Chapter 3

advertisement

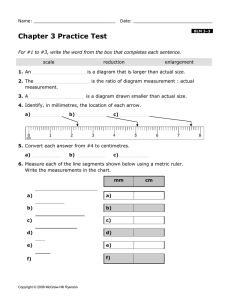

T3.1 Chapter Outline Chapter 3 Working With Financial Statements Chapter Organization 3.1 Cash Flow and Financial Statements: A Closer Look 3.2 Standardized Financial Statements 3.3 Ratio Analysis 3.4 The Du Pont Identity 3.5 Using Financial Statement Information 3.6 Summary and Conclusions CLICK MOUSE OR HIT SPACEBAR TO ADVANCE copyright © 2002 McGraw-Hill Ryerson, Ltd. Working With Financial Statements - Introduction Chapter 2 - looked at the basic financial statement components; the balance sheet and income statement and the concept of cash flow Cash Flow • cash flow identity - cash flow from assets = to cash flow paid to the suppliers of capital to the firm - creditors and shareholders • how to calculate cash flow from assets operating cash flow net capital spending changes in net working capital Chapter 3 - expands on the use of financial statements from a corporate finance perspective copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 2 Financial Statements Financial Statements and the role of Corporate Finance capital budgeting - where and how much should we invest long term financing - capital structure short term financing - working capital management risk management - derivative securities and hedging A good working knowledge of financial statements is important as F/S are the primary means of communicating financial information both internally and externally. many different ways of using F/S - or components many different users The connection between accounting information contained in financial statements and shareholder value is tenuous copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 3 Financial Statements and Shareholder Value Shareholder Value share price as established by the market dividends paid from internally generated cash flow Relationship or ‘line of sight’ between business decision and the creation of shareholder value is usually not that clear analysis ->understanding of financial statements is a starting point - understand the impact of business/financial decisions in terms of the balance sheet, income and cash flow the next step in establishing the connection between the business decision and the creation of shareholder value is complex and not well understood copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 4 Financial Statements and Cash Flow Financial statements present cash flow with a focus on the sources and uses of cash (vs. the cash flow identity) Statement of Changes in Financial Position - sources and uses of cash copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 5 T3.2 Hermetic, Inc. Balance Sheet Hermetic, Inc. Balance Sheet as of December 31 ($ in thousands) Assets 1999 2000 Current Assets Cash $ 45 $ 50 Accounts receivable 260 310 Inventory 320 385 $ 625 $ 745 985 1100 $1610 $1845 Total Fixed assets Net plant and equipment Total assets copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 6 T3.2 Hermetic, Inc. Balance Sheet (concluded) Liabilities and equity Current liabilities Accounts payable Notes payable Total Long-term debt 1999 2000 $ 210 110 $ 320 $ 260 175 $ 435 205 225 290 795 1085 290 895 1185 $1610 $1845 Stockholders’ equity Common stock and paid-in surplus Retained earnings Total Total liabilities and equity copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 7 T3.3 Hermetic, Inc., Income Statement ($ in thousands) Net sales Cost of goods sold $710.00 480.00 Depreciation Earnings before interest and taxes 30.00 $200.00 Interest Taxable income 20.00 180.00 Taxes Net income 53.45 $126.55 Dividends Addition to retained earnings copyright © 2002 McGraw-Hill Ryerson, Ltd $ 26.55 100.00 Slide 8 T3.4 Statement of Cash Flows Operating activities + Net income + Depreciation + Any decrease in current assets (except cash) + Increase in accounts payable – Any increase in current assets (except cash) – Decrease in accounts payable Investment activities + Ending fixed assets – Beginning fixed assets + Depreciation copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 9 T3.4 Statement of Cash Flows (concluded) Financing activities – Decrease in notes payable + Increase in notes payable – Decrease in long-term debt + Increase in long-term debt + Increase in common stock – Dividends paid copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 10 T3.5 Hermetic, Inc. Statement of Cash Flows Operating activities + Net income + $ 126.55 + Depreciation + 30.00 + Increase in payables + 50.00 – Increase in receivables – 50.00 – Increase in inventory – 65.00 $ 91.55 Investment activities + Ending fixed assets +$1,100.00 – Beginning fixed assets – 985.00 + Depreciation + 30.00 ($ 145.00) copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 11 T3.5 Hermetic, Inc. Statement of Cash Flows (concluded) Financing activities + Increase in notes payable + $ 65.00 + Increase in long-term debt + 20.00 – Dividends – 26.55 $ 58.45 Putting it all together, the net addition to cash for the period is: $91.55 – 145.00 + 58.45 = $5.00 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 12 Standardized Financial Statements A standardized financial statement presenting all items in percentage terms. Balance sheets are shown as a % of assets Income statements are shown as a % of sales An attempt to make comparisons of companies, who may be vastly