Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

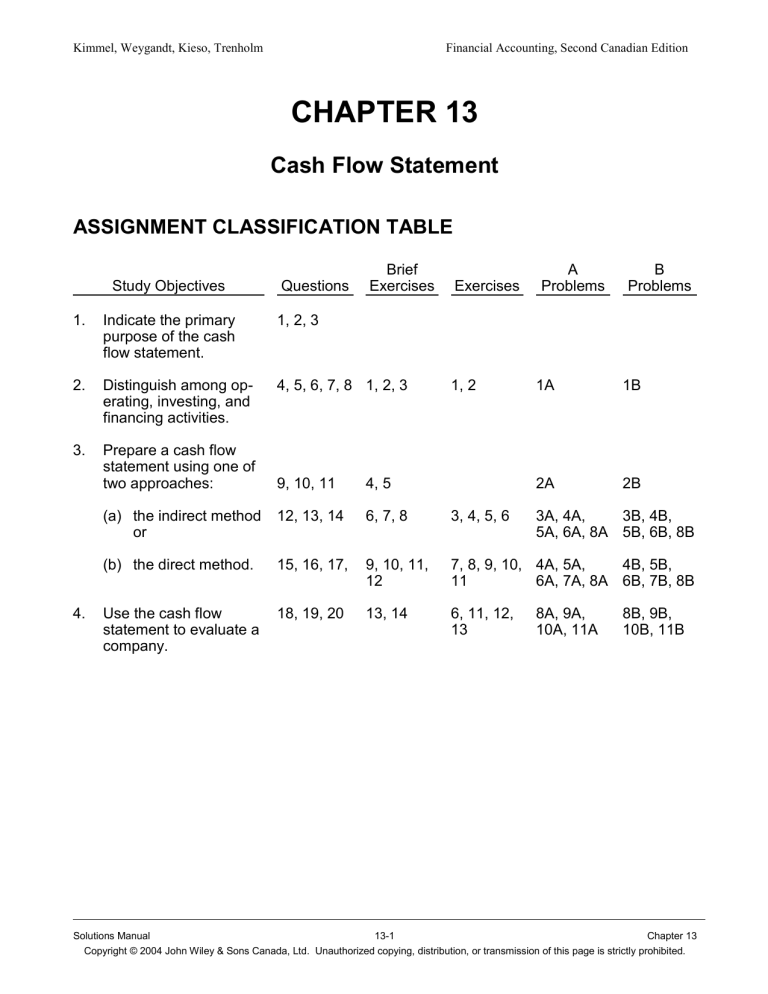

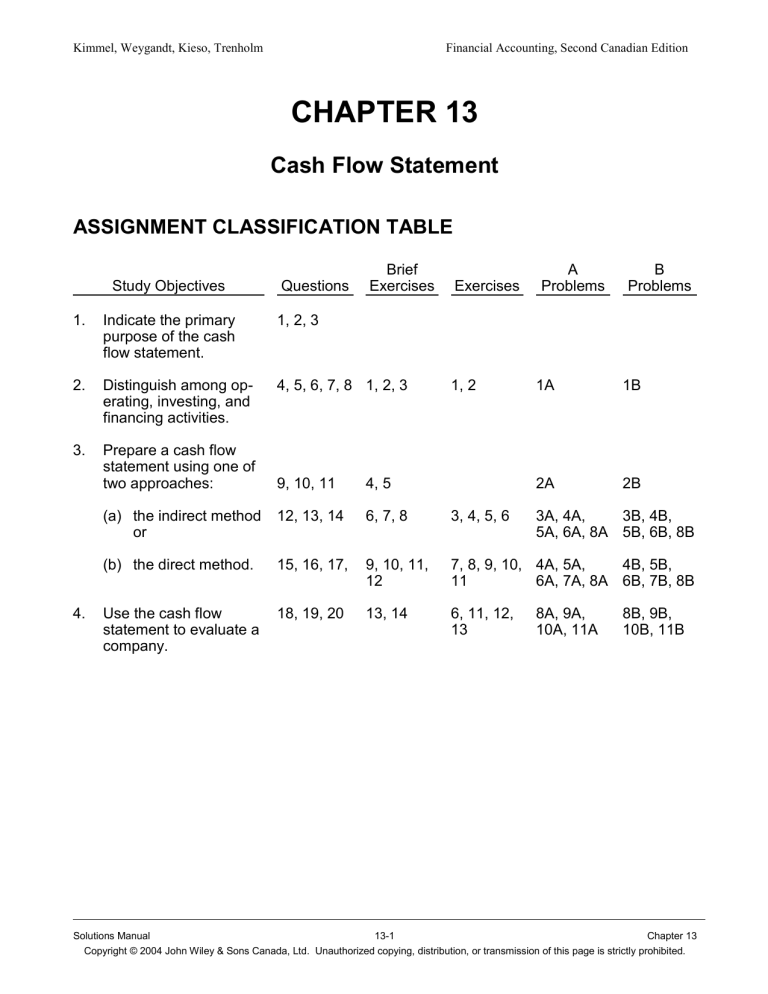

CHAPTER 13

Cash Flow Statement

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

1.

Indicate the primary

purpose of the cash

flow statement.

1, 2, 3

2.

Distinguish among operating, investing, and

financing activities.

4, 5, 6, 7, 8 1, 2, 3

3.

Prepare a cash flow

statement using one of

two approaches:

4.

Exercises

1, 2

A

Problems

B

Problems

1A

1B

2A

2B

9, 10, 11

4, 5

(a) the indirect method

or

12, 13, 14

6, 7, 8

3, 4, 5, 6

(b) the direct method.

15, 16, 17,

9, 10, 11,

12

7, 8, 9, 10, 4A, 5A,

4B, 5B,

11

6A, 7A, 8A 6B, 7B, 8B

Use the cash flow

statement to evaluate a

company.

18, 19, 20

13, 14

6, 11, 12,

13

3A, 4A,

3B, 4B,

5A, 6A, 8A 5B, 6B, 8B

8A, 9A,

10A, 11A

8B, 9B,

10B, 11B

Solutions Manual

13-1

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

Simple

20-30

1A

Classify activities.

2A

Calculate cash flows.

Moderate

20-30

3A

Prepare cash flow statement—indirect method.

