Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

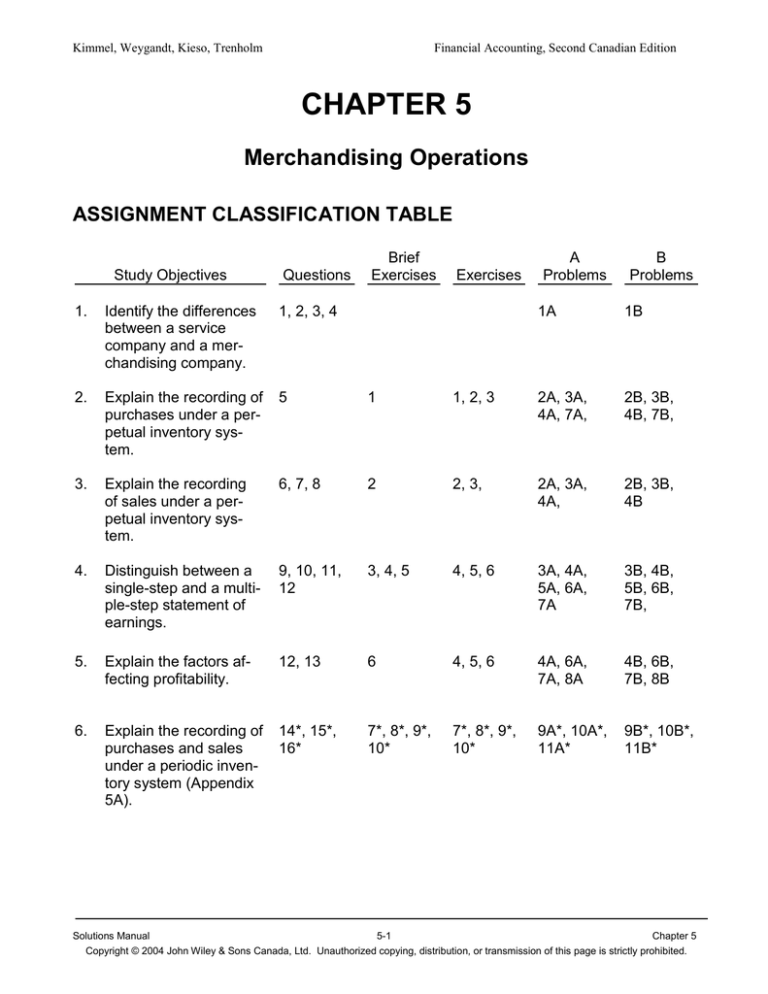

CHAPTER 5

Merchandising Operations

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

1.

Identify the differences

between a service

company and a merchandising company.

1, 2, 3, 4

2.

Explain the recording of

purchases under a perpetual inventory system.

5

1

3.

Explain the recording

of sales under a perpetual inventory system.

6, 7, 8

4.

Distinguish between a

single-step and a multiple-step statement of

earnings.

5.

6.

Exercises

A

Problems

B

Problems

1A

1B

1, 2, 3

2A, 3A,

4A, 7A,

2B, 3B,

4B, 7B,

2

2, 3,

2A, 3A,

4A,

2B, 3B,

4B

9, 10, 11,

12

3, 4, 5

4, 5, 6

3A, 4A,

5A, 6A,

7A

3B, 4B,

5B, 6B,

7B,

Explain the factors affecting profitability.

12, 13

6

4, 5, 6

4A, 6A,

7A, 8A

4B, 6B,

7B, 8B

Explain the recording of

purchases and sales

under a periodic inventory system (Appendix

5A).

14*, 15*,

16*

7*, 8*, 9*,

10*

7*, 8*, 9*,

10*

9A*, 10A*,

11A*

9B*, 10B*,

11B*

Solutions Manual

5-1

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

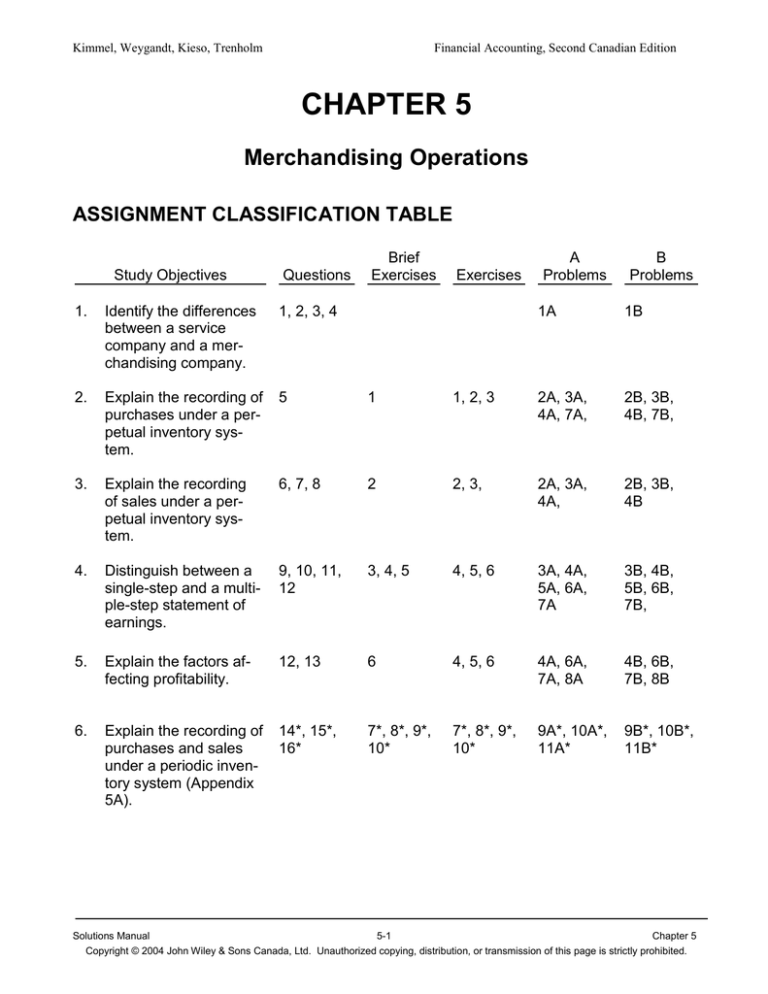

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

1A

Description

Classify accounts of merchandising company.

