Chapter 3 A Review of Statistical Principles Useful in Finance 1

advertisement

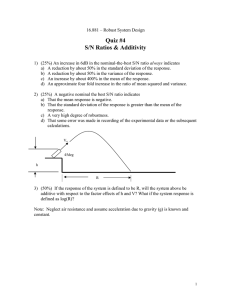

Chapter 3 A Review of Statistical Principles Useful in Finance 1 Statistical thinking will one day be as necessary for effective citizenship as the ability to read and write. - H.G. Wells 2 Outline Introduction The concept of return Some statistical facts of life 3 Introduction Statistical principles are useful in: • The theory of finance • Understanding how portfolios work • Why diversifying portfolios is a good idea 4 The Concept of Return Measurable return Expected return Return on investment 5 Measurable Return Definition Holding period return Arithmetic mean return Geometric mean return Comparison of arithmetic and geometric mean returns 6 Definition A general definition of return is the benefit associated with an investment • In most cases, return is measurable • E.g., a $100 investment at 8%, compounded continuously is worth $108.33 after one year – The return is $8.33, or 8.33% 7 Holding Period Return The calculation of a holding period return is independent of the passage of time • E.g., you buy a bond for $950, receive $80 in interest, and later sell the bond for $980 – The return is ($80 + $30)/$950 = 11.58% – The 11.58% could have been earned over one year or one week 8 Arithmetic Mean Return The arithmetic mean return is the arithmetic average of several holding period returns measured over the same holding period: n Ri Arithmetic mean i 1 n Ri the rate of return in period i 9 Arithmetic Mean Return (cont’d) Arithmetic means are a useful proxy for expected returns Arithmetic means are not especially useful for describing historical returns • It is unclear what the number means once it is determined 10 Geometric Mean Return The geometric mean return is the nth root of the product of n values: 1/ n Geometric mean (1 Ri ) i 1 n 1 11 Arithmetic and Geometric Mean Returns Example Assume the following sample of weekly stock returns: Week Return Return Relative 1 2 0.0084 -0.0045 1.0084 0.9955 3 0.0021 1.0021 4 0.0000 1.000 12 Arithmetic and Geometric Mean Returns (cont’d) Example (cont’d) What is the arithmetic mean return? Solution: n Ri Arithmetic mean i 1 n 0.0084 0.0045 0.0021 0.0000 4 0.0015 13 Arithmetic and Geometric Mean Returns (cont’d) Example (cont’d) What is the geometric mean return? Solution: 1/ n Geometric mean (1 Ri ) i 1 n 1 1.0084 0.9955 1.00211.0000 1/ 4 0.001489 1 14 Comparison of Arithmetic & Geometric Mean Returns The geometric mean reduces the likelihood of nonsense answers • Assume a $100 investment falls by 50% in period 1 and rises by 50% in period 2 • The investor has $75 at the end of period 2 – Arithmetic mean = (-50% + 50%)/2 = 0% – Geometric mean = (0.50 x 1.50)1/2 –1 = -13.40% 15 Comparison of Arithmetic & Geometric Mean Returns The geometric mean must be used to determine the rate of return that equates a present value with a series of future values The greater the dispersion in a series of numbers, the wider the gap between the arithmetic and geometric mean 16 Expected Return Expected return refers to the future • In finance, what happened in the past is not as important as what happens in the future • We can use past information to make estimates about the future 17 Return on Investment (ROI) Definition Measuring total risk 18 Definition Return on investment (ROI) is a term that must be clearly defined • Return on assets (ROA) • Return on equity (ROE) – ROE is a leveraged version of ROA 19 Measuring Total Risk Standard deviation and variance Semi-variance 20 Standard Deviation and Variance Standard deviation and variance are the most common measures of total risk They measure the dispersion of a set of observations around the mean observation 21 Standard Deviation and Variance (cont’d) General equation for variance: 2 n Variance prob( xi ) xi x 2 i 1 If all outcomes are equally likely: n 2 1 xi x n i 1 2 22 Standard Deviation and Variance (cont’d) Equation for standard deviation: Standard deviation 2 2 n prob( x ) x x i 1 i i 23 Semi-Variance Semi-variance considers the dispersion only on the adverse side • Ignores all observations greater than the mean • Calculates variance using only “bad” returns that are less than average • Since risk means “chance of loss” positive dispersion can distort the variance or standard deviation statistic as a measure of risk 24 Some Statistical Facts of Life Definitions Properties of random variables Linear regression R squared and standard errors 25 Definitions Constants Variables Populations Samples Sample statistics 26 Constants A constant is a value that does not change • E.g., the number of sides of a cube • E.g., the sum of the interior angles of a triangle A constant can be represented by a numeral or by a symbol 27 Variables A variable has no fixed value • It is useful only when it is considered in the context of other possible values it might assume In finance, variables are called random variables • Designated by a tilde – E.g., x 28 Variables (cont’d) Discrete random variables are countable • E.g., the number of trout you catch Continuous random variables are measurable • E.g., the length of a trout 29 Variables (cont’d) Quantitative variables are measured by real numbers • E.g., numerical measurement Qualitative variables are categorical • E.g., hair color 30 Variables (cont’d) Independent variables are measured directly • E.g., the height of a box Dependent variables can only be measured once other independent variables are measured • E.g., the volume of a box (requires length, width, and height) 31 Populations A population is the entire collection of a particular set of random variables The nature of a population is described by its distribution • The median of a distribution is the point where half the observations lie on either side • The mode is the value in