International Investment and Diversification

ANSWERS TO PROBLEMS

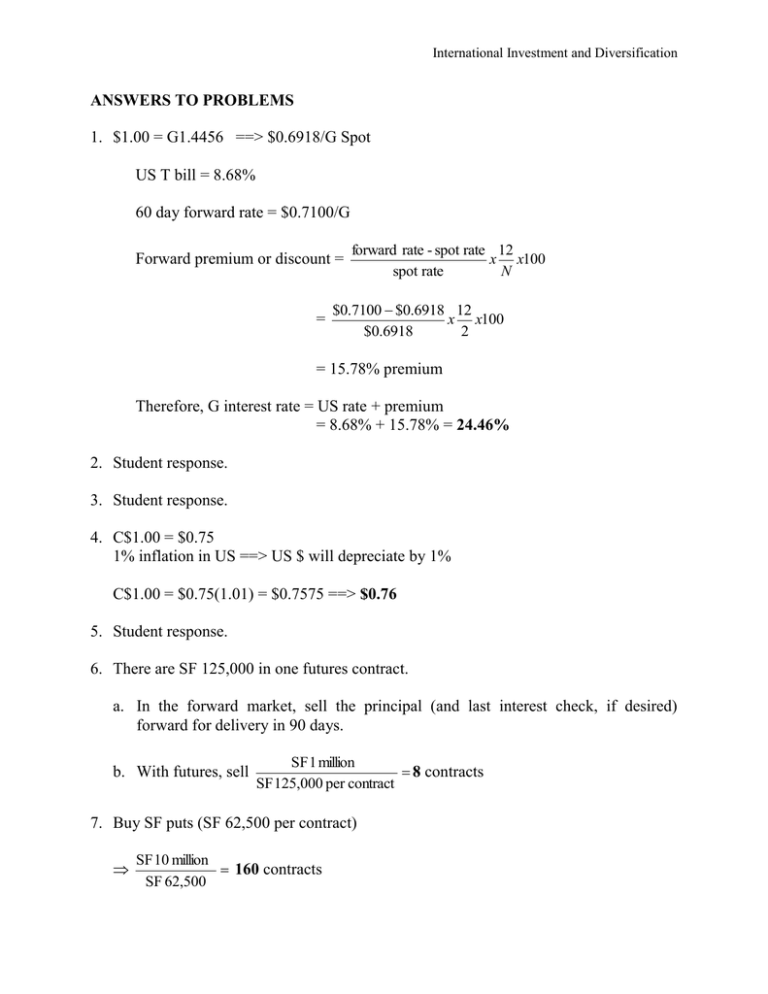

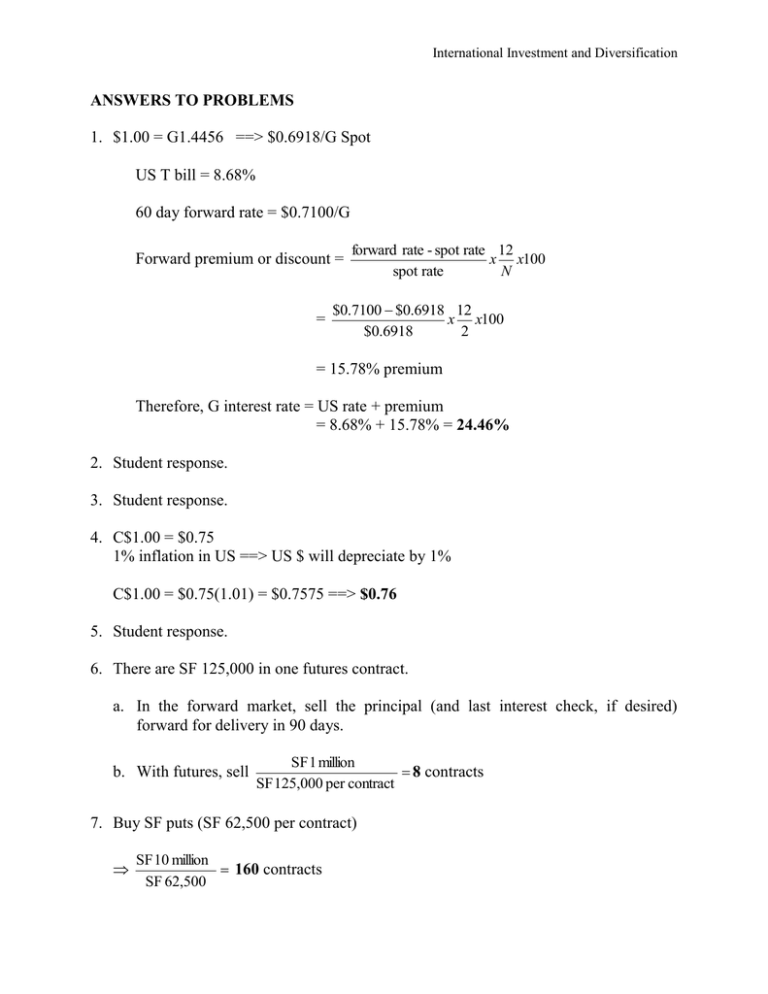

1. $1.00 = G1.4456 ==> $0.6918/G Spot

US T bill = 8.68%

60 day forward rate = $0.7100/G

Forward premium or discount =

=

forward rate - spot rate 12

x x100

spot rate

N

$0.7100 $0.6918 12

x x100

$0.6918

2

= 15.78% premium

Therefore, G interest rate = US rate + premium

= 8.68% + 15.78% = 24.46%

2. Student response.

3. Student response.

4. C$1.00 = $0.75

1% inflation in US ==> US $ will depreciate by 1%

C$1.00 = $0.75(1.01) = $0.7575 ==> $0.76

5. Student response.

6. There are SF 125,000 in one futures contract.

a. In the forward market, sell the principal (and last interest check, if desired)

forward for delivery in 90 days.

b. With futures, sell

SF 1 million

8 contracts

SF 125,000 per contract

7. Buy SF puts (SF 62,500 per contract)

SF 10 million

160 contracts

SF 62,500

International Investment and Diversification

or write deep in the money calls (or a mixture of long puts and short calls)

8. Forward premium or discount =

¥135.90 - ¥ 136.15 12

x x100 0.37%

¥136.15

6

If the Japanese rate is 8%, the US rate should be 8.00% + 0.37% = 8.37%

Therefore, the markets are not in equilibrium.

9. CFA Guideline Answer (reprinted with permission from the CFA Study Guide,

Association for Investment Management and Research, Charlottesville, VA. All

Rights Reserved.

A. The following briefly describes one strength and one weakness of each manager.

1. Manager A

Strength. Although Manager A’s one-year total return was slightly below

the EAFE Index return (-6.0 percent versus –5.0 percent, respectively), this

manager apparently has some country/security return expertise. This large

local market return advantage of 2.0 percent exceeds the 0.2 percent return

for the EAFE Index.

Weakness. Manager A has an obvious weakness in the currency

management area. This manager experienced a marked currency return

shortfall compared with the EAFE Index of 8.0 percent versus –5.2 percent,

respectively.

2. Manager B