Difficulty

Level

Simple

Time

Allotted (min.)

20-30

2A

Journalize purchase and sales transactions.

Moderate

20-30

3A

Journalize, post, and prepare trial balance and partial

statement of earnings.

Simple

30-40

4A

Journalize, post, and prepare partial statement of

earnings, and calculate ratios.

Simple

30-40

5A

Journalize, post, and prepare adjusted trial balance

and financial statements.

Moderate

40-50

6A

Prepare financial statements and calculate profitability ratios.

Moderate

40-50

7A

Calculate missing amounts and assess profitability.

Complex

30-40

8A

Consider impact of changes on profitability ratios.

Moderate

20-30

9A*

Journalize purchase and sales transactions.

Moderate

20-30

10A*

Journalize purchase and sales transactions.

Moderate

20-30

11A*

Prepare partial statement of earnings.

Simple

20-30

1B

Classify accounts of merchandising company.

Simple

20-30

2B

Journalize purchase and sales transactions.

Moderate

20-30

3B

Journalize, post, and prepare trial balance and partial

statement of earnings.

Simple

30-40

4B

Journalize, post, and prepare statement of earnings,

and calculate ratios.

Simple

30-40

5B

Journalize, post, and prepare adjusted trial balance

and financial statements.

Moderate

40-50

6B

Prepare financial statements and calculate profitability ratios.

Moderate

40-50

7B

Calculate missing amounts and assess profitability.

Complex

30-40

Solutions Manual

5-2

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

Financial Accounting, Second Canadian Edition

Description

Difficulty

Level

Time

Allotted (min.)

8B

Consider how the timing of sales and purchases can

affect ratios.

Moderate

20-30

9B

Journalize purchase and sales transactions.

Moderate

20-30

10B

Journalize purchase and sales transactions.

Moderate

20-30

11B

Prepare partial statement of earnings.

Simple

20-30

Solutions Manual

5-3

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1. (a)

The earnings measurement process is as follows:

Sales

Less

Revenues

Cost of

Goods Equals

Sold

Gross

Profit

Less

Operating

Net

Equals

Expenses

Earnings

(b)

Earnings measurement in a merchandising company differs from a service company as

follows: (a) sales are the primary source of revenue and (b) expenses are divided into

two main categories: cost of goods sold and operating expenses.

(c)

The earnings measurement is the same because in both types of companies, net earnings (or loss) results from the matching of expenses with revenue.

2. The normal operating cycle for a merchandising company is likely to be longer than in a service company because inventory must first be purchased and sold, and then the receivables

must be collected.

3. Under a perpetual inventory system the inventory records are updated for each sale and purchase when it takes place and the cost of goods sold is determined each time a sale takes

place. Using a periodic system the inventory and cost of goods sold are determined at the end

of the accounting period when a physical inventory count is taken.

4. A physical count is an important control feature. Using a perpetual inventory system a company knows what should be on hand. Performing a physical counts and checking it to the perpetual records is necessary to detect any errors in record keeping and/or shortages in stock.

5. The reason for recording the purchase of merchandise for resale in a separate account is to

enable a company to determine its gross profit. This information is useful in setting prices.

6. Sales returns are not debited directly to the Sales account because this would not provide information on the cost of the goods returned. This information can be useful in making decisions. Debiting returns directly to sales may also cause problems in comparing sales for different periods.

7.

Seller

Cash sales—

Credit sales—

Cash ..............................................................

Sales ......................................................

Cost of Goods Sold .......................................

Merchandise Inventory ...........................

Accounts Receivable .....................................

Sales ......................................................

Cost of Goods Sold .......................................

Merchandise Inventory ...........................

Debit

XX

Credit

XX

XX

XX

XX

XX

XX

XX

Solutions Manual

5-4

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

7.

(Continued)

00,Purchaser

Debit

Cash

purchases—

Merchandise Inventory ..................................

Cash .......................................................

XX

Credit

purchases —

Merchandise Inventory

Accounts Payable ...................................

XX

Credit

XX

XX

8. Disagree. In accordance with the revenue recognition principle, sales revenues are generally

considered to be earned when the goods are transferred from the seller to the buyer; that is,

when the exchange transaction occurs. The earning of revenue is not dependent on the collection of credit sales.

9. There are three distinguishing features in the statement of earnings of a merchandising company: (1) a sales revenues section, (2) a cost of goods sold section, and (3) gross profit.

10. (a)

(b)

Sales, cost of goods sold, and operating expenses

Other revenues and other expenses

11. Gross profit ......................................................................................................

Less: Earnings from operations ($300,000 – $20,000) ....................................

Operating expenses.........................................................................................

$580,000

280,000

$300,000

12. Sales revenues ................................................................................................

Less: Cost of goods sold .................................................................................

Gross profit ......................................................................................................

$100,000

70,000

$ 30,000

Gross profit margin:

$30,000

30%

$100,000

Gross profit ......................................................................................................

Less: Operating expenses ..............................................................................

Net earnings .....................................................................................................

Profit margin:

$30,000

20,000

$10,000

$10,000

10%

$100,000

Solutions Manual

5-5

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

13. Factors affecting a company’s gross profit margin include selling products with a higher (or

lower) “mark-up,” increased competition that results in lower selling prices, and price increases from suppliers.

14.*

(1) Periodic

Debit

(a)

(b)

Cash ..............................................................

Sales ......................................................

XX

Purchases .....................................................

Cash .......................................................

XX

Credit

XX

XX

(2) Perpetual

(a)

Cash ..............................................................

Sales ......................................................

Cost of Goods Sold .......................................

Merchandise Inventory ...........................

(b)

Merchandise Inventory ..................................

Cash .......................................................

Debit

XX

Credit

XX

XX

XX

XX

XX

15.*

Accounts

Purchase Returns

and Allowances

Purchase Discounts

Freight-in

16.*

(a)

(b)

(c)

(d)

(a)

Added/Deducted

(b)

Normal Balance

Deducted

Deducted

Added

Credit

Credit

Debit

X = Purchase returns and allowances and

Y = Purchase discounts, or vice versa.

X = Freight-in.

X = Cost of goods purchased.

X = Ending merchandise inventory.

