WHAT JUST HAPPENED WHERE DO WE GO FROM HERE? AND Wisconsin

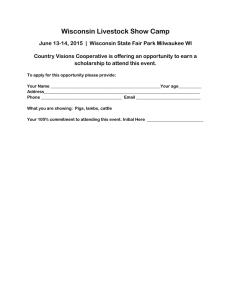

advertisement

WHAT JUST HAPPENED AND Wisconsin’s Economic Outlook WHERE DO WE GO FROM HERE? Wisconsin Economics Association December 3, 2010 Dennis K. Winters Chief, Office of Economic Advisors Wisconsin Department of Workforce Development December 3, 2010 WELCOME Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 2 FIRST, YOU HAVE TO UNDERSTAND WISCONSIN’S ECONOMY Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 http://flowingdata.com/2010/03/02/where-bars-trump-grocery-stores/ Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 HOW BAD WAS IT? HOW BAD WAS IT? THINGS THAT NEVER HAPPENED BEFORE Wisconsin’s Economic Outlook • Longest recession since the Great Depression • Four negative U.S. GDP quarters in a row • Global GDP declined • The U.S. and Japan were in recession at same time Wisconsin Economics Association December 3, 2010 • Personal consumption expenditures were down 3 out of four quarters, with the one registering just +0.1% 5 INDUSTRIAL ACTIVITY PLUNGED U.S. AND ESPECIALLY THE MIDWEST Wisconsin’s Economic Outlook Manufactuing Production Indexes 130 120 110 100 Midwest U.S. 90 80 70 Wisconsin Economics Association 60 50 40 30 Jan-73 December 3, 2010 Jan-82 Source: Chicago Fed, OEA Jan-91 Jan-00 Jan-09 6 EMPLOYMENT DROPPED PRECIPITIOUSLY JOB LOSSES WORSE THAN 1981 RECESSION Total NonFarm Y/Y Job Growth (unadjusted) 6.0% Wisconsin’s Economic Outlook Growth over 12 Months 4.0% Wisconsin Economics Association 2.0% 0.0% Wisconsin -2.0% U.S. -4.0% December 3, 2010 Source: Bureau of Labor Statistics, LMI, OEA Jan-11 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 -6.0% 7 UNEMPLOYMENT CLIMBED NOT QUITE TO LEVELS OF 1981 RECESSION Wisconsin’s Economic Outlook Unemployment Rates (seasonally adjusted) 12 11 Wisconsin 10 U.S. Percent 9 8 7 6 Wisconsin Economics Association 5 4 December 3, 2010 Source: Bureau of Labor Statistics, LMI, OEA 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 3 8 WORKERS DROPPED OUT OF THE WORKFORCE “MARGINAL” WORKER U6 - U3 Difference Wisconsin’s Economic Outlook 10% 9% Jan 2010 U3 = 9.7% U6 = 17.6% 8% 7% 6% 5% 4% 3% December 3, 2010 J-10 S-09 M-09 J-09 S-08 M-08 J-08 S-07 M-07 J-07 S-06 M-06 J-06 S-05 M-05 2% J-05 Wisconsin Economics Association Source: U.S. DOL, WI Dept. of Workforce Development; Local Area Unemployment Statistics and National Bureau of Economic Research 9 DURATION OF FINDING NEW JOB IS PROTRACTED Average Weeks Unemployed Wisconsin’s Economic Outlook 35 30 25 20 15 December 3, 2010 Source: U.S. Dept. of Labor, Bureau of Labor Statistics and National Bureau of Economic Research Jan 2008 Jan 2003 Jan 1998 Jan 1993 Jan 1988 Jan 1983 Jan 1978 Jan 1973 Jan 1968 Jan 1963 Jan 1958 5 Jan 1953 10 Jan 1948 Wisconsin Economics Association 10 WORKER ANGST DIDN’T DECREASE JUST SHIFTED CUIC State and Fed Extentions Wisconsin’s Economic Outlook 350,000 WI CUIC 300,000 Fed Exts Total 250,000 200,000 150,000 Wisconsin Economics Association 100,000 50,000 0 2008w1 2008w14 2008w27 2008w40 2009w1 2009w14 2009w27 2009w40 2010w1 2010w14 2010w27 2010w40 December 3, 2010 Source: UI, OEA 11 Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 YES VIRGINIA, WE ARE IN RECOVERY MODE, BUT… BOTH MAJOR SECTORS RECOVERING MANUFACTURING AND NON-MANUFACTURING Industry Indexes Wisconsin’s Economic Outlook 70.0 65.0 60.0 55.0 50.0 45.0 Wisconsin Economics Association Non-Manufacturing Manufacturing 40.0 35.0 30.0 7 l-9 u J December 3, 2010 8 l-9 u J 9 l-9 u J 0 l-0 u J Source: St. Louis Fed, OEA 1 l-0 u J 2 l-0 u J 3 l-0 u J 4 l-0 u J 5 l-0 u J 6 l-0 u J 7 l-0 u J 8 l-0 u J 9 l-0 u J 0 l-1 u J 13 HOW DO YOU SPELL RECOVERY? Wisconsin’s Economic Outlook • GDP • DJIA Wisconsin Economics Association December 3, 2010 • JOBS 14 HOW DO YOU SPELL RECOVERY? GDP; Five positive quarters, Q3 up 2.5% Real GDP Growth Wisconsin’s Economic Outlook 10.0 8.0 6.0 Percent 4.0 Wisconsin Economics Association 2.0 0.0 -2.0 -4.0 -6.0 -8.0 2000q1 December 3, 2010 2002q1 2004q1 Source: Bureau of Economic Analysis, OEA 2006q1 2008q1 2010q1 HOW DO YOU SPELL RECOVERY? DJIA; UP 72% SINCE MARCH 9, 2009 Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 Source: http://moneycentral.msn.com/investor/charts/chartdl.aspx HOW DO YOU SPELL RECOVERY? JOBS; STILL DOWN 150,000 Wisconsin Total Nonfarm Jobs (NSA) Wisconsin’s Economic Outlook 2,950,000 2,900,000 2,850,000 2,800,000 2,750,000 Wisconsin Economics Association 2,700,000 2007 2008 2009 2010 2,650,000 2,600,000 Jan December 3, 2010 Feb Mar Apr May Source: Bureau of Labor Statistics, LMI, OEA Jun Jul Aug Sep Oct Nov Dec 17 JOB RECOVERY WILL TAKE TIME Job Losses in Recent Recessions - Wisconsin - # of Months Since Recession Declaration 1.0% Wisconsin’s Economic Outlook 0.0% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 Job Losses Relative to Peak Month -1.0% Wisconsin Economics Association -2.0% -3.0% -4.0% 1981 Recession 2001 Recession 1990 Recession Current Recession -5.0% -6.0% -7.0% Source: DWD, OEA, X12 adjustment of not seasonally adjusted CES via U.S. BLS December 3, 2010 Source: BLS, OEA 18 EVEN JOB NUMBERS CAN BE DECEIVING THE UNDEREMPLOYED Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 19 CAUTION STILL REIGNS MANAGING YEAR-END COSTS Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 20 NEW CLAIMS MOVING SIDEWAYS INDUSTRIES CONTINUE TO ADJUST Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 21 Wisconsin’s Economic Outlook GDP = C + I + G + (I-M) Wisconsin Economics Association December 3, 2010 Wisconsin’s Economic Outlook C = CONSUMPTION Wisconsin Economics Association December 3, 2010 PERSONAL INCOME NOT SNAPPING BACK LIKE BEFORE Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 24 RETAIL SALES CLIMBING WHAT WILL BE THE NEW NORMAL Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 25 EVEN WITH LOW MORTGAGE RATES NEW HOME SALES AREN’T RESPONDING Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 26 HOUSING MARKETS WON’T BE AN ECONOMIC DRIVER U.S. Housing Starts and Permits Wisconsin’s Economic Outlook 2,400 Thousands of units 2,000 Wisconsin Economics Association 1,600 1,200 800 400 2006 2007 Housing Starts December 3, 2010 Source: Wisconsin Department of Revenue 2008 2009 2010 Housing Permits (3-Month Moving Average) 27 WHERE HAVE ALL THE YUPPIES GONE? WHO WILL BUILD A NEW HOUSE NOW? Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 28 TAKE MY HOUSE PLEASE Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 29 MORTGAGE RISK STILL HAS CHALLENGES PENDING Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 ALL SECTORS OVERBUILT RESIDENTIAL, COMMERCIAL, HEAVY Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 31 INTEREST IS LESS DISMAL BUT STILL CONTRACTING Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 32 AUTO SALES LIMITED CONTRIBUTION Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 33 FUTURE UNCERTAINTY DAMPENS CONSUMER MOOD Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 34 IS THE PHILLIPS CURVE BACK? IF YES, THEN FED HAS LEEWAY Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 35 Wisconsin’s Economic Outlook I = INVESTMENT Wisconsin Economics Association December 3, 2010 LOW INTEREST RATES GAVE INCENTIVES TO BORROW Wisconsin’s Economic Outlook All sectors Wisconsin Economics Association December 3, 2010 Domestic government sector Source: William R. Emmons, Federal Reserve Bank of St. Louis, May 7, 2010 talk on the District II Economic Outlook . 37 EXTENDING CREDIT BANKS ARE RETICENT TO LEND FUNDS Reserves of Depository Institutions (billions of dollars) Wisconsin’s Economic Outlook $1,400 Required Reserves Total reserves $1,200 $1,000 $800 $600 Wisconsin Economics Association $400 $200 December 3, 2010 Source: Federal Reserve Board, Data Download Program Jan 2010 Oct 2009 Jul 2009 Apr 2009 Jan 2009 Oct 2008 Jul 2008 Apr 2008 Jan 2008 $0 38 STILL UNCERTAIN ABOUT ECONOMIC STRENGTH Yield Spread: BAA Corporate Rate minus 10 Year Treasury Rate Wisconsin’s Economic Outlook 7.0 6.0 5.0 4.0 3.0 Wisconsin Economics Association 2.0 1.0 Jan -88 Jan -89 Jan -90 Jan -91 Jan -92 Jan -93 Jan -94 Jan -95 Jan -96 Jan -97 Jan -98 Jan -99 Jan -00 Jan -01 Jan -02 Jan -03 Jan -04 Jan -05 Jan -06 Jan -07 Jan -08 Jan -09 Jan -10 0.0 December 3, 2010 Source: Prof. Don Nichols, Emeritus 39 MANAGING RISK WHERE IS THE INCENTIVE TO EXPAND Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 CORPORATE PROFITS LOOK HEALTHY MOSTLY DUE TO COST CUTTING Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 41 FROM WHERE ELSE WILL PRIVATE INVESTMENT COME Corp Profits as % National Income Wisconsin’s Economic Outlook 12% 10% 8% 6% Wisconsin Economics Association 4% 2% December 3, 2010 Source: Prof. Don Nichols, Emeritus 09 20 07 20 05 20 03 20 01 20 99 19 97 19 95 19 93 19 91 19 89 19 87 19 85 19 83 19 81 19 79 19 19 77 0% 42 DEMAND STILL INSUFFICIENT TO EXPAND WILL KEEP INFLATION AT BAY Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 43 Wisconsin’s Economic Outlook G = GOVERNMENT Wisconsin Economics Association December 3, 2010 Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 Source: http://seekingalpha.com/article/115525-the-scariest-chart-ever?source=article_sb_popular QE1 TRACK IT Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 http://money.cnn.com/news/specials/storysupplement/stimulus-tracker/index.html QE2 = MORE MONEY TO BE APPLIED WHERE? • TARP Wisconsin’s Economic Outlook Wisconsin Economics Association – – – – – – – – – AIG AGP ASSP AITP CPP CBLI MHA PPIP TIP • Fed Reserve Rescue Efforts – – – – – – – – – – ABCPMMMFL BoALLB BSB CLLB CPFF FEDS GSEDP GSEMBSP MMIFF PDCF – TABSLF December 3, 2010 – TAF – TSLF – US Bond purchases 47 QE2 = MORE MONEY (continued) TO BE APPLIED WHERE? Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 • Federal Stimulus Programs – – – – – – ESA of 2008 UIBE SLG ARRA ATVMP CARS • AIG – – – – Asset purchases Bridge loan Gov’t stakes in subs TARP • FDIC – 2008 Bank takeovers – 2009 Bank takeovers 48 QE2 = MORE MONEY (continued again) TO BE APPLIED WHERE? • Other Financial Initiatives Wisconsin’s Economic Outlook – – – – – CUDIG MMGP NCUA Bailout of credit unions USFCUI TLGP • Other Housing Initiatives Wisconsin Economics Association – – – – Fannie Freddie FHA MHAI $11 trillion committed December 3, 2010 $3 trillion invested http://money.cnn.com/news/storysupplement/economy/bailouttracker/#TARP 49 LONG-TERM RATES RELATIVELY HIGH FED TRYING TO BRING THEM DOWN Yield Curve: Yield on Ten Year Treasury minus yield on One Year Treasury Wisconsin’s Economic Outlook 4 3 2 1 0 -1 Wisconsin Economics Association -2 -3 December 3, 2010 Source: Prof. Don Nichols, Emeritus 201 0 200 8 200 6 200 4 200 2 200 0 199 8 199 6 199 4 199 2 199 0 198 8 198 6 198 4 198 2 198 0 -4 50 Wisconsin’s Economic Outlook I-M = NET EXPORTS Wisconsin Economics Association December 3, 2010 LOWER U.S. DEMAND HELPING HOLD DOWN TRADE IMBALANCE U.S. Goods and Services Trade Balance Wisconsin’s Economic Outlook $-20 Billions $-30 Wisconsin Economics Association $-40 $-50 $-60 $-70 2007 December 3, 2010 Source: Wisconsin Department of Revenue 2008 2009 2010 52 LACK OF U.S. DEMAND HELPING HOLD DOWN TRADE IMBALANCE Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 53 DOLLAR DROPPING WHOSE SIDE ARE YOU ON? Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 54 ADD IT ALL UP AND … Wisconsin’s Economic Outlook GDP = C + I + G + (I-M) Wisconsin Economics Association December 3, 2010 RECOVERING BUT STILL LOWER U.S Gross Domestic Product (Real 2005 U.S. Dollars) 14,000 Billions Wisconsin’s Economic Outlook 13,000 12,000 11,000 10,000 9,000 8,000 7,000 Wisconsin Economics Association 6,000 5,000 December 3, 2010 Source: U.S. Bureau of Economic Analysis q1 20 08 q1 20 04 q1 20 00 q1 19 96 q1 19 92 q1 19 88 q1 19 84 q1 19 80 q1 76 19 19 72 q1 4,000 BIGGEST DIP, SLOWEST RECOVERY TWELVE Q’s SINCE LAST PEAK, STILL NOT BACK Time from Peak to New High 3% Wisconsin’s Economic Outlook % of previous GDP peak 2% Wisconsin Economics Association 1% 0% -1% 1948 1953 1957 1960 1969 1973 1980 1981 1990 2001 2007 -2% -3% -4% -5% Q1 December 3, 2010 Q2 Q3 Q4 Source: U.S. Bureau of Economic Analysis; OEA Q5 Q6 Q7 Q8 Quarters Q9 Q10 Q11 Q12 Q13 IN CONCLUSION TORTOISE RECOVERY Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 Slow but sturdy recovery Low inflation due to excess capacity Employment breach in 2012? Strength of recovery subject to consumer income and wealth uncertainty Risks Financial workouts put too much strain on economy. European Union fiscal problems wash over the global financial markets. High unemployment saps consumption. 