ECON 3012 PROBLEM 5 Answers b

advertisement

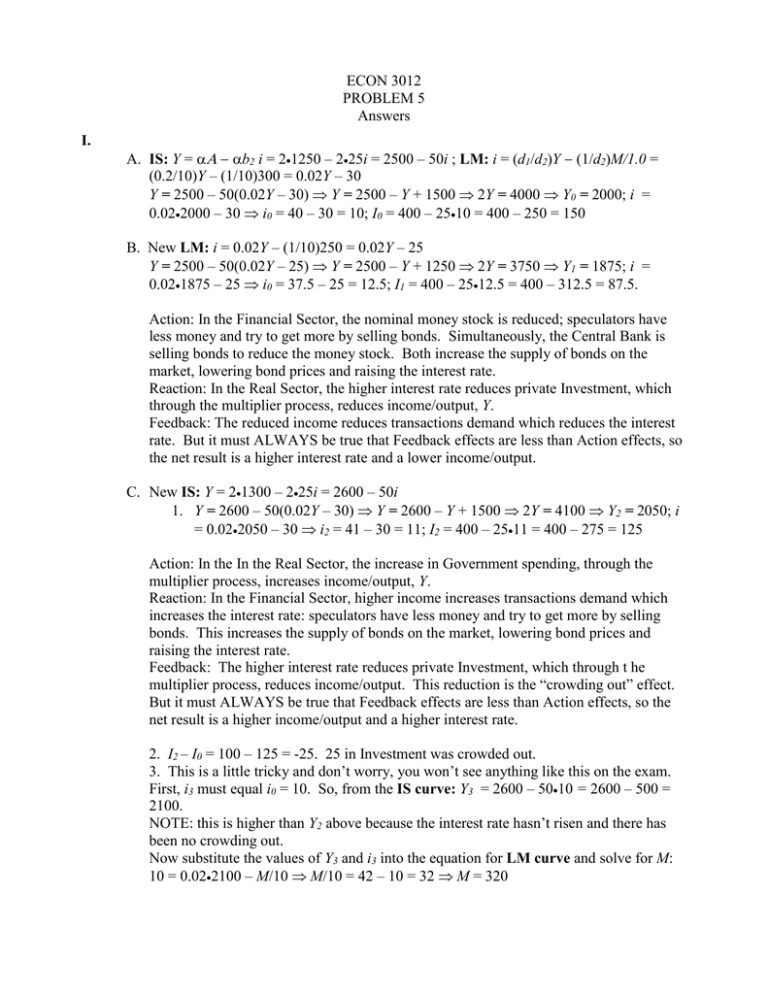

ECON 3012 PROBLEM 5 Answers I. A. IS: Y = b2 i = 21250 – 225i = 2500 – 50i ; LM: i = (d1/d2)Y (1/d2)M/1.0 = (0.2/10)Y – (1/10)300 = 0.02Y – 30 Y = 2500 – 50(0.02Y – 30) Y = 2500 – Y + 1500 2Y = 4000 Y0 = 2000; i = 0.022000 – 30 i0 = 40 – 30 = 10; I0 = 400 – 2510 = 400 – 250 = 150 B. New LM: i = 0.02Y – (1/10)250 = 0.02Y – 25 Y = 2500 – 50(0.02Y – 25) Y = 2500 – Y + 1250 2Y = 3750 Y1 = 1875; i = 0.021875 – 25 i0 = 37.5 – 25 = 12.5; I1 = 400 – 2512.5 = 400 – 312.5 = 87.5. Action: In the Financial Sector, the nominal money stock is reduced; speculators have less money and try to get more by selling bonds. Simultaneously, the Central Bank is selling bonds to reduce the money stock. Both increase the supply of bonds on the market, lowering bond prices and raising the interest rate. Reaction: In the Real Sector, the higher interest rate reduces private Investment, which through the multiplier process, reduces income/output, Y. Feedback: The reduced income reduces transactions demand which reduces the interest rate. But it must ALWAYS be true that Feedback effects are less than Action effects, so the net result is a higher interest rate and a lower income/output. C. New IS: Y = 21300 – 225i = 2600 – 50i 1. Y = 2600 – 50(0.02Y – 30) Y = 2600 – Y + 1500 2Y = 4100 Y2 = 2050; i = 0.022050 – 30 i2 = 41 – 30 = 11; I2 = 400 – 2511 = 400 – 275 = 125 Action: In the In the Real Sector, the increase in Government spending, through the multiplier process, increases income/output, Y. Reaction: In the Financial Sector, higher income increases transactions demand which increases the interest rate: speculators have less money and try to get more by selling bonds. This increases the supply of bonds on the market, lowering bond prices and raising the interest rate. Feedback: The higher interest rate reduces private Investment, which through t he multiplier process, reduces income/output. This reduction is the “crowding out” effect. But it must ALWAYS be true that Feedback effects are less than Action effects, so the net result is a higher income/output and a higher interest rate. 2. I2 – I0 = 100 – 125 = -25. 25 in Investment was crowded out. 3. This is a little tricky and don’t worry, you won’t see anything like this on the exam. First, i3 must equal i0 = 10. So, from the IS curve: Y3 = 2600 – 5010 = 2600 – 500 = 2100. NOTE: this is higher than Y2 above because the interest rate hasn’t risen and there has been no crowding out. Now substitute the values of Y3 and i3 into the equation for LM curve and solve for M: 10 = 0.022100 – M/10 M/10 = 42 – 10 = 32 M = 320 D. This is similar to the above, but a little easier. You just might see something like this on the exam. Note that you are now given the two unknowns: Y and i. Substitute into the equation for the LM curve just as above and solve for M: 8 = 0.022150 – M/10 M/10 = 43 – 8 = 35 M = 350. Now just do the same thing with the IS curve and solve for A: 2150 = 2A – 508 2A = 2150 + 400 = 2550 A = 1275. A = 950 + G 1275 – 950 = 375 II. 1. Rewrite the IS and LM curves above: IS: Y = Ai; LM: i = 0.02Y – (1/10)M(1/P). Now solve for reduced form in Y: Y = 2·A – 50[0.02Y – (1/10)M(1/P)] Y = 2·A – Y + 50(1/10)M(1/P) 2Y = 2·A + 5M(1/P) Y = 1·A + 2.5M(1/P). Since the general form of the AD curve is Y = A + M(1/P), = 1 and =2.5. The AD curve with numbers is: Y = 1·1250 + 2.5·300(1/P) = 1250 + 750(1/P) 2. Y0 = 1250 + 750(1/1) = 2000; i0 = .02·2000 – 30(1/1) = 40 – 30 = 10; I0 = 400 – 25·10 = 150 3. Y1 = 1250 + 750(1/1.25) = 1250 + 600 = 1850; i1 = .02·1850 – 30(1/1.25) = 37 – 24 = 13; I1 = 400 – 25·13 = 75 4. Y2 = 1250 + 750(1/0.83) = 1250 + 900 = 2150; i2 = .02·2150 – 30(1/0.83) = 43 – 36 = 7; I1 = 400 – 25·7 = 225 5. P 1.25 1.0 0.83 1850 2000 2150 1950 2075 6. AD curve: Y = ·A + ·M(1/P). New M = 330; new AD curve: Y = 1250 + 825(1/P). With P = 1.0, Y = 1250 + 825 = 2075 7. AD curve: Y = ·A + ·M(1/P). New A = 1200; new AD curve: Y = 1200 + 750(1/P). With P = 1.0, Y = 1200 + 750 = 1950. Y