Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

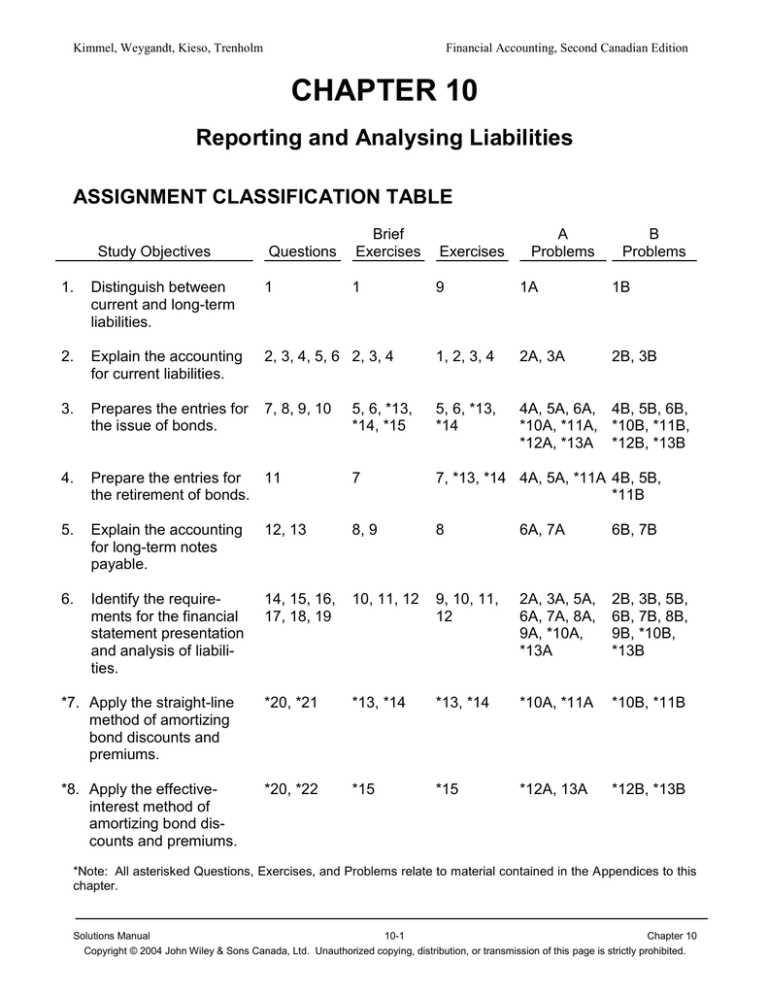

CHAPTER 10

Reporting and Analysing Liabilities

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

A

Problems

B

Problems

Exercises

1

9

1A

1B

2B, 3B

*1.

Distinguish between

current and long-term

liabilities.

1

*2.

Explain the accounting

for current liabilities.

2, 3, 4, 5, 6 2, 3, 4

1, 2, 3, 4

2A, 3A

*3.

Prepares the entries for

the issue of bonds.

7, 8, 9, 10

5, 6, *13,

*14, *15

5, 6, *13,

*14

4A, 5A, 6A, 4B, 5B, 6B,

*10A, *11A, *10B, *11B,

*12A, *13A *12B, *13B

*4.

Prepare the entries for

11

the retirement of bonds.

7

7, *13, *14 4A, 5A, *11A 4B, 5B,

*11B

*5.

Explain the accounting

for long-term notes

payable.

12, 13

8, 9

8

6A, 7A

6B, 7B

*6.

Identify the requirements for the financial

statement presentation

and analysis of liabilities.

14, 15, 16,

17, 18, 19

10, 11, 12

9, 10, 11,

12

2A, 3A, 5A,

6A, 7A, 8A,

9A, *10A,

*13A

2B, 3B, 5B,

6B, 7B, 8B,

9B, *10B,

*13B

**7. Apply the straight-line

method of amortizing

bond discounts and

premiums.

*20, *21

*13, *14

*13, *14

*10A, *11A

*10B, *11B

**8. Apply the effectiveinterest method of

amortizing bond discounts and premiums.

*20, *22

*15

*15

*12A, 13A

*12B, *13B

*Note: All asterisked Questions, Exercises, and Problems relate to material contained in the Appendices to this

chapter.

Solutions Manual

10-1

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

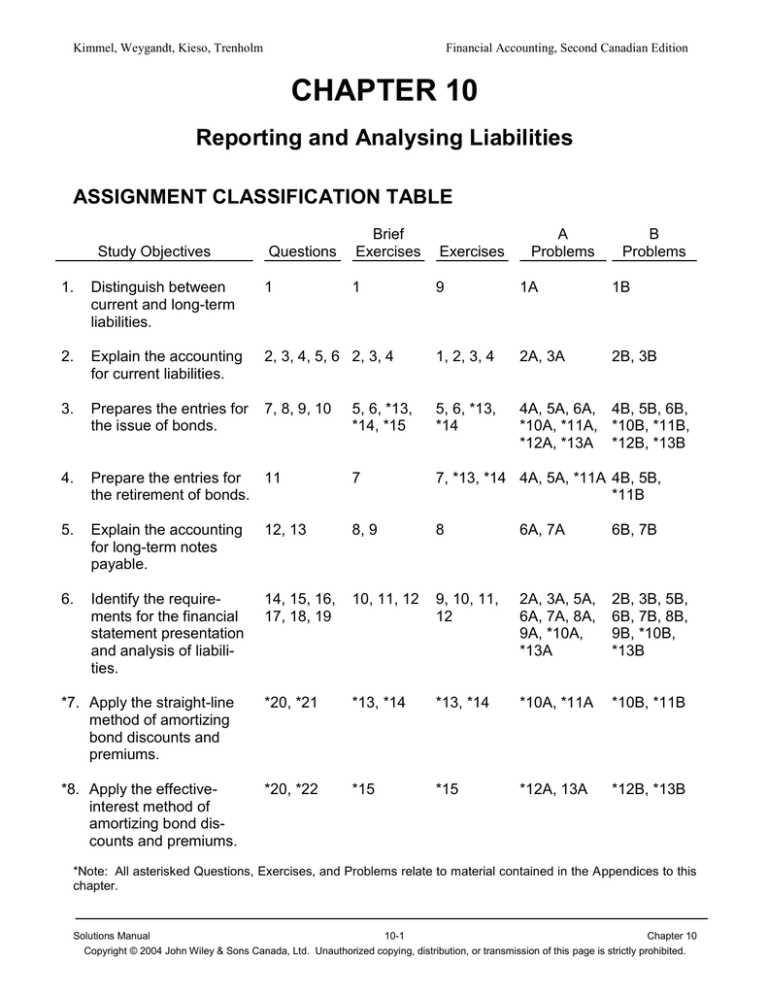

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

*1A

Identify liabilities.

Moderate

15-20

*2A

Prepare current liability entries and section of balance Moderate

sheet.

