Each article adds ABOUT 20

advertisement

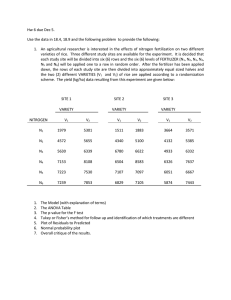

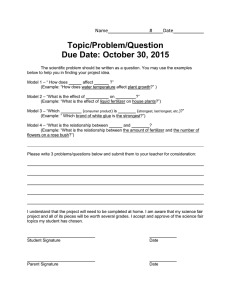

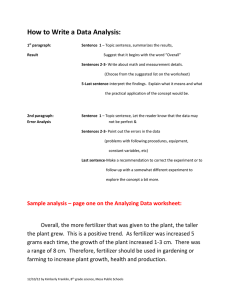

NAME:________________________ Tansey-Ec. 1100 QUIZ PREP FOR FINAL July 17, 2016 Each article adds ABOUT 20 points to the exam. For each of the following articles, there is an Do as many of these as possible. underlined event in bold letters that causes a shift in demand or supply. There is also a market failure [bracketed in italicized bold letters]. In each of the five answer sheets provided for each article: A. Set up and write down the LONGEST POSSIBLE supply chain that uses ALL BUT ONE of the markets and participants listed under the article. Each market and participant can be used at most one time. You may not be able to fill up all of the spaces provided in the answer sheet B. In the market where the underlined event first has its impact, circle the letter of the appropriate shift on the answer sheet: "A" represents a leftward (upward) shift in supply. "B" represents a rightward (downward) shift in supply. "C" represents a leftward (downward) shift in demand. "D" represents a rightward (upward) shift in demand. C. To indicate the vertical impacts of the underlined initial event, place "X"'s on the answer sheet over the appropriate letter in the rest of the markets in your supply chain based on the rules of supply and demand transmission to vertical markets that we studied in class. (Every market must have a shift that is circled or have an X, but no market should have more than one circle (or “X”). D. On your answer sheet describe each market as monopoly, oligopoly, monopolistic competition, perfect competition, monopsony, oligopsony, bilateral monopoly, or bilateral oligopoly. Support your description first by: (a) Circling the size of the market? Circle if it is international (“I”), national (“N”), regional (“R”), statewide, or local (“L”) (b) Circling “Y” if there is product differentiation and “N” if there isn’t. (c) Circling on the answer sheet “m” if there are many, “f” if there are few, and “1” if there is only one firm in the market place. Do this for both the buyers and sellers in a market. E. Answer the additional questions for each article. 1 Article 1. Natural Gas Sinks Beneath $2 Level Wall Street Journal April 12,2012 Page C4 By DAN STRUMPF, JERRY A. DICOLO and DAVID BIRD Natural-gas prices dropped below the $2 mark for the first time in more than a decade, extending a yearslong descent that many analysts say still has further to go.… Traders, analysts and other market watchers have been anticipating the decline to these levels for months. While demand for gas has remained lackluster, production has soared with the discovery of shale-gas fields across the U.S. Natural-gas inventories have been rising, and analysts have said storage facilities may run out of capacity toward the end of the year.… About half of all U.S. homes are heated using natural gas, and prices typically rise in the winter. But this winter was one of the mildest on record, squelching demand for the fuel. Natural-gas prices have fallen 52% in the past year. Here, an oil and gas drilling rig in the Eagle Ford Shale near Encinal, Texas, last month. At the same time, producers have shown little willingness to reduce their record output. The decline in prices hasn't been met with significant [cuts to production]. In January, Chesapeake Energy Corp. CHK -5.54% and ConocoPhillipsCOP -1.31% announced they would reduce output in response to falling prices, but the cuts represented a fraction of production, and few other natural-gas producers followed suit. The Energy Information Administration said last month that natural-gas output in the lower 48 states rose to an all-time high of 72.85 billion cubic feet a day in January, the most recent date for which figures are available. Markets and Participants “U.S. homes” (homeowners) Wholesalers of natural gas Natural-gas producers Natural gas storage Retailers of natural gas 2 Retail natural gas Energy Information Administration Labor market Oil and gas Participants Markets Product (m=many,f=few,1=one) Type of Market SHIFTS OF: Differentiation SELLERS BUYERS (eg. Monopoly, SUPPLY DEMAND (Y= yes, N=no) competition,etc) Left Right Left Right Workers in gas fields Seller Labor market Y