THE LAW OF ONE PRICE

advertisement

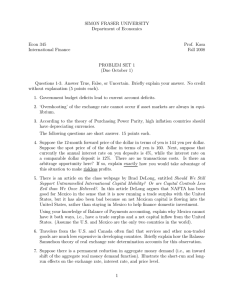

M Tansey July 17, 2016 THE LAW OF ONE PRICE A. Measures of Output, Expenditure, and Income ......................................................... 1 B. Prices And Price Indices...................................................................................... 3 (1) The Price Of Goods And Services. .......................................................... 4 (2) Wage Rates ................................................................................................. 5 (3) Interest Rates. ........................................................................................... 5 (4) Exchange Rates ........................................................................................... 5 C. The Law of One Price ..................................................................................... 6 D. Prices Across Countries................................................................................... 8 (1) Inflation and Exchange Rates: Purchasing Power Parity ..................... 8 (2) Interest Rates and Exchange Rates: Interest Rate Parity ...................... 9 (3) Inflation and Interest Rates: the Fisher Effect ..................................... 10 E. Investing Globally ......................................................................................... 11 Appendix I The Federal Reserve Site........................................................................ 12 THE LAW OF ONE PRICE The law of one price is conceptually easy to understand. But to realize its implications for planning are quite complex. This reading will provide a grasp of the implications and usefulness of this simple concept. It will also provide practice in acquiring and using data, skill in analyzing exchange rates, and appreciation for arbitrage. A. Measures of Output, Expenditure, and Income Before price can be defined, output must be defined, specifically the flow of output over a given time period. But there were many ways of conceiving of such a flow of product. There is output which is the amount of goods or services that people actually produce. But there are so many different kinds of output that it is hard to find a way to aggregate the output into a single measure. Today the Federal Reserve Board publishes measures of output of different kinds of goods and services. Then there is the notion of expenditure. This is the concept of how much buyers buy over a given time period. This concept has the advantage of being measured in terms of the money spent on the goods and services and can be aggregated easily into a single figure. However, being measured in dollars, this aggregate expenditure is distorted by inflation, or, as in the depression, by deflation. Expenditure data is collected in the National Accounts by the Bureau of Economic Analysis of the Commerce Department (http://bea.gov). Here is a break down of expenditures by the major four groups which buy output: 1 2003 Gross domestic product=C+I+G+EX-IM 11,004.00 Personal consumption expenditures (C) 7,760.90 Gross private domestic investment (I) 1,665.80 Net exports of goods and services -498.1 Exports (EX) 1,046.20 Imports (IM) 1,544.30 Government consumption expenditures and gross investment (G) Federal 2,075.50 752.2 State and local 1,323.30 There are four basic types of organizations that account for expenditures; households with personal consumption (C), government with government expenditures (G), businesses with gross investment (I), and foreigners with Net exports ( which equals Exports (Ex) minus Imports (Im)). When these expenditures are added together they equal the Gross Domestic Product. On the other hand, instead of measuring what people spend, the government could measure what people earned for their work. This concept also had the advantage of being measured in dollars so that it could be aggregated easily. In the National Accounts, the Bureau of Economic Analysis also collects this information. Following are the major groups income earners as categorized by the Bureau of Economic Analysis: 2003 National income Compensation of employees 9,679.60 6,289.00 Proprietors' income with IVA and CCAdj 834.1 Rental income of persons with CCAdj 153.8 Corporate profits with IVA and CCAdj 1,021.10 Net interest and miscellaneous payments Taxes on production and imports 543 798.1 Less: Subsidies 1 46.7 Business current transfer payments(net) 77.7 Current surplus of government enterprises 1 9.5 (*don’t forget to subtract the subsidies of 46.7) The national income consists of five major groups of income earners: wage earners, proprietors, owners of property, corporations, and owners of debt (such as bonds). Each of these groups wears out capital in the process of earning their income and therefore adjustments to capital must be made. Much of the complexity of this table simply involves the problems of accounting for depreciation of capital. Between these two tables, national income and the gross domestic product do not 2 appear to be that far apart. In fact they are very closely related to each other, and the Bureau of Economic Analysis makes use of their similarity to check their work. It works very much like the principle of double entry book keeping used by accountants and it works because of a fundamental identity: EXPENDITURES = INCOME= the value of OUTPUT In other words, it is possible