30-40

*3A

Prepare entries for note payable; show balance sheet

presentation.

Moderate

30-40

*4A

Prepare entries for bonds.

Moderate

30-40

*5A

Prepare entries for bonds; show balance sheet

presentation.

Moderate

30-40

*6A

Prepare entries for bonds and mortgage note payable. Show balance sheet presentation.

Moderate

30-40

*7A

Prepare entries for note payable. Show balance

sheet presentation.

Moderate

30-40

*8A

Analyse liquidity and solvency.

Complex

20-30

9A

Analyse liquidity and solvency.

Moderate

30-40

*10A

Prepare entries for bonds, using straight-line amortization. Show balance sheet presentation.

Moderate

30-40

*11A

Prepare entries for bonds, using straight-line amortization.

Moderate

20-30

*12A

Prepares entries for bonds, using effective-interest

amortization.

Moderate

30-40

*13A

Prepares entries for bonds, using effective-interest

amortization. Show balance sheet presentation and

answer questions.

Moderate

30-40

*1B

Identify liabilities.

Moderate

15-20

*2B

Prepare current liability entries and section of balance Moderate

sheet.

30-40

*3B

Prepare entries for notes payable; show balance

30-40

Moderate

Solutions Manual

10-2

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

Financial Accounting, Second Canadian Edition

Description

Difficulty

Level

Time

Allotted (min.)

sheet presentation.

*4B

Prepare entries for bonds.

Moderate

30-40

*5B

Prepare entries for bonds; show balance sheet

presentation.

Moderate

30-40

6B

Prepare entries for bonds, and mortgage note payable. Show balance sheet presentation.

Moderate

30-40

7B

Prepare entries for note payable. Show balance

sheet presentation.

Moderate

30-40

8B

Analyse liquidity and solvency.

Complex

20-30

9B

Analyse liquidity and solvency.

Moderate

30-40

*10B

Prepare entries for bonds, using straight-line amortization. Show balance sheet presentation.

Moderate

30-40

*11B

Prepare entries for bonds, using straight-line amortization.

Moderate

20-30

*12B

Prepares entries for bonds, using effective interest

amortization.

Moderate

30-40

*13B

Prepares entries for bonds, using effective-interest

amortization. Show balance sheet presentation and

answer questions.

Moderate

30-40

Solutions Manual

10-3

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

While this is generally true, more precisely, a current liability is a debt that can reasonably

be expected to be paid: (a) from existing current assets or through the creation of other

current liabilities and (2) within one year.

2.

Notes payable provide the lender with written documentation of the obligation and usually

require the borrower to pay interest. Accounts payable do not involve documentation other

than the suppliers invoice and do not generally provide for interest until they are past due.

Accounts payable are normally for 30 days; notes payable may be for 30 days to a multiple

of years.

Whereas a note payable is usually provided for a set amount to cover some purchase

made by the borrower, an operating line of credit allows the lender to borrow up to some

preset amount, when it is needed.

3.

In the balance sheet, Notes Payable of $25,000 and Interest Payable of $562.50 ($25,000

X 9% x 3/12) should be reported as current liabilities. In the statement of earnings, Interest

Expense of $562 should be reported under other expenses. In addition, the interest rate

and term of the note are normally reported in the notes to the statements.

4.

Disagree. The company only serves as a collection agent for the taxing authority. It does

not report sales taxes as an expense; it merely forwards the amount paid by the customer

to the government.

5.

Because property tax bills are often not received until spring, companies preparing monthly

financial statements must estimate and accrue property taxes until the bill arrives. This

gives rise to a property tax payable. Once the bill arrives and is set up in the accounts, the

company records a prepaid property tax for the period of time that has not already expired.

At this point, the company has both a prepaid asset and a current liability for the property

tax.

6.

Costs withheld from employees’ gross pay and not yet remitted to the appropriate government agency are reported in the balance sheet as current liabilities.

Costs paid by the employer are recorded in the balance sheet as a current liability until

they are paid. They are also reported as an expense in the statement of earnings, usually

as part of salaries and benefits expense.

7.

The two major obligations incurred by a company when bonds are issued are the interest

payments due on a periodic basis and the principal, which must be paid at maturity.

8.

Less than the contractual interest rate. Investors are required to pay more than the face

value; therefore, the market interest rate is less than the contractual rate.

Solutions Manual

10-4

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

9.

No, La is not right. The market price on any bond is a function of three factors: (1) the dollar

amounts to be received by the investor (interest and principal), (2) the length of time until

the amounts are received (interest payment dates and maturity date), and (3) the market

interest rate.

10.

$860,000 ($900,000 - $40,000). The balance of the Bonds Payable account minus the balance of the Discount on Bonds Payable account (or plus the balance of the Premium on

Bonds Payable account) equals the carrying value of the bonds.

11.

Debits:

Credits:

12.

Bonds Payable (for the face value) and Premium on Bonds Payable (for the

unamortized balance).

Cash (for 97% of the face value) and Gain on Bond Redemption (to balance entry).

Instalment notes with fixed principal payments are repayable in equal periodic amounts

plus interest. Each time a payment is made a constant amount of principal is applied to the

note. The total amount of the payment will decline over time as the interest expense portion decreases due to reductions in the principal amount of the note.

An instalment note with a blended principal and interest payment is repayable in equal periodic amounts and result in changing amounts of interest and principal being applied to

the note. The total payment remains the same over the life of the note but the portion applied to the principal increases over time as the interest portion decreases due to reductions in the principal amount of the note.

13.

This is not the case because the amount of interest paid each month will decrease as

payments are made and the principal decreases. This is because the amount of interest is

calculated as a percentage of the remaining principal amount. Because the payment remains constant, over time, greater portions of the payment will be applied to the principal

thereby more quickly reducing the balance of the mortgage.

14.

(a) Current liabilities should be presented in the balance sheet with each principal type

shown separately. They are normally listed in order of magnitude. The notes should

also indicate the terms, including interest rates, maturity dates, and other pertinent information such as assets pledged as collateral.

(b) The nature and the amount of each long-term liability should be presented in the balance sheet or in schedules in the accompanying notes to the statements. The notes

should also indicate the interest rates, maturity dates, conversion privileges, and assets pledged as collateral.

(c) Liquidity: working capital, current ratio, acid-test ratio, receivables turnover, inventory

turnover.

Solvency: debt to total assets ratio, times interest earned ratio.

Solutions Manual

10-5

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

15.

Joe Investor is not correct. In order to reduce costs, many companies today keep low

amounts of inventory on hand. Consequently, liquidity ratios are generally lower than they

used to be. Companies that keep fewer liquid assets on hand frequently rely on a bank line

of credit. A line of credit allows a company to borrow money on a short-term basis to meet

any cash shortfalls caused by a low amount of liquid assets. Another measure that could

be checked is the acid-test ratio. This ratio is a measure of a company’s immediate shortterm liquidity. Finally, Joe might check the company’s inventory turnover ratio to see if it

supports the assertions the company is making about its inventory levels.