Strength. Manager B’s total return slightly exceeded that of the index,

with a marked positive increment apparent in the currency return. Manager

B had a –1.0 percent currency return versus a –5.2 percent currency return

on the EAFE index. Based on this outcome, Manager B’s strength appears

to be some expertise in the currency selection area.

Weakness. Manager B had a marked shortfall in local market return.

Manager B’s country/security return was –1.0 percent versus 0.2 percent on

the EAFE Index. Therefore, Manager B appears to be weak in

security/market selection ability.

B. The following strategies would enable the Fund to take advantage of the strengths

of the two managers and simultaneously minimize their weaknesses.

International Investment and Diversification

1. Recommendation: One strategy would be to direct Manager A to make no

currency bets relative to the EAFE Index and to direct Manager B to make

only currency decisions, and no active country or security selection bets.

Justification: This strategy would mitigate Manager A’s weakness by

hedging all currency exposures into index-like weights. This would allow

capture of Manager A’s country and stock selection skills while avoiding

losses from poor currency management. This strategy would also mitigate

Manager B’s weakness, leaving an index-like portfolio construct and

capitalizing on the apparent skill in currency management.

2. Recommendation: Another strategy would be to combine the portfolios of

Manager A and Manager B, with Manager A making country exposure and

security selection decisions and Manager B managing the currency

exposures created by Manager A’s decisions (providing a “currency

overlay”).

Justification: This recommendation would capture the strengths of both

Manager A and Manager B and would minimize their collective

weaknesses.

C. Expected Return

Return Premium

Currency Premium

Germany

6% - 4% = 2%

2% + 4% = 6%

Japan

7% - 6% = 1%

-1% + 6% = 5%

United States

8% - 7% = 1%

7%

or

Green

Advisor

Japan

Local

7% +

DM

Exchange

2% +

DM

Yield

(4% -

Yen

Yield

6%) =

7%

German

Local

6% +

U.S.

Exchange

0% +

U.S.

Yield

(7% -

DM

Yield

4%) =

9%

Complete return includes the return on the local market, the expected return on

currency, and the cost/benefit of holding that currency.

The cost is the differential of the respective one-year Eurodeposit yields.

Green forgot to include the cost of holding currency in his assessment.

International Investment and Diversification

D. The following describes a strategy for temporarily hedging away both the local

market risk and the currency risk of investing in Japanese stocks. If Green had a

$200,000 position in Japan, the strategy would be to sell futures to offset that

amount or to buy put options in the offset amount, thereby creating the necessary

delta hedge on the market. Then, $200,000 in Yen currency futures would be sold

to hedge the currency exposure, or put options on the Yen bought to provide the

desired delta hedge.

E. The hedge strategy described in Part D might not be fully effective for the

following reasons:

1. The options could expire before the expected correction took place.

2. The delta of the options constantly changes and, therefore, does not provide

a perfectly symmetrical hedge.

3. The action involves costs in the form of the option premia. Repeated

rollovers would be especially costly.

4. The contract size available on the listing exchange may be too large or may

not readily match the size of Green’s position.

5. Counterparty failure is an added risk.

6. The hedge vehicle may not match the underlying asset.

7. Fluctuation in the underlying capital value of the asset, or uncertainty of

cash flows from the asset, may result in over- or underhedging.

8. Occasional mispricing of the futures price relative to the spot price may

result in tracking error.

10. CFA Guideline Answer (reprinted with permission from the CFA Study Guide,

Association for Investment Management and Research, Charlottesville, VA. All

Rights Reserved.

A.

The consultant is alluding to the behavior of cross-country equity return

correlations during different market phases, as reported in various research

studies. Specifically, the consultant is referring to the fact that correlations in

down markets tend to be significantly higher than correlations in up markets. In

other words, equity markets appear to be more correlated when they are falling

than when they are rising.

One of the reasons why investors invest in equity markets abroad is to reduce

the risk of large losses. That is, when the domestic market is expected to fall,

some other market may be expected to rise, thus reducing the impact of price

declines in the overall equity portfolio. Unfortunately, the evidence referred to

above suggests that global equity investing may not prove to be very helpful in

terms of avoiding large losses in the total equity portfolio (i.e., when protection

is needed the most). If markets are highly correlated when they are falling, then

International Investment and Diversification

it will be unlikely for foreign equity markets to rise when the U.S. market is

expected to fall. In such a situation, benefits from international diversification

are likely to be substantially reduced. The implication is that in the short run,

average historical correlations will overestimate investment performance if the

equity markets happen to be in a down-market phase.

B.

Although cross-country equity return correlations can vary significantly in the

short run, they remain surprisingly low when measured over long periods of

time. This implies that, from a policy standpoint, international investing still

offers the potential to construct more efficient portfolios, in a risk-return tradeoff sense, than ones constructed using domestic assets only. This is so because

global investing has the potential to reduce risk without sacrificing returns, even

with adverse short-run outcomes.

For example, Odier and Solnik show that the average correlation of the U.S.

equity market with 16 other equity markets was only slightly higher than the

correlation of U.S. stocks with U.S. bonds. Yet research on past data shows the

potential for achieving higher returns is much larger with 16 foreign stock

markets than with U.S. bonds.

C.

Appreciation of a foreign currency will, indeed, increase the dollar returns that

accrue to a U.S. investor. However, the amount of the expected appreciation

must be compared with the forward premium or discount on that currency in

order to determine whether hedging should be undertaken or not.

In the present example, the yen is forecast to appreciate from 100 to 98 (or 2

percent) by the manager. However, the forward premium on the yen, as given

by the differential in one-year eurocurrency rates, suggests an appreciation of

over 5 percent, as shown below:

Forward premium = (1 + one-year eurodollar rate)/(1 + one-year euroyen rate)

= (1 + 0.06)/(1 + 0.008)

= 1.0516 or 5.16 percent

Thus, the manager’s strategy to leave the yen position unhedged is not an

appropriate one. The manager should, in fact, hedge because by doing so, a

higher rate of yen appreciation can be locked in. Given the one-year

eurocurrency rate differentials, the yen position should be left unhedged only if

the yen is forecast to appreciate to over 95 yen per U.S. dollar.

International Investment and Diversification