58 Wisconsin’s Economic Outlook So, what will be the biggest socio-economic policy challenge in the next 20 years? Wisconsin Economics Association December 3, 2010 59 ELDERLY NUMBERS WILL SWELL WIDEN THE SIDEWALKS WILL YA !? Wisconsin’s Economic Outlook Wisconsin Economics Association December 3, 2010 60 Wisconsin’s Economic Outlook QUANTITY Wisconsin Economics Association December 3, 2010 WISCONSIN’S WORKFORCE GROWTH BECOMES FLAT Wisconsin Population and Labor Force Wisconsin’s Economic Outlook 7,000 POPULATION 6,000 CIVILIAN LABOR FORCE ( x 1000 ) 5,000 4,000 3,000 Wisconsin Economics Association 2,000 1,000 1960 December 3, 2010 1970 1980 Source: Bureau of Labor Statistics, OEA 1990 2000 2010 2020 2030 62 BLS RAISED LFPR FOR THE FUTURE PARTICULARLY FOR OLDER COHORTS Changes in LFPR by Age Cohort Wisconsin’s Economic Outlook 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% Constant 2000 2010 2020 2030 30.0% Wisconsin Economics Association 20.0% 10.0% 0.0% 16-19 December 3, 2010 20-24 25-34 35-44 45-54 55-59 60-64 Source: Bureau of Labor Statistics, Bureau of the Census, OEA 65-69 70-74 75+ 63 WISCONSIN’S WORKFORCE HIGHER LFPRs OFFER LIMITED GAINS Wisconsin’s Economic Outlook Worker Difference from Census 2000 140,000 120,000 100,000 80,000 60,000 40,000 Wisconsin Economics Association 20,000 (20,000) December 3, 2010 2010 2010 2020 2020 2030 2030 New BLS Plus 3% New BLS Plus 3% New BLS Plus 3% Source: Bureau of Labor Statistics, OEA 64 LITTLE CHANGES EVEN WITH HIGHER LFPR RETIREMENTS SWAMP PARTICIPATION Wisconsin Population and Labor Force Wisconsin’s Economic Outlook 7,000,000 Population Labor force base case BLS prj. change Elevated LFPR of 3 percentage points 6,000,000 5,000,000 4,000,000 3,000,000 Wisconsin Economics Association 2,000,000 1,000,000 1960 December 3, 2010 1970 1980 Source: Bureau of the Census, DOA, OEA 1990 2000 2010 2020 2030 65 NURSING WORKFORCE IN WISCONSIN DEMOGRAPHICS AT WORK Wisconsin Nurses by Age Wisconsin’s Economic Outlook 14,000 12,000 10,000 8,000 6,000 Wisconsin Economics Association 4,000 2,000 0 < 25 December 3, 2010 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75 + Source: Office of Economic Advisors 66 Wisconsin’s Economic Outlook QUALITY Wisconsin Economics Association December 3, 2010 Data: March Supplement of CPS, 1992-2007 (via IPUMS) Population projections from DOA Wisconsin’s Economic Outlook Age Groups: Wisconsin Economics Association December 3, 2010 15-24 25-34 35-44 45-54 55-64 65-74 over 75 Education Categories: Less than high school High school graduate Some college, no degree Associate degree, Bachelor’s degree, Graduate or Professional degree Income Categories: Earnings Transfer payments Dividends (interest, rent, and other income) Total income 68 AS BOOMERS RETIRE INCOME COMPONENTS CHANGE Year: 2000 7.6% Income stream shifts with age from earned income to transfer payments. Wisconsin’s Economic Outlook 10.3% 82.1% Earnings Transfers Dividends 6.9% Wisconsin Economics Association December 3, 2010 Real escalation in transfer payments is near zero – essentially eliminating gains from this income source. Source: 1992-2007 CPS (Wisconsin) & DOA Pop Projections 18.5% Year: 2035 74.6% AGGREGATE REAL INCOME GROWTH