Moderate

20-30

4A

Prepare operating activities section—indirect method

and direct method.

Moderate

40-50

5A

Prepare operating activities section—indirect method

and direct method.

Moderate

40-50

6A

Prepare cash flow statement—indirect method and

direct method.

Moderate

50-60

7A

Prepare statement of earnings and cash flow statement—direct method.

Moderate

30-40

8A

Prepare cash flow statement – indirect method and

direct method – and calculate cash-based ratios.

Moderate

50-60

9A

Use cash-based ratios to compare two companies.

Moderate

20-30

10A

Use cash-based ratios to compare two companies.

Moderate

20-30

11A

Discuss cash position.

Moderate

20-30

1B

Classify activities.

Simple

20-30

2B

Calculate cash flows.

Moderate

20-30

3B

Prepare cash flow statement—indirect method.

Moderate

20-30

4B

Prepare the operating activities section—indirect

method and direct method.

Moderate

40-50

5B

Prepare operating activities section—indirect method

and direct method.

Moderate

40-50

6B

Prepare cash flow statement—indirect method and

direct method.

Moderate

50-60

7B

Prepare statement of earnings and cash flow statement—direct method.

Moderate

30-40

Solutions Manual

13-2

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

Financial Accounting, Second Canadian Edition

Description

Difficulty

Level

Time

Allotted (min.)

8B

Prepare cash flow statement – indirect method and

direct method – and calculate cash-based ratios.

Moderate

50-60

9B

Use cash-based ratios to compare two companies.

Moderate

20-30

10B

Use cash-based ratios to compare two companies.

Moderate

20-30

11B

Discuss cash position.

Moderate

20-30

Solutions Manual

13-3

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

(a) The cash flow statement reports the cash receipts, cash payments, and net change in

cash resulting from the operating, investing, and financing activities of an enterprise

during a period. It concludes by reconciling the beginning and ending cash balances.

(b) Disagree. The cash flow statement is required. It is the fourth basic financial statement.

2.

The cash flow statement answers the following questions about cash: (a) Where did the

cash come from during the period? (b) What was the cash used for during the period? and

(c) What was the change in cash during the period?

3.

Cash equivalents are short-term, highly liquid investments that are readily convertible to

cash within a very short period of time (usually within 3 months). Sometimes short-term

demand bank advances are included as well. The cash flow statement may include cash

equivalents because they are by definition readily converted to cash, therefore, a more

complete picture of cash activities would result.

4.

The three activities are:

Operating activities include the cash effects of transactions that create revenues and expenses and thus enter into the determination of net earnings.

Investing activities include: (a) acquiring and disposing of investments and productive

long-lived assets and (b) lending money and collecting loans.

Financing activities include: (a) obtaining cash from issuing debt and repaying amounts

borrowed and (b) obtaining cash from shareholders and providing them with a return on

their investment (dividends).

5.

The cash flow statement presents cash investing and financing activities. However, companies often have significant noncash transactions such as the issuing of common shares

in return for the acquisition of a major asset. Because these transactions can have a profound impact on the financial results of the entity, it is important that users of the financial

statements be aware of these non-cash transactions. Therefore, if noncash transactions affect financial conditions significantly, the CICA requires that they be disclosed in either a

separate schedule at the bottom of the cash flow statement or in a separate note or supplementary schedule to the financial statements.

6.

Examples of noncash transactions are: (1) issue of shares for assets, (2) issue of shares to

reduce debt, and (3) issue of debt for assets.

7.

Comparative balance sheets, a current statement of earnings, and certain transaction data

all provide information necessary for preparation of the cash flow statement. Comparative

balance sheets indicate how assets, liabilities, and equities have changed during the period. A current statement of earnings provides information about the amount of cash provided from operating activities. Certain transactions provide additional detailed information

needed to determine how cash was provided or used during the period.

Solutions Manual

13-4

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

8.

A number of factors could have caused an increase in cash despite the net loss. These are

(1) high cash revenues relative to low cash expenses; (2) sales of property, plant and

equipment; (3) sales of investments; and (4) issue of debt or share capital.

9.

The advantage of the direct method is that it presents the major categories of cash receipts and cash payments in a format that is similar to the statement of earnings and familiar to statement users. Its principal disadvantage is that the necessary data can be expensive and time-consuming to accumulate.

The advantage of the indirect method is it is often considered easier to prepare, and it provides a reconciliation of net earnings to net cash provided by operating activities, while its

primary disadvantage is the difficulty in understanding the adjustments that comprise the

reconciliation.

Both methods are acceptable but the CICA expressed a preference for the direct method.

Yet, the indirect method is the overwhelming favourite of companies. Companies favour the

indirect method because it is easier to prepare, it focuses on the difference between net

earnings and net cash flow and it tends to reveal less company information to competitors.

10.

It is necessary to convert accrual-based net earnings to cash basis earnings because the

unadjusted net earnings includes items that do not provide or use cash. An example would

be an increase in accounts receivable. If accounts receivable increased during the period,

revenues reported on the accrual basis would be higher than the actual cash revenues received. Thus, accrual basis net earnings must be adjusted to reflect the net cash provided

by operating activities.

11.

Although the approaches are different, both the direct and indirect methods will produce the

same net cash provided by operating activities.

12.

Amortization expense (+)

Gain (-) or loss (+) on sale of a noncurrent asset

Increase (-) /decrease (+) in accounts receivable

Increase (+) / (-) decrease in accounts payable

Increase (-) /(+) decrease in inventory

(Note: only four were required)

13.

Under the indirect method, amortization is added back to net earnings to reconcile net

earnings to net cash provided by operating activities because amortization is an expense

but not a cash payment. Adding it back cancels the expense.

Example:

Revenue

Less: Amortization expense

Net earnings (loss)

Add back amortization

Cash provided by operating activities

$

0

1,000

(1,000)

1,000

$

0

Solutions Manual

13-5

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

14.

Under the indirect method, a gain on the sale of equipment is deducted from net earnings

to reconcile net earnings to net cash provided by operating activities. A gain is the difference between the proceeds received when the asset is sold and the book value of the asset and is not a cash inflow or outflow. Therefore, the noncash gain, which was included in

net earnings, must be deducted from earnings on the cash flow statement to convert net

earnings to net cash provided by operating activities.