16.

Off-balance sheet financing refers to situations where a company has liabilities that are not

recorded on the balance sheet. Off-balance sheet transactions arise with a company is

able to structure the acquisition of assets or the financing of its operations with arrangements that in substance are considered liabilities but do not meet the criteria under GAAP

which would require the transaction to be recorded as debt in the financial statements.

Two common types of off-the balance sheet financing are operating leases and special

purpose partnerships.

17.

The primary difference between operating leases and capital leases is that operating leases have the economic characteristics of a rental agreement, while capital leases are like

purchases. For capital leases, an asset and liability are recorded on the balance sheet. For

operating leases, rent expense is recorded on the statement of earnings.

18.

Two criteria must be met: (1) the contingency must be likely to occur and (2) the company

must be able to arrive at a reasonable estimate. If the contingency is likely to occur but not

estimable, the company should disclose the major facts concerning the contingency in its

notes.

19.

Depending on how the lease arrangements are structured, Air Canada could have significantly decreased the obligations being recorded on its balance sheet. If the leases are operating leases, the company will show fewer assets on the balance sheet and less debt, as

financing through the use of operating leases does not have to be recorded on the balance

sheet. Therefore, when preparing a trend analysis, the company will appear to have improved its solvency when in fact all it has done is moved its financing off the balance sheet.

*20. The straight-line method results in the same amortized amount being assigned to Interest

Expense each interest period. This amount is determined by dividing the total bond discount or premium by the number of interest periods the bonds will be outstanding. In contrast, the interest amount using the effective interest method is calculated as a percentage

of the outstanding principal and varies from period to period. In total the interest charged

over the term of the bond is the same – the allocation to accounting periods differs.

Solutions Manual

10-6

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

*21. $14,400. Interest expense is the interest to be paid in cash less the premium amortization

for the year. Cash to be paid equals 8% X $200,000 or $16,000. Total premium equals 4%

of $200,000 or $8,000. Since this is to be amortized over 5 years (the life of the bonds) in

equal amounts, the amortization amount is $8,000 ÷ 5 = $1,600. Thus, $16,000 – $1,600 or

$14,400 equals interest expense for 2004.

*22.

Decrease. Under the effective-interest method the interest charge per period is determined by multiplying the carrying value of the bonds by the effective-interest rate. When

bonds are issued at a premium, the carrying value decreases over the life of the bonds. As

a result, the interest expense will also decrease over the life of the bonds because it is determined by multiplying the decreasing carrying value of the bonds at the beginning of the

period by the effective-interest rate.

Solutions Manual

10-7

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 10-1

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Current liability

Current liability

Current liability

Current liability

Current liability

Current liability

Current asset

Not recorded

Current liability

Current liability

BRIEF EXERCISE 10-2

(a)

(b)

July

1

Dec. 31

Cash ......................................................................

Note Payable.................................................

60,000

Interest Expense ....................................................

Interest Payable ............................................

($60,000 X 5% X 6/12)

1,500

60,000

1,500

BRIEF EXERCISE 10-3

Sales = $8,750.00 ($9,975 ÷ 1.14)

GST payable = $612.50 ($8,750 X 7%)

PST payable = $612.50 ($8,750 X 7%)

Mar. 16

Cash ...............................................................................

Sales ......................................................................

GST Payable ..........................................................

PST Payable ..........................................................

9,975.00

8,750.00

612.50

612.50

Solutions Manual

10-8

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-4

Property tax expense June 30 statement of earnings:

$25,200 X 6/12 months = $12,600

Prepaid property tax June 30 balance sheet:

$2,100 x 6 months = $12,600

Property tax payable June 30 balance sheet

$2,100 x 12 months = $25,200

BRIEF EXERCISE 10-5

Issue Shares

Earnings before interest and taxes

Interest ($2,000,000 X 8%)

Earnings before income taxes

Income tax expense (30%)

Net earnings (a)

Number of shares (b)

Earnings per share (a) ÷ (b)

Issue Bonds

$1,000,000

0

1,000,000

300,000

$ 700,000

$1,000,000

. 160,000

840,000

252,000

$ 588,000

900,000

700,000

$0.78

$0.84

Net earnings is higher if shares are issued. However, earnings per share are lower than if bonds

are used because of the additional shares. Issuing shares is usually the preferable alternative,

since repayment of funds raised is not required.

Solutions Manual

10-9

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-6

(a)

(b)

(c)

(d)

March 1

March 1

March 1

(1)

(2)

(3)

(e)

Cash ...........................................................

Bonds Payable ...................................

(1,000 X $1,000)

1,000,000

Cash ($1,000,000 X 0.98) ...........................

Discount on Bonds Payable ........................

Bonds Payable (1,000 X $1,000) .......

980,000

20,000

Cash ($1,000,000 X 1.02) ...........................

Premium on Bonds Payable ...............

Bonds Payable (1,000 X $1,000) .......

1,020,000

1,000,000

1,000,000

20,000

1,000,000

Long-term liabilities

Bonds payable, due 2009 .......................................

$1,000,000

Long-term liabilities

Bonds payable, due 2009 .......................................

Less: Discount on bonds payable ..........................

$1,000,000

20,000

$980,000

Long-term liabilities

Bonds payable, due 2003 .......................................

Add: Premium on bonds payable ..........................

$1,000,000

20,000

$1,020,000

Regardless of whether the bonds were sold at face value, at a discount, or at a premium,

at maturity on March 1, 2009, the carrying value of the bonds will be $1,000,000.

BRIEF EXERCISE 10-7

November 30

Bonds Payable ............................................

Loss on Bond Redemption ..........................

($980,000 – $940,000)

Discount on Bonds Payable ................

Cash ($1,000,000 X .98) .....................

1,000,000

40,000

60,000

980,000

Solutions Manual

10-10

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-8

Monthly

Interest

Period

(A)

Cash

Payment

(B)

Interest

Expense

(D) X 7% ÷ 12 mos.

(C)

Reduction of

Principal

(A)- (B)

(D)

Principal

Balance

(D) - (C)

Issue date

$10,000.00

1

$116.11

$58.33

$57.78

9,942.22

2

116.11

58.00

58.11

9,884.11

3

116.11

57.66

58.45

9,825.66

BRIEF EXERCISE 10-9

(a)

Monthly

Interest

Period

Nov. 30, 2004

Dec. 31, 2004

Jan. 31, 2005

2004

Nov. 30

Dec.

31

2005

Jan. 31

(A)

Cash

Payment

$4,500

04,483

(B)

Interest

Expense

(D) X 8% X

1/12

(C)

Reduction

of Principal

(A) – (B)

(D)

Principal

Balance

(D) – (C)

$2,000

01,983

$2,500

02,500

$300,000

297,500

295,000

2,000

Cash .........................................................................

Mortgage Note Payable ...................................

300,000

Interest Expense .......................................................

Mortgage Note Payable ............................................