FLATTENS WITH WORKFORCE AND SOURCE Aggregate. Real Income Historic 1992-2007, and Projected 2010-2035 Billions Wisconsin’s Economic Outlook $200 $175 Historic $150 Version 2.0 Wisconsin Economics Association $125 $100 1992 December 3, 2010 1997 2002 2007 2012 Source: 1992-2007 CPS (Wisconsin) & DOA Pop Projections 2017 2022 2027 2032 70 UNDER BASE CASE ASSUMPTIONS PCI DECREASES STARTING IN 2015 Wisconsin’s Economic Outlook Graph 1: Population vs Agg Real Income Change, 1995-2035 25% Pop 15+ Change Agg Income Change (Base) 20% 15% 10% 5% Wisconsin Economics Association 0% -5% 19952000 December 3, 2010 20002005 20052010 20102015 20152020 Source: Bureau of Labor Statistics, Bureau of the Census, OEA 20202025 20252030 20302035 LAYING IN EDUCATION PROJECTIONS TO ACCOUNT FOR ATTAINMENT TRENDS 15-24 Wisconsin’s Economic Outlook 50.0% 25.0% 0.0% Less HS HS Some AA BA Grad 25-34 50.0% 25.0% December 3, 2010 25.0% 2034 2031 2028 2025 2022 2019 2016 2013 2010 2007 0.0% 2004 199 2 199 7 200 2 200 7 201 2 201 7 202 2 202 7 203 2 0.0% 45-54 2001 25.0% Less HS HS Some AA BA Grad 1998 Wisconsin Economics Association 35-44 1995 50.0% 50.0% 1992 199 2 199 7 200 2 200 7 201 2 201 7 202 2 202 7 203 2 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 14 20 16 20 18 20 20 20 22 20 24 20 26 20 28 20 30 20 32 20 34 0.0% 72 WE GET A BOOST IN PERSONAL INCOME FROM MORE EDUATION AND TRAINING Aggregate Real Income Historic 1992-2007, and Projected 2010-2035 Billions Wisconsin’s Economic Outlook $200 $175 Historic $150 Version 2.0 Version 3.0 Wisconsin Economics Association $125 $100 1992 December 3, 2010 1997 2002 2007 2012 Source: 1992-2007 CPS (Wisconsin) & DOA Pop Projections 2017 2022 2027 2032 73 THE INCOME BOOST ONLY DELAYS THE PCI LOSS FOR A FEW YEARS Wisconsin’s Economic Outlook Graph 1: Population vs Agg Real Income Change, 1995-2035 25% 20% Pop 15+ Change Agg Income Change (Base) Agg Income Change (New ) 15% 10% 5% Wisconsin Economics Association 0% -5% 19952000 December 3, 2010 20002005 20052010 20102015 20152020 Source: Bureau of Labor Statistics, Bureau of the Census, OEA 20202025 20252030 20302035 74 WORKFORCE TRENDS ARE: Wisconsin’s Economic Outlook Unprecedented – we have never faced a declining workforce before; Assured – demographics will change little; Largely unalterable – demographics and migration patterns do not change abruptly. Wisconsin Economics Association December 3, 2010 75 RAMIFICATIONS OF WORKFORCE TRENDS ARE: Wisconsin’s Economic Outlook Potentially devastating – without sufficient productivity gains the state’s economy will stagnate; Necessitating a focus on talent – large investments in education and training are needed; best ROI is early childhood Wisconsin Economics Association December 3, 2010 Requiring match – talent supply and industry demand must be matched or you lose both. 76 Wisconsin’s Economic Outlook QUESTIONS? Wisconsin Economics Association December 3, 2010 77 CONTACT INFORMATION Wisconsin’s Economic Outlook Dennis Winters Phone: 608-267-3262 Email: dennis.winters@dwd.wisconsin.gov Wisconsin Economics Association December 3, 2010 Website: www.dwd.wisconsin.gov OEA website: www.dwd.wisconsin.gov/oea 78