Solutions Manual

5-6

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 5-1

(a)

(b)

(c)

Jan.

3 Merchandise Inventory .......................................

Accounts Payable.......................................

900,000

6 Accounts Payable...............................................

Merchandise Inventory ...............................

100,000

Jan. 12 Accounts Payable...............................................

Cash ...........................................................

Merchandise Inventory ($80,000 X 2%) .....

800,000

Jan.

900,000

100,000

784,000

16,000

BRIEF EXERCISE 5-2

(a)

(b)

(c)

Jan.

3 Accounts Receivable ..........................................

Sales ..........................................................

900,000

Cost of Goods Sold ............................................

Merchandise Inventory ...............................

600,000

6 Sales Returns and Allowances ...........................

Accounts Receivable ..................................

100,000

Merchandise Inventory .......................................

Cost of Goods Sold ....................................

80,000

Jan. 12 Cash ...................................................................

Sales Discounts..................................................

Accounts Receivable ..................................

784,000

16,000

Jan.

900,000

600,000

100,000

80,000

800,000

BRIEF EXERCISE 5-3

(a)

(b)

(c)

(d)

(e)

(f)

Sales = $181,500 ($71,900 + $109,600).

Cost of goods sold = $31,500 ($75,000 – $43,500).

Gross profit = $43,000 ($108,000 – $65,000).

Operating expenses = $30,000 [$43,500 – ($16,200 - $2,700)].

Non operating revenues = $1,500 [$43,000 (from (c)) – $15,000 - $29,500).

Net earnings = $73,000 ($109,600 – $39,500 + $2,900).

Solutions Manual

5-7

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 5-4

COSBY INC.

Statement of Earnings (Partial)

Month Ended October 31, 2004

Sales revenues

Sales ($300,000 + $100,000) ............................................

Less: Sales returns and allowances ...............................

Sales discounts .....................................................

Net sales ...........................................................................

$400,000

$18,000

5,000

23,000

$377,000

BRIEF EXERCISE 5-5

As the names suggest, numerous steps are required in determining net earnings in a multiplestep statement.

Item

Gain on sale of equipment

Cost of goods sold

Amortization expense

Interest expense

Sales returns and allowances

Income tax expense

(1)

Multiple Step

Other revenues

Cost of goods sold

Operating expenses

Other expenses

Sales revenue

Income tax expense

(2)

Single Step

Revenues

Expenses

Expenses

Expenses

Sales revenue

Income tax expense

Solutions Manual

5-8

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 5-6

2003

2002

Gross profit margin:

Gross profit margin:

$923.8 - $603.3

= 34.7%

$923.8

$758.3 - $497.8

= 34.3%

$758.3

Profit margin:

Profit margin:

$30.5

= 3.3%

$923.8

$20.6

= 2.7%

$758.3

The Forzani Group Ltd. has maintained a fairly stable gross profit margin over the two years indicating there has been very little change in the percentage mark-up it has been able to command.

However, in 2003 the company had a slightly higher profit margin indicating it has been better

able to control its operating costs.

BRIEF EXERCISE 5-7

(a)

(b)

(c)

Jan. 3

Purchases ..........................................................

Accounts Payable.......................................

900,000

Accounts Payable...............................................

Purchase Returns and Allowances.............

100,000

Jan. 12 Accounts Payable...............................................

Cash ...........................................................

Purchase Discounts ...................................

800,000

Jan. 6

900,000

100,000

784,000

16,000

Solutions Manual

5-9

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 5-8*

(a)

(b)

(c)

Jan.

3 Accounts Receivable ..........................................

Sales ..........................................................

900,000

6 Sales Returns and Allowances ...........................

Accounts Receivable ..................................

100,000

Jan. 12 Cash ...................................................................

Sales Discounts..................................................

Accounts Receivable ..................................

784,000

16,000

Jan.

900,000

100,000

800,000

BRIEF EXERCISE 5-9*

Purchases .................................................................................

Less: Purchase returns and allowances ...................................

Purchase discounts ........................................................

Net purchases ...........................................................................

$400,000

$11,000

7,800

Net purchases ...........................................................................

Add: Freight-in ........................................................................

Cost of goods purchased...........................................................

18,800

$381,200

$381,200

16,000

$397,200

BRIEF EXERCISE 5-10*

Net sales ..................................................................................

Beginning inventory ..................................................................

Add: Cost of goods purchased* ................................................

Cost of goods available for sale ...............................................

Ending inventory.......................................................................

Cost of goods sold ....................................................................

Gross profit ...............................................................................

$630,000

$ 60,000

397,200

457,100

0 90,000

367,200

$262,800

Information taken from Brief Exercise 5-9*.

Solutions Manual

5-10

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 5-1

(a)

1.

April

5

2.

6

3.

7

4.

5.

(b)

8

15

May 4

Merchandise Inventory .................................

Accounts Payable ................................

18,000

Merchandise Inventory .................................

Cash ....................................................

900

Equipment ....................................................

Accounts Payable ................................

26,000

Accounts Payable .........................................

Merchandise Inventory ........................

2,800

Accounts Payable ($18,000 – $2,800) .........

Merchandise Inventory ........................

[($15,200 X 2%]

Cash ($15,200 – $304) ........................

15,200

Accounts Payable ($18,000 – $2,800) ...........

Cash……………………………………...

15,200

18,000

900

26,000

2,800

304

14,896

15,200

Solutions Manual

5-11

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-2

Sept.

6

10

12

14

20

21

Merchandise Inventory (60 X $20) ......................................

Accounts Payable ......................................................

1,200

Accounts Payable ...............................................................

Merchandise Inventory ..............................................

40

Accounts Receivable (26 X $30).........................................

Sales ..........................................................................

780

Cost of Goods Sold (26 X $20) ...........................................

Merchandise Inventory ..............................................

520

Sales Returns and Allowances ...........................................

Accounts Receivable .................................................

30

Merchandise Inventory .......................................................

Cost of Goods Sold ....................................................

20

Accounts Receivable (30 X $30).........................................

Sales ..........................................................................

900

Cost of Goods Sold (30 X $20) ...........................................

Merchandise Inventory ..............................................

600

Cash ($780 - $30) X 98% ...................................................

Sales Discounts ..................................................................

Accounts Receivable ($780 - $30) .............................