Cash ................................................................

2,000

2,500

Interest Expense .......................................................

Mortgage Note Payable ............................................

Cash ................................................................

1,983

2,500

300,000

4,500

4,483

Solutions Manual

10-11

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-9 (Continued)

(b)

Monthly

Interest

Period

(A)

Cash

Payment

Nov. 30, 2004

Dec. 31, 2004

Jan. 31, 2005

2004

Nov. 30

Dec.

31

2005

Jan. 31

$3,639.83

3,639.83

(B)

Interest

Expense

(D) X 8% X

1/12

$2,000.00

1,989.07

(C)

Reduction

of Principal

(A) – (B)

$1,639.83

1,650.76

01476.73

(D)

Principal

Balance

(D) – (C)

$300,000.00

298,360.17

296,709.41

22,000

Cash .........................................................................

Mortgage Note Payable ...................................

300,000.00

Interest Expense .......................................................

Mortgage Note Payable ............................................

Cash ................................................................

2,000.00

1,639.83

Interest Expense .......................................................

Mortgage Note Payable ............................................

Cash ................................................................

1,989.07

1,650.76

300,000.00

3,639.83

3,639.83

Solutions Manual

10-12

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-10

WARNER LTD.

Balance Sheet (Partial)

December 31, 2004

Current liabilities

Bank indebtedness .........................................................

Accounts payable............................................................

Interest payable ..............................................................

Employee benefits payable .............................................

Property tax payable .......................................................

Sales taxes payable ........................................................

Current portion of long-term debt ....................................

Total current liabilities .............................................

Long-term liabilities

Bonds payable, due 2008 ................................................

Less: Discount on bonds payable ...................................

Notes payable, due 2006.................................................

Total long-term liabilities .........................................

Total liabilities ...........................................................................

$ 20,000

135,000

40,000

7,800

3,500

1,400

240,000

$ 447,700

$900,000

45,000

855,000

80,000

935,000

$1,382,700

BRIEF EXERCISE 10-11

[dollar figures in millions]

(a)

Working capital = $516.3 $458.2 $58.1

(b)

Current ratio =

(c)

Acid-test ratio =

(d)

Debt to total assets =

(e)

Times interest earned =

$516.3

1.13 : 1

$458.2

($4.9 $90.3)

0.21: 1

$458.2

$1,261.3

57.8%

$2,178.9

($246.7 $52.1 $0.5)

5.7 times

$52.1

Solutions Manual

10-13

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 10-12

(a)

(b)

Debt to total assets:

Without operating leases

$12,297

= 65%

$18,924

With operating leases

$12,297 $1,154

= 67%

$18,924 $1,154

CN does not have significant operating leases therefore its assets and liabilities reflect its

true financial position. By increasing its assets and liabilities for these operating leases we

see that its debt to total assets ratio increases only marginally from 65% to 67%.

*BRIEF EXERCISE 10-13

(a)

(b)

Jan.

July

1

1

Cash (0.96 X $2,000,000) ...........................

Discount on Bonds Payable ........................

Bonds Payable ...................................

1,920,000

80,000

Bond Interest Expense ................................

Discount on Bonds Payable

($80,000 ÷ 20) .................................

Cash ($2,000,000 X 9% X 6/12) .........

94,000

2,000,000

4,000

90,000

*BRIEF EXERCISE 10-14

(a)

(b)

Jan. 1

July 1

Cash (1.03 X $5,000,000) ...........................

Bonds Payable ....................................

Premium on Bonds Payable ...............

5,150,000

Interest Expense .........................................

Premium on Bonds Payable

($150,000 ÷ 10)...........................................

Cash ($5,000,000 X 8% X 6/12) .........

185,000

5,000,000

150,000

15,000

200,000

Solutions Manual

10-14

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*BRIEF EXERCISE 10-15

(a)

(b)

Cash ..........................................................................................

Discount on Bonds Payable .......................................................

Bonds Payable ..................................................................

937,689

62,311

Interest Expense ........................................................................

Discount on Bonds Payable ..............................................

Cash ..................................................................................

46,884

1,000,000

1,884

45,000

(c)

Interest expense is greater than interest paid because the bonds sold at a discount. The

discount is an additional cost of borrowing that should be recorded as bond interest expense over the life of the bonds. The bonds sold at a discount because investors demand a

market interest rate higher than the contractual interest rate.

(d)

Interest expense increases each period because the bond carrying value increases each

period. As the market interest rate is applied to this bond carrying amount, interest expense

will increase.

(e)

The carrying value of the bond on its maturity date will be $1,000,000.

Solutions Manual

10-15

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 10-1

(a)

(b)

(c)

June

June 30

Cash ......................................................................

Note Payable .................................................

50,000

Interest Expense .....................................................

($50,000 X 8% X 1/12)

Interest Payable.............................................

333

Interest payable accrued each month ........................

Number of months from borrowing to year end ..........

Balance in interest payable account ...........................

Dec.

(d)

1

1

50,000

333

$ 333

x

6

$2,000

Note Payable ..........................................................

Interest Payable ......................................................

Cash ..............................................................

50,000

2,000

52,000

The total financing cost (interest expense) was $2,000.

EXERCISE 10-2

(a)

Valerio Construction

Oct. 1

Nov. 1

(b)

Cash .........................................................................

Note Payable..................................................

250,000

Interest Expense .......................................................

Cash ...............................................................

($250,000 X 5% X 1/12)

1,042

Note Receivable .......................................................

Cash ...............................................................

250,000

Cash .........................................................................

Interest Revenue ............................................

($250,000 X 5% X 1/12)

1,042

250,000

1,042

TD Bank

Oct. 1

Nov. 1

250,000

1,042

Solutions Manual

10-16

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-3

(a)

Jintao Ltd.

Apr. 10

(b)

Cash ...........................................................................

Sales ..................................................................

GST Payable ......................................................

PST Payable ......................................................

28,750

25,000

1,750

2,000

Gan Ltd.

Apr. 15

Cash ...........................................................................

Sales ($11,700 ÷ 1.17) .......................................

GST Payable ($10,000 x 7%) .............................

PST Payable ($10,000 x 10%) ...........................

11,700

10,000

700

1,000

Solutions Manual

10-17

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-4

(a)

Last calendar year

Oct. 31

- Dec. 31

Property Tax Expense ($24,000 X 1/12) ........................

Prepaid Property Tax ............................................

2,000

2,000

This entry would be made monthly Oct. to Dec. ($2,000 X 3 mos. = $6,000).

Current calendar year

Jan. 31

- Apr. 30

Property Tax Expense ($24,000 X 1/12) ........................

Property Tax Payable............................................

2,000

2,000

This entry would be made monthly Jan. to April ($2,000 X 4 mos. = $8,000).

(b)

May 1

Prepaid Property Tax

($26,400 x 8/12 mos. May-Dec.) ....................................

Property Tax Expense ...................................................

