February 28, 2008 Option Pricing Review 1

advertisement

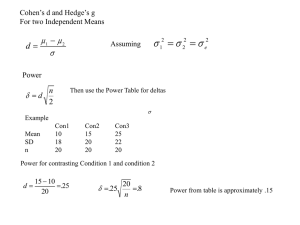

February 28, 2008 Option Pricing Review 1 © 2004 South-Western Publishing Lecture Objectives Wrap up Greek application – Review Option Greeks and Delta application Review Option valuation – – 2 Delta in Directional and Speed Market Binomial BSOPM Directional Market Whether we are bullish or bearish indicates a directional market Delta measures exposure in a directional market – – 3 Bullish investors want a positive position delta Bearish speculators want a negative position delta Speed Market The speed market refers to how quickly we expect the anticipated market move to occur – 4 Not a concern to the stock investor but to the option speculator Speed Market (cont’d) 5 In fast markets you want positive gammas In slow markets you want negative gammas Gamma (cont’d) 2C c c 2 S S 2 P p p 2 S S 6 Gamma (cont’d) 7 As calls become further in-the-money, they act increasingly like the stock itself For out-of-the-money options, option prices are much less sensitive to changes in the underlying stock An option’s delta changes as the stock price changes Gamma (cont’d) Gamma is a measure of how often option portfolios need to be adjusted as stock prices change and time passes – 8 Options with gammas near zero have deltas that are not particularly sensitive to changes in the stock price For a given striking price and expiration, the call gamma equals the put gamma Functions and their derivatives Call price as a function of the following variables: – – – – – 9 Stock price Time Volatility Interest rate Striking price constant Stock price and Delta Measure of Option Sensitivity to small changes in the stock For a call option: For a put option: 10 C c S P p S Measure of Option Sensitivity Delta indicates the number of shares of stock required to mimic the returns of the option – E.g., a call delta of 0.80 means it will act like 0.80 shares of stock 11 If the stock price rises by $1.00, the call option will advance by about 80 cents Call and Put deltas 12 For a European option, the absolute values of the put and call deltas will sum to one Delta is exactly equal to N(d1) S, K and delta 13 The delta of an at-the-money option declines linearly over time and approaches 0.50 at expiration The delta of an out-of-the-money option approaches zero as time passes The delta of an in-the-money option approaches 1.0 as time passes Hedge Ratio Delta is the hedge ratio – 14 Assume a short option position has a delta of 0.25. If someone owns 100 shares of the stock, writing four calls results in a theoretically perfect hedge Likelihood of Becoming In-theMoney Delta is a crude measure of the likelihood that a particular option will be in the money at option expiration – 15 E.g., a delta of 0.45 indicates approximately a 45 percent chance that the stock price will be above the option striking price at expiration Position Derivatives The position delta is the sum of the deltas for a particular security Delta neutrality means the combined deltas of the options involved in a strategy net out to zero – 16 Important to institutional traders who establish large positions using straddles, strangles, and ratio spreads Position Risk 17 Position risk is an important, but often overlooked, aspect of the riskiness of portfolio management with options Option derivatives are not particularly useful for major movements in the price of the underlying asset Importance of risk monitoring 18 Barings Bank was among the oldest merchant banking companies in England, having been founded in 1762 as the 'John and Francis Baring Company' by Sir Francis Baring. In 1806 his son Alexander Baring joined the firm and they renamed it Baring Brothers & Co., merging it with the London offices of Hope & Co., where Alexander worked with Henry Hope. It collapsed in 1995 after one trader, Nick Leeson, lost $1.4 billion in speculation primarily on futures contracts. Binomial Pricing Long stock + Write N calls Long stock + Buy N Puts 19 Price the options if Rf=10% 20 Solve for N (number of calls) The cost of the portfolio today and value of the portfolio in one year (40/1.1) Pricing puts 21 Solve for N (number of puts) (2) The cost of the portfolio today and value of the portfolio in one year (50/1.1) P=.23 Risk Neutrality For multi-period binomial pricing: – – – 22 Build the stock price binomial tree Calculate the intrinsic value of the option at the end period (C=S-K; P=K-S) Find the risk neutral probabilities of the two branches (U and D use % S1u/S0 and S1d/S0) The Black-Scholes option pricing model C SN ( d1 ) Ke RT N ( d 2 ) where 2 S ln R 2 K d1 T and d 2 d1 23 T T put/call parity 24 Writing a call exposes you to risk, therefore you cover your position with a long stock. What is the outcome of this strategy? ……………Synthetic short put………… Cash Flows and time value 25 The Put/Call Parity Relationship We now know how the call prices, put prices, the stock price, and the riskless interest rate are related: K C P S0 t (1 r ) 26