+ Decrease in accounts receivable

15.

Cash receipts from customers

(a)

= Sales revenue

– Increases in accounts receivable

+ Increase in inventory

Purchases

(b)

= Cost of goods

– Decrease in inventory

+ Decrease in accounts payable

Cash payments to suppliers

= Purchases

– Increase in accounts payable

16.

Sales ............................................................................................................ $2,000,000

Add: Decrease in receivables ......................................................................

100,000

Cash receipts from customers ...................................................................... $2,100,000

17.

Amortization expense is not listed in the direct method operating activities section because

it is not a cash flow item—it does not affect cash.

18.

For common shareholders this means the company is generating less cash from operating

activities to pay future dividends and to expand the business in the form of future growth.

19.

Free cash flow is the cash from operating activities available to the company after considering all cash expenditures for capital expenditures and dividends paid during the year. The

potential increase in free cash flow means the company should have more cash available

to invest in new business opportunities or pay more dividends to the shareholders.

20.

(a) The cash current debt coverage ratio is a cash-based ratio that measures liquidity.

(b) Solvency can be measured by the cash total debt coverage ratio (cash-based).

Solutions Manual

13-6

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

sold

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 13-1

(a)

(b)

(c)

(d)

(e)

Cash inflow from financing activity, $200,000

Cash outflow from investing activity, $150,000

Cash inflow from investing activity, $30,000

Cash outflow from financing activity, $50,000

Noncash activity. Not shown on the cash flow statement

BRIEF EXERCISE 13-2

(a)

(b)

(c)

Investing activity

Investing activity

Operating activity

(d)

(e)

(f)

Financing activity

Financing activity

Financing activity

BRIEF EXERCISE 13-3

Financing activities

Proceeds from issue of bonds payable ..................................................

Payment of dividends .............................................................................

Net cash provided by financing activities .......................................

$200,000)

(50,000)

$150,000

Solutions Manual

13-7

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 13-4

Original cost of equipment sold .........................................................................

Less: Accumulated amortization.......................................................................

Book value of equipment sold ...........................................................................

Less: Loss on sale of equipment ......................................................................

Cash received from sale of equipment ..............................................................

$22,000

5,500

16,500

7,500

$ 9,000

Note to instructor–some students may find journal entries helpful in understanding this exercise.

Amortization expense .............................................................................

Accumulated amortization ..............................................................

12,000

Equipment ..............................................................................................

Cash ...............................................................................................

41,600

Cash (plug) .............................................................................................

Accumulated amortization ......................................................................

Loss on sale of equipment .....................................................................

Equipment ......................................................................................

9,000

5,500

7,500

12,000

41,600

22,000

BRIEF EXERCISE 13-5

Beginning balance, retained earnings ....................................

Add: Net earnings ..................................................................

Less: Adjustment for share repurchases .................................

Less: Ending balance, retained earnings ...............................

Dividends paid ........................................................................

$ 973.1

202.4

(5.9)

(1,138.0)

$ 31.6

Solutions Manual

13-8

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 13-6

1.

2.

3.

4.

5.

+

–

+

+

–

BRIEF EXERCISE 13-7

Operating activities

Net earnings ..................................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense ...........................................

Accounts receivable decrease ..............................

Loss on the sale of equipment ..............................

)

Accounts payable decrease .................................

Net cash provided by operating activities ............................

$2,500,000

$260,000

350,000

10,000

(280,000 )

340,000

$2,840,000

BRIEF EXERCISE 13-8

Operating activities

Net earnings ........................................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Decrease in accounts receivable ................................

Increase in prepaid expenses .....................................

Increase in inventories ................................................

Net cash provided by operating activities .....................................

$200,000

$80,000 )

(18,000 )

(30,000 )

32,000

$232,000

Solutions Manual

13-9

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 13-9

Cash payment

for income taxes

=

Income tax

expense

- Increase in income tax expense

+ Decrease in income tax payable

$67,000 = $70,000 - $3,000 (Increase in income taxes payable)

BRIEF EXERCISE 13-10

Receipts from

customers

=

Sales

revenues

+ Decrease in accounts receivable

- Increase in accounts receivable

$490,000 = $480,000 + $10,000 (Decrease in accounts receivable)

BRIEF EXERCISE 13-11

+ Increase in prepaid expenses

Cash

payments for

operating

expenses

=

Operating

expenses,

excluding

amortization

- Decrease in prepaid expenses

and

+ Decrease in accrued expenses payable

- Increase in accrued expenses payable

$49,000 = $60,000 – $6,600 – $4,400

Solutions Manual

13-10

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 13-12

Purchases

= Cost of goods

+ Increase in inventory

– Decrease in inventory

sold

$438.8 - $20.0 = $418.8

Cash payments to suppliers

= Purchases

+ Decrease in accounts payable

– Increase in accounts payable

$418.8 - $17.3 = $401.5

BRIEF EXERCISE 13-13

(a)

Free cash flow = $300,000 – $200,000 – $0 = $100,000

(b)

Cash current debt coverage =

$300,000

2 times

$150,000

(c)

Cash total debt coverage =

$300,000

1.3 times

$225,000

BRIEF EXERCISE 13-14

(a)

Free cash flow = $44.6 million - $1.6 million = $43 million

Solutions Manual

13-11

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 13-1

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Noncash investing (purchase of assets) and financing (issue of note) activities

Financing activities (cash provided)

Operating activities (cash provided)

Financing activities (cash used)

Investing activities (cash provided)

Financing activities (cash used)

Operating activities (cash used)

Noncash financing activity

EXERCISE 13-2

Indirect method assumed:

(a) Investing activity

(b) Financing activity

(c) Investing activity

(d) Noncash investing

(e) Operating activity

(f)

Financing activity

(g) Operating activity

(h) Financing activity

Direct method assumed:

(a) Investing activity

(b) Financing activity

(c) Investing activity

(d) Noncash investing

(e) No effect

(f)

Financing activity

(g) Operating activity

(h) Financing activity

(i)

(j)

Operating activity

Noncash investing activity (land);

financing (bonds) activity

(k) Operating activity

(l)

Noncash financing activity

(m) Operating activity (gain); investing activity

(cash proceeds from sale)

(n) Operating activity*

(i)

(j)

Operating activity

Noncash investing activity (land);

financing (bonds) activity

(k) Operating activity

(l)

Noncash financing activity

(m) No effect (gain); investing activity (cash proceeds from sale of land)

(n) Operating activity*

* Note to instructors—this assumes that the dividends have been received from equity investments recorded using the cost method. If the investment is recorded using the equity method, the

answer would change to an investing activity.

