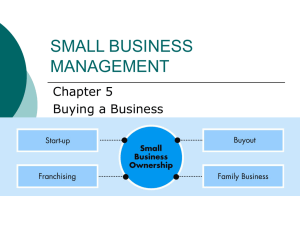

SMALL BUSINESS MANAGEMENT Chapter Five Buying a Business

advertisement

SMALL BUSINESS MANAGEMENT Chapter Five Buying a Business 1 Purchasing an Existing Business Advantages – – – – – – of Purchasing Reduction of Risk Reduction of Time and Setup Expenses Reduction of Competition Capitalization of Business Strength Possible Assistance from Previous Owner Easier Planning 2 Purchasing an Existing Business Disadvantages – – – – – – – of Purchasing Physical Facilities Personnel Inventory Accounts Receivable Financial Condition Market Deciding on the Price 3 Sources of Businesses for Sale Classified Ads Government Departments Trade Journals Real Estate Brokers Other Professionals Word of Mouth 4 Evaluating a Business For Sale Industry Analysis – Sales and Profit Trends in the Industry The Previous Owner Financial Condition of the Business – Validity of the Financial Statements – Evaluation of the Financial Statements 5 Evaluating a Business For Sale Condition – – – – – – of the Assets Liquid Assets (Cash and Investments) Accounts Receivable Inventory Building and Equipment Real Estate Goodwill 6 Evaluating a Business For Sale Quality of Personnel External Relationships of the Business Conditions of the Records 7 Determining the Price or Value of a Business Market Value Asset value – Book Value – Replacement Value Earnings Value – Capitalization of Earnings Method – Times Earnings Method Combination Method 8 The Purchase Transaction Coverage – – – – – purchase price, including principal and interest amounts Payment dates - when and to whom Detailed list of assets included in the purchase Conditions of the Purchase - nonfinancial requirements Provisions for noncompliance with conditions and penalties for breaches – Collateral or security pledged Negotiating the Deal 9 Appendix A Checklist of Considerations in Purchasing a Business – – – – – – – The Industry The Previous Owner Financial Conditions of the Business Condition of Assets Quality of Personnel Conditions of External Relationships Conditions of Records 10 Concept Checks 1. What are the potential advantages and disadvantages of owning a small business? 2. What are the common sources of determining which businesses are for sale? 3. In addition to experience what key areas should be investigated in an industry analysis? 11 Concept Checks 4. Why is it important to investigate the background of the previous owner? 5. What parts of the business should be analysed to determine the financial condition of the business? 6. Under what conditions would it be advantageous to purchase a business even though it isn’t financially sound? 12 Concept Checks 7. What nonfinancial aspects of the business should be evaluated ? 8. What methods are available in determining a price for a business which is for sale? 13 Concept Checks 9. What steps are involved in determining the selling price using the combination method? 10. What areas should be included in the purchase agreement? 14