to measure output of the economy by the amount buyers paid for it, the amount that sellers received, or the value of the physical goods or services that were produced. The differences in the measures reflect differences in the organizations that spend, earn, and produce. The most widely used measure of all three is the Gross Domestic Product (GDP). It is measure of finished goods and services (in other words, the goods and services that will become extinct after they are purchased by the buyers who are called the final purchasers). Because foreign owned firms produce goods and services in the United States and American firms produce abroad, it is sometimes useful to define another concept, the Gross National Product (GNP), which reflects expenditure by domestically owned operations, whether their income comes from home or abroad, and to exclude the production of foreign owned companies. Other concepts of income, output and expenditure will be examined later when we examine government accounting in more detail. However, GDP is an aggregate. It combines the output of millions of specific products and services. Each of these specific outputs of goods and services is typically valued in terms of money. Money (referred to as a “numeraire”) provides a standard of value by which goods can be exchanged in a market place. “Price” is the measure of goods and services (or money) that are to be exchanged. B. Prices And Price Indices Prices are a measure of the way goods are exchanged. They are a ratio of how much of one good is exchanged for another good. Most generally owners give up the title of something which they wish to exchange in order to receive title to something else they want title to. Ownership requires a justice system and a procedure of enforcement. Exchange involves a contract, explicit or implicit, which can be negotiated and enforced. Many prices for a single commodity may exist, depending upon the procedures in making an exchange. When price setting involves a negotiation, there are bid prices which are quite different from the agreed price. The price at the time of contract may very well be different from the price at time of delivery because of particular contract conditions (eg. Adjustments for cost-of-living, quantity, quality, and other contingencies). Often prices are unspecified as a matter of trust. Often agents of an owner decide the price, not the owner. Often trade associations report a price that they have surveyed their members to determine. However, for economic purposes it is important to pinpoint the final price at which the last goods are actually exchanged in a market before defining what a price is. 3 Following are the most important price ratios that are used in economics: (1) The Price Of Goods And Services. The ratio usually represents the amount of money (placed in the numerator) that is exchanged for a certain amount of goods (placed in the denominator). For example, the price of a CD might be quoted as “ten dollars”. The price is the ratio of the $10 to the one CD and is properly written as: $10 1 CD A price index is constructed by choosing a base year from which to compare the prices in all years. There is nothing significant about the choice of a particular base year. It can be any year. In fact agricultural subsidies often are computed using the base year of 1917, which was one of the best years for farm subsidies. Suppose, we chose a base year of 1995 for CDs and suppose the 1995 price was $20 per CD. Then the CD price index would be: Price index of a CD (with a 1995 base year)= ($10/CD)/ ($20/CD)= .50 Instead of using the fraction, indexes are often quoted as if they were percentages. That requires the multiplication of the price index by 100 to get 50. Once we have the base year, we can then divide the prices in any year by the price of the base year so that the index shows the rate of change in prices since the base year. What would the price index for the base year be? It is always 100 because the 1995 price divided by itself equals 1.0. The Bureau of Labor Statistics provides many different price indices for specific products and services. However, it provides two major types of price indexes; the Consumer Price Index and the Producer Price Index. The Consumer Price Index (CPI) measures what the consumer pays, while the Producer Price Index (PPI) measures what the producers charge. Why might they be different? The middleman. Sometimes Consumer demand pulls the producer prices upward. However, usually the Producer Price Index leads the Consumer Price index in time. Both the CPI and PPI are available in EXCEL format at the BLS.gov website. The Bureau of Economic Analysis also provides price indexes. They use the Bureau of labor statistics data to compute price indexes with which to correct for inflation in the National Accounts. The price indices are often referred to as the “GDP deflator” although there are also special price indexes computed for each of the items in the national accounts. The GDP deflator is an index with a standard base year (the most recent one is 1997). The Nominal GDP is divided by the GDP deflator index to arrive at the Real GDP: Real GDP= Nominal GDP/GDP deflator The GDP deflator is correcting for the effects of inflation so that the actual (“real”) output of the economy can be measured through time. To do this calculation the GDP deflator must 4 be put back into