Solutions Manual

13-12

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-3

PESCI COMPANY LTD.

Cash Flow Statement (Partial)—Indirect Method

Year Ended July 31, 2004

Operating activities

Net earnings ..........................................................................

Adjustments to reconcile net earnings to net

cash provided by operating activities

Amortization expense ...................................................

Decrease in accounts receivable ..................................

Increase in accounts payable .......................................

Decrease in prepaid expenses .....................................

Loss on sale of equipment ............................................

Net cash provided by operating activities .......................................

$195,000

$45,000

15,000

10,000

4,000

5,000

79,000

$274,000

EXERCISE 13-4

BARTH INC.

Cash Flow Statement (Partial)—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings ..........................................................................

Adjustments to reconcile net earnings to net

cash provided by operating activities

Amortization expense ...................................................

Increase in accounts receivable ...................................

Decrease in inventory ...................................................

Increase in prepaid expenses .......................................

Increase in accrued expenses payable ........................

Decrease in accounts payable .....................................

Net cash provided by operating activities .......................................

$153,000

$19,000)

(31,000)

25,000)

(5,000)

10,000)

(7,000)

11,000

$164,000

Solutions Manual

13-13

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-5

DUPRÉ CORP.

Cash Flow Statement (Partial)—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings ..........................................................................

Adjustments to reconcile net earnings to net

cash provided by operating activities

Amortization expense ...................................................

Loss on sale of equipment ............................................

Net cash provided by operating activities .......................................

$ 67,000

$28,000

6,000

Investing activities

Sale of equipment ................................................................. $ 3,000*

Purchase of equipment ......................................................... (123,000)

Net cash used by investing activities ..............................................

34,000

101,000

(120,000)

Financing activities

Payment of cash dividends....................................................

(14,000)

Net decrease in cash ......................................................................

$(33,000)

*Cost of equipment sold ........................................................

*Accumulated amortization ....................................................

*Book value ...........................................................................

*Loss on sale of equipment ...................................................

*Cash proceeds .....................................................................

$39,000

30,000

9,000

6,000)

$ 3,000)

Solutions Manual

13-14

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-6

(a)

PUFFY LTD.

Cash Flow Statement—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings .................................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense ..........................................

Increase in accounts receivable ..........................

Decrease in inventory ..........................................

Decrease in accounts payable.............................

Net cash provided by operating activities ........................

$105,000

$34,000

(9,000)

9,000

(8,000)

Investing activities

Sale of land ..................................................................

Purchase of equipment.................................................

Net cash used by investing activities .....................................

$25,000

(60,000)

Financing activities

Payment of cash dividends ...........................................

Redemption of bonds ...................................................

Issue of common shares ..............................................

Net cash used by financing activities .....................................

$(40,000)

(50,000)

35,000

Net increase in cash ..............................................................

Cash, January 1 ....................................................................

Cash, December 31 ..............................................................

26,000

131,000

(35,000)

(55,000)

41,000)

22,000)

$ 63,000)

Solutions Manual

13-15

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-6 (Continued)

(b)

1.

Free cash flow = $131,000 - $60,000 - $40,000 = $31,000

2.

Cash current debt coverage =

Net cash provided

by operating activities

3.

÷

Average current

liabilities

$131,000

3.05 times

($39,000 $47,000)/2

Cash total debt coverage =

Net cash provided

by operating activities

÷

Average total

liabilities

$131,000

0.60 times

($189,000 * $ 247,000 * *)/2

*$39,000 + $150,000 = $189,000

**$47,000 + $200,000 = $247,000

Solutions Manual

13-16

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-7

Cost of goods sold........................................................................

Add: Increase in inventory ...........................................................

Purchases ....................................................................................

Add: Decrease in accounts payable .............................................

Cash payments to suppliers ..............................................

$14,535

135

14,670

800

$15,470

Operating expenses .....................................................................

Add: Increase in prepaid expenses .............................................

Decrease in accrued liabilities ............................................

Cash payments for operating expenses ............................

$8,068

160

10

$8,238

EXERCISE 13-8

Cash payments for rentals

Rent expense

Add: Increase in prepaid rent ($9,000 - $5,900)

Cash payments for rent

$31,000*

3,100*

$34,100*

Cash payments for salaries

Salaries expense

Add: Decrease in salaries payable ($10,000 - $8,000)

Cash payments for salaries

$54,000*

2,000*

$56,000*

Cash receipts from customers

Revenue from sales

Add: Decrease in accounts receivable ($12,000 - $7,000)

Cash receipts from customers

$180,000*

5,000*

$185,000*

Solutions Manual

13-17

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-9

Operating activities

Cash receipts from customers .......................................................

Cash payments

For operating expenses .........................................................

For income taxes ...................................................................

Net cash provided by operating activities .......................................

$130,000*

$57,000**

31,000

88,000*

$ 42,000*

*$182,000 - $52,000 = $130,000

** $78,000 - $21,000 = $57,000

EXERCISE 13-10

Operating activities

Cash receipts from

Customers ....................................................................

Dividends on investment ..............................................

Cash payments

To suppliers for merchandise .......................................

For operating expenses ................................................

For salaries and wages ................................................

For interest ...................................................................

For income taxes ..........................................................

Net cash provided by operating activities .......................................

$240,000*

14,000

254,000

$90,000

28,000

53,000

10,000

12,000

193,000*

$ 61,000*

*$48,000 + $192,000 = $240,000

Solutions Manual

13-18

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-11

(a)

PUFFY LTD.

Cash Flow Statement—Direct Method

Year Ended December 31, 2004

Operating activities

Cash receipts from customers* ....................................

Cash payments

To suppliers** ............................................................... $587,000

For operating expenses*** ............................................ 251,000

Net cash provided by operating activities ..............................

Investing activities

Sale of land ..................................................................

Purchase of equipment.................................................

