Chapter 8 Fundamentals of the Futures Market 1

advertisement

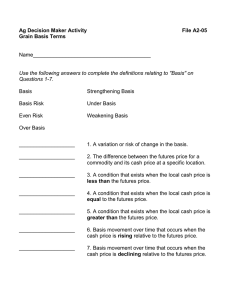

Chapter 8 Fundamentals of the Futures Market 1 © 2004 South-Western Publishing Outline The concept of futures contracts Market mechanics http://www.pbs.org/itvs/openoutcry/thepit.html Market participants The clearing process Principles of futures contract pricing http://www.cme.com/ http://www.cbot.com https://www.theice.com/clear_canada.jhtml 2 / Introduction 3 A futures contract is a legally binding agreement to buy or sell something in the future Futures Compared to Options 4 Both involve a predetermined price and contract duration The person holding an option has the right, but not the obligation, to exercise the put or the call With futures contracts, a trade must occur if the contract is held until its delivery deadline Futures Compared to Forwards A futures contract is more similar to a forward contract than to an options contracts A forward contract is an agreement between a business and a financial institution to exchange something at a set price in the future – 5 Most forward contracts involve foreign currency Futures Regulation In 1974, Congress passed the Commodity Exchange Act establishing the Commodity Futures Trading Commission (CFTC) – 6 Ensures a fair futures market Futures Regulation (cont’d) A self-regulatory organization, the National Futures Association was formed in 1982 – 7 Enforces financial and membership requirements and provides customer protection and grievance procedures Trading Mechanics Most futures contracts are eliminated before the delivery month – – 8 The speculator with a long position would sell a contract, thereby canceling the long position The hedger with a short position would buy a contract, thereby canceling the short position Market Participants 9 Hedgers Processors Speculators Scalpers Delivery Delivery can occur anytime during the delivery month Several days are of importance: – – – Several reports are associated with delivery: – 10 First Notice Day Position Day Intention Day – Notice of Intention to Deliver Long Position Report Principles of Futures Contract Pricing 11 The expectations hypothesis Normal backwardation A full carrying charge market The Expectations Hypothesis The expectations hypothesis states that the futures price for a commodity is what the marketplace expects the cash price to be when the delivery month arrives – 12 Price discovery is an important function performed by futures There is considerable evidence that the expectations hypothesis is a good predictor Normal Backwardation Basis is the difference between the future price of a commodity and the current cash price – – 13 Normally, the futures price exceeds the cash price (contango market) The futures price may be less than the cash price (backwardation or inverted market) Normal Backwardation (cont’d) John Maynard Keynes: – – 14 Locking in a future price that is acceptable eliminates price risk for the hedger The speculator must be rewarded for taking the risk that the hedger was unwilling to bear Thus, at delivery, the cash price will likely be somewhat higher than the price predicated by the futures market A Full Carrying Charge Market A full carrying charge market occurs when the futures price reflects the cost of storing and financing the commodity until the delivery month The futures price is equal to the current spot price plus the carrying charge: F St C 15 A Full Carrying Charge Market (cont’d) 16 Arbitrage exists if someone can buy a commodity, store it at a known cost, and get someone to promise to buy it later at a price that exceeds the cost of storage In a full carrying charge market, the basis cannot weaken because that would produce an arbitrage situation