DEMAND What Buyers are Willing and Able Period, ceteris paribus.

advertisement

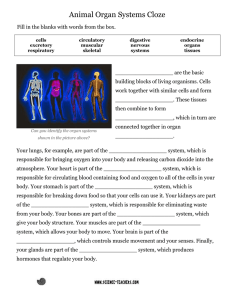

DEMAND What Buyers are Willing and Able to Buy, during a given Time Period, ceteris paribus. KEY POINTS ABOUT DEMAND “WILLINGNESS AND ABILITY” (not stridently wanting) “BUYERS” (not sellers) “during a given time period” is a FLOW (not a STOCK) “ceteris paribus”- all other things are held constant except price and quantity. Whole set of P-Q combinations (not QUANTITY DEMANDED) Doctor Remnueration ($thousands/service years) 300 200 160 Demand Curve: What Buyers are Willing and able To buy at different prices Doctor Services (# of doctors/year) Price ($thousands/organ transplant) 95 60 40 36 Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) GENERALIZED DEMAND FUNCTION f = f( Price: Taxes, Price of Complements Price of Substitutes Tastes for good/service Income, Buyer Expectations, Number of buyers) P Q Percentage Change 0.4 0.3 Line 1 GDP Auto Sales 0.2 0.1 0 75 -0.1 -0.2 -0.3 85 95 Percentage Change 0.5 0.4 0.3 0.2 0.1 0 -0.1 -0.2 -0.3 -0.4 -0.5 75 85 95 Oil Line 2 Auto Sales Percentage Change 0.5 0.4 0.3 0.2 0.1 0 -0.1 -0.2 -0.3 -0.4 -0.5 75 85 95 Oil Line 2 Auto Sales SUPPLY What Buyers XXXXX Sellers are Willing and Able to XXX buy Sell, during a given Time Period, ceteris paribus. KEY POINTS ABOUT SUPPLY “WILLINGNESS AND ABILITY” (not stridently wanting) XXXXXXXXXXXXXXXXXXX “BUYERS” (not sellers) Sellers (not buyers) “during a given time period” is a FLOW (not a STOCK) “ceteris paribus”- all other things are held constant except price and quantity. Whole set of P-Q combinations (not QUANTITY XXXXXXXXXXX DEMANDED) SUPPLIED Yearly Remuneration ($thousands/year of service) 300 Supply Curve: What Sellers are Willing and able To sell at different prices 200 160 Doctor Services (# of doctors/year) Price ($thousands/organ transplant) 95 60 Supply Curve: What Sellers are Willing and able To sell at different prices 40 36 Organ Transplants (number per year) GENERALIZED SUPPLY FUNCTION f = f( Price: Price of Resources Technology, Seller Expectations, Number of Sellers) HOW TO BE SHERLOCK HOLMES IN READING BETWEEN THE LINES If You Know P and Q then you know whether demand or supply is involved as well as the direction of the shift. If You Know the shift in demand or supply, then you know what is likely to happen to price and quantity If You Know the determinant that has changed and price, then you know what is happening to quantity demanded. If You Know the determinant that has changed and quantity demanded, then you know what is happening to price. Lower Price Lower Output Higher Price Leftward (downward) Shift of Demand Leftward (upward) Shift of Supply Higher Output Rightward (downward) Shift of Supply Rightward (upward) Shift of Demand Breakdown all shifts into their output and price vectors Lower Price Lower Output Higher Price Less productivity (technological change) Higher price of resources Seller expectations of future surpluses Less number of sellers Leftward (downward) Shift of Demand less income less tastes for good less buyers less complement lower priuce for substitutes Buyer expectations about future shortages Higher Output Rightward (downward) Shift of Supply Leftward (upward) Shift of Supply More productivity (technological change) Lower price of resources Seller expectations of future shortages More number of sellers Rightward (upward) Shift of Demand Breakdown all shifts into their output and price vectors More income More tastes for good More buyers More complement Higher priuce for substitutes Buyer expectations about future shortages Price ($thousands/organ transplant) EQUILIBRIUM 95 Supply Curve: What Sellers are Willing and able To sell at different prices 40 Equilibrium @ Price=$40,000 Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) Markets Want to Work Markets = the process of procuring and allocating a good The market can “fail” in that the resulting allocation of goods is either inadequate