Net cash used by investing activities .....................................

$25,000

(60,000)

Financing activities

Payment of cash dividends ...........................................

Redemption of bonds ...................................................

Issue of common shares ..............................................

Net cash used by financing activities .....................................

$(40,000)

(50,000)

35,000

Net increase in cash ..............................................................

Cash, January 1 ....................................................................

Cash, December 31 ..............................................................

$969,000

838,000

131,000

(35,000)

(55,000)

41,000)

22,000

$ 63,000)

*Cash receipts = sales – increase in accounts receivable

$978,000 – $9,000

**Cash payments to suppliers = cost of goods sold – decrease in inventories + decrease in

accounts payable

$588,000 - $9,000 + $8,000

***Operating expenses – amortization

$285,000 - $34,000

Solutions Manual

13-19

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-11 (Continued)

(b)

1.

Free cash flow = $131,000 - $60,000 - $40,000 = $31,000

2.

Cash current debt coverage =

Net cash provided

by operating activities

3.

÷

Average current

liabilities

$131,000

3.05 times

($39,000 $47,000)/2

Cash total debt coverage =

Net cash provided

by operating activities

÷

Average total

liabilities

$131,000

0.60 times

($189,000 * $ 247,000 * *)/2

*$39,000 + $150,000 = $189,000

**$47,000 + $200,000 = $247,000

Solutions Manual

13-20

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-12

Ria

Corporation

Les

Corporation

Cash current debt coverage

$200,000

$50,000

= 4.0 times

$200,000

$100,000

= 2.0 times

(b)

Cash total debt coverage

$200,000

$200,000

= 1.0 times

$200,000

$250,000

= 0.80 times

(c)

Free cash flow

$200,000 – $20,000 –

$14,000 = $166,000

$200,000 – $35,000 –

$18,000 = $147,000

(a)

Ria’s liquidity and solvency ratios are higher (better) than Les’ comparable ratios. In particular,

Ria’s cash current debt coverage is twice as high as Les’. These ratios indicate that Ria is substantially more liquid than Les. Ria’s solvency, as measured by the cash total debt coverage ratio, is also better than Les’, although only marginally so. Finally, Ria has a higher free cash flow

which would give the company a better ability to invest in new opportunities without having to obtain outside financing.

Solutions Manual

13-21

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 13-13

PepsiCo

Coca-Cola

Cash current debt coverage

$4,627

$5,525

= 0.84 times

$4,742

$7,885

= 0.60 times

(b)

Cash total debt coverage

$4,627

$13,612

= 0.34 times

$4,742

$11,876

= 0.40 times

(c)

Free cash flow

(a)

$4,627 – $1,788 –

$1,041

=$1,798

$4,742 - $1,395 –

$1,987

= $1,360

PepsiCo’s liquidity, as measured by its cash current debt coverage is higher (better) than CocaCola’s comparable ratio. However, Coca-Cola’s cash total debt coverage ratio is almost 18%

[(0.40 – 0.34) ÷ 0.34] higher than PepsiCo’s.

PepsiCo has a higher free cash flow, which indicates the company is in a slightly better position

to use cash flows from operating activities to pay dividends or finance expansion and growth.

Solutions Manual

13-22

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 13-1A

Transaction

Classification

(a)

Recorded amortization expense.

NC

Cash Inflow

or Outflow?

No effect

(b)

Incurred a gain on the sale of

land

Recorded cash proceeds for a

sale of land.

Acquired land by issuing common shares.

Paid a cash dividend to preferred

shareholders.

Distributed a stock dividend to

common shareholders.

Recorded cash sales.

Recorded sales on account.

Purchased inventory for cash.

Purchased inventory on account.

Paid income taxes.

NC

No effect

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

I

NC

F

Inflow

No effect

Outflow

NC

No effect

O

NC

O

NC

O

Inflow

No effect

Outflow

No effect

Outflow

Solutions Manual

13-23

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-2A

(a) Net earnings:

Retained earnings, beginning of year ....................

Add: Net earnings (plug) ........................................

Less: Cash dividends.............................................

Stock dividends .............................................

Retained earnings, end of year ..............................

$240,000

78,400

318,400

10,000

8,400

$300,000

(b)

Cash inflow: Issue of common shares, $28,000

Cash outflow: Payment of dividends, $10,000

(c)

Both of the above activities (issue of common shares and payment of dividends) would be classified as financing activities on the cash flow statement.

Solutions Manual

13-24

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-3A

CORTINA LIMITED

Cash Flow Statement—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings ..............................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense ......................................... $70,000

Loss on sale of equipment .................................

1,000

Gain on sale of land ...........................................

(5,000)

Increase in accounts receivable ......................... (13,000)

Increase in inventory .......................................... (52,000)

Decrease in prepaid expenses ...........................

4,400

Decrease in accounts payable ........................... (12,000)

Net cash provided by operating activities ..........................

Investing activities

Sale of land ($150,000 - $105,000 + $5,000) ............. $50,000

Sale of equipment ...................................................... 12,000

Purchase of equipment .............................................. (65,000)

Net cash used by investing activities .................................

$26,890

(6,600)

20,290

(3,000)

Financing activities

Payment of cash dividends ........................................

(44,290)

Net decrease in cash.........................................................

Cash, January 1 ................................................................

Cash, December 31 ..........................................................

(27,000)

57,000

$30,000

Note: Significant noncash investing and financing activities

Conversion of bonds by issue of shares ............................

$30,000

Solutions Manual

13-25

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-4A

(a)

GUM SAN LTD.

Cash Flow Statement (Partial)—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings .......................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense ..................................

Decrease in accounts receivable.................

Increase in inventory ...................................

Increase in prepaid expenses .....................

Increase in accounts payable ......................

Decrease in accrued expenses payable ......

Decrease in income taxes payable ..............

Net cash used by operating activities .........................

$728,000

$145,000

510,000

(220,000)

(170,000)

50,000

(165,000)

(26,000)

124,000

$852,000

Solutions Manual

13-26

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-4A (Continued)

(b)

GUM SAN LTD.

Cash Flow Statement (Partial)—Direct Method

Year Ended December 31, 2004

Operating activities

Cash receipts from customers .................

