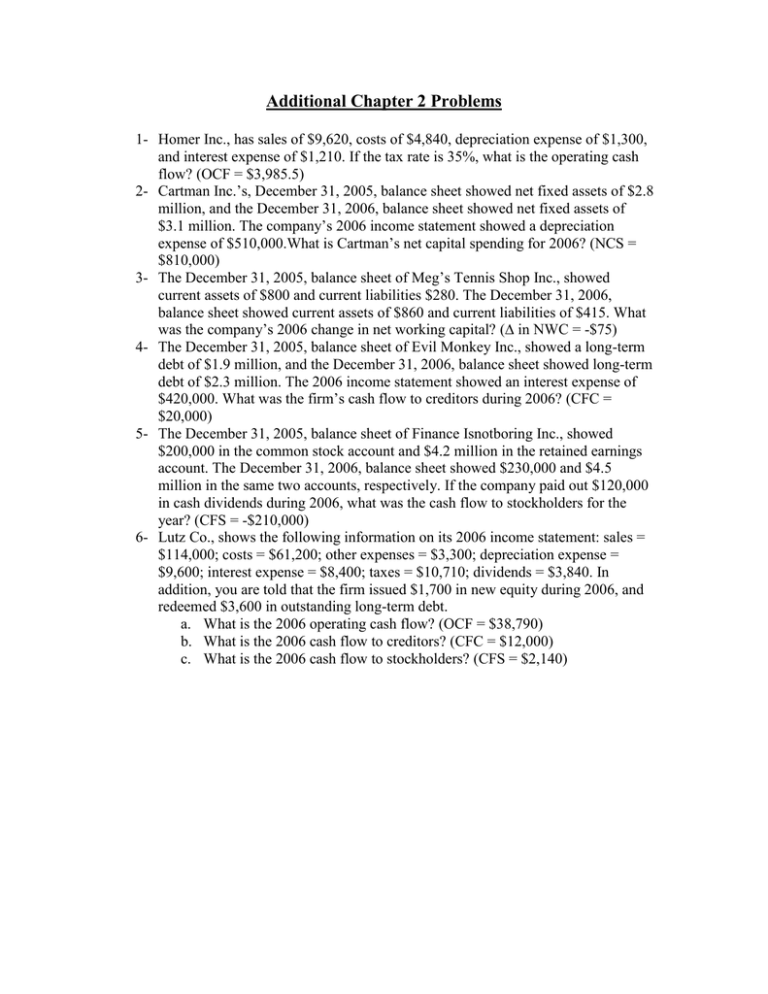

Additional Chapter 2 Problems

advertisement

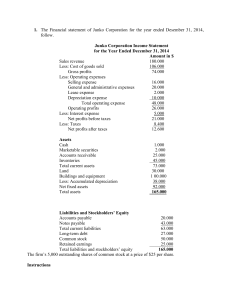

Additional Chapter 2 Problems 1- Homer Inc., has sales of $9,620, costs of $4,840, depreciation expense of $1,300, and interest expense of $1,210. If the tax rate is 35%, what is the operating cash flow? (OCF = $3,985.5) 2- Cartman Inc.’s, December 31, 2005, balance sheet showed net fixed assets of $2.8 million, and the December 31, 2006, balance sheet showed net fixed assets of $3.1 million. The company’s 2006 income statement showed a depreciation expense of $510,000.What is Cartman’s net capital spending for 2006? (NCS = $810,000) 3- The December 31, 2005, balance sheet of Meg’s Tennis Shop Inc., showed current assets of $800 and current liabilities $280. The December 31, 2006, balance sheet showed current assets of $860 and current liabilities of $415. What was the company’s 2006 change in net working capital? (∆ in NWC = -$75) 4- The December 31, 2005, balance sheet of Evil Monkey Inc., showed a long-term debt of $1.9 million, and the December 31, 2006, balance sheet showed long-term debt of $2.3 million. The 2006 income statement showed an interest expense of $420,000. What was the firm’s cash flow to creditors during 2006? (CFC = $20,000) 5- The December 31, 2005, balance sheet of Finance Isnotboring Inc., showed $200,000 in the common stock account and $4.2 million in the retained earnings account. The December 31, 2006, balance sheet showed $230,000 and $4.5 million in the same two accounts, respectively. If the company paid out $120,000 in cash dividends during 2006, what was the cash flow to stockholders for the year? (CFS = -$210,000) 6- Lutz Co., shows the following information on its 2006 income statement: sales = $114,000; costs = $61,200; other expenses = $3,300; depreciation expense = $9,600; interest expense = $8,400; taxes = $10,710; dividends = $3,840. In addition, you are told that the firm issued $1,700 in new equity during 2006, and redeemed $3,600 in outstanding long-term debt. a. What is the 2006 operating cash flow? (OCF = $38,790) b. What is the 2006 cash flow to creditors? (CFC = $12,000) c. What is the 2006 cash flow to stockholders? (CFS = $2,140)