Nm Natural-gas producers Extent: I N R L Buyer Seller Oil and gas Wholesalers ofBuyer natural gasI N R L Y N m Extent: Seller Natural gas storage Retailers of natural gas Extent: I N R L Buyer Y Nm Retail natural gas “U.S. homes” Seller (homeowners) Buyer f 1 m f 1 ___________ A B CX D f 1 m f 1 ___________ A B OC D f 1 m f 1 ___________ XC D A B O X Extent: I N R L Y Nm f 1 m f 1 ___________ XC D A B Extent: I N R L Y Nm f 1 m f 1 ___________ A B C D Extent: I N R L Y Nm f 1 m f 1 ___________ A B C D Extent: I N R L Y Nm f 1 m f 1 ___________ A B C D Seller Buyer Seller Buyer Seller Buyer Seller Buyer Y N m f 1 m f 1 ___________A B C D 1. Read the above article again and look for the [brackets] in the second to last paragraph which indicate another demand or supply shift. In the natural gas market what would the effect be of “ cuts to production by Chesapeake Energy Corp. and ConocoPhillips…”- even if they are small? a) b) c) d) Higher prices and higher output. Lower prices and lower output. Higher prices but lower output. Lower prices but higher output. 2. Read the above article again and look for the italicized bold letters in the third paragraph which indicate another demand or supply shift. In the natural gas market a winter that has been “one of the mildest on record” would cause: a) b) c) d) 3 Higher prices and higher output. Lower prices and lower output. Higher prices but lower output. Lower prices but higher output. 3. What market failure most likely justifies the Energy Information Administration’s role in this article? Information asymmetry, public good, externality, indivisibility 4. What type of government intervention is the Energy Information Administration engaging in? Provision of information 5. If the government were to prohibit exports of natural gas which of the following diagrams would best characterize the effect of their export prohibition? (circle the best choice) 6. Relative to the equilibrium without regulation where Is the shadow price due to the regulation? (circle just one) a) Above equilibrium b) Below Equilbrium 7. Describe the inefficiencies and type of disequilbrium that will occur due to this kind of regulation. Be thorough. Illegal markets requiring government enforcement. Smuggling rampant. 8. Such an export ban would: a) Accomplish two goals by stabilizing energy prices and promoting energy independence. b) Accomplish two goals by stabilizing energy prices and lowering other energy costs. 4 c) Hurt energy independence and cause inflation in energy prices. d) Lower energy prices still further and promote energy independence. 9. Which of the following would most likely NOT be a government failure of such a government intervention? a) Administrative costs from enforcing the export ban. b) Compliance costs on the part of natural gas producers. c) Dynamic government failure. d) Information Asymmetry. Article 2. “How Corn Keeps Fertilizer Costly” By Simon Constable Here’s a puzzle: How is it that fertilizer prices are so stubbornly high while the production cost has plunged? The answer lies in the Corn Belt … Anhydrous ammonia, a nitrogen-based plant food, now sells for nearly $700 a ton. That’s off from the highs of $800 late last year. But the biggest variable cost in making fertilizer, natural gas, has seen its price collapse. It’s off over half from $4.50 a million British thermal units in mid-2011. Natural gas for May delivery closed at $1.927 on theNew York Mercantile Exchange Friday, down 2.7% for the week. If that drop in input costs were passed through, farmers would be paying around $231 a ton for nitrogen fertilizer, according to an analysis of the historical relationship between gas and fertilizer prices by Kevin Dhuyvetter, a farm-management specialist atKansas State University. So what gives? A combination of abnormally high corn prices and increased plantings is keeping plantfood costs elevated. Fertilizer products “have been more tied to crop prices than lower natural-gas prices,” says Jeffrey Stafford, a Morningstar analyst in Chicago. “So producers have been able to capture that wide margin.” That wasn’t always the case. Anhydrous ammonia prices stayed steady and modest from 2000 through 2006, averaging $366 a ton (ranging from a little above $200 to over $500), according to the U.S. Department of Agriculture [USDA]. That