Cash payments

To suppliers ..................................... $3,460,000 (2)

For operating expenses.................... 1,260,000 (3)

For income taxes..............................

338,000 (4)

Net cash provided by operating activities ........

$5,910,000 (1)

5,058,000

$ 852,000

Calculations

(1) Cash receipts from customers

Sales ........................................................................

Add: decrease in accounts receivable .....................

Cash receipts from customers ..................................

$5,400,000

510,000

$5,910,000

(2) Cash payments to suppliers

Cost of goods sold ...................................................

Add: Increase in inventories ....................................

Cost of purchases ....................................................

Deduct: Increase in accounts payable .....................

Cash payments to suppliers .....................................

$3,290,000

220,000

3,510,000

50,000

$3,460,000

(3) Cash payments for operating expenses

Operating expenses .................................................

Add: Decrease in accrued expenses payable ...........

Add: Increase in prepaid expenses ..........................

Cash payments for operating expenses ....................

$ 925,000

165,000

170,000

$1,260,000

(4) Cash payments for income taxes

Income tax expense .................................................

Add: Decrease in income tax expense ....................

Cash payments for income taxes .............................

$312,000

26,000

$338,000

Solutions Manual

13-27

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-5A

(a)

HANALEI INTERNATIONAL INC.

Cash Flow Statement (Partial)—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings .......................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Decrease in accounts receivable.................

Decrease in accounts payable ....................

Increase in income taxes payable ...............

Net cash used by operating activities .........................

$131,250

$10,000

(11,000)

4,000

3,000

$134,250

Solutions Manual

13-28

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-5A (Continued)

(b)

HANALEI INTERNATIONAL INC.

Cash Flow Statement (Partial)—Direct Method

Year Ended December 31, 2004

Operating activities

Cash receipts from customers ......................

Cash payments

For operating expenses......................... $381,000 (2)

For income taxes................................... 39,750 (3)

Net cash provided by operating activities .............

$555,000 (1)

420,750

$134,250

Calculations

(1) Cash receipts from customers

Revenues ...................................................................

Add: Decrease in accounts receivable ......................

($50,000 - $60,000) .............................................

Cash receipts from customers ....................................

(2) Cash payments for operating expenses

Operating expenses ...................................................

Add: Decrease in accounts payable

($30,000 - $41,000) .............................................

Cash payments for operating expenses .....................

(3) Cash payment for income taxes

Income tax expense ...................................................

Deduct: Increase in income taxes payable

($8,000 - $4,000) .................................................

Cash payments for income taxes ...............................

$545,000

10,000

$555,000

$370,000

11,000

$381,000

$43,750

4,000

$39,750

Solutions Manual

13-29

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-6A

(a)

NORWAY INC.

Cash Flow Statement —Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings ............................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense ....................................... $58,700

Gain on sale of property, plant and equipment . (8,750)

Increase in accounts receivable ....................... (53,800)

Increase in inventory ........................................ (19,250)

Increase in accounts payable ...........................

4,420

Decrease in accrued expenses payable ........... (6,730)

Net cash provided by operating activities ........................

$91,480

(25,410)

66,070

Investing activities

Sale of investments ................................................. $ 22,500

Sale of property, plant and equipment ..................... 15,550

Purchase of property, plant and equipment ............. (141,000)

Net cash used by investing activities ...............................

(102,950)

Financing activities

Sale of common shares ........................................... $50,000

Issue of bonds ......................................................... 70,000

Payment of cash dividends ...................................... (37,670)

Net cash provided by financing activities .........................

82,330

Net increase in cash ........................................................

Cash, January 1 ..............................................................

Cash, December 31 ........................................................

45,450

47,250

$92,700

Solutions Manual

13-30

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-6A (Continued)

(b)

NORWAY INC.

Cash Flow Statement —Direct Method

Year Ended December 31, 2004

Operating activities

Cash receipts from customers (1) ...........................

Cash payments

To suppliers (2) ............................................... $114,290

For operating expenses (3) .............................

21,400

For Interest......................................................

2,940

For income taxes.............................................

39,000

Net cash provided by operating activities ........................

$243,700

177,630

66,070

Investing activities

Sale of investments ................................................. $ 22,500

Sale of property, plant and equipment ..................... 15,550

Purchase of property, plant and equipment ............. (141,000)

Net cash used by investing activities ...............................

(102,950)

Financing activities

Sale of common shares ........................................... $50,000

Issue of bonds ......................................................... 70,000

Payment of cash dividends ...................................... (37,670)

Net cash provided by financing activities .........................

82,330

Net increase in cash ........................................................

Cash, January 1 ..............................................................

Cash, December 31 ........................................................

45,450

47,250

$ 92,700

Solutions Manual

13-31

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-6A (Continued)

(b)

(Continued)

Calculations

(1) Cash receipts from customers

Revenues ...................................................................

Less: Increase in accounts receivable .......................

Cash receipts from customers ....................................

$297,500

53,800

$243,700

(2) Cash payments to suppliers

Cost of goods sold ...................................................

Add: Increase in inventories ....................................

Cost of purchases ....................................................

Deduct: Increase in accounts payable .....................

Cash payments to suppliers .....................................

$ 99,460

19,250

118,710

4,420

$114,290

(3) Cash payments for operating expenses

Operating expenses ...................................................

Add: Decrease in accrued expenses payable ...........

Cash payments for operating expenses .....................

$14,670

6,730

$21,400

Solutions Manual

13-32

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-7A

(a)

DESROCHES INC.

Statement of Earnings

Month Ended January 31, 2005

Sales ($2,500 + $15,000) .............................................

Expenses

Interest expense ($15,000 X 7% x 1/12) .................

Rent expense–space ..............................................

Insurance expense .................................................

Rent expense–equipment .......................................

Supplies expense ($1,000 - $300) ..........................

Operating expenses ...............................................

Salary expense.......................................................

Net earnings ..................................................................

$17,500

$ 88

1,000

100

750

700

2,000

500

5,138

$12,362

DESROCHES INC.

Cash Flow Statement—Direct Method

Month Ended January 31, 2005

Operating activities

Cash receipts from customers ($2,500 + $12,200) ..

Cash payments

To suppliers ........................................................... $ 800

For space rent ($1,000 X 3) ................................... 3,000

For equipment rent ................................................