735

15

1,200

40

780

520

30

20

900

600

750

Solutions Manual

5-12

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-3

(a)

1.

Dec.

2.

8

3.

(b)

1.

2.

3.

3

13

Dec.

3

8

13

Accounts Receivable ...............................

Sales ..............................................

480,000

Cost of Goods Sold .................................

Merchandise Inventory ...................

320,000

Sales Returns and Allowances ................

Accounts Receivable ......................

24,000

Cash ($456,000 – $9,120) .......................

Sales Discounts.......................................

[($480,000 – $24,000) X 2%]

Accounts Receivable ......................

($480,000 – $24,000)

446,880

9,120

Merchandise Inventory ............................

Accounts Payable ...........................

480,000

Accounts Payable....................................

Merchandise Inventory ...................

24,000

Accounts Payable ($480,000 – $24,000)

Merchandise Inventory ...................

[($480,000 – $24,000) X 2%]

Cash ($456,000 – $9,120) ..............

456,000

480,000

320,000

24,000

456,000

480,000

24,000

9,120

446,880

Solutions Manual

5-13

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-4

(a)

Young Company

Sales.......................................................................................

*Sales returns (1) ....................................................................

Net sales .................................................................................

$90,000)

(9,000)

$81,000)

Net sales .................................................................................

Cost of goods sold ..................................................................

*Gross profit (2) ......................................................................

$81,000)

(56,000)

$25,000)

Gross profit .............................................................................

Operating expenses................................................................ 0

Income tax expense................................................................

*Net earnings (3).....................................................................

$25,000)

,(15,000)

(4,000)

$ 6,000)

Rioux Company

*Sales (4) ................................................................................

Sales returns...........................................................................

Net sales .................................................................................

$100,000)

0 (5,000)

$ 95,000)

Net sales .................................................................................

*Cost of goods sold (5) ...........................................................

Gross profit .............................................................................

$95,000)

57,000)

$38,000)

Gross profit .............................................................................

*Operating expenses (6) .........................................................

Income tax expense................................................................

Net earnings ...........................................................................

$38,000)

(20,000)

(7,000)

$11,000)

*Indicates missing amount

(b)

Young

Rioux

Profit margin

$6,000 ÷ $81,000 = 7.4%

$11,000 ÷ $95,000 = 11.6%

Gross profit margin

$25,000 ÷ $81,000 = 30.9%

$38,000 ÷ $95,000 = 40.0%

Solutions Manual

5-14

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-5

(a)

FORTIER CORP.

Statement of Earnings

Month Ended January 31, 2004

Sales revenues

Sales ........................................................................

Less: Sales returns and allowances ........................

Sales discounts ..............................................

Net sales...................................................................

Cost of goods sold .............................................................

Gross profit ........................................................................

Operating expenses

Salary expense .........................................................

Rent expense ...........................................................

Insurance expense ...................................................

Freight-out ................................................................

Total operating expenses ................................

Earnings before income taxes ...........................................

Income tax expense ..........................................................

Net earnings ....................................................................

(b)

Profit margin =

$350,000

$13,000

8,000

21,000

329,000

208,000

121,000

$61,000

18,000

12,000

7,000

98,000

23,000

9,200

$ 13,800

$13,800

= 4.2%

$329,000

Gross profit margin =

$121,000

= 36.8%

$329,000

Solutions Manual

5-15

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-6

(a)

DANIER LEATHER INC.

Statement of Earnings

Year Ended June 29, 2002

Revenue ............................................................................

Expenses

Cost of sales .............................................................

Selling, general, and administrative expenses..........

Interest expense .......................................................

Total expenses ................................................

Earnings before income taxes ...........................................

Income tax expense ..........................................................

Net earnings ......................................................................

$179,977

$92,098

69,264

461

161,823

18,154

7,429

$ 10,725

(b)

DANIER LEATHER INC.

Statement of Earnings

Year Ended June 29, 2002

Revenue ............................................................................

Cost of sales ....................................................................

Gross profit ........................................................................

Selling, general and administrative expenses ...................

Earnings from operations ..................................................

Interest expense ................................................................

Earnings before income taxes ...........................................

Income tax expense ..........................................................

Net earnings ....................................................................

(c)

Gross profit margin =

Profit margin =

$179,977

92,098

87,879

69,264

18,615

461

18,154

7,429

$ 10,725

$87,879

= 48.8%

$179,977

$10,725

= 6%

$179,977

Earnings per share =

$10,725

= $1.57

6,850 shares

Price-earnings ratio =

$12.10

= 7.7 times

$1.57

Solutions Manual

5-16

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-7

(a)

1.

April

5

2.

6

3.

7

4.

5.

(b)

8

15

May 4

Purchases ....................................................

Accounts Payable ................................

18,000

Freight-In ......................................................

Cash ....................................................

900

Equipment ....................................................

Accounts Payable ................................

26,000

Accounts Payable .........................................

Purchase Returns and Allowances ......

2,800

Accounts Payable ($18,000 – $2,800) .........

Purchase Discounts [($15,200 X 2%] ..

Cash ($15,200 – $304)........................

15,200

Accounts Payable ($18,000 – $2,800) ...........

Cash……………………………………...

15,200

18,000

900

26,000

2,800

304

14,896

15,200

Solutions Manual

5-17

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-8

(a)

Pele Ltd. (purchaser)

Perpetual Inventory System

June

10

11

12

19

Merchandise Inventory ...............................................

Accounts Payable .............................................

5,000

Merchandise Inventory (freight) .................................

Cash ..................................................................

300

Accounts Payable ......................................................

Merchandise Inventory (returns) .......................

300

Accounts Payable ($5,000 – $300) ............................

Merchandise Inventory ($4,700 X 2%) ..............

Cash ($4,700 – $94) .........................................

4,700

5,000

300

300

94

4,606

Periodic Inventory System

June

10

11

12

19

Purchases ..................................................................

Accounts Payable .............................................

5,000

Freight-In ....................................................................

Cash ..................................................................

300

5,000

300

Accounts Payable ......................................................

Purchase Returns and Allowances ...................

300

Accounts Payable ($5,000 – $300) ............................

Purchase Discounts ($4,700 X 2%) ..................

Cash ($4,700 – $94) .........................................

