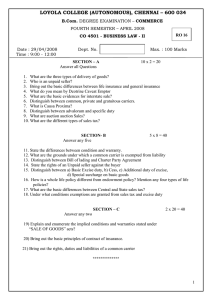

Central Excise Tax- basic concepts conducted on 13.05.2016

advertisement

V S Datey Direct and Indirect Taxes Tax is the price we pay for civilised society – Justice Holmes of US Supreme Court Taxes broadly classified as direct and indirect Direct taxes are paid directly by assessee to Government while indirect taxes are paid indirectly Foundation of all Laws in India Constitution of India is foundation of all laws in India It is mother of all laws in India, law how to make laws All other laws and Parliamentary or Government actions are subordinate to Constitution. Act contrary to provisions of Constitution is Ultra vires the Constitution and void Constitutional Background India, that is Bharat, shall be a Union of States [Article 1(1)] Article 246 read with Seventh Schedule gives bifurcation of powers between Union and State List I – Union List List II – State List List III – Concurrent List Taxation in Union List Entry No. 82 - Tax on income other than agricultural income. Entry No. 83 - Duties of customs including export duties. Entry No. 84 - Duties of excise on tobacco and other goods manufactured or produced in India except alcoholic liquors for human consumption, opium, narcotic drugs, but including medicinal and toilet preparations containing alcoholic liquor, opium or narcotics. - - Continued Union List (Continued) Entry No. 85 - Corporation Tax. Entry 92 - Tax on advertisements in newspapers Entry 91 - Stamp duty on specified transactions Entry No. 92A - Taxes on the Sale or purchase of goods other than newspapers, where such sale or purchase takes place in the course of Interstate trade or commerce. List I (Continued) Entry No. 92C – Tax on services (Entry passed but not yet notified and hence not effective) Entry No. 97 - Any other matter not included in List II, List III and any tax not mentioned in list II or list III [This is ‘residual entry’] Central Excise duty is levied under Entry 84 and 97 Four Pillars of Central Excise Duty Liability Valuation Classification of goods Cenvat General excise duty rate is 12.5% - no education cess Charging Section of Central Excise Section 3 of Central Excise Act (often called the ‘Charging Section’ ) states that ‘There shall be levied and collected in such manner as may be prescribed duty of excise on all excisable goods (excluding goods produced or manufactured in special economic zones) which are produced or manufactured in India - . - . -' Basic Requirements for excise duty Duty is on ‘goods’ Goods must be ‘excisable goods’ Goods must be manufactured or produced Such manufacture or production should be in India What are ‘goods’ Must be movable and marketable. Actual marketing not necessary. Marketable – Not ‘marketed’ Mere mention in Central Excise Tariff not sufficient – SC in Bhor Industries and Moti Laminates Illustration of Goods Electricity Water Software – packaged and tailor made Air Photograph Dutiability of waste and scrap Waste and scrap is ‘final product’ for excise. Waste and scrap are ‘goods’ if these are normally salable. Waste and scrap is dutiable only if ‘manufactured’. Waste and scrap is dutiable only if it is specified in Central Excise Tariff Plant and machinery erected at site In Triveni Engineering v. CCE AIR 2000 SC 2896 = 120 ELT 273 (SC), it was observed, 'The marketability test requires that the goods as such should be in a position to be taken to market and sold. If they have to be separated, the test is not satisfied'. [Thus, if machine has to be dis-assembled for removal, it is not ‘goods’ and duty cannot be levied]. Excisable Goods Section 2(d) - Excisable Goods means ‘Goods specified in the Schedule to Central Excise Tariff Act, 1985 as being subject to a duty of excise and includes salt’. Goods include article capable of being sold. Nil Duty and Exempt from Duty – Both are ‘excisable goods’ Manufactured or Produced ‘Production’ is broader than ‘manufacture’. ‘Production’ included ‘manufacture’ In both production and manufacture, new and identifiable product should emerge Usually, ‘production’ term is used for new product by natural process. ‘Manufacture’ derived from ‘manu’ i.e. by hands. Production Items like ore, asbestos, coffee, tea, tobacco, dairy products etc. live products