its fractional form. For example if the nominal GDP were $24 trillion and the GDP deflator with a 1997 base year were 120, then Real GDP would be: Real GDP= $24 trillion/1.2= $20 trillion This would be interpreted to mean that the real GDP today would have been worth $20 trillion if there had been no inflation since 1997. Unfortunately the price indexes used for deflating the national accounts are not available very quickly and they are not as commonly used as the Consumer Price Index. They can be found at the Commerce (http://BEA.gov) website and are only a little less difficult to extract than the price indices at BLS. (2) Wage Rates. Wage rates measure the ratio of money exchanged for units of labor. For example the minimum wage is quoted as the minimum dollars that can be paid for an hour of work. If the minimum wage is $6.00 the correct way to represent it as a price would be: six dollars 1 hour of work The Bureau of Labor Statistics compiles wage rate data for most professions. Again, this data is under “employment and earnings” at the BLS.gov website. (3) Interest Rates. Interest rates are the ratio of the dollars that must be paid back at some future date relative to the dollars that are received today. For example the prime rate is quoted as the percentage by which the dollars paid back will exceed the dollars received. If the prime rate is 5% then $1.05 must be paid back for every $1.00 borrowed. In effect, interest rates are quoted as a percentage which is a shorthand way to describe the ratio at which future dollars are to be exchanged for current dollars. The way to view the interest rate as a price would be to say that the interest rate is: Dollars paid back next year Dollars received this year Interest rate data is available from the website (http://federalreserve.gov). They have a rather painful format for getting the data (See Appendix I below) (4) Exchange Rates. Exchange rates are the ratio of the amount of one currency (shown in the numerator of the exchange ratio) that is exchanged for another currency (shown in the denominator). So the exchange rate for the dollar might be quoted as “100 yen”. The correct way to describe the exchange rate would be: 100 yen one dollar The symbol for this exchange rate can be represented as E¥$. In the Wall Street Journal such an exchange rate would be represented under the column “currency per U.S. $”. The inverse of this ratio is listed under the column “U.S. $ equivalent” which is the price of the 5 foreign currency. In the case of the yen the representation would be E$¥. Exchange rate data is available from the Wall Street Journal on a daily basis and historical data is available from the website (http://federalreserve.gov). Just as painful to get as the interest rate data. (See Appendix I below) C. The Law of One Price Within any marketplace, powerful forces keep all prices the same. When consumers go to the store and price shop, they are checking to see which price is cheapest for the quality they wish to purchase. Whatever they choose will have greater demand and will force the price up. Whatever they reject will experience lower demand which will push the price down. As many consumers make such decisions, sellers get the message and align their prices to the market signals sent by the consumers. They will supply more of what is in demand and withdraw what is not in demand. Whatever is on the market will tend toward a single price as a result. While comparison shopping pushes prices of a commodity to be the same, the law of one price also works between different commodities when there are differences in preferences. Radner provides an example of World War II concentration camps where British and American inmates all received the same aid packages but had different preferences for the tea and coffee in the packages. Suppose the following barter exchange rates of tea for coffee were observed between the two camps: American Camp 2 pounds of tea/1 pound of coffee British Camp .5 pounds of tea/1 pound of coffee In the American camp 2 pounds of tea would be needed to buy 1 pound of coffee, but in the British Camp only 0.5 pounds of tea would be needed to buy 1 pound of coffee. These ratios might reflect a greater preference of the English for tea over coffee relative to the Americans. Radner described how a priest, allowed to trade between the two camps, caused these ratios to change. Simply by trading tea from the American camp (greater supply of tea in the British camp) for coffee from the British camp (greater supply of coffee in the American camp) the prices were brought into alignment with each other. Trading within the same market place tends to cause such realignments of price. As markets globalize, market boundaries widen and allow such supply and demand effects from trade to realign prices worldwide. Such effects do not just occur between goods and services. Gold, which used to be the international standard of value, similarly brought different currencies into alignment. Today, with flexible exchange rates in place of a gold standard, different national monies serve the purpose of being an international standard. These standards are continually being brought into alignment by the working of supply and demand. With floating exchange rates, the law of one price takes on increased complexity. The workings of the law involve more than just price comparisons and obvious