4,700

300

94

4,606

Solutions Manual

5-18

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-8 (Continued)

(b)

Duvall Ltd. (seller)

Perpetual Inventory System

June

10

Accounts Receivable..................................................

Sales .................................................................

5,000

Cost of Goods Sold ....................................................

Merchandise Inventory ......................................

3,000

5,000

3,000

11

No entry

12

Sales Returns and Allowances ..................................

Accounts Receivable .........................................

300

Merchandise Inventory ...............................................

Cost of Goods Sold ...........................................

180

Cash ($4,700 – $94) ..................................................

Sales Discounts ($4,700 X 2%) .................................

Accounts Receivable ($5,000 – $300) ..............

4,606

94

19

300

180

4,700

Periodic Inventory System

June

10

Accounts Receivable..................................................

Sales .................................................................

5,000

5,000

11

No entry

12

Sales Returns and Allowances ..................................

Accounts Receivable .........................................

300

Cash ($4,700 – $94) ..................................................

Sales Discounts ($4,700 X 2%) .................................

Accounts Receivable ($5,000 – $300) ..............

4,606

94

19

300

4,700

Solutions Manual

5-19

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 5-9*

(a)

(b)

(c)

(d)

$1,435 ($1,500 $40 - $25)

$1,545 ($1,435 + $110)

$1,485 ($1,795 $310)

$30 ($1,080 $20 - $1,030)

(g)

(h)

(i)

(j)

(e)

(f)

$200 ($1,230 $1,030)

$120 ($1,350 $1,230)

(k)

(l)

$7,650 ($7,210 + $150 + $290)

$730 ($7,940 $7,210)

$8,940 ($1,000 + $7,940)

$5,200 ($49,530 $44,330

from l)

$800 ($43,590 $700 - $42,090)

$44,330 ($42,090 + $2,240)

EXERCISE 5-10*

Inventory, September 1, 2003 .....................................

Purchases ...................................................................

Less: Purchase returns and allowances .....................

Purchase discounts ..........................................

Net purchases .............................................................

Add: Freight-in .............................................................

Cost of goods purchased.............................................

Cost of goods available for sale ..................................

Inventory, August 31, 2004… ......................................

Cost of goods sold .......................................................

$ 17,200

$144,000

2,000

2,200

139,800

4,000

143,800

161,000

25,000

$136,000

Solutions Manual

5-20

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 5-1A

Account

Statement

Classification

Accounts payable and accrued Balance Sheet

liabilities

Current Liabilities

Accumulated depreciation

Balance Sheet

Cash and cash equivalents

Balance Sheet

Property, Plant and

Equipment, Contra Account

Current Assets

Cost of products sold

Statement of Earnings

Cost of Goods Sold

Current portion of long-term

debt

Balance Sheet

Current Liabilities

Depreciation expense

Statement of Earnings

Operating Expense

Deficit

Balance Sheet

Statement of

Retained Earnings

Shareholders’ Equity

Deficit

Goodwill and other intangible

assets

Balance Sheet

Assets

Income taxes expense

Statement of Earnings

Income Tax Expense

Income taxes payable

Balance Sheet

Current Liabilities

Interest expense

Statement of Earnings

Other Expenses

Inventories

Balance Sheet

Current Assets

Long-term debt

Balance Sheet

Long-term Liabilities

Operating expenses

Statement of Earnings

Operating Expenses

Solutions Manual

5-21

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-1A (Continued)

Account

Statement

Classification

Prepaid expenses

Balance Sheet

Current Assets

Property, plant and equipment

Balance Sheet

Property, Plant and

Equipment

Sales and operating revenue

Statement of Earnings

Revenue

Selling, administrative, and

general expenses

Statement of Earnings.

Operating Expenses

Share capital

Balance Sheet

Shareholders’ Equity

Trade and other accounts

receivable

Balance Sheet

Current Assets

Solutions Manual

5-22

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-2A

Oct. 1

5

8

10

12

15

Merchandise Inventory ...........................................

Accounts Payable ...........................................

75,000

Merchandise Inventory ...........................................

Cash ...............................................................

1,800

Accounts Payable ...................................................

Merchandise Inventory....................................

6,000

Accounts Receivable .............................................

Sales...............................................................

22,000

Cost of Goods Sold ................................................

Merchandise Inventory ...................................

16,500

Sales Returns and Allowances ...............................

Accounts Receivable ......................................

3,000

Merchandise Inventory ...........................................

Cost of Goods Sold .........................................

2,250

Inventory–Supplies .................................................

Cash ...............................................................

5,000

Merchandise Inventory ...........................................

Cash. ..............................................................

7,500

75,000

1,800

6,000

22,000

16,500

3,000

2,250

5,000

7,500

Solutions Manual

5-23

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-2A (Continued)

Oct. 17

20

25

28

Cash [($22,000 – $3,000) X 98%]...........................

Sales Discounts [($22,000 – $3,000) X 2%] ...........

Accounts Receivable ($22,000 – $3,000) .......

18,620

380

Delivery Equipment ................................................

Accounts Payable ...........................................

44,000

Accounts Payable ($75,000 - $6,000).....................

Cash ...............................................................

69,000

Accounts Receivable .............................................

Sales...............................................................

30,000

Cost of Goods Sold ................................................

Merchandise Inventory ...................................

22,500

19,000

44,000

69,000

30,000

22,500

Solutions Manual

5-24

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-3A

(a)

General Journal

Date

Apr. 4

6

8

10

11

13

14

15

17

Account Titles

Debit

Merchandise Inventory ...........................................

Accounts Payable...........................................

840

Merchandise Inventory ...........................................

Cash...............................................................

60

Accounts Receivable .............................................

Sales ..............................................................

900

Cost of Goods Sold ................................................

Merchandise Inventory ...................................

600

Accounts Payable ..................................................

Merchandise Inventory ...................................

140

Merchandise Inventory ...........................................

Cash...............................................................

300

Accounts Payable ($840 – $140) ...........................

Merchandise Inventory ($700 X 2%) ..............

Cash...............................................................

700

Merchandise Inventory ...........................................

Accounts Payable...........................................

700

Cash ......................................................................

Merchandise Inventory ...................................

50

Merchandise Inventory ...........................................

Cash...............................................................