different in terms of size, more effective. There are two general approaches to standardized financial statements: common size common base year copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 13 Financial Statement Analysis Common - Size Statements a standardized financial statement expressing all items in percentage terms • the balance sheet as a % of assets and • the income statement as a % of sales Common-Base Year Financial Statement - Trend Analysis A standardized financial statement presenting all items relative to a certain base year amount • useful in trend analysis • lends itself to plotting the trends graphically . copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 14 T3.6 Hermetic, Inc. Common-Size Balance Sheet Assets 1999 2000 Current Assets Cash Accounts receivable Inventory Total 2.8% 16.1 19.9 38.8% 2.7% 16.8 20.9 40.4% 61.2% 59.6% 100% 100% Fixed assets Net plant and equipment Total assets copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 15 T3.6 Hermetic, Inc., Common-Size Balance Sheet (continued) Liabilities and equity 1999 Current liabilities Accounts payable Notes payable Total 13.0% 6.8 19.9% 14.1% 9.5 23.6% Long-term debt 12.7% 12.2% Stockholders’ equity Common stock and paid-in surplus Retained earnings Total 18.0% 49.4 67.4 15.7% 48.5 64.2 Total liabilities and equity 100% 2000 100% copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 16 T3.6 Hermetic, Inc., Common-Size Balance Sheet More on Standardized Statements Suppose we ask: “What happened to Hermetic’s net plant and equipment (NP&E) over the period?” 1. Based on the 1999 and 2000 B/S, NP&E rose from $985 to $1100, so NP&E rose by $115 (a use of cash). 2. If we standardized the 2000 numbers by dividing each by the 1999 number, we get a common base year statement. In this case, $1100/$985 = 1.117, so NP&E rose by 11.7% over this period. copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 17 T3.6 Hermetic, Inc., Common-Size Balance Sheet (concluded) More on Standardized Statements 3. Did the firm’s NP&E go up or down? Obviously, it went up, but so did total assets. In fact, looking at the standardized statements, NP&E went from 61.2% of total assets to 59.6% of total assets. 4. If we standardized the 2000 common size numbers by dividing each by the 1999 common size number, we get a combined common size, common base year statement. In this case, 59.6%/61.2% = 97.4%, so NP&E fell by 2.6% as a percentage of assets. (. *.)In absolute terms, NP&E is up by $115, or 11.7%, but relative to total assets, NP&E fell by 2.6%. copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 18 T3.7 Hermetic, Inc. Common-Size Income Statement Net sales Cost of goods sold 100.0 % 67.6 Depreciation Earnings before interest and taxes Interest 28.2 2.8 Taxable income Taxes Net income 25.4 7.5 17.8 % Dividends Addition to retained earnings copyright © 2002 McGraw-Hill Ryerson, Ltd 4.2 3.7 % 14.1 % Slide 19 Ratio Analysis Ratio Analysis relationships determined from a firm’s financial information and used for comparison purposes Similar to Common Size and Base Year Financial Statements, the use of financial ratios is an attempt to make comparisons of different sized companies more effective. We eliminate the size problem in ratios by focusing only on percentages, or multiples or time periods Wide range of users of financial ratios: Investment: • financial analysts with major brokerage firms • pension fund managers & money management firms Bond Rating Firms Lenders Table 3.8 in the text is a good summary copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 20 T3.8 Things to Consider When Using Financial Ratios What aspect of the firm or its operations are we attempting to analyze? Firm performance can be measured along “dimensions” -liquidity, capital structure, performance What goes into a particular ratio? Historical cost? Market values? What is the unit of measurement? Dollars? Days? Turns? What would a desirable ratio value be? What is the benchmark? Is there an industry standard? Time-series analysis? Peer Group Analysis copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 21 T3.9 Categories of Financial Ratios Short-Term Solvency, or Liquidity Ability to pay bills in the short-run Long-Term Solvency, or Financial Leverage Ability to meet long-term obligations Asset Management, or Turnover Intensity and efficiency of asset use Profitability The ability to control expenses Market Value focusing on share market price copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 22 T3.10 Common Financial Ratios (Table 3.8) I. Short-Term Solvency, or Liquidity, Ratios Current assets Current ratio = Current liabilities Quick ratio = (Current assets - inventory) / Current liabilities Cash ratio = Cash / Current liabilities Current assets Interval measure = Average daily operating costs copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 23 T3.10 Common Financial Ratios (Table 3.8) (continued) II. Long-Term Solvency, or Financial Leverage Ratios Total assets - Total equity Total debt ratio = Total assets Debt/equity ratio = Total debt/Total equity Equity multiplier = Total assets/Total equity Long-term debt Long-term debt ratio = Long-term debt + Total equity EBIT Times interest earned ratio = Interest EBIT + depreciation Cash coverage ratio = Interest copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 24 T3.10 Common Financial Ratios (Table 3.8) (continued) III. Asset Utilization, or Turnover, Ratios Cost of goods sold Inventory turnover = Inventory 365 days Days’ sales in inventory = Inventory turnover Sales Receivables turnover = Accounts receivable Days’ sales in receivables = 365 days Receivables turnover Sales NWC turnover = NWC Sales Fixed asset turnover = Net fixed assets Sales Total asset turnover = Total assets copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 25 T3.10 Common Financial Ratios (Table 3.8) (continued) IV. Profitability Ratios Net income Profit margin = Sales Net income Return on assets (ROA) = Total assets Net income Return on equity (ROE) = Operating Margin Total equity Op. Income o Sales copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 26 T3.10 Common Financial Ratios (Table 3.8) (concluded) V. Market Value Ratios Price per share Price-earnings ratio = Earnings per share Market value per share Market-to-book ratio = Dividend yield Book value per share Dividend per share/ current market price copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 27 Financial Ratios - Oil & Gas Industry There exists a unique set of ratios which are utilized in the oil & gas industry and with some variation in other resource based industries e.g. Reserve Life Index looks at how long the current reserve base will support a given level of production • calculated as - year end proven producing reserves/year end production Operating Costs per BOE - annual operating costs divided by yearly production on a BOE basis General and Administrative Costs per BOE Finding and Onstream Cost per BOE • important efficiency ratio measuring costs to add new reserves over a specified period of time copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 28 Financial Ratios - Oil & Gas Price to cash flow multiple share price / cash from operations per share • as opposed to the traditional P/E ratio • emphasizes cash flow instead of earnings copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 29 T3.11 The Du Pont Identity 1. Return on equity (ROE) can be decomposed as follows: ROE = Net income/Total equity = Net income/Total equity Total assets/Total assets = Net income/Total assets Total assets/Total equity = _____________ Equity multiplier 2. Return on assets (ROA) can be decomposed as follows: ROA = Net income/Total assets Sales/Sales = Net income/Sales Sales/Total assets = ______________ _______________ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 30 T3.11 The Du Pont Identity 1. Return on equity (ROE) can be decomposed as follows: ROE = Net income/Total equity = Net income/Total equity Total assets/Total assets = Net income/Total assets Total assets/Total equity = ROA Equity multiplier 2. Return on assets (ROA) can be decomposed as follows: ROA = Net income/Total assets Sales/Sales = Net income/Sales Sales/Total assets = Profit margin Total asset turnover copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 31 T3.11 The Du Pont Identity 3. Putting it all together gives the Du Pont identity: ROE = ROA Equity multiplier = Profit margin Total asset turnover Equity multiplier 4. Profitability (or the lack thereof!) thus has three parts: Operating efficiency Asset use efficiency Financial leverage copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 32 T3.11 The Du Pont Identity (concluded) copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 33 T3.12 Using Financial Statement Information Why evaluate Financial Statements? Internal Uses Allocate capital by division Measure and reward performance Corporate/ Financial Planning External Uses Extend trade credit to customers Investor Community Ratio Analysis Banks requiring loan covenants Competitor Analysis Valuing a target in an acquisition Benchmarks Year on year Peer group copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 34 T3.12 Using Financial Statement Information Problems with Financial Statement Analysis The need for theory what is the connection between financial statements and a firm’s true value and the associated risk ? Which ratios matter most? What is the “right” value for the ratio The difficulty in establishing appropriate benchmarks Conglomerates or diversified firms Not identified in a single industry or sector Hard to find comparables Global reach Comparability of financial statements between countries with differences in accounting regulations copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 35 Quick Quiz What is the Statement of Cash Flows and how do you determine sources and uses of cash? How do you standardize balance sheets and income statements and why is standardization useful? What are the major categories of ratios and how do you compute specific ratios within each category? What are some of the problems associated with financial statement analysis? copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 36 Summary You should be able to: Identify sources and uses of cash Understand the Statement of Cash Flows Understand how to make standardized financial statements and why they are useful Calculate and evaluate common ratios Understand the Du Pont identity Describe how to establish benchmarks for comparison purposes and understand some key problems that can arise copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 37