period also coincided 5 with a period of relative calm for corn prices. Corn averaged $2.29 a bushel over the period, generally bouncing between $2 and $3. “But then demand for corn exploded in the middle of the past decade. That was largely due to increased domestic ethanol production and swelling global demand, according to David Asbridge, president of St. Louis-based NPK Fertilizer Advisory Service. As a result, prices for the grain shot up. Corn for May delivery closed at $6.125 a bushel Friday, off 2.7% on the week. As corn became more profitable, the acreage devoted to it ballooned. An average of 79 million acres of corn was planted each year in the U.S. from 2000 through 2006. Planted acres reached 92 million last year, according to the USDA, and farmers are expected to plant even more this year. This has aided fertilizer makers. “A lot of people have planted corn, and need nitrogen, so the fertilizer makers have the upper hand,” says Kansas State’s Dhuyvetter. The farmers are willing to pay more for the fertilizer because they can get more revenue from a bigger corn crop. So fertilizer stocks had a bull market. … However, don’t count on the nitrogen boom to continue forever. “Eventually, natural-gas prices will increase,” says Morningstar’s Stafford. That will squeeze margins for fertilizer makers. Also, farmers could switch from corn to soybeans, which aren’t fertilized with nitrogen. But barring those flashing lights, look for fertilizer stocks to keep rising. http://blogs.wsj.com/economics/2012/04/23/how-corn-keeps-fertilizercostly/?mod=WSJBlog&mod=marketbeat Markets and Participants Ethanol producers Jobbers Fertilizer Farmers Service stations Corn Wholesale gasoline Ethanol Natural gas producers Retail gasoline Natural gas Labor market Fertilizer producers NPK Fertilizer Advisory Service Consumers Workers 6 Workers Labor market Natural gas producers Natural gas Fertilizer producers Fertilizer Farmers Corn Ethanol producers Ethanol Jobbers Wholesale gasoline Service stations Retail gasoline Consumers 1. X X X X X X X X X X X X X X X X X X Under “Shift #1” in the above template you should have circled where “increased domestic ethanol production” initially shifts a supply or demand curve and then should place “X”s over the resulting shifts that are transmitted through the chain according to the rules of supply and demand transmission that were studied in class. 2. If you have followed the transmission rules for supply and demand properly, what prediction does this template make about what should happen to prices and output in the fertilizer market? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. 7 3.As stated in the 1st paragraph “the biggest variable cost in making fertilizer, natural gas, has seen its price collapse.” Under “Shift #2” in the above template circle where supply or demand first shifts as a result. Then place “X”s over the resulting shifts that are transmitted through the chain according to the rules of supply and demand transmission that were studied in class. 4. What will occur as a result of this shift alone in the fertilizer market (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. 5. Solve the “puzzle” posed by the article in the first paragraph of the article by deciding which of the following can be said about the fertilizer market the net effect of the two shifts: (a) The price effect of the ethanol shift dominates the price effect of the natural gas shift and the output effects of both pull in opposite directions. (b) The price effect of the natural gas shift dominates the price effect of the ethanol shift and the output effects of both pull in opposite directions. (c) The price effect of the ethanol shift dominates the price effect of the natural gas shift and the output effects of both pull fertilizer output upward. (d) The price effect of the natural gas shift dominates the price effect of the ethanol shift and the output effects of both pull fertilizer output upward. (e) The price effect of the ethanol shift dominates the price effect of the natural gas shift and the output effects of both pull fertilizer output downard. (f) The price effect of the natural gas shift dominates the price effect of the ethanol shift and the output effects of both pull fertilizer output downard. 