Budget Planning, Implementation and Monitoring Chris Droussiotis – Corporate Approach

advertisement

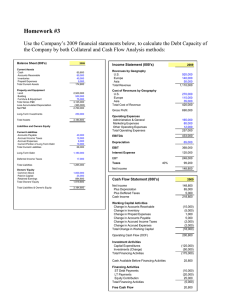

Lecture Series #2 Budget Planning, Implementation and Monitoring Second Step: Building the Projections – Corporate Approach Chris Droussiotis September 2011 Table of Contents Top to Bottom / Bottom to Top Line (Government Approach) Revenue Growth & Operating Assumptions Striving for Cash Flow / Profit Performance measurements These slides could be obtain via the Instructor’s Web page at www.celeritymoment.com 2 Top to Bottom Line Drivers Revenue Drivers – Growth Assumptions (increase/decrease) – “Volume” concept – 3 “Same Store Sales” “Acquisitions / “New Stores” “Price” concept Historical averages Future assumptions / views Demand and Supply: Volume Vs Price Market Conditions / Pass-through concepts Revenue Segments (subsidiaries, product/services, geographical, departments) Top to Bottom Line Drivers Cost / Expense Drivers – Direct Expenses / Gross Profit Cost of Revenue as % of Revenue – – Cost per Unit / Hourly Wages Indirect Expenses / EBIT or EBITDA Margins Operating Assumptions as % of Revenues – – – – 4 Selling / General / Administrative Utility Expenses Depreciation Expenses (% of Revenue / Based on Assets and Average Life) Interest Expense – Material / Labor / Overhead New or Existing Debt Taxes / Tax Rate Bottom to Top Line Approach Cost Drives Revenue – – Gross Margin / Operating Margin EBITDA / Net Income REVENUE Price 5 Operating Assumptions / Drivers Ratio Analysis / Assumptions 6 123 124 125 126 127 Trend Analysis Ratios Revenue Growth - USA Revenue Growth - Europe Revenue Growth - Asia Revenue Growth 129 130 131 132 133 Liquidity Ratios Current Ratio Quick ratio Accounts Receivable Turnover (ART) Accounts Receivable Days 135 136 137 138 139 140 141 142 Solvency Ratios Debt/Equity Ratio LTD / Total Capitalization EBITDA / Interest (Coverage Ratio) EBIT / Interest Fixed Charge Coverage Ratio Cash Avail.for Debt Service / Debt Svce LTD / EBITDA (Leverage Ratio) 2009 2010 2011 2012 2013 2014 2015 15.0% 16.7% 25.0% 15.6% 5.0% 5.0% 10.0% 5.0% 5.0% 10.0% 5.0% 5.0% 10.0% 5.0% 5.0% 10.0% 5.0% 5.0% 10.0% 1.75x 1.23x 2.56x 1.91x 21.14x 17.26 3.53x 2.82x 21.14x 17.26 4.04x 3.32x 21.14x 17.26 4.38x 3.66x 21.14x 17.26 4.60x 3.88x 21.14x 17.26 4.74x 4.02x 21.14x 17.26 68.7% 40.7% 2.96x 2.50x 61.5% 38.1% 3.61x 3.07x 1.72x 0.97x 2.73x 54.3% 35.2% 3.84x 3.26x 1.81x 1.26x 2.48x 47.0% 32.0% 4.25x 3.61x 1.86x 1.21x 2.22x 39.6% 28.4% 4.75x 4.04x 1.82x 1.16x 1.93x 32.3% 24.4% 5.46x 4.63x 1.81x 1.12x 1.63x 25.3% 20.2% 6.47x 5.49x 1.82x 1.10x 1.32x 3.12x Operating Assumptions / Drivers Ratio Analysis / Assumptions 7 144 145 146 147 148 Activity Ratios / Operating Ratios Inventory Ratio (IR) Inventory Ratio - Days Fixed Asset Turnover Ratio Asset Turnover Ratio 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 Profitability Ratios Gross Margin EBITDA Margin EBIT Margin Return on Assets (ROA) Gross Return on Assets Return on Equity (ROE) Operating Assumptions Cost of Revenues % of Revenues U.S. Europe Asia Operating Expense % of Revenues Administrative & General Marketing Expenses Other Operating Expenses Depreciation Expense % of Revenues Tax Rate 2009 2010 2011 2012 2013 2014 2015 12.92x 28.24 0.407x 0.36x 12.92x 28.24 0.418x 0.36x 12.92x 28.24 0.430x 0.37x 12.92x 28.24 0.442x 0.37x 12.92x 28.24 0.454x 0.38x 12.92x 28.24 0.467x 0.39x 64.1% 40.1% 33.9% 62.2% 39.0% 33.2% 4.8% 11.8% 8.1% 62.1% 38.9% 33.1% 5.0% 11.9% 8.0% 62.0% 38.9% 33.0% 5.3% 12.1% 8.1% 61.9% 38.8% 32.9% 5.6% 12.3% 8.2% 61.9% 38.7% 32.9% 5.9% 12.6% 8.2% 61.8% 38.6% 32.8% 6.3% 12.8% 8.3% 27.5% 83.3% 62.5% 29.3% 82.1% 70.0% 29.3% 82.1% 70.0% 