trades between two commodities. Suppose there are three commodities- and let’s assume those three commodities are currencies. Suppose three different marketplaces (New York, London, and Tokyo) have three different exchange rate for 6 three different currencies as follows: New York L /$= 2.00 London Y/L = 2.00 Tokyo $/Y =2.00 Suppose we have a $1000 to invest and three currency transactions that we can make. There are only two ways that the $1000 can be used; (a) exchanging for pounds (L) in New York, exchanging the pounds for yen in Tokyo and then exchanging back to dollars in Tokyo or (b) exchange for yen (Y) in Tokyo, changing the yen for pounds in Londn,and then exchanging back to dollars in London. How can we tell the order in which to make these transactions? We simply look for the available exchange rates from which to change the currencies Here is how both of the transactions look when thoroughly carried out: (a) exchanging for pounds (L) in New York, exchanging the pounds for yen in Tokyo and then exchanging back to dollars in Tokyo =$1000 * 2.00 (L/$) * 2.00 (Y/L) *2.00 ($/Y) =$8000 (b) exchange for yen (Y) in Tokyo, changing the yen for pounds in London,and then exchanging back to dollars in London. =$1000 * 1/2.00 (Y/$)* 1/2.00 (L/Y) *1/2.00 ($/L) =1/8 =$125 It makes a lot of difference which direction we make the trades. What makes the two directions of trade different is the fact that the law of one price is violated. But what is the one price? The one price reflects that each of the currency can buy the same goods and these goods must have the same price- a notion called purchasing power parity, which will be formally defined below. Notice how the exchange rates had to be inverted when the direction of trading was changed! The key to figuring out the direction of trades is to keep careful track of the units in which the exchange rates are measured. After each trade, remember what currency your value is measured in and then pick the exchange rate which includes both the currency you own and the one you trade into. Invert the exchange rate if the currency you own is not in the denominator. KEY RULE: Whenever you want to trade out of a currency that you have, make sure the exchange rate contains that currency in the denominator. The currency which you want to trade into should be in the numerator. In your currency equation you can cancel the units of the currencies if they appear both in the denominator and in the numerator- just as you would a multiplication factor. This is 7 an invaluable tool for setting up trades involving more than two currencies (or more than two of anything that is to be exchanged). D. Prices Across Countries Exchange rates are not the only consideration for firms in global markets. Inflation rates in different countries play a role in determining prices, the quantity demanded and exchange rates themselves. Interest rates in different countries determine where it is cheapest to borrow and where it is best to maintain portfolios. The law of one price works to align all of these markets, and arbitrageurs (see below) are the people most directly responsible for ensuring that one price prevails. 1. Inflation and Exchange Rates: Purchasing Power Parity Inflation rates and exchange rates are closely tied to each other. If exchange rates are not allowed to adjust for inflation, investors can maintain value by holding their money in the currencies that do not experience inflation. In a floating exchange rate system, greater demand for currencies with low inflation rates will force the depreciation of inflationary currencies. Markets will adjust to maintain purchasing power parity between the commodities produced in different countries. For a weighted average of goods and services absolute purchasing parity guarantees that those goods and services will cost the same in one country as they do in another: Purchasing Power Parity P$ =(E$€ )P€ Where P$ is the weighted price of the goods and services in dollars ($) E$€ is the dollar exchange rate for euros, and P€ is the weighted price of the goods and services in euros (€) For example if the weighted price of a group of food items is 20 euros, then we find the exchange rate that can convert those euros into dollars. The exchange rate shows how many dollars purchase a euro. If it takes $2.00 to buy one euro on the foreign exchange market, then the equation becomes: P$ =(E$€ )P€ = ($2.00/1€)*20€ = $40.00 To make sure we have the right exchange rate it is useful to see if the units ($ and €) Notice that € appears in both the numerator and denominator and can be cancelled just like 8 numbers, leaving both sides of the equation to be measured in dollars. Because of the unwillingness of foreign firms in any country to adjust prices due to exchange rate changes (they would rather keep such goods competitive with the domestic goods with which they compete), such absolute purchasing power parity is often significantly off for any particular combination of goods or services that we might weigh together. Nevertheless we can use the concept of relative purchasing power parity to measure how prices and exchange rates are related to each other. To maintain the purchasing power across different currencies, exchange rates must adjust to the differences in inflation rates among countries. Specifically, the percentage change in an exchange rate over a given time period should be related to the difference in the expected inflation rates of two countries over the same period. For example, if markets are working efficiently and inflation rates are fully anticipated, the percentage change in the exchange rate for the dollar with respect to the yen over a year (%EY$) should approximate the difference of the inflation rate percentage changes of the yen (%PY) and the U.S.