like horse, fish, flowers etc. By-products, scrap etc. which are not really 'manufactured' but they do get 'produced' It also covers ‘manufactured goods’ as term ‘produced’ is broader than ‘manufacture’. Meaning of ‘Manufacture’ Manufacture as specified in various Court decisions i.e. new and identifiable product having a distinctive name, character or use must emerge or Deemed Manufacture – (a) Process amounting to manufacture (b) Products covered under MRP provisions ‘Manufacture’ as defined by Courts Union of India v. Delhi Cloth Mills Co. Ltd. AIR 1963 SC 791 = 1 ELT (J199) (SC five member constitution bench) - manufacture means bringing into existence a new substance. Manufacture is end result of one or more processes, through which original commodity passes. Manufacture implies a change but every change is not manufacture. A new and different article must emerge having a distinctive name, character or use. Issues relating to ‘Manufacture’ Repairs, testing Packing, Labelling – not manufacture except in case of deemed marketability Assembly of computer components Assembly of CKD packs Deemed Manufacture Processes specified as ‘amounting’ to manufacture in Central Excise Tariff – About 35 processes in different Chapters Repacking, relabelling, putting or altering MRP is ‘deemed manufacture’ in case of about 110 articles covered under MRP valuation provisions Taxable Event in Central Excise Manufacture or production of excisable goods in India is taxable event. Distinction between sales tax and central excise. Captive consumption, free samples, intermediate product Ownership irrelevant in Excise. Excise Duty payable on intrinsic value of goods Manufacturer Section 2(f) - “the word manufacturer shall be understood accordingly and shall include not only a person who employs hired labour in the production or manufacture of excisable goods, but also any person who engages in their production or manufacture on his own account.” Duty Liability Duty liability is on ‘manufacturer’ – rule 4(1) of Central Excise Rules Exceptions – (a) Molasses produced in Khandsari sugar factory (b) goods in warehouse (c) Job work under Notification No. 214/86-CE Who is ‘Manufacturer’ Person who actually brings new and identifiable product into existence Raw material supplier is not ‘manufacturer’. Job worker is the manufacturer. Brand name owner is not ‘manufacturer’. Loan licensee is not ‘manufacturer’ Principal to Principal Relation Contractor undertaking contract work within the factory is not ‘manufacturer’ Example – Wheat given to chakkiwala for grinding into wheat powder Specialised agency doing fabrication within factory Manufacture must be in India Imported goods Imports of CKD packs – assembly in India will not be ‘manufacture’ Why Classification? Classification tells you rate of duty, while valuation tells you on what value that rate should apply Thousands of products – Not possible to list all and state duty of each product Goods have to be classified and sub-classified and then rate of each sub-classification is to be specified Tariff to specify rate of duty payable on each Article - Central Excise Tariff Act and Customs Tariff Act. Background of Tariff Harmonised Commodity Description and Coding System developed by World Customs Organisation (WCO) Based on International convention of Harmonised System of Nomenclature (HSN). Indian Customs adopted this nomenclature w.e.f. 28-2-1986. Central Excise Tariff also adopted HSN based classification w.e.f. 1-3-1986. Eight digit classification Arrangement of Tariff Classification of goods from groups to sub-groups to sub-sub groups Arrangement similar to menu in a Hotel All goods classified in 20 Sections in Excise Tariff and 21 Sections in Customs Tariff. Sections are divided into 96 chapters in Excise Tariff and 98 Chapters in Customs Tariff. Chapter 77 is blank in both Tariffs. Headings and sub-headings within the Chapter Each chapter and sub-chapter is further divided into various headings depending on different types of goods belonging to same class of products. The tariff is designed to group all goods relating to same industry and all the goods obtained from the same raw material under one Chapter in a progressive manner as far as possible. Eight Digit classification First two digits indicate chapter number. Two more digits are added to make ‘headings’. Thus, ‘headings’ have four digits. Further 2 digits are added for subclassification, which are termed as ‘sub-headings’. Last 2 digits are added for sub-sub-classification, which is termed as ‘tariff item’. Rate of duty is indicated against each ‘tariff item’ and not against heading or subheading. Rules for interpretation of Tariff Exemption from Excise Duty Government can grant exemption from excise duty – partial or complete – conditional or unconditional by issuing a notification – section 5A(1) of CEA and section 25(1) of Customs Act Tariff has to be read along-with exemption notification to find exact rate of duty Exemption Notification Notifications are issued by Government by notifying in Official Gazette They become effective on the date issued [section 5A(5) of CEA and section 102(4) of Customs Act] Notification subordinate to Act. Notification cannot be with retrospective effect CE, CE(NT), Cus, Cus(NT) and Ser suffix to indicate type of Notification Tariff Rate and Effective Rate Tariff Rate is as prescribed in Tariff Effective Rate is as specified in exemption Notification Nil duty means the Tariff itself specifies duty as ‘Nil’ Exempt from duty means exempted by a notification Some Exemption Notifications SSI Exemption – 8/2003-CE Exemption to goods manufactured in backward areas like North-East Region, J&K, Sikkim and Kutch Goods supplied to EOU Overview of SSI Exemption Notification No. 8/2003-CE dated 1-3-2003 Unit whose turnover was less that Rs 4 crores in previous financial year are entitled to full exemption upto Rs 150 lakhs in current financial year. Goods manufactured by an SSI unit with brand name of others are not eligible for SSI concession, unless goods are manufactured in a rural area. Valuation After determining that excise duty is payable, rate of excise duty is found out on the basis of Central Excise Tariff Act read with relevant exemption notification. Next issue is valuation i.e. ‘value’ on which excise duty is payable. Excise duty payable on one of following basis Specific duty, based on some measure like weight, volume, length etc. Duty as % of Tariff Value fixed under section 3(2) Duty on basis of production capacity – section 3A of Central Excise Act Duty based on basis of Maximum Retail Price printed on carton after allowing deductions - section 4A of CEA Duty as % based on Assessable Value fixed under section 4 (ad valorem duty) (If not covered in any of above) MRP Based Valuation In case of about 144 products, duty is payable u/s 4A of Central on basis of MRP printed on the package, after allowing abatement at specified rates. MRP should be inclusive of all taxes and duties. For example, if MRP is Rs 100 and abatement is 35%, ‘value’ will be Rs 65 for excise purposes, irrespective of actual sale price Applicability of MRP Valuation provisions The provision applies only when product is package intended for retail sale and is specified in a notification issued u/s 4A of CEA. MRP provisions u/s 4A of CEA are overriding provisions (even for job work) Even in case of products covered u/s 4A, where MRP provisions are not applicable, valuation will be on basis of ‘value’ u/s 4 i.e. Assessable Value e.g. wholesale package, industrial or institutional consumers, exports Composition Scheme Compounded levy scheme under rule 15 of Central Excise rules, provides for payment of duty on basis of production capacity. It is an optional scheme and not compulsory like production capacity basis scheme. The scheme is presently applicable to stainless steel pattas/patties and Aluminium circles. These articles are not eligible for SSI exemption. Duty on Production Capacity Section 3A of CEA provides for payment of duty on basis of production capacity, without any reference to actual production. Production capacity will be determined as per Rules. Scheme compulsory and not optinal Pan masala , gutkha and chewing tobacco are covered under these provisions. Reduction if factory closed for 15 days or more Tariff Value In some cases, tariff value is fixed by Government from time to time. This is a “Notional Value” for purpose of calculating the duty payable. Once ‘tariff value’ for a commodity is fixed, duty is payable as percentage of this 'tariff value' and not the Assessable Value fixed u/s 4. This is fixed u/s 3(2) of Central Excise Act. In customs, tariff values fixed for edible oils Ad valorem duty This is residual method of valuation Duty is payable on ‘value’ as per section 4 of Central Excise Act Section and Rules well drafted to avoid manipulation in ‘value’ Basic principle is that excise duty is payable on intrinsic value of goods – ownership is irrelevant When transaction value is assessable value The goods should be sold at the time and place of removal. Buyer and assessee should not be related. Price should be the sole consideration for the sale. Each removal will be treated as a separate transaction and 'value' for each removal will be separately fixed. Transaction Value excludes taxes Amount of duty of excise, sales tax and other taxes, if any, actually paid or actually payable on such goods is deductible Only taxes actually paid or payable are allowed as deduction. If goods are cleared without payment of duty, the price is taken as ‘cum duty’ price and excise duty payable should be calculated by back calculations Inclusions in Assessable Value Packing charges and design charges related to manufacture. Price escalation after clearance, but not when price was final at the time of clearance – interest Transport charges upto place of removal are includible in assessable value. Notional interest on advances is includible only if there is evidence that it has depressed the selling price. Exclusions from Value Any Trade discount is allowable as deduction from assessable value. Cash discounts Taxes are not includible in ‘value’ Outward freight after place of removal Valuation Rules If transaction value is not acceptable, valuation is required to be done as per Valuation Rules [Section 4(1)(b) of Central Excise Act and Valuation Rule 3] Valuation can be done on value of ‘such’ goods (i.e. goods of same class of same manufacturer) [Rule 4] Valuation of free samples, when price not sole consideration, related party transactions, depot sales Valuation in case of captive consumption In case of captive consumption, duty is payable on basis of cost of production plus 10%. Cost of Production should be calculated on basis of CAS-4 [Rule 8] Job Work Since excise duty is on manufacture, duty will be payable even if goods are manufactured on job work basis, on intrinsic value As per rule 10A of Valuation Rules, duty is payable on the basis of price at which raw material supplier sales the final product in the market. If product is covered under MRP, duty is payable as per section 4A. Exemption to Job work Job work is exempt if material is sent to job worker under Cenvat Credit Rule 4(5)(a). Job work is exempt if material was sent under Cenvat provisions or under notification No. 214/86CE. Service tax is payable on Job work if (a) Activity is not manufacture or (b) Material is not sent under Cenvat provisions Basics of Vat Vat is tax on value added Broadly, ‘value added’ is difference between ‘value’ at the output stage and ‘value’ at the input stage Conventional Mode of tax on Goods Detail Purchases Value Added Sub-Total Add Tax 10% Total A B C 100 110 40 165 35 100 10 150 15 200 20 110 165 220 Transaction with VatTransaction With VAT Transaction without VAT Details Purchases Value Added Subtotal Add Tax Total A 100 B 110 40 100 10 110 150 15 165 A 100 B 100 40 100 10 110 140 14 154 Highlights of Cenvat Instant Credit – You need not wait till actual use One to one co-relation not required in Vat/Cenvat Credit on inputs, input services as well as capital goods Destination principle Document for availing Cenvat Credit Original or Duplicate Invoice (in case of manufactured goods), Dealer’s Invoice, Bill of Entry (in case of imports), Supplementary Invoice Xerox not permitted. Endorsed Invoice/Bill of Entry permissible Defect in document – Permission of AC/DC required to avail Cenvat Credit Core procedures in Central Excise Registration – PAN based Registration Number Daily Stock Account Invoice for clearance Monthly/quarterly payment of duty Records and returns Other procedures Exports Receipt of goods for repairs/reconditioning Provisional assessment Warehousing of goods Adjudication, appeals and settlement Thanks Thanks