Property Tax Payable ($26,400 - $8,000) .............

17,600

800*

18,400

*[($2,200 - $2,000) x 4 mos. (Jan. to April) under-expensed]

May 31

- June 30

Property Tax Expense ($26,400 X 1/12) ........................

Prepaid Property Tax ............................................

2,200

2,200

This entry would be made monthly May and June ($2,200 X 2 mos. = $4,400).

(c)

(d)

July 1

July 31

- Sept. 30

Property Tax Payable ($8,000 + $18,400) .....................

Cash......................................................................

26,400

Property Tax Expense ($26,400 X 1/12) ........................

Prepaid Property Tax ............................................

2,200

26,400

2,200

This entry would be made monthly July, August, and September.

Solutions Manual

10-18

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-5

(a)

The Bank of Montreal bonds were issued at a premium and the Bell Canada bonds were

issued at a discount.

(b)

The prices of the two bonds differed because bond price is based on the market rate of interest not the stated rate of interest. Market interest rates must have been different when

the two bonds were issued causing the selling prices to differ.

(c)

Cash (1.1112 X $500,000) ..........................

Premium on Bonds Payable ...............

Bonds Payable ...................................

555,600

Cash (0.9908 X $500,000) ..........................

Discount on Bonds Payable ........................

Bonds Payable ...................................

495,400

4,600

55,600

500,000

500,000

EXERCISE 10-6

(a)

(b)

(c)

Sept.

Dec.

Feb.

1

1

1

Cash ...........................................................

Bonds Payable ...................................

400,000

Interest Expense ($400,000 X 9% X 4/12) ..

Interest Payable .................................

12,000

Interest Expense .........................................

Interest Payable ..........................................

Cash ($400,000 X 9% X 6/12) ............

6,000

12,000

400,000

12,000

18,000

Solutions Manual

10-19

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-7

(a)

(b)

June

June

30

Bonds Payable ..................................................

Loss on Bond Redemption ................................

Discount on Bonds Payable .....................

($120,000 – $107,500)

Cash ($120,000 X 102%) .........................

30

120,000

14,900*

12,500*

122,400*

Bonds Payable. ................................................. 0000 120,000

Loss on Bond Redemption ................................

10,100**

Discount on Bonds Payable. .................... 000000

12,500

Cash ($120,000 X 98%) ...........................

117,600

*$107,500 – (102% X $120,000) = $14,900

**$107,500 – (98% X $120,000) = $10,100

EXERCISE 10-8

(a)

Semi-annual

Interest

Period

(A)

Cash

Payment

Dec. 31, 2004

June 30, 2005

Dec. 31, 2005

$9,750

9,600

01

(B)

Interest

Expense

(D) X 8% X

6/12

(C)

Reduction

of Principal

(A) – (B)

$6,000

05,850

(D)

Principal

Balance

(D) – (C)

$150,000

146,250

142,500

22,000

$3,750

3,750

01476.73

Issue of Note

2004

Dec.

31

Cash ...............................................................

Mortgage Note Payable .........................

150,000

150,000

First Instalment Payment

2005

June

30

Interest Expense ($150,000 X 8% X 6/12) .....

Mortgage Note Payable ..................................

Cash ......................................................

6,000

3,750

9,750

Second Instalment Payment

Dec.

31

Interest Expense

[($150,000 – $3,750) X 8% X 6/12] .............

Mortgage Note Payable ..................................

Cash.......................................................

5,850

3,750

9,600

Solutions Manual

10-20

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-8 (Continued)

(b)

Semi-annual

Interest

Period

(B)

Interest

Expense

(D) X 8% X

6/12

(A)

Cash

Payment

Issue Date

June 30, 2005

Dec. 31, 2005

$7,578.52

7,578.52

01

$6,000.00

5,936.86

(C)

Reduction

of Principal

(A) – (B)

(D)

Principal

Balance

(D) – (C)

$1,578.52

1,641.66

01476.73

$150,000.00

148,421.48

146,779.82

22,000

0

Issue of Note

2004

Dec.

31

Cash ...............................................................

Mortgage Note Payable .........................

150,000

150,000

First Instalment Payment

2005

June

30

Interest Expense

($150,000 X 8% X 6/12) ..............................

Mortgage Note Payable ..................................

Cash ......................................................

6,000.00

1,578.52

7,578.52

Second Instalment Payment

Dec.

31

Interest Expense [($150,000

– $1,578.52) X 8% X 6/12] ...........................

Mortgage Note Payable ..................................

Cash.......................................................

5,936.86

1,641.66

7,578.52

Solutions Manual

10-21

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-9

(a) Account

Classification

Reason

Accounts payable

Current liability

Due within one year

Accrued benefit liability

Long-term liability

Accrued liabilities

Current liability

Likely relates to pensions. Not

due within one year

Due within one year

Bonds payable

Long-term liability

Not due within one year

Current portion of long-term

debt

Current liability

Due within one year

Deferred income taxes

Long-term liability

Income taxes payable

Current liability

Income taxes payable in the future

Due within one year

Notes payable - long-term

Long-term liability

Not due within one year

Operating leases

N/A

Other liabilities

Long-term liability

Not a balance sheet item – may

be disclosed in notes

Not due within one year

Other loans payable

Long-term liability

Not due within one year

Payroll related liabilities

Current liability

Due within one year

Short-term borrowings

Current liability

Due within one year

Unused operating line of credit

NA

Warranty provision

Both

Not a balance sheet item as unused – may be disclosed in

notes

Can be current and/or long-term

depending on the length of the

warranty

Solutions Manual

10-22

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-9 (Continued)

(b)

BOMBARDIER INC.

(Partial) Balance Sheet

January 31, 2003

(in millions)

Current liabilities

Short-term borrowings ....................................................

Accounts payable ...........................................................

Accrued liabilities............................................................

Current portion of long-term debt ...................................

Payroll related liabilities ..................................................

Income taxes payable ....................................................

Total current liabilities.............................................

Long-term liabilities

Bonds payable ...............................................................

Notes payable, long-term ...............................................

Other liabilities ................................................................

Accrued benefit liability...................................................

Other loans payable .......................................................

Warranty provision .........................................................

Deferred income taxes ...................................................

Total long-term liabilities.........................................

Total liabilities .........................................................................

$2,563.6

3,263.9

1,258.1

1,992.2

558.1

28.8

$ 9,664.7

$1,961.2

5,746.7

1,498.7

1,215.2

335.6

1,417.3

206.4

12,381.1

$22,045.8

Solutions Manual

10-23

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-10

($ in thousands)

(a)

Current ratio

2002:

$ 9,034

0.57 : 1

$15,944

2001:

$12,636

0.70 : 1

$18,162

Acid-test ratio

(b)

2002:

($ 1,834 $ 4,616 $ 448)

0.43 : 1

$15,944

2001:

($ 2,247 $ 7,545 $ 612)

0.57 : 1

$18,162

Current ratio

$ 9,034 - $1,000

0.54 : 1

$15,944 - $1,000

Acid-test ratio

($ 1,834 $ 4,616 $ 448 - $1,000)

0.39 : 1

($15,944 - $ 1,000)

Paying off the $1 million would make the Stampede’s current ratio decrease from 0.57:1 to

0.54:1. Its acid-test ratio would decrease from 0.43:1 to 0.39:1.