( %P$): Relative Purchasing power parity equation for the yen price of the $: %E Y $ = %PY - %P$ If this relative purchasing power parity equation does not hold, arbitragers (See Market Perspectives below) can have a field day in earning profits… if they can correctly anticipate the differences in expected inflation rates of different countries. 2. Interest Rates and Exchange Rates: Interest Rate Parity The interest rate and exchange rate have a very close relationship. When interest rates rise in the United States relative to those abroad, foreign investors find that investment in the United States becomes more profitable. Under those circumstances they should purchase assets to take advantage of the higher rates of return. Such buying of U.S. assets creates an increase in the demand for dollars, driving up the value of the dollar in foreign exchange markets, driving down the return on the assets, and eliminating the advantage of the interest rate differential. Thus, exchange markets should work to maintain interest rate parity among the rates of return in various countries. To maintain the interest rate parity across different currencies, the percentage change in an exchange rate over a given time period should be related to the difference in the interest rates of two countries over the same period. In the case of the Japan and the United States, the percentage change in the exchange rate for the dollar over a year (%E$Y) should approximate the anticipated difference of the interest rate percentages of Japan (rY) and the U.S.( r$): Interest parity equation for the dollar: %E$Y = rY - r$ 9 For example, if the United States has a 4% interest rate while Japan has a 6% interest rate, then the number of dollars required to buy a Japanese yen should rise 2%: %E$Y = rY - r$ =6%-4% =2% In other words, the dollar will have fallen in value (it takes more dollars to buy the extra yen that the Japanese are earning). Such an interest parity relationship would hold if there is perfect information about future interest rates and the assets of the two countries had the same risks. If this relationship does not hold over long periods of time, arbitragers will again have an opportunity to make profits and, in the process, bring exchange rates back into line. 3. Inflation and Interest Rates: the Fisher Effect The expected effect of inflation on the nominal interest rate is known as the Fisher Effect. The Fisher effect suggests a close, positive relationship between the inflation rate and the interest rate:i nominal interest rate= real interest + uncertainty + expected rate of inflation Interest rates should be greater than inflation rates by several percentages, representing the real cost of borrowing. When there is a significant differential between interest rates and inflation rates, firms cannot afford to borrow and they may be shut down. On the other hand if the inflation rate exceeds the nominal interest rate, there can be a profound dislocation in the financial sector. Lenders who make long term loans will suddenly find that they are giving purchasing power away. The Fisher effect should also hold in comparisons across countries. Essentially the differential in expected inflation rates of two countries should be reflected in the difference of their interest rates. Using the previous notation: Fisher Effect rY - r$ =%PY - %P$ If the Japanese have a 6% inflation rate and the U.S. has a 4% inflation rate then Japanese interest rates should be higher by the 2% difference: rY - r$ =%PY - %P$ = 6%- 4% =2% We have already seen that interest rate parity should also be reflected in the exchange rate differences (by interest rate parity above) The Fisher effect is consistent with both purchasing power and interest rate parity. The close, direct relationship predicted by the 10 Fisher effect is usually dependable within a country. Foreign exchange rates should change to maintain the differentials in inflation and interest rates among nations. While interest rates, exchange rates, and prices seem to be different prices, the law of one price is at work among all of them. You should be able to tell the story (both political and economic) why they are all similarly related to wages. MARKET PERSPECTIVES: ARBITRAGERS There are powerful market forces that work to keep exchange rates, inflation rates, and interest rates in line with each other. Arbitragers buy and sell currencies, futures contracts in currencies, and various asset markets to maintain certain relationships among these different prices. One of the most important laws governing arbitrage is the Law of One Price. If the same commodity were selling for two different prices in different markets, buyers would purchase in the low price market and drive the price up there; simultaneously buyers would leave the high price market and the price would fall there. The only discrepancy which should separate the two would be shipping costs, but in the markets for currencies, such costs are negligible. Arbitragers