a coupon of 8.8%, maturing in 8 years, and a yield to maturity of 10.00%. 29 Bullet Immunization (cont’d) Bullet Immunization Example (cont’d) Panel A: Interest Rates Remain Constant Year 1 $8,800 Year 2 $9,680 $8,800 Year 3 $10,648 $9,680 $8,800 Year 4 $11,713 $10,648 $9,680 $8,800 Year 5 $12,884 $11,713 $10,648 $9,680 $8,800 Interest Bond Total 30 Year 6 $14,172 $12,884 $11,713 $10,648 $9,680 $8,800 $68,805 $97,920 $165,817 Bullet Immunization (cont’d) Bullet Immunization Example (cont’d) Panel B: Interest Rates Fall 1 Point in Year 3 Year 1 $8,800 Year 2 $9,680 $8,800 Year 3 $10,648 $9,680 $8,800 Year 4 $11,606 $10,551 $9,592 $8,800 Year 5 $12,651 $11,501 $10,455 $9,592 $8,800 Interest Bond Total 31 Year 6 $13,789 $12,536 $11,396 $10,455 $9,592 $8,800 $66,568 $99,650 $166,218 Bullet Immunization (cont’d) Bullet Immunization Example (cont’d) Panel C: Interest Rates Rise 1 Point in Year 3 Year 1 $8,800 Year 2 $9,680 $8,800 Year 3 $10,648 $9,680 $8,800 Year 4 $11,819 $10,745 $9,768 $8,800 Year 5 $13,119 $11,927 $10,842 $9,768 $8,800 Interest Bond Total 32 Year 6 $14,563 $13,239 $12,035 $10,842 $9,768 $8,800 $69,247 $96,230 $165,477 Bullet Immunization (cont’d) Bullet Immunization Example (cont’d) The compound rates of return in the three scenarios are 10.10%, 10.04%, and 9.96%, respectively. 33 Duration Shifting 34 The higher the duration, the higher the level of interest rate risk If interest rates are expected to rise, a bond portfolio manager may choose to bear some interest rate risk (duration shifting) Duration Shifting (cont’d) 35 The shorter the maturity, the lower the duration The higher the coupon rate, the lower the duration A portfolio’s duration can be reduced by including shorter maturity bonds or bonds with a higher coupon rate Duration Shifting (cont’d) Coupon Lower Higher Lower Ambiguous Duration Lower Higher Duration Higher Ambiguous Maturity 36 Hedging With Interest Rate Futures A financial institution can use futures contracts to hedge interest rate risk The hedge ratio is: Pb Db (1 YTM ctd ) HR CFctd Pf D f (1 YTM b ) 37 Hedging With Interest Rate Futures (cont’d) The number of contracts necessary is given by: portfolio par value # contracts hedge ratio $100,000 38 Hedging With Interest Rate Futures (cont’d) Futures Hedging Example A bank portfolio holds $10 million face value in government bonds with a market value of $9.7 million, and an average YTM of 7.8%. The weighted average duration of the portfolio is 9.0 years. The cheapest to deliver bond has a duration of 11.14 years, a YTM of 7.1%, and a CBOT correction factor of 1.1529. An available futures contract has a market price of 90 22/32 of par, or 0.906875. What is the hedge ratio? How many futures contracts are needed to hedge? 39 Hedging With Interest Rate Futures (cont’d) Futures Hedging Example (cont’d) The hedge ratio is: 0.97 9.0 1.071 HR 1.1529 0.9898 0.906875 11.14 1.078 40 Hedging With Interest Rate Futures (cont’d) Futures Hedging Example (cont’d) The number of contracts needed to hedge is: $10,000,000 # contracts 0.9898 98.98 $100,000 41 Summary of Immunization and duration hedging 42 Bullet immunization (bond with target yield and duration = target date) Duration as a measure of sensitivity to interest rate changes Duration is a convex function hedge ratio does not change linearly (BPV) Examples for review Spot rate is $1.33 per 1€. The US 3m T-bill rate is 2.7% and the Forward 3m rate is 1.327011. What is the risk free rate of the European Central Bank if the interest rate parity condition determined this forward rate? (3.6%) The spot rate is CAD 2.2733 per 1£. If the inflation rate in Canada is 3.4% a year and the inflation rate in UK is 2.3% per year, according to the purchasing power parity the forward exchange rate should be……….? (2.285838) 43