750

For insurance......................................................... 1,200

For operating expenses ......................................... 2,000

Net cash provided by operating activities ......................

Financing activities

Borrowing from note payable ................................. $15,000

Sale of common shares ......................................... 5,000

Net cash provided by financing activities .......................

Increase in cash during the year ...................................

$ 14,700

7,750

6,950

20,000

$26,950

Solutions Manual

13-33

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-7A (Continued)

(b) The accrual-based statement of earnings shows net earnings of $12,362. The

cash flow statement shows cash provided by operating activities of $6,950 and

total increase in cash of $26,950. Some decision makers will find the accrualbased statement of earnings more useful. Others will find the cash flow statement more useful.

For example, shareholders investing in the company’s common shares for the

long-term will find the accrual-based statement of earnings more useful as it

provides a better indication of the long-term profitability of the company. Shortterm creditors will find the cash flow statement more useful as it provides a

better indication of the company’s ability to generate cash and repay its current obligations.

Solutions Manual

13-34

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-8A

(a)

SEYMOR LIMITED

Cash Flow Statement—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings.......................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense* ................................ $11,000

Increase in accounts receivable.................. (14,000)

Increase in inventory .................................. (13,000)

Decrease in accounts payable .................... (14,000)

Decrease in income taxes payable .............

(5,000)

Net cash provided by operating activities ...................

$36,000

(35,000)

1,000

Investing activities

Sale of equipment .............................................. $10,000

Purchase of equipment**....................................

(7,000)

Net cash provided by investing activities....................

3,000

Financing activities

Issue of bonds .................................................... $10,000

Payment of cash dividends ................................ (21,000)

Net cash used by financing activities .........................

(11,000)

Net decrease in cash .................................................

Cash, January 1 ........................................................

Cash, December 31 ...................................................

(7,000)

33,000

$26,000

* [$30,000 – ($24,000 - $5,000)] = $11,000

** $70,000 - $78,000 + $15,000 = $7,000

Solutions Manual

13-35

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-8A (Continued)

(b)

SEYMOR LIMITED

Cash Flow Statement—Direct Method

Year Ended December 31, 2004

Operating activities

Cash receipts from customers (1) ...........................

$272,000

Cash payments

To suppliers (2) .................................................. $221,000

For operating expenses ($34,000 – $11,000) .....

23,000

For Interest.........................................................

7,000

For income taxes (3) ..........................................

20,000

271,000

Net cash provided by operating activities ...................

1,000

Investing activities

Sale of equipment .............................................. $10,000

Purchase of equipment* .....................................

(7,000)

Net cash provided by investing activities....................

3,000

Financing activities

Issue of bonds .................................................... $10,000

Payment of cash dividends ................................ (21,000)

Net cash used by financing activities .........................

(11,000)

Net decrease in cash .................................................

Cash, January 1 ........................................................

Cash, December 31 ...................................................

(7,000)

33,000

$26,000

* $70,000 - $78,000 + $15,000 = $7,000

Solutions Manual

13-36

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-8A (Continued)

(b) (Continued)

Calculations

(1) Cash receipts from customers

Revenues ....................................................................

Less: Increase in accounts receivable ........................

Cash receipts from customers .....................................

$286,000

14,000

$272,000

(2) Cash payments to suppliers

Cost of goods sold ......................................................

Add: Increase in inventories .......................................

Cost of purchases .......................................................

Add: Decrease in accounts payable ...........................

Cash payments to suppliers ........................................

$194,000

13,000

207,000

14,000

$221,000

(3) Cash payments for income taxes

Income tax expense ...................................................

Add: Decrease in income taxes payable ....................

Cash payments for income taxes ................................

$15,000

5,000

$20,000

Solutions Manual

13-37

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-8A (Continued)

(c)

1.

Cash current debt coverage =

Net cash provided

Average current

by operating activities ÷

liabilities

2.

$1,000

0.02 times

($44,000 $63,000)/2

Cash total debt coverage =

Net cash provided

÷

by operating activities

3.

Average total

liabilities

$1,000

0.015 times

($64,000 $73,000)/2

Free cash flow = $1,000 - $7,000 - $21,000 = $(27,000)

Solutions Manual

13-38

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-9A

Cash current debt coverage

Cash total debt coverage

Free cash flow

Air Canada

WestJet

$(95)

$161

$2,730

$135

= - 0.03 times

= 1.19 times

$(95)

$161

$9,954

$300

= -0.01 times

= 0.54 times

$(95) – $109

= $(204)

$161 – 345

= $(184)

WestJet is significantly more liquid than Air Canada. As evidenced by its cash current debt coverage ratio, WestJet is able to generate sufficient cash to meet all of

its currently maturing liabilities. Air Canada’s negative ratio indicates the company

is not generating any positive cash flows at all.

In terms of solvency, we again see that Air Canada is generating no positive cash

flows that can be used to repay the company’s liabilities. WestJet however, does

have a positive cash flow that can be used to repay its liabilities. WestJet is definitely the more solvent of the two companies.

The negative free cash flow indicates that neither company has cash from operating activities that can be used for future investment purposes or the payment of dividends. However, given WestJet’s rapid expansion over the past several years this

is to be expected for this company.

Solutions Manual

13-39

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-10A

(a) Burrard is definitely the more liquid of the two companies. The company has

more assets to repay its currently maturing liabilities as evidenced by its higher acid test ratio and current ratio. Burrard is also turning its receivables into

cash every 60 days (365 ÷ 6 times) which is quicker than Pender who is currently taking over 90 days on the average to collect its receivables. As well,

Burrard is moving its inventory faster than Pender, which again indicates that

the company is the more liquid. Finally, Burrard’s cash current debt coverage

is higher than Pender’s. This indicates that Burrard is generating more cash

from operating activities that can be used to repay current obligations.

(b) Burrard has a much higher percentage of debt to total assets than Pender,

which would indicate that the company is the less solvent of the two. However, Burrard is generating more cash to use for the repayment of long-term

debt as can be seen by examining the cash total debt coverage ratios of the

two companies. Finally, the times interest earned ratio indicates that Burrard’s

earnings when compared to its required interest payments (the companies

times interest earned ratio is 6 times) is higher than the same ratio for Pender.