6. The final paragraph states “farmers could switch from corn to soybeans, which aren’t fertilized with nitrogen.” Under “Shift #3” in the above template circle where supply or demand first shifts as a result. Then place “X”s over the resulting shifts that are transmitted through the chain according to the rules of supply and demand transmission that were studied in class. 7. What will occur as a result of this shift alone in the fertilizer market (circle only one)? (a) Price and quantity both rise. (b) Price and quantity both fall. (c ) Price rises and quantity falls. (d) Price falls and quantity rises. 8. What market failure most likely justifies the role of the U.S. Department of Agriculture (USDA) in this article? Information asymmetry, Public good, dynamic market failure 8 9.What type of government intervention is the U.S. Department of Agriculture (USDA) engaging in Provision of information 10. If the government were to put a price ceiling on fertilizer which of the following diagrams would best characterize the effect of their price ceiling? (circle the best choice) 11. Relative to the equilibrium without regulation where is the shadow price due to the regulation? (circle just one) a) Above equilibrium b) Below Equilbrium 12. Describe the inefficiencies and type of disequilbrium that will occur due to this kind of regulation. Be thorough. Shortages, illegal markets with higher prices than original equilibrium price, government required to enforce price controls with resulting administrative costs, 13. If farmers avoided the price ceiling by going into foreign markets to buy fertilizer not controlled by American regulations such a price ceiling would: a) Raise the price they pay for fertilizer above the equilibrium price that would have occurred without the price ceiling. b) Lower the price they pay for fertilizer below the equilibrium price that would have occurred without the price ceiling. 9 14. Which of the following would the government find most effective for lowering fertilizer prices. a) Tax the fertilizer market. b) Privatize the fertilizer producers. c) Enforce domestic ceiling prices. d) Distribute its own stockpiles of fertilizer to farmers. Article 3. In This ER, Doctors Operate on PocketSize Patients By IAN SHERR The patient might have been under water too long. Only a few months old, the victim wasn't responding. A doctor, in green surgical scrubs, rushed to his sparkling clean operating room, hopeful the patient could be saved. After thoroughly scrubbing and putting in some new parts, he tightened the last screw and pushed the power button. The familiar Apple Inc. AAPL -0.59% logo filled the screen of the phone. The iHospital is a chain of stores that fixes broken Apple products but takes Apple-care to new levels, Ian Sherr reports on Lunch Break. Photo: Julie Busch Branaman for the Wall Street Journal. This doctor works at the iHospital. The chain of repair shops is one of many firms that have sprung up and build their business largely by repairing Apple devices. Far from the dingy, box-and-cord littered shops of the past, these businesses have taken on the Apple ethos with slick presentation and savvy brand building. Their customers come hoping to pay less for repairs than at Apple's own stores. "There are about 250 Apple Stores in the U.S., but there are millions of customers," says Ross Newman, the 27-year-old founder of iHospital, based in Tampa, Fla. "They need somewhere to go to fix their products." Other repair shops range from iHospital to Cupertino iPhone Repair in the San Francisco Bay area, to Orlando, Fla.-based uBreakiFix Co. which has stores around the country including in Chicago and Los Angeles. 10 Apple's own warranties are considered among the best by Consumer Reports. But until recently the company charged a hefty premium to fix broken screens or water damage—all too common problems as people take their beloved devices almost everywhere, even to the bathroom. The independent stores say they can fix devices for roughly half the cost as Apple. Apple doesn't have any ties to the stores. An Apple spokeswoman said Apple's new AppleCare Plus policy for the iPhone costs $99 and will cover up to two incidents of accidental damage at a cost of $49 each time. The service, which lasts for two years from the date of purchase, also includes technical support in Apple's stores and over the