OUTPUT/INFLATION DYNAMICS Jeremiah Allen ©1982; 2004 Derivations and Analysis:

advertisement

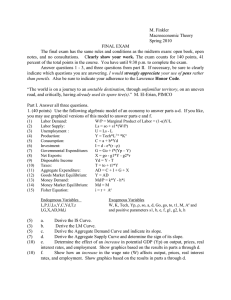

OUTPUT/INFLATION DYNAMICS Derivations and Analysis: Dynamic Aggregate Demand (DAD) curve and the Dynamic Short-run Aggregate Supply (DSAS) curve Jeremiah Allen ©1982; 2004 I. DAD A. The Model Making the Aggregate Demand curve dynamic is necessary if one is to understand the dynamics of the interactions of output and inflation. This is inherently dynamic; inflation is, by definition, a dynamic process. Having the AD curve dynamic makes this understanding fairly simple; without it proper understanding is nearly impossible. In fact, making the AD curve dynamic makes understanding inflation/output dynamics so much easier that one could really say that it makes understanding inflation/output dynamics possible. It allows us to write out the period by period values of output (Yt) and inflation (t ). It also allows a simple graphical and algebraic depiction of an equilibrium with a non-zero rate of inflation. All variables that were defined in “Symbols and Basic Macroeconomic Algebra” remain as defined there. The only difference is that now the variables we use are subscripted “t” for time periods. These notes begin where those notes left off. There are two ways to derive the DAD curve. The first one gives a form that is more accurate, and that gives a more accurate description of the process. However, the first form is both more cumbersome and is non-linear. Although you won’t use the first form in problems, I derive it here so you can see it. I add one more convention. I use bold, lower case italic Roman letters for changes of variables. The first of these is mt , defined and used in 1 below. There is, as always, an exception: lower case Greek is used for the rate of inflation: t . 1. The first derivation begins with the static AD curve from intermediate theory, and adds time period subscripts: Y = A + M/P Yt = At + Mt /Pt) (I. i) Now define rates of change: t = (Pt – Pt-1)/Pt-1 and mt = (Mt – Mt-1)/Mt-1 , (I. ii) and Mt = (Mt-1)(1+mt) . (I. iii) Which can be rewritten as: Pt = (Pt-1)(1+t) Substitute equations (I. iii) into equation (I. i) to get the reduced form of the DAD curve: DADt: Yt = At + [(Mt-1)/(Pt-1)][(1+mt)/(1+t)] . (I. iv) At remains the fiscal policy variable, but the monetary policy variable is now mt. This form of the DAD curve has two “unknowns” or endogenous variables: Yt and t . It can be, and conventionally is, drawn in the ,Y space, with t on the vertical axis and Yt on the horizontal axis. In this form of the DAD curve there are four exogenous variables: the two policy variables, At and mt , and the two lagged variables, Mt-1 and Pt-1 . Since we’ve followed the output/inflation dynamics Page 2 convention that all parameter values are positive, we know that is positive. So, since is in the denominator, the DAD curve is downward sloping. (Which is nice since it is a demand curve.) 2. The second derivation also begins with the static AD curve from intermediate theory, and adds time period subscripts: Y = A + M/P Yt = At + Mt /Pt) . (I. i) In this derivation, we take the logarithms of both sides. This gives: yt = at + ’mt – t) , (I. v) where the bold lower-case italicized variables are rates of change. Now we cheat (just a little) and treat yt and at as absolute changes. So yt = Yt – Yt-1, and at = At – At-1. [Note: this has no qualitative effect on the model, it just makes it a little easier to see what is happening in the economy. So the cheating is quite benign here.] Substituting these into equation (I. v), and changing ’ to , we get: Yt – Yt-1 = at + mt – t), which can be rewritten as the reduced form: DADt: Yt = Yt-1 + at + mt – t) (I. vi) Despite the fact that we cheated (just a little, just a little) to get it, this form of the DAD curve has two advantages. First, it is very easy to use. Secondly, it is linear, making it still easier to use. You will use this equation to do the exercises of Problems #3 and #4. This form of the DAD curve also has two engogenous variables: Yt and t . So it, too, can be, and conventionally is, drawn in the ,Y space, with t on the vertical axis and Yt on the horizontal axis. In this form there are three exogenous variables: the two policy variables, now at and mt ; and the one lagged variable, now Yt-1 . Since we’ve followed the convention that all parameter values are positive, we know that and are positive. Since t is in the equation with a minus sign in front, the DAD curve is downward sloping. (Which is nice since it is a demand curve.) The DAD curve shifts between two periods, t-1 and t : 1) when Yt-1 is not equal to Yt ; 2) when at is non-zero ; and 3) when mt is non-zero; all other things, in particular t , held constant. There is movement along the DAD curve between the two periods, t-1 and t, when t changes between periods – that is, if t t-1 . There is one special case: If we begin with Yt-1 = Yn , and if mt = t > 0, t t-1, the new equilibrium point is directly above or below the old. What’s going on is that there is both a shift in the DAD curve, from mt > 0, and a movement along it, from t t-1 . The two offset each other exactly. In the equation of the DAD: Yt = Yt-1 + at + With all other things equal, ie with at = 0, Yt = Yt-1 . B. Analysis The DAD curve has two unknowns: t and Yt. To get solutions – dynamic equilibria – we need another equation. Initially, here, in order to explore the properties of the DAD alone, we will use a simple Medium-run Aggregate Supply curve (MAS). The MAS curve is constructed from the fact that there is a limit to