a distribution that occurs most frequently 32 Populations (cont’d) A distribution can have skewness • There is more dispersion on one side of the distribution • Positive skewness means the mean is greater than the median – Stock returns are positively skewed • Negative skewness means the mean is less than the median 33 Populations (cont’d) Positive Skewness Negative Skewness 34 Populations (cont’d) A binomial distribution contains only two random variables • E.g., the toss of a die A finite population is one in which each possible outcome is known • E.g., a card drawn from a deck of cards 35 Populations (cont’d) An infinite population is one where not all observations can be counted • E.g., the microorganisms in a cubic mile of ocean water A univariate population has one variable of interest 36 Populations (cont’d) A bivariate population has two variables of interest • E.g., weight and size A multivariate population has more than two variables of interest • E.g., weight, size, and color 37 Samples A sample is any subset of a population • E.g., a sample of past monthly stock returns of a particular stock 38 Sample Statistics Sample statistics are characteristics of samples • A true population statistic is usually unobservable and must be estimated with a sample statistic – Expensive – Statistically unnecessary 39 Properties of Random Variables Example Central tendency Dispersion Logarithms Expectations Correlation and covariance 40 Example Assume the following monthly stock returns for Stocks A and B: Month Stock A Stock B 1 2 3 2% -1% 4% 3% 0% 5% 4 1% 4% 41 Central Tendency Central tendency is what a random variable looks like, on average The usual measure of central tendency is the population’s expected value (the mean) • The average value of all elements of the population 1 n E ( Ri ) Ri n i 1 42 Example (cont’d) The expected returns for Stocks A and B are: 1 n 1 E ( RA ) Ri (2% 1% 4% 1%) 1.50% n i 1 4 1 n 1 E ( RB ) Ri (3% 0% 5% 4%) 3.00% n i 1 4 43 Dispersion Investors are interest in the best and the worst in addition to the average A common measure of dispersion is the variance or standard deviation E xi x 2 2 E xi x 2 2 44 Example (cont’d) The variance ad standard deviation for Stock A are: 2 2 E xi x 1 (2% 1.5%) 2 (1% 1.5%) 2 (4% 1.5%) 2 (1% 1.5%) 2 4 1 (0.0013) 0.000325 4 2 0.000325 0.018 1.8% 45 Example (cont’d) The variance ad standard deviation for Stock B are: 2 2 E xi x 1 (3% 3.0%)2 (0% 3.0%)2 (5% 3.0%)2 (4% 3.0%)2 4 1 (0.0014) 0.00035 4 2 0.00035 0.0187 1.87% 46 Logarithms Logarithms reduce the impact of extreme values • E.g., takeover rumors may cause huge price swings • A logreturn is the logarithm of a return Logarithms make other statistical tools more appropriate • E.g., linear regression 47 Logarithms (cont’d) Using logreturns on stock return distributions: • Take the raw returns • Convert the raw returns to return relatives • Take the natural logarithm of the return relatives 48 Expectations The expected value of a constant is a constant: E (a) a The expected value of a constant times a random variable is the constant times the expected value of the random variable: E (ax) aE ( x) 49 Expectations (cont’d) The expected value of a combination of random variables is equal to the sum of the expected value of each element of the combination: E ( x y ) E ( x) E ( y ) 50 Correlations and Covariance Correlation is the degree of association between two variables Covariance is the product moment of two random variables about their means Correlation and covariance are related and generally measure the same phenomenon 51 Correlations and Covariance (cont’d) COV ( A, B) AB E ( A A)( B B ) AB COV ( A, B) A B 52 Example (cont’d) The covariance and correlation for Stocks A and B are: AB 1 (0.5% 0.0%) (2.5% 3.0%) (2.5% 2.0%) (0.5% 1.0%) 4 1 (0.001225) 4 0.000306 AB COV ( A, B) A B 0.000306 0.909 (0.018)(0.0187) 53 Correlations and Covariance Correlation ranges from –1.0 to +1.0. • Two random variables that are perfectly positively correlated have a correlation coefficient of +1.0 • Two random variables that are perfectly negatively correlated have a correlation coefficient of –1.0 54 Linear Regression Linear regression is a mathematical technique used to predict the value of one variable from a series of values of other variables • E.g., predict the return of an individual stock using a stock market index Regression finds the equation of a line through the points that gives the best possible fit 55 Linear Regression (cont’d) Example Assume the following sample of weekly stock and stock index returns: Week Stock Return Index Return 1 2 0.0084 -0.0045 0.0088 -0.0048 3 4 0.0021 0.0000 0.0019 0.0005 56 Linear Regression (cont’d) Return (Stock) Example (cont’d) 0.01 Intercept = 0 0.008 Slope = 0.96 R squared = 0.99 0.006 0.004 0.002 0 -0.01 -0.005 -0.002 0 0.005 0.01 -0.004 -0.006 Return (Market) 57 R Squared and Standard Errors Application R squared Standard Errors 58 Application R-squared and the standard error are used to assess the accuracy of calculated statistics 59 R Squared R squared is a measure of how good a fit we get with the regression line • If every data point lies exactly on the line, R squared is 100% R squared is the square of the correlation coefficient between the security returns and the market returns • It measures the portion of a security’s variability that is due to the market variability 60 Standard Errors The standard error is the standard deviation divided by the square root of the number of observations: Standard error n 61 Standard Errors (cont’d) The standard error enables us to determine the likelihood that the coefficient is statistically different from zero • About 68% of the elements of the distribution lie within one standard error of the mean • About 95% lie within 1.96 standard errors • About 99% lie within 3.00 standard errors 62