80

Credit

840

60

900

600

140

300

14

686

700

50

80

Solutions Manual

5-25

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-3A (Continued)

(a) (Continued)

Date

Account Titles

Apr. 18

Accounts Receivable .............................................

Sales ..............................................................

800

Cost of Goods Sold ................................................

Merchandise Inventory ...................................

410

Cash ......................................................................

Accounts Receivable......................................

500

Accounts Payable ..................................................

Merchandise Inventory ($700 X 2%) ..............

Cash ..............................................................

700

Sales Returns and Allowances ..............................

Accounts Receivable......................................

50

Cash ......................................................................

Accounts Receivable......................................

350

20

21

27

30

Debit

Credit

800

410

500

14

686

50

350

Solutions Manual

5-26

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-3A (Continued)

(b)

Cash

Apr. 1 Bal. 2,500 Apr. 6

Apr. 15

50 Apr. 11

Apr. 20

500 Apr. 13

Apr. 30

350 Apr. 17

Apr. 21

Apr. 30 Bal. 1,588

60

300

686

80

686

Accounts Receivable

Apr. 8

900 Apr. 20

Apr. 18

800 Apr. 27

Apr. 30

Apr. 30 Bal. 800

500

50

350

Merchandise Inventory

Apr. 1 Bal. 1,700 Apr. 8

Apr. 4

840 Apr. 10

Apr. 6

60 Apr. 13

Apr. 11

300 Apr. 15

Apr. 14

700 Apr. 18

Apr. 17

80 Apr. 21

Apr. 30 Bal. 2,452

600

140

14

50

410

14

Sales

Apr. 8

900

Apr. 18

800

Apr. 30 Bal. 1,700

Sales Returns and Allowances

Apr. 27

50

Apr. 30 Bal. 50

Cost of Goods Sold

Apr. 8

600

Apr. 18

410

Apr. 30 Bal.1,010

Accounts Payable

Apr. 10

140 Apr. 4

840

Apr. 13

700 Apr. 14

700

Apr. 21

700

Apr. 30 Bal.

0

Common Shares

Apr. 1 Bal. 4,200

Apr. 30 Bal. 4,200

Solutions Manual

5-27

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-3A (Continued)

(c)

J’s TENNIS SHOP

Trial Balance

April 30, 2004

Cash ........................................................................

Accounts Receivable ...............................................

Merchandise Inventory .............................................

Common Shares ......................................................

Sales........................................................................

Sales Returns and Allowances ................................

Cost of Goods Sold ..................................................

Debit

$1,588

800

2,452

Credit

$4,200

1,700

50

1,010

$5,900

___ __

$5,900

(d)

J.’s TENNIS SHOP

Statement of Earnings (Partial)

Month Ended April 30, 2004

Sales revenues

Sales ....................................................................................

Less: Sales returns and allowances ....................................

Net sales ..............................................................................

Cost of goods sold .......................................................................

Gross profit ..................................................................................

$1,700

50

1,650

1,010

640

Solutions Manual

5-28

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

(a) General Journal

Date

Apr. 2

4

5

6

11

13

14

16

18

20

Financial Accounting, Second Canadian Edition

PROBLEM 5-4A

Account Titles

Debit

Credit

Merchandise Inventory ........................................... 6,300

Accounts Payable ...........................................

6,300

Accounts Receivable .............................................. 5,000

Sales ..............................................................

5,000

Cost of Goods Sold ................................................ 4,000

Merchandise Inventory ...................................

4,000

Freight-out ..............................................................

Cash ...............................................................

200

Accounts Payable ..................................................

Merchandise Inventory ...................................

300

200

300

Accounts Payable ($6,300 – $300)......................... 6,000

Merchandise Inventory ($6,000 X 2%) ............

Cash ...............................................................

120

5,880

Cash....................................................................... 4,900

Sales Discounts ($5,000 X 2%) ..............................

100

Accounts Receivable ......................................

5,000

Merchandise Inventory ........................................... 4,400

Cash ...............................................................

4,400

Cash.......................................................................

Merchandise Inventory ...................................

500

500

Merchandise Inventory ........................................... 4,200

Accounts Payable ...........................................

Merchandise Inventory ...........................................

Cash ...............................................................

4,200

100

100

Solutions Manual

5-29

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-4A (Continued)

(a) (Continued)

General Journal

Date

Apr. 23

26

27

29

30

30

30

Account Titles

Debit

Credit

Cash ....................................................................... 8,100

Sales ...............................................................

8,100

Cost of Goods Sold ................................................ 6,700

Merchandise Inventory ....................................

6,700

Merchandise Inventory ........................................... 2,300

Cash ...............................................................

2,300

Accounts Payable ................................................... 4,200

Merchandise Inventory ($4,200 X 2%) ............

Cash ...............................................................

84

4,116

Sales Returns and Allowances ...............................

Cash ...............................................................

110

Merchandise Inventory ...........................................

Cost of Goods Sold .........................................

75

110

75

Accounts Receivable .............................................. 3,700

Sales ...............................................................

3,700

Cost of Goods Sold ................................................ 3,000

Merchandise Inventory ....................................

3,000

Operating Expenses ............................................... 1,400

Cash ...............................................................

1,400

Income Tax Expense .............................................. 1,000

Cash ...............................................................

1,000

Solutions Manual

5-30

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-4A (Continued)

(b)

Cash

Apr. 1 Bal. 9,000 Apr. 5

Apr. 13

4,900 Apr. 11

Apr. 16

500 Apr. 14

Apr. 23

8,100 Apr. 20

Apr. 26

Apr. 27

Apr. 29

Apr. 30

Apr. 30

Apr. 30 Bal. 2,994

200

5,880

4,400

100

2,300

4,116

110

1,400

1,000

Accounts Receivable

Apr. 4

5,000 Apr. 13

5,000

Apr. 30

3,700

Apr. 30 Bal. 3,700

Apr. 1 Bal. 9,000

Apr. 30 Bal. 9,000

Sales

Apr. 24

5,000

Apr. 23

8,100

Apr. 30

3,700

Apr. 30 Bal. 16,800

Sales Returns and Allowances

Apr. 29

110

Apr. 30 Bal. 110

Sales Discounts

Apr. 13

100

Apr. 30 Bal. 100

Merchandise Inventory

Apr. 2

6,300 Apr. 4

4,000

Apr. 14

4,400 Apr. 6

300

Apr. 18

4,200 Apr. 11

120

Apr. 20

100 Apr. 16

500

Apr. 26

2,300 Apr. 23

6,700

Apr. 29

75 Apr. 27

84

Apr. 30

3,000

Apr. 30 Bal. 2,671

Cost of Goods Sold

Apr. 4

4,000 Apr. 29

Apr. 23

6,700

Apr. 30

3,000

Apr. 30 Bal.13,625

Accounts Payable

Apr. 6

300 Apr. 2

6,300

Apr. 11

6,000 Apr. 18

4,200

Apr. 27

4,200

Apr. 30 Bal.