output. (This limit was the first thing you learned in an economics class: the Production Possibilities Curve or Frontier.) That showed that in the short-run and medium-run, with resources fixed, there is a clear limit to the maximum level of output. BJM label this limit Yn , derived from the so-called “natural rate of unemployment, Nn . Because we now need to use time subscripts, I will move the “n” from a subscript to a superscipt, so the limit is Yn , derived from the so-called “natural rate of unemployment, Nn. Th MAS is in Chapter 10 of BJM. BJM don’t actually draw the MAS curve, but it is there, implicitly but clearly, in the analysis of Chapter 10. output/inflation dynamics Page 3 There are theoretically two of these: 1) Flexible-Price: MAS(FP), and New-Keynesian: MAS(NK). With Flexible-Prices, Aggregate Prices, P, can fall; that is, inflation, , can be negative, so MAS(FP) is perfectly vertical at Y = Yn. With NK, aggregate prices, P, can not fall; that is, inflation is constrained: 0, so MAS(NK) is a backwards L-shape: perfectly horizontal at = 0 and perfectly vertical at Y =Yn. These two curves are shown on Figure I-1 below. Figure I-1 MAS NK 0 Y FP Yn In BJM, Aggregate Prices, which is our variable, P, don’t fall. That is, the BJM model is New Keynesian. BJM “model” this fact by having Prices set by mark-up pricing. See Figures 9-4, 9-5, and Figure 1 in the “Focus” at the end of Chapter 9. So the MAS curve we use exclusively is the New Keynsian curve, the backwards-L, the bold line shown in Figure 1 above. [The question of which is more realistic depends on how one views the “medium-run”. It has been the convention in macroeconomics to call the analytical time period that is long enough to allow all markets to clear the “long-run”. But this contradicts the usage in microeconomics where “long-run” is the period long enough that new Kapital can be created. So BJM use what I hope will become the new convention, that the period long enough for markets to clear is the “medium-run”, leaving the “long-run” to mean long enough for new Kapital. In macroeconomics, new Kapital means growth. Growth requires different kinds of models – growth models always assume full employment, for example, while “standard” macroeconomics considers unemployment as a problem to be solved – and growth theory is a separate field in itself. Here we do only “standard” macroeconomics: short-run and medium-run. [If one believes it possible for prices to fall, for to be less than zero, then the correct model is the FP model. It’s astonishing how many economists appear to believe this. Aggregate Prices haven’t fallen – inflation hasn’t been negative – in any market industrial economy since 1938. Given that, I’ll leave it to you to decide how you feel about analysis that blithely begins “Aggregate Prices fall and … .” My own opinion is that this is religion, not science, and that flexible price models are belief systems, not models of working economies.] Note that right now we label the movement up the MAS curve as the same analytic time, medium-run, as movement down. It is clear from the world that the time for inflation to rise ( t > t-1) is generally shorter than the time for inflation to fall (t < t-1). This usage is temporary; soon we will refer to inflation increasing as the short-run. And we will see that the analysis is not symmetric; what goes on when inflation increases is different from what goes on when inflation decreases. output/inflation dynamics Page 4 As I go through the various analyses in these notes, both here and in Part III below, I will use only the MAS(NK) curve. The reason is not just that I don’t believe in the FP model. (I don’t. But while my first obligation to you is to tell you the truth as I see it, my second is to show you models that you may encounter later, and there are enough theologically-inclined economists that it is likely you will encounter FP models if you go to graduate school.) The reason I don’t do FP explicitly is that by doing NK for cases where > 0, I am also doing FP implicity, since the MAS is the same for both NK and FP when > 0. And the Flexible Price approach is perfectly symmetrical. The description of what happens when Aggregate Prices fall, < 0, is identical to the description of what happens when Aggregate Prices rise, > 0, but with all signs reversed. That is, what goes up (down) as > 0 in FP, just goes down (up) as < 0, and by equal amounts. So, as I do the analysis when > 0 with NK, I am simultaneously doing the analysis with FP, and I am implicitly doing the analysis of the hypothetical (fictional) case where < 0. The latter is identical, but reversed, from the case where > 0. To make this more clear, consider the following matrix, Table I-1: ____________________________________________________________________________ TABLE I-1 ____________________________________________________________________________ Model Aggregate Prices, P Rise >0 Fall, or stay same ≤0 NK FP 1 2 3 4 ____________________________________________________________________________ Cases 1 and 2 are identical; the vertical portion of the MAS curve when > 0 is both the NK and the FP MAS, so the analysis is identical. (Note: this will still be true after we introduce shortrun behavior with the DSAS curve.) Case 3 is the IS/LM analysis alone. With Case 3, Aggregate Prices do not fall ( = 0), so P is pre-determined. This is the assumption used for the IS/LM analysis. So Case 3 is just IS/LM and what we did in Economics 3012. Case 4 is just Case 2 with all signs reversed, and all increases(decreases) turned to decreases(increases) of an equal