29.3% 82.1% 70.0% 29.3% 82.1% 70.0% 29.3% 82.1% 70.0% 29.3% 82.1% 70.0% 15.1% 7.8% 1.0% 6.3% 14.9% 7.2% 1.1% 5.9% 14.9% 7.2% 1.1% 5.9% 40% 14.9% 7.2% 1.1% 5.9% 40% 14.9% 7.2% 1.1% 5.9% 40% 14.9% 7.2% 1.1% 5.9% 40% 14.9% 7.2% 1.1% 5.9% 40% Operating Assumptions / Drivers Ratio Analysis / Assumptions 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 8 2009 2010 2011 2012 2013 2014 2015 Cash Flow Statement Assumptions as % of Revenues Prepaid Expenses 1.0% Accrued Income Taxes 1.3% Accounts Payable 3.6% Accrued Income Taxes 1.3% Accrued Expenses 1.0% Capital Expenditures Deferred Income Taxes 1.3% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 0.8% 0.9% 3.6% 0.9% 0.7% 11.3% 1.5% 10,000 (10,000) 1,180,000 (20,000) 1,190,000 (10,000) 1,130,000 (50,000) 1,130,000 118,506 10.0% 1,060,000 (70,000) 1,060,000 112,531 10.0% 970,000 (90,000) 970,000 105,560 10.0% 860,000 (110,000) 860,000 96,598 10.0% 730,000 (130,000) 730,000 85,643 10.0% 178,506 182,531 195,560 206,598 215,643 Debt Assumptions Short-term Outstanding Debt Principal Payments - Short-Term Long-term Outstanding Debt Principal Payments - LongTerm Total Outstanding Interest Payments Average Interest Rate 20,000 1,200,000 1,220,000 Total Interest + Principal payments (Debt Service) Results Historical Income Statement (000's) 9 2009 Projections 2010 2011 2012 2013 2014 2015 50 51 52 53 54 55 56 57 58 59 60 Revenues by Geography U.S. Europe Asia Total Revenue 800,000 120,000 40,000 960,000 920,000 140,000 50,000 1,110,000 966,000 147,000 55,000 1,168,000 1,014,300 154,350 60,500 1,229,150 1,065,015 162,068 66,550 1,293,633 1,118,266 170,171 73,205 1,361,642 1,174,179 178,679 80,526 1,433,384 Cost of Revenues by Geography U.S. Europe Asia Total Cost of Revenue 220,000 100,000 25,000 345,000 270,000 115,000 35,000 420,000 283,500 120,750 38,500 442,750 297,675 126,788 42,350 466,813 312,559 133,127 46,585 492,271 328,187 139,783 51,244 519,213 344,596 146,772 56,368 547,736 62 63 64 65 66 67 68 69 70 Gross Profit 615,000 690,000 725,250 762,338 801,362 842,428 885,648 Operating Expenses Administrative & General Marketing Expenses Other Operating Expenses Total Operating Expenses 145,000 75,000 10,000 230,000 165,000 80,000 12,000 257,000 173,622 84,180 12,627 270,429 182,711 88,587 13,288 284,587 192,297 93,235 13,985 299,517 202,406 98,136 14,720 315,263 213,071 103,307 15,496 331,874 EBITDA 385,000 433,000 454,821 477,751 501,845 527,165 553,774 72 Depreciation 60,000 65,000 68,396 71,977 75,753 79,736 83,937 74 EBIT 325,000 368,000 386,425 405,773 426,092 447,429 469,837 76 Interest Expense 130,000 120,000 118,506 112,531 105,560 96,598 85,643 78 EBT 195,000 248,000 267,919 293,242 320,532 350,832 384,194 80 81 82 Taxes 78,000 99,200 107,167 117,297 128,213 140,333 153,678 117,000 148,800 160,751 175,945 192,319 210,499 230,516 Net Income Results Historical Cash Flow Statement (000's) 86 87 88 89 10 Projections 2010 2011 (15,000) (5,000) 1,000 5,000 (2,000) (2,000) (18,000) Operating Cash Flow (OCF) 200,800 238,093 246,804 266,887 288,977 313,119 102 103 104 105 106 107 Investment Activities Capital Expenditures Investments (Change) Total Financing Activities (125,000) (50,000) (175,000) (131,532) (131,532) (138,418) (138,418) (145,679) (145,679) (153,338) (153,338) (161,417) (161,417) 25,800 106,561 108,386 121,207 135,639 151,702 109 110 111 112 113 Financing Activities ST Debt Payments LT Payments Equity Contribution / (Dividend) Total Financing Activities (10,000) (20,000) 24,200 (5,800) (10,000) (50,000) (60,000) (70,000) (70,000) (90,000) (90,000) (110,000) (110,000) (130,000) (130,000) 115 Free Cash Flow 20,000 46,561 38,386 31,207 25,639 21,702 117 Beginning Cash 50,000 