(c)

The liquidity ratios would not change but having access to a line of credit means that cash

is available on a short-term basis and therefore the assessment of the company’s shortterm liquidity would improve. However, if the company borrows money on their line of credit, their liquidity would be reduced.

Solutions Manual

10-24

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 10-11

($ in thousands)

(a)

(1) Working capital = $156,866 $243,121 $266,889 $14,806 - $597,003 $ 84,679

(2) Current ratio =

($156,866 $243,121 $266,889 $14,806)

1.14 : 1

$597,003

(3) Acid-test ratio =

($156,866 $ 243,121)

0.67 : 1

$ 597,003

(4) Debt to total assets =

$1,457,346

66.6%

$2,189,247

(5) Times interest earned =

(b)

($84,686 $56,289 $54,947)

3.5 times

$56,289

Since operating leases are accounted for as rent expense, Maple Leaf Foods can avoid reporting the lease obligations on its balance sheet. By not reporting the lease obligations as

liabilities, Maple Leaf’s working capital, current ratio, and acid-test ratio are all higher than

they would have been if the leases had been accounted for as a capital lease. The debt to

total assets ratio is lower because of the off-balance sheet financing (keeping liabilities off

the balance sheet).

EXERCISE 10-12

(a)

Wal-Mart does not have to record these contingent liabilities because they have determined that they are not likely to occur and the impact would be immaterial in any event.

(b)

For financial statement users it is important to understand the possible implications that the

contingent liabilities could have on the financial results of the company. If the contingent

liabilities result in material losses for the company it will negatively impact the companies

financial results and affect the decisions made by the users of the financial statements.

Solutions Manual

10-25

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*EXERCISE 10-13

(a)

(b)

(c)

(d)

Jan.

July

1/04

1/04

Dec. 31/04

Jan.

1/24

Cash ($300,000 X 103%) ................................

Premium on Bonds Payable ....................

Bonds Payable ........................................

309,000

Bond Interest Expense ....................................

Premium on Bonds Payable ............................

($9,000 X 1/40)

Cash ($300,000 X 9% X 6/12).................

13,275

225

Bond Interest Expense ....................................

Premium on Bonds Payable ............................

Bond Interest Payable .............................

13,275

225

Bonds Payable ................................................

Cash ........................................................

300,000

9,000

300,000

13,500

13,500

300,000

*EXERCISE 10-14

(a)

(b)

(c)

(d)

Dec. 31/04

Jun. 30/04

Dec. 31/04

Dec. 31/14

Cash ...............................................................

Discount on Bonds Payable ............................

Bonds Payable .........................................

172,000

8,000

Bond Interest Expense ....................................

Discount on Bonds Payable .....................

($8,000 ÷ 20)

Cash ($180,000 X 6% X 6/12) .................

5,800

Bond Interest Expense ....................................

Discount on Bonds Payable .....................

Cash ($180,000 X 6% X 6/12) .................

5,800

Bonds Payable ................................................

Cash.........................................................

180,000

180,000

400

5,400

400

5,400

180,000

Solutions Manual

10-26

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*EXERCISE 10-15

(a)

(b)

(c)

Jan. 1

Cash ............................................................................

Discount on Bonds Payable ........................................

Bonds Payable ........................................................

559,231

40,769

Interest Expense ($559,231 X 8% X 6/12) ..................

Discount on Bonds Payable ($22,369 – $21,000) ...

Cash ($600,000 X 7% X 6/12).................................

22,369

Dec. 31 Interest Expense [($559,231 + $1,369) X 8% X 6/12] .

Discount on Bonds Payable ($22,424 – $21,000) ...

Interest Payable ($600,000 X 7% X 6/12) ...............

22,424

July 1

600,000

1,369

21,000

1,424

21,000

Solutions Manual

10-27

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 10-1A

(a) 1. Not on balance sheet

FOB destination and arrived after

year-end

2. Current liabilities section

Bonus payable

3. Current liabilities section

Salaries payable

CPP payable

EI payable

Income tax payable

4. Current liabilities section

Unearned revenue

5. Current liabilities section

Environmental liability

6. Current liabilities section

Interest payable

7. Current Liabilities

$36,000

$5,0361

7922

4033

2,4004

$25,000

$250,0005

$1676

Note payable

$25,000

Income Taxes Payable

$10,0007

Calculations:

1

($10,000 X 4/5) – (4.95% X $8,000) – (2.10% X $8,000) – ($3,000 x

4/5) = $5,036

2

(4.95% X $8,000) X 2 = $792

3

(2.10% X $8,000) X 2.4 = $403

4

$3,000 x 4/5 = $2,400

5

Note: Because this contingent liability is likely and estimable, it

should be recorded in the accounts

6

$25,000 X 8% X 1/12 = $167

7

$240,000 - $250,000

(b)

The notes should disclose information on the Note Payable including the interest rate and repayment term.

Solutions Manual

10-28

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-2A

(a) Jan. 5

5

12

14

20

20

21

25

25

Cash ...........................................................

Sales ($26,632 ÷ 1.15) ........................

GST Payable ($23,158 X 7%) .............

PST Payable ($23,158 X 8%)..............

26,632

Cost of Goods Sold .....................................

Inventory .............................................

15,000

Unearned Service Revenue ........................

Service Revenue .................................

16,000

GST Payable ..............................................

PST Payable ...............................................

Cash ...................................................

7,500

8,570

Accounts Receivable ..................................

Sales (500 X $150) .............................

GST Payable ($75,000 X 7%) .............

PST Payable ($75,000 X 8%)..............

86,250

Cost of Goods Sold .....................................

Inventory .............................................

45,000

Cash ...........................................................

Note Payable—HSBC Bank ................

18,000

Cash ...........................................................

Sales ($31,340 ÷ 1.15) ........................

GST Payable ($27,252 X 7%) .............

PST Payable ($27,252 X 8%)..............

31,340

Cost of Goods Sold .....................................

Inventory .............................................

12,500

23,158

1,621

1,853

15,000

16,000

16,070

75,000

5,250

6,000

45,000

18,000

27,252

1,908

2,180

12,500

Solutions Manual

10-29

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-2A (Continued)

(a)

(Continued)

31

(b) Jan. 31

(c)

Wages Expense..........................................

CPP Payable .......................................

EI Payable ...........................................

Income Tax Payable ...........................

Cash ...................................................

75,000

Employee Benefits Expense .......................

CPP Payable .......................................

EI Payable ...........................................

Workers’ Compensation Payable ........

6,668

Interest Expense .........................................

Interest Payable ..................................