amount. There are four situations of interest, noted in Table I-2 below. These are explored in Problem #3. To make sense of these, however, I first must discuss monetary policy. -----------------------------------------------------------------------------------------------------------Monetary Policy Monetary policy is of two types; 1) “exogenous” or “initiating”, and 2) “endogenous” or “responsive”. The first type is how monetary policy was modelled in Economics 1012 and 3012. Here the monetary authorities, perhaps ordered by government, choose to change the nominal money stock, M, to consciously cause changes in various economic variables. This type of policy will always be given to you in any problems, since the policy variable is exogenous. output/inflation dynamics Page 5 “Endogenous” monetary policy is changing the nominal money stock, M, in response to changes in aggregate prices, P, or, better, in response to inflation. In these cases the monetary authorities are following some rule. One rule is special, and referred to as “monetary accommodation”. Accommodation here is of two types. The first is instant. Here the monetary authorities set mt = t . This produces a different model. With instant accommodation, mt – t) always equals zero, and DADt becomes Yt = Yt-1 + at . That is, any change in income/output, Y, is determined entirely by fiscal policy. (Or exogenous changes to Exports if the foreign sector is included.) This model is not only unrealistic, it is wrong – it is “too” simple. Because it is, it yields a result that we don’t see in the world: any positive inflation, any rise in Aggregate Prices, will inevitably lead to hyperinflation. So an inflationary equilibrium can’t exist. [The actions inside the economic model that bring Yt back down to Yn are caused by rising prices reducing the real Money stock, MS. Instant accommodation interferes with those actions; it holds MS constant. This will prevent the actions which return Yt to Yn. So Ye in this model, where Ye is dynamic equilibrium, is always greater than Yn, and the economy is always “chasing its tail. Inflation exists because Ye > Yn . As rising prices try to reduce MS , accommodation interferes, holding MS constant. This keeps Ye > Yn , causing inflation to increase, t > t-1 . As rising prices again try to reduce MS , accommodation again interferes, holding MS constant. This again keeps Ye > Yn , causing inflation to increase again, t > t-1 . There is no end to this, so inflation increases without bound. You will see this when you do Problem #4.] The second type of accommodation I call lagged. With lagged accommodation the monetary authorities set mt = t-1 ; monetary policy follows inflation. This in an interesting model, as you will see. You will also see that lagged accommodation is a necessary condition for an inflationary equilibrium. From now on, when I use the word “accommodation”, I mean “lagged accommodation”. [One can get an inflationary equilibrium with instant accommodation, but one must use a different model. I may show you this model in class, but you won’t be responsible for it – that is, it won’t be on an exam.] ____________________________________________________________________________ TABLE I-2 ____________________________________________________________________________ Exogenous Change Monetary Response Do Nothing Accommodate Supply Shock A Expansionary Policy B C D ____________________________________________________________________________ I don’t want to do Problem #3 for you here, but I will show the first step of what happens for each of these two Exogenous Changes. Both begin with full employment, Y0= Yn, and no inflation, 0 = 0. Cases A and C are supply shocks. The horizontal section of the AS curve shifts up for one period as Aggregate Prices, P, rise exogenously, causing inflation to become positive. This can be temporary, so that new curve is labeled AS*. The first step in these two situations, which are identical in their first steps, is shown on Figure I-2 below. In Cases A and C, the value of Y1 is different from Y0, so the DAD curve will shift in Period 2. output/inflation dynamics Page 6 Figure I-2 DAD0,1 MAS AS*1 0 1 0 MAS Y Yn Cases B and D are expansionary policies, either fiscal, a1 > 0, or monetary, m1 > 0. The DAD curve shifts to the right. The first steps in these two situations are identical, and are shown on Figure I-3 below. What happens in Period 2 is for you to work out as you do Problem #3. The two figures below show you where to begin with your graphs for Problem #3. Figure I-3 DAD1 DAD0 1 0 0 Y Yn Both graphs above show changes beginning with full employment, Y0= Yn, and no inflation, 0 = 0. Problem #3 has one other beginning situation: #5. That exercise has the economy beginning with full employment, Y0= Yn, and positive inflation: 0 = .125. This is shown on Figure I-4 below. Here I show it with a policy of “cold-turkey” in Period 1: in Period 1 the government orders the Bank of Canada to stop accommodating, so the Bank sets m1 = 0. Figure I-4 DAD0 MAS DAD1 0 1 0.125 0 Yn Y output/inflation dynamics Page 7 None of these situations gives a complete analysis, because the system immediately moves to medium-run equilibrium. The analysis is incomplete because it doesn’t show short-run supply shifts. Furthermore, this incomplete analysis actually gives false results for some medium-run equilibria. This is because, as you know by now, dynamics can generate different results than statics. The true medium-run equilibrium is reached with all of the short-run dynamics, including shifts of the Dynamic Short-run Aggregate Supply curve.