or viewed as inappropriate MARKET GOVERNMENT GOVERNMENT FAILURE INTERVENTION FAILURE EXTERNALITY PUBLIC ENTERPRISE ADMINISTRATIVE -PUBLIC GOODS -NATIONALIZATION COST MARKET -PRIVATIZATION COMPLIANCE POWER REGULATION COST INEQUITIES - OUTPUT EFFICIENCY COST DYNAMIC - PRICE - NEGATIVE EXTER. MKT. FAIL. - STANDARDS -PUBLIC BADS INDIVISIBILITY ANTITRUST - MKT POWER INFORMATION -STRUCTURE - INEQUITIES ASYMMETRY -CONDUCT - DYNAMIC TAXES (SUBSIDIES) - INDIVISIBILITY PROVISION OF - INFORMATION INFORMATION RATIONING (MONEY) Define & Protect Property, Contracts MARKET POWER: The power of a single Company to change the price of a good Or service in the market place. includes: MONOPOLY, MONOPOLISTIC COMPETITION, BILATERAL MONOPOLY. Examples: Drug Companies while they have Patents. Learning, Leadership and Service in the Jesuit Tradition Slide 3 Market Power: the ability to Price ($thousands/organ transplant) Impact market price (or the 95 sales of other firms) Supply Curve: Typically through higher What Sellers are Prices. Willing and able To sell at different prices 40 Equilibrium @ Price=$40,000 Demand Curve: What Buyers are Willing and able To buy at different Alternatively through prices Lower production Organ Transplants (number per year) EXTERNALITIES: impacts on third parties besides the buyer and seller. CONSUMPTION EXTERNALITIES: impacts on third parties as a result of the consumption of a good. Eg. Each infected person who takes Drugs eliminates disease helps all of society, not Just the drug company which provides the medicine PRODUCTION EXTERNALITIES: impacts on third parties as a result of the production of a good. Eg. New discoveries & innovations impact all of Society, not just the scientist who disovers them and the firm who employs the Scientist (streptomyacin patent problem) Learning, Leadership and Service in the Jesuit Tradition Slide 2 Price EXTERNALITIES: ($thousands/organ transplant) Difference between private and social curves 95 CONSUMPTION EXTERNALITIES PRIVATE Supply Curve: What Sellers are Willing and able To sell at different prices SOCIAL DEMAND CURVE PRIVATE MARKET 40 Equilibrium @ Price=$40,000 PRIVATE Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) Price EXTERNALITIES: ($thousands/organ transplant) Difference between private and social curves 95 ;PRODUCTION EXTERNALITIES PRIVATE Supply Curve: What Sellers are Willing and able To sell at different prices PRIVATE MARKET 40 Equilibrium @ Price=$40,000 SOCIAL SUPPLY CURVE PRIVATE Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) Price EXTERNALITIES: ($thousands/organ transplant) Difference between private and social curves 95 PRIVATE SOCIAL DEMAND Supply Curve: CURVE What Sellers are SOCIAL OPTIMUM Willing and able To sell at different prices PRIVATE MARKET 40 Equilibrium @ Price=$40,000 SOCIAL SUPPLY CURVE PRIVATE Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) PUBLIC GOODS: Can’t exclude people from the enjoyment of the goods after they have been paid for. eg. Defense goods, parks, roads, many kinds of infrastructures PUBLIC BADS: Can’t prevent people from being affected by the evils eg. Terrorism, nuclear disaster, contagion, Pollution, global warming. INDIVISIBILITIES: a problem cannot be subdivided into smaller pieces for the purpose of solving the problem or marketing the solution Example: even one remaining infected person means no cure has been achieved. any plan to wipe out a disease means that a comprehensive world wide plan must be undertaken. Learning, Leadership and Service in the Jesuit Tradition Slide 6 INDIVISIBILITY: Only one good that cannot be subdivided. Examples: The winner’s curse- the market does not efficiently allocate an indivisible good to the best users Too big to fail Too big to insures Price Winner’s price too high ($thousands/organ transplant) 95 INDIVISIBILITY: Only one Supply Curve: What Sellers are Willing and able To sell at different prices 40 Equilibrium @ Price=$40,000 Demand Curve: What Buyers are Willing and able