Why Concepts? Financial Accounting Standards Board Robert H. Herz

advertisement

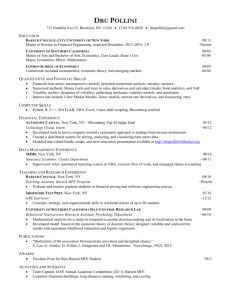

Financial Accounting Standards Board Why Concepts? Robert H. Herz FASB Chairman 2007 Baruch Financial Reporting Conference May 3, 2007 The views expressed in this presentation are my own and do not represent positions of the Financial Accounting Standards Board. Positions of the FASB are arrived at only after extensive due process procedures and deliberations. 5-3-07 Baruch Financial Reporting Conference-(1) 1 Topics for Discussion The Joint Framework Project Potential Payoffs from the Project “Cross-Cutting Issues” 5-3-07 Baruch Financial Reporting Conference-(1) 2 Joint FASB-IASB Conceptual Framework Project Improve & refine existing concepts Reflect contemporary thinking Fill voids in existing framework Converge FASB & IASB Frameworks Conduct project in “phases” Focus on “cross-cutting issues” 5-3-07 Baruch Financial Reporting Conference-(1) 3 Phases of the Project Objectives Qualitative Characteristics Reporting Entity Elements Definitions Recognition & Derecognition Measurement Financial Statement Presentation Disclosures (& boundaries of financial reporting) 5-3-07 Baruch Financial Reporting Conference-(1) 4 What’s the Payoff from Having a Framework? Provides a common ground for reasoning the issues (As opposed to the personal frameworks of individual Board members or constituents) Consistent conclusions on similar issues more likely despite changes in Board membership Standards = more principles based & more durable Financial reports = more comparable, more consistent, easier to understand & more useful 5-3-07 Baruch Financial Reporting Conference-(1) 5 What’s the Payoff from Improving the Framework? Will help reduce complexity by creating greater consistency between standards that are based on it Will improve standards by providing a sound foundation for reasoning that better reflects the underlying economics By better reflecting the economics, the resulting standards should be more intuitive 5-3-07 Baruch Financial Reporting Conference-(1) 6 What’s the Payoff from Converging the Framework? Eliminate differences in the existing FASB & IASB frameworks Guide the Boards toward consistent conclusions on issues in standards Promote converged and improved global accounting standards 5-3-07 Baruch Financial Reporting Conference-(1) 7 Some Cross-Cutting Issues Involving the Objective of Financial Reporting o Broad range of users vs. only existing common shareholders? Decision usefulness vs. stewardship? Entity vs. owner (or counterparty) perspective? Interaction between financial reporting and management’s perspective? 5-3-07 Baruch Financial Reporting Conference-(1) 8 Some Cross-Cutting Issues Involving the Objective of Financial Reporting (continued) Do user information needs differ for: Large, publicly-traded corporations? Smaller, privately-held companies? Not-for-profit organizations? 5-3-07 Baruch Financial Reporting Conference-(1) 9 Some Cross-Cutting Issues Involving the Qualitative Characteristics Relevance vs. Reliability Ex.- Assessing fair value vs. historical cost Preparers & auditors seem to emphasize reliability Investors seem to emphasize relevance Confusion about meaning of reliability Faithful representation of real-world economic phenomena Verifiability contributes to faithful representation 5-3-07 Baruch Financial Reporting Conference-(1) 10 Some Cross-Cutting Issues Involving the Reporting Entity When is a legal entity or an economic unit a reporting entity? When should aggregation or disaggregation occur? When should a legal entity be divided into several reporting units? When should several legal entities be combined into a reporting unit? Is there a difference between control over an entity and control over assets? 5-3-07 Baruch Financial Reporting Conference-(1) 11 Some Cross-Cutting Issues Involving the Definitions of Elements What is role of uncertainty (“probable” or “expected”)? Is there a role? If so, where does it belong? In the definitions? In recognition? In measurement? 5-3-07 Baruch Financial Reporting Conference-(1) 12 Some Cross-Cutting Issues Involving the Definitions of Elements (continued) “Probable” in assets and liabilities definitions “Obligating event” in liabilities definition Likely vs. not certain Existence vs. ultimate outcome Which in a series of events is the obligating event? Can “economic compulsion” create a liability? 5-3-07 Baruch Financial Reporting Conference-(1) 13 Some Cross-Cutting Issues Involving the Definitions of Elements (continued) Liabilities vs. Equity How to distinguish between them? Can there be a bright line distinction? Must there be a bright line distinction? Wholly executory contracts Can they give rise to assets & liabilities? If so, when should they be netted? 5-3-07 Baruch Financial Reporting Conference-(1) 14 Some Cross-Cutting Issues Involving Recognition & Derecognition Should the recognition criteria differ for different measurement bases? Ex.- Is “probability” criterion necessary for historical cost basis but not for fair value basis? What is the recognition event? If asset or liability does not meet recognition criteria when obtained or incurred, what event causes it to be recognized at a later date? 5-3-07 Baruch Financial Reporting Conference-(1) 15 Some Cross-Cutting Issues Involving Recognition & Derecognition (continued) Is derecognition the opposite of recognition? Or does history matter? Not discussed in either FASB or IASB conceptual frameworks Ex.- Conflicting guidance in standards Both FAS 140 & IAS 39 require other things to occur for financial assets to be derecognized Standards require different other things to occur before liabilities can be derecognized 5-3-07 Baruch Financial Reporting Conference-(1) 16 Some Cross-Cutting Issues Involving Measurement How should a measurement basis be selected? Little current guidance on which basis to use & when to use it Should one basis or different bases be used? Result: mixed bag of bases in financial statements What do totals & subtotals really mean? (Like adding & subtracting apples & oranges) Initial vs. subsequent measurement Assets vs. liabilities Different types of assets and liabilities Unit of Account—Should measurement reflect synergies, volume discounts, blockage, portfolio? 5-3-07 Baruch Financial Reporting Conference-(1) 17 Some Cross-Cutting Issues Involving Financial Statement Presentation & Disclosure Little or no guidance on issues like: What are objectives of disclosure? How to classify in statement of financial position? What level of detail & subtotals in income statement (operating earnings, net income, OCI, etc. & what should be included in them)? EPS or other summary indicators 5-3-07 Baruch Financial Reporting Conference-(1) 18 Summing Up The lack of answers to those cross-cutting issues has resulted in suboptimal financial reporting But imagine a world where we have good, sound, conceptual answers to those issues Those answers would go a long way toward providing all of us with the tools we need to: Suboptimal for preparers & auditors Suboptimal for investors & creditors Decrease complexity and Increase the transparency and general usefulness of financial reporting That is why a developing an improved & converged Conceptual Framework is a key to our being able to move forward 5-3-07 Baruch Financial Reporting Conference-(1) 19