[4830-01-p] DEPARTMENT OF THE TREASURY Internal Revenue Service (IRS)

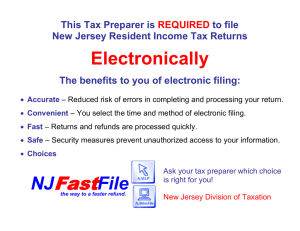

advertisement

![[4830-01-p] DEPARTMENT OF THE TREASURY Internal Revenue Service (IRS)](http://s2.studylib.net/store/data/016081744_1-30e68c188d5e5113facd544e92cbfd26-768x994.png)