To buy at different prices Organ Transplants (number per year) INFORMATION ASYMMETRY: decision makers do not have access to the same information which leads to different definitions, boundaries, and solutions to problems to be solved and social outcomes. Examples: indifference to disease, lack of education about how to treat diseases, and failure to understand the tradeoff between private rights and public goods. Learning, Leadership and Service in the Jesuit Tradition Slide 7 SYMMETRIC INFORMATION- everyone should have equal access to information so that there is a level playing field in competition for resources. Eg. what’s wrong with insider information? INEQUITIES: any economic, social or political mechanism that systematically causes one part of the population to be worse off than another part of a population through time without the possibility of correction. Examples: Poor Populations have greater vulnerability to TB due to their economic and social conditions. Learning, Leadership and Service in the Jesuit Tradition Slide 4 INCOME DISTRIBUTION: measured by the Lorenz Curve 100 90 C u m u l a t i v e 80 70 Line of equality 60 50 40 % 30 G D 20 P 10 0 0 10 20 30 40 50 60 70 80 percentage of population (in order of income) World GDP USA GDP 90 100 DYNAMIC MARKET FAILURE: the failure through time to achieve technological change and the failure of the market to achieve stable, equilibrium outcomes. Examples: As a disease disappears in a given locale: -lack of incentives for new drug development -Lack of treatment for those who are diseased both in the area and in other areas where pandemics may occur Learning, Leadership and Service in the Jesuit Tradition Slide 5 Price COBWEB MODEL The cycle repeats, but, if left untouched, it results now in the total destruction of the market. No output at all!!! Ao x B1 B2 B3 CHEMICALS (millions of pounds/year) SUMMARY OF MARKET FAILURES MARKET POWER- ability to affect market price EXTERNALITIES- third party effects (beyond buyer & seller) PUBLIC GOODS, BADS- can’t exclude others INDIVISIBILITY- cannot subdivide good INFORMATION ASYMMETRY- unequal access to information INEQUITY- unequal opportunity DYNAMIC MARKET FAILURE- unstable equilibrium through time MARKET FAILURE Tuberculosis Example EXTERNALITY -PUBLIC GOODS MARKET POWER INEQUITIES DYNAMIC MKT. FAIL. INDIVISIBILITY INFORMATION ASYMMETRY Third party: healthy population TB tests, Drugs, Hospitals, Ventilation Systems Drug Companies, Patents Poor Populations have greater vulnerability Lack of incentives for new drug development As disease becomes less threatening Even one infected person means no cure Indifference, lack of education, personal vs. public good. Learning, Leadership and Service in the Jesuit Tradition Slide 8 Public Enterprise: The government provides the Service instead of the market. • Nationalization: Government takes over private enterprises Examples: Move to single payor system •Privatization: Government sells off government enterprises to the private market Examples: Sell off Veterans Administration Hospitals Learning, Leadership and Service in the Jesuit Tradition Slide 9 REGULATION: Government determines how Market outcomes are to be limited. *output regulation: Government sets quotas or Limits the amount of output that can be provided By participants in a market. Examples: prohibition of bogus cures *price regulation: Government sets price controls Either as minimum or maximum prices that can Be charged in a market. Examples: price controls on drugs *standards regulation: Government sets limits on The characteristics of a product or service Examples: FDA regulations on advertising & quality Learning, Leadership and Service in the Jesuit Tradition Slide 10 ANTITRUST: the government limits the structure and conduct of firms in the market instead of market performance such as output and price. • Structure: Government examines all mergers Examples: Hospital, drug co. mergers •Conduct: Government limits conspiracies to fix