phone. Mr. Newman says he can compete. A new front screen for an iPhone would cost about $150, including the cost of signing up for AppleCare Plus and the incident charge. The iHospital charges roughly between $79 and $100 for that same repair, depending on the model. And, Mr. Newman added, his doctors offer tech support and a one-year warranty on repairs. Other repair shops offer similar prices and services. Keith Fredrickson, 34, and his wife Margaret, 35, of Jersey City, N.J., each bought a brand new iPhone 4S a couple of months ago. A few days after Ms. Fredrickson got her phone, it slipped out of her back pocket in the bathroom. "She had already flushed the toilet, thankfully," Mr. Fredrickson says.… Once out of the water, the device wouldn't turn on. … So, Mr. Fredrickson took the dunked device to an iHospital. "I walked in and noticed they were in scrubs, and thought it was mildly entertaining," Mr. Fredrickson says. "I was traumatized and nervous about whether they would fix it." They did. Water damage is among the most common ailments for devices, repair-shop operators say. Hayden Dawes, 25, who formed iBroke LLC in Palm Beach Garden, Fla., last year, says many of the customers who ship him their broken devices have had some sort of liquid damage. Apple doesn't supply parts to either business. Both Mr. Newman and Mr. Dawes say their parts come from China, where most of Apple's devices are manufactured. Mr. Newman says he didn't have to ask Apple for permission to use the lowercase i and had no trouble getting iHospital registered as a trademark in the U.S. and Europe. To drive home an image of Apple-level quality, Mr. Newman created a certificate program called D.i.D., "Doctor of iDevices," which requires passing Apple's technicalcertification tests in addition to his own. Mr. Newman says employees must retake the exams every year, just like Apple's in-store technicians. 11 The company's six stores have rung up about $1 million each in sales in the last year. The company, founded in 2009, started expanding to states outside of Florida last year. While in training, Mr. Newman's technicians are typically relegated to the "triage" area, where devices are laid out on an antistatic mat and diagnosed before being brought to the "operating room," a workshop in the back of the store that has a large glass window for customers to watch what's going on. There is even a "graveyard" bin for devices to be repurposed or recycled for parts. Mr. Newman says he plans to expand the chain across the country and to stick with his medical motif. He bought an ambulance to do on-site repairs for corporate clients. He emblazoned it with ads for iHospital, and outfitted it with white flashers, not red, so people don't get confused…. Markets and Participants Although the article doesn’t say it, assume repair technicians must pay for their own “d.i.d” certification, and that Chain repair stores (for example, iHospital) must buy Apple Technical certification tests from Apple Inc. in order to provide such certification. Now fill in everything possible in the following chart. 12 Participants Apple employees Markets Product (m=many,f=few,1=one) Type of Market SHIFTS OF: Differentiation SELLERS BUYERS (eg. Monopoly, SUPPLY DEMAND (Y= yes, N=no) competition,etc) Left Right Left Right Apple employee labor market Y N m f 1 m f 1 ___________ Apple Inc. Extent: I N R L Buyer Seller Apple technical certification tests Y N m f 1 m f 1 ___________ Extent: I N R L Chain Stores repairingBuyer Apple products Seller D.i.D certification Repair Technicians Buyer Extent: I N R L Y N m f 1 m f 1 ___________ Seller Repair-technician services Chain Stores repairingBuyer Apple products Y N m f 1 m f 1 ___________ Extent: I N R L Seller Repair Services for Apple products Apple Consumer Extent: I N R L Buyer Y N m f 1 m f 1 ___________ Seller X A B C D X A B C D X A B C D X A B C D A B C D Seller Buyer Extent: I N R L Y Nm f 1 m f 1 ___________ A B C D Extent: I N R L Y Nm f 1 m f 1 ___________ A B C D Seller Buyer Seller Buyer Y N m f 1 m f 1 ___________A B C D 1. What market failure is indicated by the italicized words in the article? Market power 2. What type of government intervention is used to correct this market failureantitrust 3. What type of study would be undertaken to correct this market failure? Industry study 13