0

Freight -out

Apr. 5

200

Apr. 30 Bal. 200

Common Shares

75

Operating Expenses

Apr. 30

1,400

Apr. 30 Bal. 1,400

Income Tax Expense

Apr. 30

1,000

Apr. 30 Bal. 1,000

Solutions Manual

5-31

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-4A (Continued)

(c)

NISSON DISTRIBUTING LTD.

Statement of Earnings

Month Ended April 30, 2004

Sales revenues

Sales ....................................................................

Less: Sales returns and allowances ....................

Sales discounts .........................................

Net sales ..............................................................

Cost of goods sold .......................................................

Gross profit ..................................................................

Expenses

Operating expenses .............................................

Freight-out............................................................

Total expenses ............................................................

Earnings before taxes ..................................................

Income tax expense .....................................................

Net earnings ................................................................

(d) Gross profit margin =

Profit margin =

$16,800

$110

100

210

16,590

13,625

2,965

$1,400

200

1,600

1,365

1,000

$ 365

$2,965

= 17.9%

$16,590

$365

= 2.2%

$16,590

Solutions Manual

5-32

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-5A

(a) Nov. 30

30

30

30

30

Store Supplies Expense .............................

Store Supplies ....................................

3,000

Amort. Expense—Store Equipment............

Accumulated Amortization—

Store Equipment .............................

9,000

Amort. Expense—Delivery Equipment .......

Accumulated Amortization—

Delivery Equipment ........................

6,000

Interest Receivable ....................................

Interest Revenue ................................

3,000

Income Tax Expense..................................

Income Tax Payable ...........................

30,000

3,000

9,000

6,000

3,000

30,000

Solutions Manual

5-33

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-5A (Continued)

(b)

Store Supplies

Nov. 30 Bal.5,500 Nov. 30

Nov. 30 Bal.2,500

3,000

Accumulated Amortization—

Store Equipment

Nov. 30 Bal. 18,000

Nov. 30

9,000

Nov. 30 Bal. 27,000

Accumulated Amortization—

Delivery Equipment

Nov. 30 Bal. 6,000

Nov. 30

6,000

Nov. 30 Bal. 12,000

Amortization Expense—

Delivery Equipment

Nov. 30

6,000

Nov. 30 Bal. 6,000

Interest Receivable

Nov. 30

3,000

Nov. 30 Bal. 3,000

Interest Revenue

Nov. 30

3,000

Nov. 30 Bal. 3,000

Income Tax Payable

Nov. 30

30,000

Nov. 30 Bal. 30,000

Store Supplies Expense

Nov. 30

3,000

Nov. 30 Bal. 3,000

Income Tax Expense

Nov. 30

30,000

Nov. 30 Bal. 30,000

Amortization Expense—

Store Equipment

Nov. 30

9,000

Nov. 30 Bal. 9,000

Solutions Manual

5-34

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-5A (Continued)

(c)

FASHION CENTRE LTD.

Adjusted Trial Balance

November 30, 2004

Debit

$ 16,700

33,700

51,000

45,000

2,500

72,000

Cash ...............................................................

Accounts Receivable ......................................

Notes Receivable – Current ............................

Merchandise Inventory ....................................

Store Supplies ................................................

Store Equipment .............................................

Accumulated Amortization—Store ..................

Equipment...................................................

Delivery Equipment ......................................... 30,000

Accumulated Amortization—Delivery

Equipment...................................................

Accounts Payable ...........................................

Common Shares .............................................

Retained Earnings ..........................................

Dividends ........................................................ 10,000

Sales...............................................................

Sales Returns and Allowances .......................

4,200

Cost Of Goods Sold ........................................ 469,400

Salaries Expense ............................................ 100,000

Advertising Expense ....................................... 26,400

Utilities Expense ............................................. 14,000

Repair Expense .............................................. 12,100

Delivery Expense ............................................ 16,700

Rent Expense ................................................. 24,000

Store Supplies Expense ..................................

3,000

Amortization Expense—Store

Equipment...................................................

9,000

Amortization Expense—Delivery

Equipment...................................................

6,000

Income Tax Expense ...................................... 30,000

Income Tax Payable .......................................

Interest Revenue ............................................

Interest Receivable .........................................

3,000

Totals ...................................................... $978,700

Credit

$ 27,000

12,000

39,500

80,000

30,000

757,200

30,000

3,000

0000 000

$978,700

Solutions Manual

5-35

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-5A (Continued)

(d)

FASHION CENTRE LTD.

Statement of Earnings

Year Ended November 30, 2004

Sales revenues

Sales .........................................................

Less: Sales returns and allowances ..........

Net sales ...................................................

Cost of goods sold ............................................

Gross profit .......................................................

Operating expenses

Salaries expense.......................................

Advertising expense ..................................

Rent expense ............................................

Delivery expense.......................................

Utilities expense ........................................

Repair expense .........................................

Amortization expense—store equipment ...

Amortization expense—delivery equipment

Store supplies expense .............................

Total operating expenses ..................

Earnings from operations ..................................

Other revenues

Interest revenue ........................................

Earnings before tax...........................................

Income tax expense..........................................

Net earnings .....................................................

$757,200)

4,200)

753,000)

469,400)

283,600)

$100,000

26,400

24,000

16,700

14,000

12,100

9,000

6,000

3,000

211,200)

72,400

3,000)

75,400

30,000

$ 45,400

FASHION CENTRE LTD.

Statement of Retained Earnings

Year Ended November 30, 2004

Retained earnings, December 1, 2003 .............

Add: Net earnings ............................................

Less: Dividends ...............................................