prices Examples: Drug company pricing Learning, Leadership and Service in the Jesuit Tradition Slide 11 Subsidies: Government provides money to provide incentives for certain market outcomes Examples: Medicare, Medicaid, Free Drugs (Isoniazid, Myambutol) Taxes: Government collects money to provide revenues for government services and to discourage certain market outcomes. Examples: Income Taxes Learning, Leadership and Service in the Jesuit Tradition Slide 12 PROVISION OF INFORMATION: Government provides information that the market otherwise Would not provide Examples: Data on extent of TB RATIONING: Government determines market Signals that will determine how distribution of goods or services is to occur Examples: TB drugs and treatment Learning, Leadership and Service in the Jesuit Tradition Slide 13 GOVERNMENT TUBERCULOSIS INTERVENTION EXAMPLE PUBLIC ENTERPRISE -NATIONALIZATION -PRIVATIZATION REGULATION - OUTPUT - PRICE - STANDARDS ANTITRUST -STRUCTURE -CONDUCT TAXES (SUBSIDIES) PROVISION OF INFORMATION RATIONING SINGLE PAYOR SYSTEM SELL OFF VA HOSPITALS ISOLATION, QUARANTINE PROHIBITION OF BOGUS CURES PRICE CONTROLS ON DRUGS FDA Regulations on Advertising, Quality HOSPITAL, DRUG CO. MERGERS PRICE FIXING, MEDICARE, MEDICAID,FREE DRUGS (ISONIAZID, MYAMBUTOL) PUBLIC HEALTH INFORMATION, DATA ON EXTENT OF TB Learning, Leadership and Service in the Jesuit Tradition Slide 14 GOVERNMENT TUBERCULOSIS FAILURE EXAMPLE? ADMINISTRATIVE COST COMPLIANCE COST EFFICIENCY COST *How much it costs the government to Intervene. *How much it costs the private sector To comply with government intervention *How much is lost in efficiency of service As a result of government intervention Learning, Leadership and Service in the Jesuit Tradition Slide 15 GOVERNMENT FAILURE FAILURE to define and enforce property rights, property transference, and contracts ADMINISTRATIVE COST COMPLIANCE COST EFFICIENCY COST -ANDAll of the Market Failures as well!!! NEGATIVE EXTER. PUBLIC BADS MKT POWER INEQUITIES DYNAMIC INDIVISIBILITY INFORMATION ASYMETRY Learning, Leadership and Service in the Jesuit Tradition Slide 16 GOVERNMENT STUDIES Type of Study Objective of Study Definition and Focus Cost Benefit Analysis Net Social Benefit Regulatory Impact Analysis Net Social Benefit & other social objectives Economic Impact Analysis Describe all regulatoryt impacts Closure Analysis Maximize regulatory objective Cost Effectiveness Analysis Maximize pollution Avoids $ value on abatement, etc. benefits of government intervention Up to decision Focuses only on makers govt. unit Fiscal Impact Analysis Implicit Constraints Benefits & costs None included to whomever occurring Includes cost Environmental & benefit analysis and other constraints other studies Examines price, output, financial, & employment impacts Defines degree of regulation that will shut firms down Assumes impacts should be minimal Implicitly, firms are not to be shut down Budget or cost constraint limits amount of intervention Govt. revnue must exceed cost Problem ________ Comprehensive measurement of benefits & costs is hard Goes beyond costbenefit, but becomes very subjective Regulation discouraged. Limited weighing of costs/benefits Overregulates profitable, underregulates unprofitable Comparisons difficult across different types of intervention Ignores costws & benefits to society MARKET GOVERNMENT GOVERNMENT FAILURE INTERVENTION FAILURE EXTERNALITY PUBLIC ENTERPRISE -PUBLIC GOODS-NATIONALIZATION MARKET -PRIVATIZATION POWER REGULATION INEQUITIES - OUTPUT DYNAMIC - PRICE MKT. FAIL. - STANDARDS INDIVISIBILITY ANTITRUST INFORMATION -STRUCTURE ASYMMETRY -CONDUCT TAXES (SUBSIDIES) PROVISION OF ADMINISTRATIVE COST COMPLIANCE COST EFFICIENCY COS - NEGATIVE EXTER. -PUBLIC BADS - MKT POWER - INEQUITIES - DYNAMIC - INDIVISIBILITY - INFORMATION (E) (F) Current Price P Supply Demand (G) Current Price P Demand Supply (H) Current Price P P Demand Supply Minimum Output Quota Current Price Demand Supply Minimum Price Control Maximum