($18,000 X 6% X 1/12 X 1/3 = $30)

30

3,713

1,575

15,000

54,712

3,713

2,205

750

30

BURLINGTON INC.

(Partial) Balance Sheet

January 31, 2004

Liabilities

Current liabilities

Accounts payable...................................................................

Notes payable ........................................................................

GST payable ($7,500 + $1,621- $7,500 + $5,250 + $1,908) ..

PST payable ($8,570 + $1,853 - $8,570 + $6,000 + $2,180)..

CPP Payable ($3,713 X 2) .....................................................

EI payable ($1,575 + $2,205) .................................................

Income tax payable ................................................................

Workers’ compensation payable ............................................

Interest payable .....................................................................

Total current liabilities ........................................................

$ 52,000

18,000

8,779

10,033

7,426

3,780

15,000

750

30

$115,798

Solutions Manual

10-30

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-3A

(a) Mar.

2

31

Apr.

1

30

May

1

2

31

June

1

2

30

Equipment .................................................

Note Payable .....................................

8,000

Interest Expense ($8,000 X 9% X 1/12) ....

Interest Payable .................................

60

Land ..........................................................

Note Payable .....................................

21,000

Interest Expense .......................................

[($8,000 X 9% X 1/12)

Interest Payable .................................

60

Interest Expense ($21,000 X 9% X1/12) ...

Cash ..................................................

158

Cash..........................................................

Note Payable .....................................

20,000

Interest Expense .......................................

[($20,000 X 6% X 1/12) + $60]

Interest Payable .................................

160

Interest Expense (21,000 X 9% X1/12) .....

Cash ..................................................

158

Note Payable.............................................

Interest Payable ........................................

Cash ..................................................

8,000

180

Interest Expense ($158 + $100) ................

Interest Payable .................................

258

8,000

60

21,000

60

158

20,000

160

158

8,180

258

Solutions Manual

10-31

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-3A (Continued)

(b) Current liabilities

Notes payable ......................................................................

Interest payable ...................................................................

(c)

41,000

358

Total interest expense is $854.

Solutions Manual

10-32

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-4A

(a) Jan

(b) Jan

(c) July

1

1

1

(d) Dec. 1

Bond Interest Payable .....................

Cash .......................................

72,000

Bonds Payable ................................

Loss on Bond Redemption ..............

Cash ($400,000 X 1.04) ...........

400,000

16,000

72,000

416,000

Bond Interest Expense ....................

Cash ........................................

[($1,600,000 –$400,000) X 9% X 6/12]

54,000

Bond Interest Expense ....................

Bond Interest Payable ..............

[($1,600,000 –$400,000) X 9% X 6/12]

54,000

54,000

54,000

Solutions Manual

10-33

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-5A

2003

(a) May 1

(b) Dec. 31

Cash ...............................................

Bond Payable ..........................

800,000**

Bond Interest Expense ....................

Bond Interest Payable ..............

($800,000 X 9% X 8/12)

48,000**

800,000

48,000

(c) Current liabilities

Bond interest payable .......................................

$48,000

Long-term debt

Bond payable....................................................

$800,000

2004

(d) May 1

(e) Dec. 31

2005

(f) Jan

1

Interest Expense

($800,000 X 8% X 4/12) ............

Interest Payable ..............................

Cash ($800,000 X 9%) .............

24,000

48,000

72,000

Bond Interest Expense ....................

Bond Interest Payable ..............

($800,000 X 9% X 8/12)

48,000**

Bond Interest Payable .....................

Cash .......................................

48,000

Bonds Payable ................................

Loss on Bond Redemption ..............

Cash ($800,000 X 1.01) ...........

800,000

8,000

48,000

48,000

808,000

Solutions Manual

10-34

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-6A

(a)

Sept. 1

Dec. 31

2004

Cash ..........................................

Bonds Payable ....................

Bond Interest Expense* ..............

Bond Interest Payable .........

12,000,000

12,000,000**

240,000

240,000

**($12,000,000 X 6% X 4/12) = $240,000

(b)

(A)

Quarterly

Interest Period

Issue Date

Dec. 31/04

March 31/05

June 30/05

Sept. 30/05

Dec. 31/05

Oct.

1

Dec. 31

Cash

Payment

$49,536

049,536

049,536

049,536

049,536

(B)

Interest

Expense

(D) X 6%

X 3/12

$10,500

009,914

009,320

008,717

008,105

(C)

Reduction

of Principal

(A) – (B)

(D)

Principal

Balance

(D) – (C)

$39,036

039,622

040,216

040,819

041,431

$700,000

0660,964

0621,342

0581,126

0540,307

0498,876

Cash ..........................................

Mortgage Note Payable .......

Interest Expense .....................................

Mortgage Notes Payable .........................

Cash ................................................

700,000

700,000

10,500

39,036

49,536

Solutions Manual

10-35

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-6A (Continued)

(c)

MYRON CORPORATION

Balance Sheet (Partial)

December 31, 2004

Current liabilities

Bond interest payable........................................

$240,000

Current portion of long-term debt.......................

162,088

Total current liabilities .................................

$ 402,088

Long-term liabilities

Bonds payable, due 2014 ................................... $12,000,000

Mortgage note payable, due 2008

($660,964 – $162,088) .......................................

498,876

Total long-term liabilities..............................

12,498,876

Total liabilities............................................................

$12,900,964

Solutions Manual

10-36

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-7A

(a)

(A)

Cash

Payment

Period

April 1, 2004

March 31, 2005

March 31, 2006

March 31, 2007

March 31, 2008

March 31, 2009

Total

1

(B)

Interest

Expense

(D) X 10%

$ 26,380

26,380

26,380

26,380

26,380

$131,900

$10,000

8,362

6,560

4,578

2,4001

$31,900

(C)

Principal

Reduction

(A) - (B)

$ 16,380

18,018

19,820

21,802

23,980

$100,000

(D)

Balance

(D) - (C)

$100,000

83,620

65,602

45,782

23,980

0

difference of $2 due to rounding.

April 1/04

March 31/05

March 31/06

Cash ..........................................

Note Payable .......................

100,000

Note Payable ..............................

Interest Expense .........................

Cash ....................................

16,380

10,000

Note Payable ..............................

Interest Expense .........................

Cash ....................................

18,018

8,362

100,000

26,380

26,380

(b)

SKI HILL

Balance Sheet (Partial)

December 31, 2006

Current liabilities

Current portion of 10% notes payable

Long-term liabilities

Note payable, 10%, due in 2009

($65,602 - $19,820)

$19,820

45,782

Solutions Manual

10-37

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-8A

(a)

2002

2001

1. Current ratio

$143,015

0.82 : 1

$175,064

$85,730

0.90 : 1

$95,095

2. Acid-test ratio

($100,410 $20,532)

0.69 : 1

$175,064

($58,942 $12,211 779)

0.76 : 1

$95,095

3. Cash current debt

coverage

$161,624

($175,064 $95,095) 2

1.2 times

$67,361

($95,095 $90,780) 2

0.7 times

$428,449

54.6%

$784,205

$171,733

43.6%

$393,903

5. Times interest

earned ratio

$51,780 $3,960 $31,064

$3,960

21.9 times

$36,710 $2,249 $21,079

$2,249

26.7 times

6. Cash total debt

coverage

$161,624

($428,449 $171,733) 2

0.5 times

$67,361

($171,733 $156,080) 2

0.4 times

4. Debt to total

assets ratio

Solutions Manual

10-38

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-8A (Continued)

(b) In recent years all airline companies have struggled, this is reflected in the low

liquidity ratios and high debt to total asset ratios in the industry as a whole. In

terms of short-term liquidity WestJet, is as good as or slightly better than other

companies in the industry. The company’s short-term liquidity has fallen in the

past year but is still above the industry average of 0.8:1. WestJet’s acid test ratio of 0.69:1 is well above the industry average of 0.50:1. The increase in the

cash current debt coverage ratio from 0.7 to 1.2 is also a positive indicator that

the company has a good liquidity position.

WestJet’s long-run solvency of the company declined in 2002. However, even

though the company’s debt to total assets ratio has increased over the past

year, at 54.6% it is still well below the industry average of 82.9%. Times interest earned has declined slightly but is still very high indicating the company

has more than enough earnings to repay current interest obligations. The improvement in the cash to total debt coverage ratio is also a positive indicator

when assessing the company’s solvency.

(c) WestJet’s use of operating leases (vs. capital leases) would impact the long

term solvency. If the leases were capital rather than operating, the balance

sheet would include higher property, plant and equipment and total assets and

higher long-term liabilities. Using the total lease obligations as an estimate of

the increase in liabilities and capital assets the revised debt to total assets ratio would be higher:

$428,449 $632,466

74.9%

$784,205 $632,466

The revised cash total debt coverage ratio would be lower:

$161,624

[($428,449 $ 171,733) 2] $632,466

0.17 times

Solutions Manual

10-39

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-9A

(a)

When reviewing the liquidity ratios for the two companies we can see that the

acid test and current ratios for both companies are better than the industry

average. The receivable turnover ratio shows that Chick’N’ Lick is turning its

receivables over faster than Grab’N Gab, which indicates that the company is

able to convert sales to cash more quickly. However, Chick’N Lick does

seem to be having some problems with its inventory. As indicated by its

higher inventory turnover ratio Grab’N Gab appears to be moving its inventory faster which may also be why the Grab’N Gab’s current ratio is slightly

higher than Chick’N Lick’s even though its acid-test ratio is lower.

Grab’N Gab is performing well when compared to the industry except for the

receivables turnover. The company is taking significantly longer to collect its

accounts receivable than Chick’N Lick and the average firm in the industry.

As a bank manager considering lending money to Grab’N Gab we would

want to ensure that the receivables are not outdated or uncollectible.

Given this information Chick’N Lick appears to be the more liquid company

and is probably a better candidate for a loan.

(b)

In reviewing the solvency of these two companies we see that Chick’N Lick’s

debt to total assets ratio is the better of the two companies. However, both

companies are below the industry average of 66.5%, which indicates that

both companies have a much lower percent of its assets financed by debt.

Both companies appear to have more earnings per dollar of interest expense

than the average company in the industry as evidenced by the times interest

earned ratio of 7.1 times for Grab’N Gab and 8.2 times for Chick’N Lick compared to the industry average of 6.1 times. Based on this analysis, I would

not be concerned about the solvency of either business.

Solutions Manual

10-40

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 10-10A

2004

(a) July

1

Dec. 31

Cash ($1,500,000 X 102%) ...............

Premium on Bonds Payable .......

Bonds Payable ...........................

1,530,000

Bond Interest Expense ......................

Premium on Bonds Payable ..............

($30,000 ÷ 20)

Bond Interest Payable ................

($1,500,000 X 7% X 6/12)

51,000

1,500

Cash ($1,500,000 X 94%) .................

Discount on Bonds Payable ...............

Bonds Payable ...........................

1,410,000

90,000

Bond Interest Expense ......................

Discount on Bonds

Payable ($90,000 ÷ 20) ..........

Bond Interest Payable ................

($1,500,000 X 7% X 6/12)

57,000

30,000

1,500,000

52,500

(b)

July

1

Dec. 31

1,500,000

4,500

52,500

Solutions Manual

10-41

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 10-10A (Continued)

(c)

December 31, 2004

Premium

Long-term liabilities

Bonds payable, due 2014

Add: Premium on bonds payable

$1,500,000

28,5001

$1,528,500

$1,500,000

85,5002

$1,414,500

Discount

Long-term liabilities

Bonds payable, due 2014

Less: Discount on bonds payable

1

2

$30,000 - $1,500 = $28,500

$90,000 - $4,500 = $85,500

Solutions Manual

10-42

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 10-11A

2005

(a) Jan. 1

(b) July

(c) July

1

1

Bond Interest Payable .....................

Cash ........................................

108,000**

Bond Interest Expense ....................

Premium on Bonds Payable ............

($300,000 ÷ 20)

Cash ........................................

93,000**

15,000**

Bonds Payable ................................

Premium on Bonds Payable ............

Gain on Bond Redemption .......

($1,942,500 – $1,818,000)

Cash ($1,800,000 X 1.01) ........

1,800,000**

142,500**

108,000

108,000

124,500

1,818,000

*($300,000 – $15,000) X 1/2 = $142,500

(d) Dec. 31

Bond Interest Expense ....................

Premium on Bonds Payable ............

Bond Interest Payable ..............

($1,800,000 X 6% X 6/12)

46,500**

7,500**

54,000

**$300,000 – $15,000 – $142,500 ÷ 19 periods = $7,500

or $15,000 X 1/2 = $7,500

Text Errata:

Please remind students to check the text errata published on the

Kimmel website www.wiley.com/canada/kimmel. Additional information is available noting that the bonds were originally issued

January 1, 2003 at a premium of $360,000.

Solutions Manual

10-43

Chapter 10

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 10-12A

(a)

July

(b)

1

2004

Cash ..................................................

Bonds Payable ...........................

Premium on Bonds Payable .......

1,616,917

1,500,000

116,917

PONASIS CORPORATION

Bond Premium Amortization

Effective Interest Method—Semi-annual Interest Payments

6% Bonds Issued at 5%

Semiannual

Interest

Periods

(A)

Interest to Be

Paid

(6% x 6/12 =

3%)

Issue date

Jan.1/05

July 1/05

Jan.1/06

$45,000

045,000

045,000

(c) Dec. 31

(d)

July

1

(e) Dec. 31

(B)

(C)

Interest

Premium

Expense

Amortiza(5% x

tion

6/12 =

(A) – (B)

2.5%)

$40,423

040,309

040,192

$4,577

04,691

04,808

(D)

Unamortized

Premium