Retained earnings, November 30, 2004 ...........

0$30,000)

45,400

75,400

10,000

$65,400)

Solutions Manual

5-36

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-5A

(d)

(Continued)

FASHION CENTRE LTD.

Balance Sheet

November 30, 2004

Assets

Current assets

Cash .....................................................

Accounts receivable..............................

Interest receivable ................................

Notes receivable – current portion ........

Merchandise inventory ..........................

Store supplies .......................................

Total current assets.......................

Notes receivable, due 2006 ..........................

Property, plant and equipment

Store equipment ...................................

Accumulated amortization—

store equipment ................................

Delivery equipment ...............................

Accumulated amortization—

delivery equipment............................

Total assets ..................................................

$ 16,700

33,700

3,000

30,000

45,000

2,500

130,900

21,000

$72,000

27,000

$30,000

45,000

12,000

18,000

$214,900

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable .................................

Income taxes payable ...........................

Total current liabilities ...................

Shareholders’ equity

Common shares ...................................

Retained earnings.................................

Total shareholders’ equity .............

Total liabilities and shareholders’ equity .......

$ 39,500

30,000

69,500

80,000

65,400

145,400

$214,900

Solutions Manual

5-37

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-6A

(a)

N-MART DEPARTMENT STORE LTD.

Statement of Earnings

Year Ended December 31, 2004

Sales revenues

Sales .....................................................

Less: Sales returns and allowances ......

Net sales ...............................................

Cost of goods sold.........................................

Gross profit....................................................

Operating expenses

Sales salaries expense ..........................

Office salaries expense .........................

Sales commissions expense..................

Amortization expense ............................

Insurance expense ................................

Property taxes expense .........................

Utilities expense ....................................

Total operating expenses ...............

Earnings from operations ..............................

Other revenues

Interest revenue .....................................

Other expenses

Interest expense ....................................

Earnings before income tax expense ............

Income tax expense ......................................

Net earnings ..................................................

$700,000

8,000

692,000

412,700

279,300

$76,000

32,000

14,500

7,600

21,350

24,800

11,000

186,850

92,450

$4,000

6,400

(2,400)

90,050

46,000

$ 44,050

Solutions Manual

5-38

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-6A (Continued)

(a) (Continued)

N-MART DEPARTMENT STORE

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1...........................................

Add: Net earnings ..........................................................

Less: Dividends ...............................................................

Retained earnings, December 31 .....................................

$199,300

44,050

243,350

8,000

$235,350

Solutions Manual

5-39

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-6A (Continued)

(a) (Continued)

N-MART DEPARTMENT STORE

Balance Sheet

December 31, 2004

Assets

Current assets

Cash .....................................................

Accounts receivable..............................

Merchandise inventory ..........................

Prepaid insurance .................................

Total current assets.......................

Property, plant and equipment

Land .....................................................

Building.................................................

Less: Accumulated amortization—

building ..................................

Delivery equipment ...............................

Less: Accumulated amortization—

equipment..............................

Total property, plant and equipment

Total assets ..................................................

$ 17,000

50,300

75,000

2,400

144,700

250,000

$190,000

38,000

$110,000

152,000

68,750

41,250

443,250

$587,950

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable ......................................................

Property taxes payable ..............................................

Interest payable .........................................................

Sales commissions payable.......................................

Current portion of mortgage payable .........................

Total current liabilities ........................................

Long-term liabilities

Mortgage payable ......................................................

Total liabilities ....................................................

Shareholders’ equity

Common shares ........................................................

Retained earnings......................................................

Total shareholders’ equity ..................................

Total liabilities and shareholders’ equity.....................

$ 89,300

24,800

5,000

3,500

20,000

142,600

60,000

202,600

150,000

235,350

385,350

$587,950

Solutions Manual

5-40

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-6A (Continued)

(b)

Gross profit margin =

Profit margin =

$279,300

= 40.4%

$692,000

$44,050

= 6.3%

$692,000

Solutions Manual

5-41

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-7A

(a)

2003

Cost of goods sold:

Beginning inventory

Plus: Purchases

Equals: Cost of goods available for sale

Less: Ending inventory

Equals: Cost of goods sold

2004

2005

$ 13,000

141,000

154,000

$ 11,000

150,000

161,300

$ 14,700

132,000

146,700

(11,300)

$142,700

(14,700)

$146,600

(12,200)

$134,500

2003

$225,700

142,700

$ 83,000

2004

$227,600

146,600

$ 81,000

2005

$219,500

134,500

$ 85,000

36.8%

35.6%

38.7%

2003

$ 20,000

141,000

135,000

$ 26,000

2004

$ 26,000

150,000

161,000

$ 15,000

2005

$ 15,700

132,000

127,000

$ 20,000

(b)

Net sales

Less: Cost of goods sold

Gross profit

Gross profit margin

(c)

Beginning accounts payable

Plus: Purchases

Less: Payment to suppliers

Ending accounts payable

(d)

Even though sales declined in 2005 from each of the two prior years, the

gross profit margin increased. This means that cost of goods sold declined

more than sales did, reflecting better purchasing power or control of costs.

Therefore, in spite of declining sales, profitability, as measured by the gross

profit margin, actually improved.

Solutions Manual

5-42

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-8A

(a)

Gross profit margin =

Profit margin =

$135,000

= 30%

$450,000

$21,000

= 4.7%

$450,000

(b)

1.

Gross profit margin = Gross profit ÷ Sales

0000000000000

= $136,080* ÷ $504,000 = 27.0%

Profit margin = Net earnings ÷ Sales

000000000000000

= $17,412*** ÷ $504,000 = 3.5%

* 27% x $504,000 ($450,000 X 1.12) = $136,080

** $92,000 + ($5,600 x 10%) + ($65,000 x 10%) = $99,060

*** $136,080 - $99,060 - $8,000 = $29,020 – ($29,020 x 40%) = $17,412

2.

Sales will increase by $54,000. However, this will be off-set by the increase in

cost of goods sold, advertising expense and sales salaries. Overall, the proposal will result in a decrease in net earnings of $3,588 and a decrease in

profit margin from 4.7% to 3.5%. The sales manager’s proposal should be rejected.

Solutions Manual

5-43

Chapter 5

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 5-9A*

Oct. 1

5

8

10