70,000 116,561 154,947 186,155 211,794 119 Ending Cash 70,000 116,561 154,947 186,155 211,794 233,496 (3,050) (1,970) (523) 2,324 581 465 (2,173) 210,499 79,736 1,042 291,277 2015 Working Capital Activities Change in Accounts Receivable Change in Inventory Change in Prepaid Expenses Change in Accounts Payable Change in Accrued Income Taxes Change in Accrued Expenses Total Change in Working Capital (2,892) (1,862) (496) 2,204 551 441 (2,055) 192,319 75,753 988 269,060 2014 91 92 93 94 95 96 97 98 99 100 4,757 740 (470) 2,090 523 418 8,057 175,945 71,977 937 248,859 2013 148,800 65,000 5,000 218,800 Cash Available Before Financing Activities 160,751 68,396 888 230,036 2012 Net Income Plus Depreciation Plus Deffered Taxes Cash Income (3,217) (2,085) (551) 2,451 613 490 (2,299) 230,516 83,937 1,099 315,552 (3,393) (2,207) (582) 2,585 646 517 (2,433) Results Historical Balance Sheet (000's) Current Assets Cash Accounts Receivable Inventories Prepaid Expenses Total Current Assets Property and Equipment Land Building Furniture & Equipment Total Gross P&E Less Accumulated Depreciaition Net P&E Long-Term Investments 2009 Projections 2010 2011 2012 2013 2014 2015 50,000 45,000 30,000 10,000 135,000 70,000 60,000 35,000 9,000 174,000 116,561 55,243 34,260 9,470 215,535 154,947 58,135 36,122 9,966 259,171 186,155 61,185 38,092 10,489 295,921 211,794 64,402 40,177 11,040 327,413 233,496 67,795 42,384 11,622 355,297 2,500,000 450,000 50,000 3,000,000 (300,000) 2,700,000 2,500,000 550,000 75,000 3,125,000 (365,000) 2,760,000 3,256,532 (433,396) 2,823,135 3,394,949 (505,374) 2,889,576 3,540,629 (581,127) 2,959,502 3,693,967 (660,863) 3,033,104 3,855,384 (744,800) 3,110,584 200,000 250,000 250,000 250,000 250,000 250,000 250,000 3,035,000 3,184,000 3,288,670 3,398,747 3,505,423 3,610,517 3,715,881 35,000 12,000 10,000 20,000 77,000 40,000 10,000 8,000 10,000 68,000 42,090 10,523 8,418 61,031 44,294 11,073 8,859 64,226 46,617 11,654 9,323 67,595 49,068 12,267 9,814 71,149 51,653 12,913 10,331 74,898 1,200,000 1,180,000 1,130,000 1,060,000 970,000 860,000 730,000 12,000 17,000 17,888 18,825 19,812 20,854 21,953 Total Liabilties 1,289,000 1,265,000 1,208,919 1,143,051 1,057,408 952,003 826,850 Owners' Equity Common Stock Paid-in-Capital Retained Earnings Total Owners' Equity 1,000,000 746,000 1,746,000 1,000,000 24,200 894,800 1,919,000 1,000,000 24,200 1,055,551 2,079,751 1,000,000 24,200 1,231,496 2,255,696 1,000,000 24,200 1,423,815 2,448,015 1,000,000 24,200 1,634,315 2,658,515 1,000,000 24,200 1,864,831 2,889,031 Total Liabilities & Owner's Equity 3,035,000 3,184,000 3,288,670 3,398,747 3,505,423 3,610,517 3,715,881 Total Assets Liabilities and Owners Equity Current Liabilities Accounts Payable Accrued Income Taxes Accrued Expenses Current Portion of Long Term Debt Total Current Liabilities Long-Term Debt: Deferred Income Taxes 11 Performance Measurements 12 Quick & Dirty Cash Flow 2012 % of Rev 192 193 194 195 Revenues Less Cost of Revenue Less Operating Expenses EBITDA 1,229,150 (466,813) (284,587) 477,751 100.0% -38.0% -23.2% 38.9% 197 198 199 200 201 Less Interest Less Cash Taxes Less Working Capital Less Capex Cash Flow Available for Debt Service (112,531) (116,360) (2,055) (138,418) 108,386 -9.2% -9.5% -0.2% -11.3% 8.8% 203 204 Less Principal Payments Free Cash Flow (70,000) 38,386 -5.7% 3.1% Performance Measurements Solvency Ratios – Managing Debt – – Profitability Ratios – – – Cost efficiencies / Cost Rationalization Revenue Drivers / Acquisition Growth Rationale Striving for Higher Margin Business Activity Ratios – – 13 Leverage Ratio / Debt Capacity Coverage Ratio / Adequate coverage of Obligations Inventory Management Working Capital Management