Therefore, although Burrard carries more debt than Pender, the company

seems to be in a better position to meet its obligations regarding repayment of

principal and interest.

Solutions Manual

13-40

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-11A

(a)

A review of the company’s cash flow statement will probably reveal that Nexfor collected a significant amount of receivables over the year or had large

increases in the amounts owed to current creditors such as suppliers or employees. Decreases in current assets and increase in current liabilities would

cause cash to be higher than accrual based net income. As well, the company could have had losses relating to the sale of assets or high amounts of

amortization, which would have reduced net earnings, but would have no effect on cash flows from operating activities.

(b)

Cash flow from operating activities can increase because of increased cash

receipts or decreased cash payments. These cash flows may or may not result in accrual based revenues and expenses. Cash flow and net earnings do

not have a direct correlation in any one period. In addition, earnings may not

have increased as much as cash flow because of an increase in accrual

based expenses, such as losses from investments, property, plant, and

equipment, or intangible assets, losses from discontinued operations, or an

increase in future income tax.

(c)

Nexfor might have been able to increase its free cash flow by increasing

cash from operating activities as explained in parts (a) and (b) or by decreasing the cash it spent on capital expenditures or by reducing its dividend payments.

Solutions Manual

13-41

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-1B

(a)

(b)

(c)

(d)

Transaction

Classification

Recorded amortization ex- NC

pense.

Removed, from the account- NC

ing records, accumulated

amortization on equipment

that was sold during the year.

Incurred a loss on sale of NC

equipment.

Acquired a building by paying 10% in cash and signing

a mortgage payable for the

balance.

I (for the cash downpayment)

NC (for the exchange)

Cash Inflow or Outflow?

No effect

(Amortization expense is a

noncash expense on the

statement of earnings. To

cancel out the subtraction

of this expense using the

indirect method of preparation in getting to net

earnings, amortization expense is added on the

cash flow statement in operating activities.)

No effect

(The proceeds from the

sale is the cash inflow in

investing activities)

No effect

(A loss is the noncash

component of a transaction. To cancel out the

subtraction of this item in

getting to net earnings

when using the indirect

method of preparation, the

loss is added on the cash

flow statement in operating activities.)

The 10% down payment is

a cash outflow.

The acquisition of the

building and assumption

of a mortgage is a noncash transaction that is

disclosed in the notes to

the cash flow statement.

Solutions Manual

13-42

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-1B (CONTINUED)

(e)

(f)

(g)

(h)

(i)

Transaction

Made principal repayments on

the mortgage.

Issued common shares.

Purchased shares of another

company to be held as a longterm equity investment.

Paid dividends to common

shareholders.

Sold inventory on credit. The

company uses a perpetual inventory system.

(j)

Purchased inventory on

credit.

(k)

Paid wages owing to employees.

Classification

F

Cash Inflow or Outflow?

Cash outflow

F

I

Cash inflow

Cash outflow

F

Cash outflow

NC

NC

O

No effect

(Indirect method–The increase in accounts receivable is subtracted in

operating activities. The

decrease in inventory is

added in operating activities)

No effect

(Indirect method–The increase in inventory is

subtracted in operating

activities. The increase in

accounts payable is added in operating activities.)

Cash outflow

Solutions Manual

13-43

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-2B

(a)

Cash inflows (outflows) related to property, plant and equipment in 2004:

Equipment purchase

Land purchase

Proceeds from equipment sale

($80,000)

(30,000)

5,000*

* Cost of equipment sold $240,000 + $80,000 - $300,000 = $20,000

Accumulated amortization removed from accounts

($300,000 + $96,000 + $101,500 - $337,500 - $144,000) = $16,000

Cash proceeds = NBV ($20,000 – accumulated amortization $16,000) +

gain $1,000 = $5,000

Note to instructor–some students may find journal entries helpful in understanding this exercise.

Equipment .............................................................................. 80,000

Cash ................................................................................

80,000

Land ....................................................................................... 30,000

Cash ................................................................................

30,000

Cash (plug)............................................................................. 5,000

Accumulated amortization ...................................................... 16,000

Gain on sale of equipment ...............................................

Equipment .......................................................................

1,000

20,000

(b)

Equipment purchase

Land purchase

Proceeds from equipment sale

Investing activities (use)

Investing activities (use)

Investing activities (source)

Solutions Manual

13-44

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-3B

COUSIN TOMMY’S TOYS LTD.

Cash Flow Statement—Indirect Method

Year Ended December 31, 2004

Operating activities

Net earnings ............................................................

Adjustments to reconcile net earnings to net

cash provided by operating activities

Amortization expense .......................................

Loss on sale of equipment ...............................

Decrease in accounts receivable......................

Increase in inventory ........................................

Decrease in prepaid expenses .........................

Increase in accounts payable ...........................

Net cash provided by operating activities ........................

$ 38,000

$42,000

1,900

14,500

(9,450)

4,220

13,730

Investing activities

Sale of land..............................................................

Sale of equipment ....................................................

Purchase of equipment ............................................

Net cash used by investing activities ...............................

$40,000

8,100

(95,000)

Financing activities

Payment of cash dividends ......................................

Net cash used by financing activities ...............................

$(22,000)

66,900

104,900

(46,900)

(22,000)

Net decrease in cash.......................................................

Cash, January 1 ..............................................................

Cash, December 31 ........................................................

36,000

45,000

$ 81,000

Note: Significant noncash investing and financing activities

Conversion of bonds by issue of common shares ...........

$40,000

Solutions Manual

13-45

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 13-4B

(a)

BRECKENRIDGE LTD.

Cash Flow Statement (Partial)—Indirect Method

Year Ended November 30, 2004

Operating activities

Net earnings .......................................................

Adjustments to reconcile net earnings to

net cash provided by operating activities

Amortization expense .................................. $ 90,000

Increase in accounts receivable .................. (200,000)

Decrease in inventory ................................. 500,000*

Increase in prepaid expenses ..................... (150,000)

Decrease in accounts payable .................... (300,000)

Increase in income taxes payable ...............

20,000

Decrease in accrued expenses payable ...... (100,000)

Net cash provided by operating activities ...................

$875,000

(140,000)

$735,000

*$1,900,000 - $1,400,000 = $500,000

Solutions Manual

13-46

Chapter 13

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition