Coping With The Limits of Macroeconomic Policy

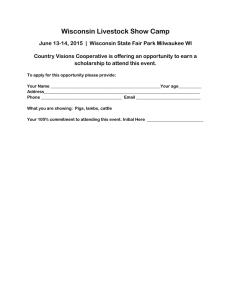

advertisement

Coping With The Limits of Macroeconomic Policy The Recovery from the Great Recession In this presentation • National forecasts are produced by Global Insight, Inc. • State and Metropolitan forecasts are public information produced by the Division of Research and Policy, Wisconsin DOR. • Information is supplied by the U.S. Bureau Of the Census, U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, Federal Housing Finance Authority, Federal Reserve Board of Governors, Federal Reserve Bank of Philadelphia, Federal Reserve Bank of New York, the Wisconsin Department of Workforce Development, and various divisions of the Wisconsin DOR. 1 Today’s Themes 1) Living a Half-Fast Recovery. 2) Coping with the Limits of Macroeconomic Policy 3) Prospects for US and Wisconsin in 2011 & 2012 2 Economy Now Fully Recovered At least pending another GDP Revision 3 Recovery Already in 29th Month 4 Real GDP Growth Has Stalled Compared to Recent Recoveries 5 Growth is About Half of Post War Average Recoveries Aren't What They Used to Be Average Real GDP Growth First 9 Quarters of Recovery 7 6 5 4 3 2 1 0 September 30, 2011 6 Remember the National Income Identity Yd = C + I + (X-M) + G Total Aggregate Demand is the sum of purchases for consumption, investment, net exports and government. 7 Consumption Fully Recovered by Late 2010 8 National Retail Sales Continue to Rise Around 8.0% Over Prior Year Retail Sales 12% Year-over-year Growth 8% 4% 0% -4% -8% -12% 2007 2008 Total 2009 2010 2011 Total Less Sales of M otor Vehicles 9 Exports Recovered Quickly September 30, 2011 10 Federal Spending Never Faltered September 30, 2011 11 Limits of Macroeconomic Policy • Fiscal Policy – Keynesian Fallacy of Composition – Bill comes dues for 2009 Stimulus • Monetary Policy – Living in the Liquidity Trap September 30, 2011 12 State & Local Purchases Matter More In the "G" in the National Income Identity 13 2001q1 2001q3 2002q1 2002q3 2003q1 2003q3 2004q1 2004q3 2005q1 2005q3 2006q1 2006q3 2007q1 2007q3 2008q1 2008q3 2009q1 2009q3 2010q1 2010q3 2011q1 2011q3 State & Local Spending Unwinds 10 Years of Growth State & Local Purchases, NIPA Basis 1540 1520 1500 1480 1460 1440 1420 1400 14 20 06 20 -I 06 20 -II 06 20 -III 06 -IV 20 07 20 -I 07 20 -II 07 20 -III 07 -I 20 V 08 20 -I 08 20 -II 08 20 -III 08 -IV 20 09 20 -I 09 20 -II 09 20 -III 09 -IV 20 10 20 -I 10 20 -II 10 20 -III 10 -I 20 V 11 20 -I 11 20 -II 11 -II I Billions of Dollars State & Local Tax Revenues Have Not Recovered Income and Sales Tax Collections, NIPA Basis 800 780 760 740 720 700 680 660 640 620 600 15 20 06 20 -I 06 20 -II 06 20 -III 06 -IV 20 07 20 -I 07 20 -II 07 20 -III 07 -I 20 V 08 20 -I 08 20 -II 08 20 -III 08 -IV 20 09 20 -I 09 20 -II 09 20 -III 09 -IV 20 10 20 -I 10 20 -II 10 20 -III 10 -I 20 V 11 20 -I 11 20 -II 11 -II I Billions of Dollars Bill Comes Dues for Stimulus Stimulus Funds Fading Away Federal Grants-In-Aid, NIPA Basis 600 550 500 450 400 350 300 16 National Data 3% Total Pvt State Govt 2% 1% 0% -1% -2% -3% -4% -5% -6% 26 24 22 20 18 16 14 12 10 8 6 4 2 -7% 0 Percent Change Over Prior Year State Government Losing Jobs Months Since End of Recession 17 Persistent State Government Job Losses This Recovery State Government Employment, Pct Change Over Prior Year 5% 4% 3% 2% 1990-91 2001 2007-09 1% 0% -1% -2% 27 25 23 21 19 17 15 13 11 9 7 5 3 1 -3% Source: U.S. Bureau of Labor Statistics 18 Wisconsin State Government Employment at 20 Year Low 19 In Wisconsin, State Government Job Losses Now Exceed Manufacturing Job Losses 20 Limits of Monetary Policy • Principal Weakness in the Economy is Lack of Investment • Low short-term interest rates have not spurred investment – Haven't move long-term rates that much – Relationship between interest and investment has changed • Lack of demand for funds 21 The Economy's Principal Weakness is Lack of Investment 22 Living in the Liquidity Trap Fed Funds Rate less than 0.1% Since April 23 Pushing on the String Yield on Inflation Indexed Securities Negative Since April September 30, 2011 24 Cutting Short-Term Rates Does Not Necessarily Move Long-Term Rates September 30, 2011 25 Mortgage Rates At Record Lows September 30, 2011 26 II I 20 I 04 20 IV 05 -I 20 I I 06 -I 20 I 07 20 -I 07 20 IV 08 -I 20 I I 09 -I 20 I 10 20 -I 10 20 IV 11 -II I 04 - II 03 - 20 20 02 - IV I II 01 - 01 - 20 20 II I 00 - 20 20 99 - IV I 98 - 98 - 19 19 II 97 - II I 900 19 19 96 - IV I 95 - 95 - 19 19 19 Housing Stuck In Low Investment in Residential Housing, Billions of 2005 Dollars 800 700 600 500 400 300 27 Lower Mortgage Rates Don’t Spur Starts Relationship Between Housing Starts and Mortgage Rates Breaks Down 3,000 20.0 18.0 2,500 16.0 14.0 12.0 1,500 10.0 Percent Thousands of Units 2,000 8.0 1,000 6.0 4.0 500 Housing Starts 30-year Mortgage Rate (Right Axis) 0 Apr-71 Jan-77 Oct-82 Jul-88 2.0 Apr-94 Jan-00 Oct-05 0.0 Jul-11 Source: U.S. Department of Commerce: Census Bureau/Board of Governors of the Federal Reserve System/FRED 28 220 FHFA Index CPI 200 180 160 140 120 Index 1991q1=100 Correcting the Housing Price Bubble Housing Prices Relative to Consumer Prices 240 100 1 -1 ar M 0 -1 ar M 09 ar M 8 -0 ar M 7 -0 ar M 6 -0 ar M 05 ar M 4 -0 ar M 3 -0 ar M 2 -0 ar M 01 ar M 0 -0 ar M 9 -9 ar M 8 -9 ar M 97 ar M 6 -9 ar M 5 -9 ar M 4 -9 ar M 3 -9 ar M 92 ar 1 -9 M ar M 29 US WI 10% 5% 0% -5% -10% Percent Change Over Prior Year Correcting the Housing Price Bubble Wisconsin’s Correction More Modest than US FHFA Purchase Index 15% -15% 1 -1 ar M 0 -1 ar M 9 -0 ar M 8 -0 ar M 7 -0 ar M 6 -0 ar M 5 -0 ar M 4 -0 ar M 3 -0 ar M 2 -0 ar M 1 -0 ar M 0 -0 ar M 9 -9 ar M 8 -9 ar M 7 -9 ar M 6 -9 ar M 5 -9 ar M 4 -9 ar M 3 -9 ar 2 -9 M ar M 30 Wisconsin Housing Bouncing Around the Bottom Wisconsin Building Permits, 12 Month Total 45000 40000 35000 30000 25000 20000 15000 10000 5000 0 11 1 l1 n Ju Ja 10 0 l1 n Ju Ja 09 9 l0 n Ju Ja 08 8 l0 n Ju Ja 07 7 l0 n Ju Ja 06 6 l0 n Ju Ja 05 5 l0 n Ju Ja 04 4 l0 n Ju Ja 03 3 l0 n Ju Ja 02 2 l0 n Ju Ja 01 1 l0 n Ju Ja 31 14 12 10 8 6 4 2 0 -2 -4 Percent Change At Anual Rates Lack of Demand for Funds Households Paying Down Debt Household Debt Outstanding 06 q2 11 20 q1 11 20 q4 10 20 q3 10 20 q2 10 20 q1 10 20 q4 09 20 q3 09 20 q2 09 20 q1 09 20 q4 08 20 q3 08 20 q2 08 20 q1 08 20 q4 07 20 q3 07 20 q2 07 20 q1 07 20 q4 06 20 q3 06 20 q2 06 20 q1 20 32 Lack of Demand for Funds Consumers Rapidly De-Leveraging Consumer Financial Obligations at Lowest Level in 18 years Consumer Financial Obligaton Ratio (FOR) Pct. of Disposable Personal Income 20.0 FOR 30 Yr Avg 19.5 19.0 18.5 18.0 17.5 17.0 16.5 16.0 15.5 10q1 08q3 07q1 05q3 04q1 02q3 01q1 99q3 98q1 96q3 95q1 93q3 92q1 90q3 89q1 87q3 86q1 84q3 83q1 81q3 80q1 15.0 Source: Federal Reserve Board of Governors 33 Ja n Ap 1 r 1 200 Ju 2 0 0 O l 1 2 00 ct 0 J a 1 2 00 n 0 Ap 1 00 r 1 200 Ju 2 0 1 O l 1 2 01 ct 0 J a 1 2 01 n 0 Ap 1 01 r 1 200 Ju 2 0 2 O l 1 2 02 ct 0 J a 1 2 02 n 0 Ap 1 02 r 1 200 Ju 2 0 3 O l 1 2 03 ct 0 J a 1 2 03 n 0 Ap 1 03 r 1 200 Ju 2 0 4 O l 1 2 04 ct 0 J a 1 2 04 n 0 Ap 1 04 r 1 200 Ju 2 0 5 O l 1 2 05 ct 0 J a 1 2 05 n 0 Ap 1 05 r 1 200 Ju 2 0 6 O l 1 2 06 ct 0 J a 1 2 06 n 0 Ap 1 06 r 1 200 Ju 2 0 7 O l 1 2 07 ct 0 J a 1 2 07 n 0 Ap 1 07 r 1 200 Ju 2 0 8 O l 1 2 08 ct 0 J a 1 2 08 n 0 Ap 1 08 r 1 200 Ju 2 0 9 O l 1 2 09 ct 0 1 09 1/ 2 00 1 9 4/ /2 0 1 10 7/ /2 0 10 1/2 10 /1 01 / 0 1/ 201 1/ 0 20 11 Change over Prior Year $M Consumers Still Paying Down Credit Cards Revolving Credit Has Been Dropping Rapidly Since Feb 2009 100000 80000 60000 40000 20000 0 -20000 -40000 -60000 -80000 -100000 Source: Federal Reserve Board of Governors Last Month Plotted: February 2011 34 20 00 -I 00 -I 20 I I 01 20 -I 01 -I 20 I I 02 20 -I 02 -I 20 I I 03 20 -I 03 -I 20 I I 04 20 -I 04 -I 20 I I 05 20 -I 05 -I 20 I I 06 20 -I 06 -I 20 I I 07 20 -I 07 -I 20 I I 08 20 -I 08 -I 20 I I 09 20 -I 09 -I 20 I I 10 20 -I 10 -I 20 I I 11 -I 20 New Frugality Savings Up Substantially 800 Personal Savings, Billions of Dollars 700 600 500 400 300 200 100 0 35 Collateral Damage Low Interest Rates Reduce Personal Income 36 Two Sectors Sufficient to Explain the Half-Fast Recovery Real GDP Growth At Annual Rates Contributions to Real GDP Growth From Sector 1.2 1.0 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 S&L Govt Residential 19 1 1 1 1 1 1 2 2 53 957 960 969 974 981 990 000 007 -54 -58 -61 -70 -75 -82 -91 -01 -09 Source: BEA, NIPA Table 1.1.2. Contributions to Percent Change in Real Gross Domestic Product Rest of Economy Outpacing Last Two Recoveries 9 Qtr Real GDP Growth in Recovery Real GDP At Annual Rates 7 Total Less S&L, Res Inv 6 5 4 3 2 1 0 1953-54 1957-58 1960-61 1969-70 1973-75 1981-82 1990-91 2001 2007-09 Wisconsin Outlook in 2011 and 2012 Wisconsin Among 25 States with Unemployment Significantly Below US State Unemployment Rates August 2011 Below US Average (25) Near US Average (16) Above US Average (9) 40 Manufacturing Leading Wisconsin’s Recovery 6% 4% 2% Wisconsin Employment, Percent Change over Prior Year Total Manufacturing 0% -2% -4% -6% -8% -10% -12% -14% Ja n0 Ap 7 r-0 7 Ju l-0 O 7 ct -0 7 Ja n0 Ap 8 r-0 8 Ju l-0 O 8 ct -0 8 Ja n0 Ap 9 r-0 9 Ju l-0 O 9 ct -0 9 Ja n1 Ap 0 r-1 0 Ju l-1 O 0 ct -1 0 Ja n11 -16% 41 Milwaukee Manufacturing Edges Up Index; Reading above 50 signals expansion ISM Manufacturing Index: PMI 75 50 25 2007M01 2008M01 2009M01 National 2010M01 2011M01 Milwaukee 42 Sales Tax Collections Trend Higher 3 Month Moving Average Sales Tax Collections 3-Month Moving Average 8.0% Year/Year Change 6.0% 4.0% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0% -10.0% -12.0% 2007M09 2008M09 2009M09 2010M09 43 Withholding Collections Also Trend Higher Withholding Collections 3-Month Moving Average 12.0% Year/Year Change 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% -4.0% -6.0% -8.0% 2007M09 2008M09 2009M09 2010M09 44 Wisconsin Income Held Up Better Than US Cumulative Income Growth Since 2007q4 10% 8% US WI 6% 4% 2% 0% -2% -4% 20 20 20 20 20 20 20 20 20 20 20 20 20 20 11 11 10 10 10 10 09 09 09 09 08 08 08 08 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 45 Wisconsin Per Capita Income Edging Closer to US Average 97.0% 96.0% 95.0% 94.0% 93.0% 92.0% 91.0% 2004 2005 2006 2007 2008 2009 2010 46 Wisconsin Ranks 25th in Per Capita Personal Income State Per Capita Personal Income 2010 Top 10 Second 10 Middle 10 Fourth 19 Bottom 10 (8) (10) (10) (10) (12) 47 Employment Outlook Wisconsin Slightly Ahead of US in 2011 Percent Change Over Prior Year Change in Nonfarm Employment 2 1 0 -1 US WI -2 -3 -4 -5 2007 2008 2009 2010 2011 2012 2013 Source: Wisconsin DOR, Wisconsin Economic Outlook http://www.revenue.wi.gov/ra/econ/index.html 48 Income Outlook Wisconsin Outperforms US in 2011 Percent Change Over Prior Year Total Personal Income 8 6 4 2 US WI 0 -2 -4 -6 2007 2008 2009 2010 2011 2012 2013 Source: Wisconsin DOR, Wisconsin Economic Outlook http://www.revenue.wi.gov/ra/econ/index.html 49