ECONOMICS 3012 Closed Economy: No Foreign Sector Notes-II

advertisement

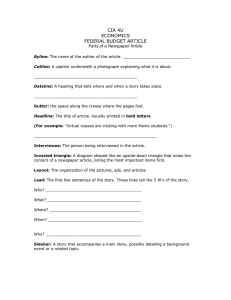

ECONOMICS 3012 Notes-II: Symbols and Basic Macroeconomic Algebra Closed Economy: No Foreign Sector Parts A and B INTRODUCTION: Symbols The symbols used in this course are mostly those used in the textbook: Blanchard, Johnson and Melino (BJM) Macroeconomics, Second Canadian Edition. They are defined in Appendix 4 at the end of the book, on p. A15. I will add some variables to those, and I will define one variable differently. BJM roughly follow the conventions that ITALICIZED UPPER-CASE Roman letters are VARIABLES, and italicized lower-case Roman letters are simple parameters. The latter are often subscripted. BJM do not use these conventions exclusively. I will note where they deviate from convention. I will use those same conventions for variables that I define. I will define some variables that BJM don’t, and I define a few variables differently from BJM. I also use another convention: lower-case Greek letters, like , and , will be used for combinations of simple parameters into more complex parameters. Other conventions: a superscript, d, means “demanded”; a superscript, e, means “expected”; an asterisk, *, means “foreign value” – here usually the US value. A convention that I use and which you will find useful, one that is not in the textbook, is to use subscripts, as in Y0 or Y1 , to denote equilibria. I use the subscript 0 normally to denote the initial equilibrium; other numbers used as subscripts denote equilibria which occur after changes to the initial conditions. A final convention that is extremely useful is that if a relation is negative, I, and the textbook, put a minus sign before the parameter. That means that all parameters themselves are positive. This has the happy quality of making it very easy to “sign” the complex parameters. What this means will become clear in the development of the model below. Here I define only variables that are not defined in the BJM Appendix. So if a variable is not defined here, check that Appendix. AE is Aggregate Expenditure. This is the same as Z in BJM: “Demand for Goods”, so AE ≡ Z AE ≡ C + I + G Y≡C+S+T There are two things that I do a bit differently, although these end up being the same as the symbols used in BJM in Chapter 4. I define them now and use them throughout, instead of changing the definitions of some symbols as we go along, which the textbook does (sloppy). 1) I use just I for all investment. The book differentiates Investment (I) and Inventory Investment (Is) at the beginning of Chapter 3, then drops the latter. There’s no need for it, we will ignore Inventory Investment. 2) In Chapter 3, the book puts a bar over I to denote that it is exogenous. Later it drops the bar. The Study Guide doesn’t use the bar. I do not use the bar. (The book doesn’t put a bar over other exogenous variables; the use of the bar is unnecessary.) -----------------------------------------------------------------------------------------------------------------PART A: Goods Markets Alone Notes-I dealt with the basic macroeconomic identities. Now the model becomes analytical rather than definitional. To make the transition, we need to add “behavioral” relations (equations) to the definitions. First (another definition) to simplify the algebra I add the variable A, which is the sum of all exogenous, or “autonomous”, spending: Econ 3012: Notes on Symbols and Algebra page 2 A = [c0 + I + G – c1T] in Chapter 3 and A = [c0 + bo + G – c1T] in Chapters 5 and 10 I also use AE, which is Aggregate Expenditure: AE = C + I + G The basic algebra generates complex parameters: parameters that are a mix of other parameters. It makes things easier to use the convention that lower-case Greek () letters stand for these parameters. In problems I assign, I will often give you numerical values for these complex parameters. The Goods Markets, or The Real Sector Alone, Chapter 3 Disposable Income (definition) Consumption Function (behavior) Aggregate Expenditure (definition) I, G, and T are “exogenous” or “autonomous” (behavior) so complex parameter: note that since we know that c1 is positive and c1 also know that > 1. Equilibrium (behavior) This gives the “reduced form” solution (p 48 in BJM) or, simplified: YD = Y – T C = c0 + c1 YD = c0 + c1Y – c1T; AE = C + I + G c1 < 1 A = c0 + I + G – c1T = 1/(1 – c1) < 1, we not only know that is positive, we Y = AE Y0 = [1/(1 – c1)] [c0 + I + G – c1T] Y0 = A Finally, a special value of Y, called the “natural rate” In BJM, but usually called “full employment” output. Yn This is the level of output associated with full employment: ---------------------------------------------------------------------------------------------------------------------PART B: Government Budget First we make taxes in part a function of the level of Income, Y. This is sensible; most taxes are fixed rates times a base, and most tax bases (Sales, Personal Income, Corporate Profits) increase or decrease as the level of Income increases or decreases. The main part of the textbook does not do this, but it is in Problem 6 at the end of Chapter 3. Add: Tax Function (behavior) T = t0 + t1Y; t1 < 1 This has two effects: there is a new equation for and a new equation for A. You will not need to know these because I will give you values of and A in any problems I ask you to do. What is of interest is that it affects the definition of the Government Budget Deficit. That deficit is BD ≡ (G – T), which is now the Budget Deficit function: BD = [G – (t0 + t1Y)] = [(G – t0) – t1Y] . So the government budget deficit is now (and in reality) a negative function of Income. Again, this is sensible; if Income falls, Taxes decrease while Government spending remains roughly constant, so the deficit increases. Since the analysis at this point is perfectly symmetrical, the opposite is true when Income rises: sizes are the same but the directions are opposite. The BD function can be drawn as on Figure 1 below: Econ 3012: Notes on Symbols and Algebra page 3 Figure 1 $ 0 Y YBB BD As Y increases, the Budget Deficit decreases and, obviously, vice versa. For any given values of G and t0 , both of which are exogenous, there is a unique value of Y, which I label YBB , which gives a balanced budget. If G increases or t0 decreases, the BD function shifts up; this is shown as the dotted line above. This in turn shifts YBB to the right – that is, it increases YBB . And vice-versa: if G decreases or t0 increases, the BD function shifts down; this is shown as the dashed line above. This shifts YBB to the left – that is, it decreases YBB . Thus the Budget Deficit increases as three things happen. The first is having G increase. The second is a tax cut, having t0 decrease. The third is having Y decrease. However the first two effects are not the whole story. If G increases or t0 decreases, the BD function shifts up. At the original level of Income, Y, the Budget Deficit increases by the amount of the shift: the increase in G or the decrease in t0 . But either an increase in G, or a decrease in t0 , cause Y to increase. So while there is a shift in the BD function, there is also a movement along the BD function. The movement along reduces the increase in the Budget Deficit. This is shown for a government spending increase or a tax cut in Figure 2 below: Figure 2 BD1 : no Income change $ BD1 : after Income 0 change BD0 a b Y Y0 BD1 function Y1 : After G or t0 BD0 function Econ 3012: Notes on Symbols and Algebra page 4 Initially there is a balanced budget and Income of Y0 . An increase in G or a tax cut shifts the BD function to the dotted line. If Income stayed at Y0 , then the new Budget Deficit would be BD1. But the increase in G, or the tax cut, causes Income to increase as the analysis of Part A above demonstrated. In this case Y increases to Y1 . This causes a movement along the new BD function, from point a to point b, which reduces the Budget Deficit to BD1 . Without going into the details, the conditions on the parameters make it impossible for the second effect to be larger than the first. An increase in spending with no tax increase, and a tax cut with no spending decrease, always increase the Budget Deficit. And vice-versa. The “fact” of the BD function lets us define a special value of the budget deficit, known as the structural deficit, or SD. The SD is the value of the budget deficit when output is at the full employment level, Yn. The structural deficit function is: SD = [G – (t0 + t1Yn)] = [(G – t0) – t1Yn] . This is shown on Figure 3 below: Figure 3 $ SD1 0 Y Yn SD2 BD0 BD1 BD2 With Budget Deficit function, BD0 , the Structural Deficit is zero. If G is higher or t0 is lower, the Budget Deficit function is BD1 , and the Structural Deficit is positive at SD1 . And if G is lower or t0 is higher, the Budget Deficit function is BD2 , and the Structural Deficit is negative – that is, it is a budget surplus – and equal to SD2 .