in the foreign exchange markets trade currencies with the hope of profiting from small discrepancies which might exist simultaneously between exchange rates in different foreign exchange markets. For example, if the price of a dollar is 2 euros in New York and 2.1 euros in Germany, then arbitragers will buy dollars with euros in New York and resell the dollars for euros in Germany. Through such arbitrage the price of a dollar in New York will move upward and in Germany it will move downward until the two meet. Arbitragers help to maintain the relationships which exist between inflation, interest and exchange rates. These relationships may indicate where arbitragers can make money and can help economists to predict exchange rate movements. E. Investing Globally Too often businesses are too busy to think about opportunities abroad for parking their money. But in global business, with exchange rates changing 10% to 20% a year, firms can gain large advantages by investing more wisely than their competitors… and vice versa. Furthermore, as accounting boards move ever closer to requirements to reflect exchange rate losses in profits firms can see hard earned gains from lowering costs- often in the range of 1% or 2% per year- wiped out by exchange rate fluctuations. When examining how foreign investments compare to domestic investment, it is necessary to consider three key variables, today’s exchange rate, the foreign interest rate, and the exchange rate that foreign money is to be converted back into the U.S. dollar. If an investment, X, were to be made in the U.S. at an interest rate of r%. The following formula would disclose how much the investment would be worth in one year: Value of X after one year = X*(1 + r%) 11 So, investing $1000 at 12% would mean the investment would be worth after one year: Value of $1000 after one year = $1000*(1 + 12%)=$1,120 The only difference from investing abroad is that dollars must first be converted into the other currency before the foreign investment is made and then must be converted out of it after the interest has been earned. The formula for the exchange rate for the dollar must use two different exchange rates; one for today when the foreign currency is being bought, and one for the date when a foreign investment is cashed and the foreign currency must be exchanged back into dollars. The Wall Street Journal reports the daily exchange rate for the dollar as the “currency per U.S. dollar” and it represent the amount of foreign currency that is received today in exchange for one dollar. It is, in a sense, the “price of the dollar.” But a different exchange rate is used to represent the future exchange rate. The inverse of the price of the dollar must be used. In section B above we noted that the inverse is referred as the “U.S. dollar equivalent of a currency”. We must use this equivalent at the future date, say a year from now. The Wall Street Journal regularly reports the “Forward” exchange rate represented by Futures contracts in major currencies. This forward rate is available for as much as a year into the future. This forward exchange rate, represented as F$¥, shows how many dollars are expected to be exchanged at the future desired date for a unit of foreign currency (in this case the yen). With today’s exchange rate showing the “currency per U.S. $” (E¥$)and the forward exchange rate (F$¥), showing the expected future “$ equivalent” the new formula for investing $X abroad is: Value of X after one year = E¥$*X*(1 + r%) * F$¥ So, investing $1000 at 12% where the exchange rate of the dollar in terms of yen is 100¥/$ and the forward exchange rate is 150¥/$ would mean the investment would be worth after one year: Value of $1000 after one year = 100¥/$ *$1000*(1 + 12%)*(1/150¥/$)=$747. Notice that we effectively had to divide by the forward rate in order to arrive at how much we have lost due to the expected depreciation of the yen. When there are multiple opportunities to invest abroad then separate calculations like these should be done for each investment. The country investment resulting in the highest amount of dollars a year from now should be selected. Appendix I The Federal Reserve Site At the http://federalreserve.gov site click in the following order to get either interest rate or foreign exchange rate data: Economic Research and Data Statistics. Releases and Historical Data 12 Foreign Exchange Rates (or Selected Interest rates) Historical data For foreign exchange rates go to EMU if you want the euro data, but remember, that was only created in 1999. The earliest exchange rate data is 1971- when the dollar was allowed finally to float. Try to avoid getting the ASCII data if possible. Use “screen ready” instead. But if ASCII is all that is available on the series you want , then select it and copy it to EXCEL. EXCEL will junk all the ASCII into the first column. To spread it into other columns, use the following commands: DATA Text to Columns Delimited (or fixed if that works) Next Space Next. Now you should be able to use the data. Copyright INDEX Arbitragers, 11 Expenditure, 1 Fisher Effect, 10 Floating Exchange Rates, 6 Flow, 1 GDP Deflator, 4 Gross Domestic Product (GDP, 3 Gross National Product (GNP), 3 Interest Rate Parity, 9 Law Of One Price, 6 Output, 1 Purchasing Power Parity, 8 Relative Purchasing Power Parity, 9 i. Michael Melvin, 2nd. ed., Harper and Row, 1989 p. 89 13