Output Control Maximum Price Control Aggregate Income Aggregate Income Aggregate Income Aggregate Income Expansion of Organ Transplants 1988 1998 Number of organ transplants each year Number of centers performing 12,618 20,961 66% 235 278 18% Number of patients waiting 14,000 66,000 370% 5,906 9.913 68% Number of donors % increase Health Resources and Services Administration (HSRA) of the U.S. Department of Health and human Services, “Impproving the Nation’s organ transplantation system, p. 1 Conclusion: 5000 patients die each year Government Intervention Procurement Slows Year 1981 to 1986 Cadavers 2142 3990 – Annual Growth Rate Prior to Regulation 14.4% 1987* to 1999 4000 5849 – Annual Growth Rate Since Regulation 3.7% % Change in Organ Transplants per year 18 16 14 12 10 8 6 4 2 0 Market Failure Early Transplant Success Created a “Gold Rush” mind set. Limited pool of cadavers encouraged competition and the development of “God Squad” allocation of the limited pool of organs Inequities of who gets organs No control over diseased organs Distasteful cadaver mongering (international) Price ($thousands/organ transplant) 95 Surplus @ Price= $60,000 60 40 36 Supply Curve: What Sellers are Willing and able To sell at different prices Equilibrium @ Price=$40,000 Demand Curve: What Buyers are Willing and able Shortage @ Price = $36,000 To buy at different prices Organ Transplants (number per year) Price ($thousands/organ transplant) 95 Supply 40 36 Equilibrium @ Price=$40,000 PRICE CEILING At $36 causes Shortage Demand Organ Transplants (number per year) Quantity demanded exceeds quantity supplie Price ($thousands/organ transplant) 95 Supply 40 36 Equilibrium @ Price=$40,000 PRICE CEILING At $36 causes Shortage Demand Organ Transplants (number per year) Price Quantity demanded exceeds quantity supplied ($thousands/organ transplant) Black market prices exceed legal prices 95 Supply 40 36 Equilibrium @ Price=$40,000 PRICE CEILING At $36 causes Shortage Demand Organ Transplants (number per year) Quantity demanded exceeds quantity supplied ($thousands/organ transplant) Black market prices exceed legal prices 95 Lines of people with first-come-first-served rationing Price Supply 40 36 Equilibrium @ Price=$40,000 PRICE CEILING At $36 causes Shortage Demand Organ Transplants (number per year) Government Failure NOTA (1984/1986) is passed and the present system of procurement and allocation developed » People cannot sell their own organs (there is a price ceiling of zero which maximizes a shortage). » Procurement organizations can sell the organs but recovery is limited by the rules of procurement » The rules of allocation encourage people to be put onto waiting lists. Rationing is based on “waiting time”… But “medical need” could be worse- lower success rate » “Regionalization” or other bootstrap solutions will not fix what is fundamentally an incentives problem Price Quantity supplied exceeds quantity demanded ($thousands/organ transplant) 95 Supply Price Floor of $60,000 CausesSurplus Supply 60 40 Equilibrium @ Price=$40,000 Demand Demand Organ Transplants (number per year) Quantity supplied exceeds quantity demanded Price ($thousands/organ transplant) Black market prices below legal prices 95 Supply Price Floor of $60,000 CausesSurplus Supply 60 40 Equilibrium @ Price=$40,000 Demand Demand Organ Transplants (number per year) Quantity supplied exceeds quantity demanded Black market prices below legal prices ($thousands/organ transplant) Lines of product (inventories) can’t be sold and 95 Supply are dumped. Price Price Floor of $60,000 CausesSurplus Supply 60 40 Equilibrium @ Price=$40,000 Demand Demand Organ Transplants (number per year) Quantity supplied exceeds quantity demanded ($thousands/organ transplant) Black market prices below legal prices Lines of product (inventories) can’t be sold and 95 are dumped. Supply Price Price Floor of $60,000 CausesSurplus Supply 60 40 Equilibrium @ Price=$40,000 Demand Demand Organ Transplants (number per year)