Economics

advertisement

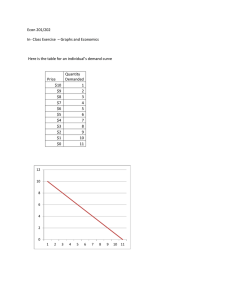

A Definition of Economics • Economics is the study of how individuals and societies choose to use the scarce resources that nature and previous generations have provided. Another Definition of Economics • Economics is the study of how scarce resources are allocated among conflicting demands. 1. To Learn a Way of Thinking... • Three Fundamental Concepts of Economic Thinking – Opportunity Cost – Marginalism – Information, Incentives, and Market Coordinations Opportunity Costs • The opportunity cost of something is that which we give up when we make that choice or decision. • The implication is that all decisions involve trade-offs. • “There’s no such thing as a free lunch!!” •Margins and Incentives –People make choices at the margin, which means that they evaluate the consequences of making incremental changes in the use of their resources. –The benefit from pursuing an incremental increase in an activity is its marginal benefit. –The opportunity cost of pursuing an incremental increase in an activity is its marginal cost. 1-5 Production Possibilities and Opportunity Cost –The production possibilities frontier (PPF) is the boundary between those combinations of goods and services that can be produced and those that cannot. –To illustrate the PPF, we focus on two goods at a time and hold the quantities of all other goods and services constant. –That is, we look at a model economy in which everything remains the same (ceteris paribus) except the two goods we’re considering. 2-6 Production Possibilities and Opportunity Cost •Production Efficiency –We achieve production efficiency if we cannot produce more of one good without producing less of some other good. –Points on the frontier are efficient. 2-7 Using Resources Efficiently –All the points along the PPF are efficient. –To determine which of the alternative efficient quantities to produce, we compare costs and benefits. •The PPF and Marginal Cost –The PPF determines opportunity cost. –The marginal cost of a good or service is the opportunity cost of producing one more unit of it. 2-8 Using Resources Efficiently •Preferences and Marginal Benefit –Preferences are a description of a person’s likes and dislikes. –To describe preferences, economists use the concepts of marginal benefit and the marginal benefit curve. –The marginal benefit of a good or service is the benefit received from consuming one more unit of it. –We measure marginal benefit by the amount that a person is willing to pay for an additional unit of a good or service. 2-9 Using Resources Efficiently –It is a general principle that the more we have of any good or service, the smaller its marginal benefit and the less we are willing to pay for an additional unit of it. –We call this general principle the principle of decreasing marginal benefit. –The marginal benefit curve shows the relationship between the marginal benefit of a good and the quantity of that good consumed. 2-10 Determinants of Household Demand: • The price of the product in question • The income available to the household • The households amount of accumulated wealth • The prices of other products available • Tastes and preferences • Expectations about future income, wealth, and prices Changes in Quantity Demanded vs. Changes in Demand • Changes in the price of a product affect the quantity demanded per period. Changes in any other factor, such as income or preferences, affect demand. An increase in income, for instance, tends to increase demand. While a drop in prices will increase the quantity demanded. The Law of Demand • The negative relationship between price and quantity demanded. As price rises, quantity demanded decreases. As price falls, quantity demanded increases • This is why we observe a negative slope in demand curves. Demand • Substitution Effect • When the relative price (opportunity cost) of a good or service rises, people seek substitutes for it, so the quantity demanded decreases. • Income Effect • When the price of a good or service rises relative to income, people cannot afford all the things they previously bought, so the quantity demanded decreases. 3-14 Substitution Effect of a Price Change • The substitution effect of a price change is a change in consumption of a good or service that results from holding well-being unchanged. • When the price of a product falls, that product becomes more attractive relative to potential substitutes. • When the price of a product rises, that product becomes less attractive relative to potential substitutes. Income Effect of a Price Change • The income effect of a price change is a change in consumption of a good or service that results from a change in well-being, other things being equal. • When the price of a product falls, a consumer has more purchasing power with the same amount of income and is better off. • When the price of a product rises, a consumer has less purchasing power with the same amount of income and is worse off. Income as a Determinant of Demand • Normal Goods: Goods for which demand goes up when income is higher and for which demand goes down when income is lower. • Inferior Goods: Goods for which demand falls when income rises. Prices of Other Goods and Services as Determinants of Demand • Substitutes: Goods that can serve as replacements for one another; when the price of one increases, demand for the other goes up. – Perfect substitutes are identical products. • Complements: Goods that “go together”; when the price of one increases, demand for the other goes down, and vice versa. Other Determinants of Household Demand: • Tastes and Preferences - These are quite subjective and tend to change over time. • Expectations - With respect to future income, wealth, prices, and availability. Anna’s Demand for Telephone Calls -A Change in Quantity Demanded Price • The graph shows a shift in quantity demanded from 3 to 7 caused by a change in price from $7.50 to $3.50. $15.00 $10.00 $7.50 $3.50 $ .50 01 3 7 25 30 Quantity demanded Anna’s Demand for Telephone Calls - A Change in Demand $15.00 $10.00 $7.50 $3.50 $ .50 01 3 7 • When any factor except price changes the relationship between price and quantity is D2 different; there is a shift of the D1 demand curve, in 25 30 this case from D1 to D . Changes in Demand: Prices of Related Goods P Price of hamburger rises P P Q D2 Demand for complement good (ketchup) shifts left D1 Q Quantity of hamburger demanded falls D1 D2 Demand for substitute good (chicken) shifts right Q Market Demand Defined • Market demand may be defined as the sum of all the quantities of a good or service demanded per period by all the households buying in the market for that good or service. Deriving market demand from the individual demand curves: P P $3.50 DA $1.50 0 P $3.50 DB $1.50 4 8 Qd DC $3.50 $1.50 0 3 Price Qd 0 4 9 Market Demand $3.50 $1.50 0 8 20 Qd Qd Supply • A firm’s decision about what quantity of product to supply depends on: – The price of the good or service – The cost of producing the product which depends on: • The price of required inputs (land, labour, capital) • The technologies to be used to produce the product – The prices of related products The Law of Supply • The positive relationship between price and quantity of a good supplied. An increase in market price will lead to an increase in quantity supplied, and a decrease in market price will lead to a decrease in quantity supplied. Changes in Quantity Supplied vs. Changes in Supply: • Changes in quantity supplied imply movement along a supply curve. • Changes in supply imply a shift in the entire supply curve. Market Supply • The sum of all the quantities of a good or service supplied per period by all the firms selling in the market for that good or service. • As with market demand, market supply is the horizontal summation of the individual firms’ supply curves. From Individual Firm to Market Supply Market Equilibrium • The operation of the market depends on the interaction between suppliers and demanders. • An equilibrium is the condition that exists when quantity supplied and quantity demanded are equal. • At equilibrium, there is no tendency for the price to change. Excess Demand • Excess Demand is the condition that exists when quantity demanded exceeds quantity supplied at the current price. Excess Demand • At $85 per tonne quantity demanded exceeds quantity supplied by 2500 tonnes. • Excess demand tends to lead to an increase in prices. Excess Supply • Excess supply is the condition that exists when quantity supplied exceeds quantity demanded at the current price. Excess Supply • At $150, quantity supplied exceeds the quantity demanded by 2000 tonnes. • This causes prices to fall Price Elasticity of Demand • The price elasticity of demand is the ratio of the percentage change in quantity demanded to the percentage change in price. • Price Elasticity of Demand = % change in quantity demanded % change in price Perfectly Inelastic Demand • Perfectly inelastic demand is demand in which quantity demanded does not respond at all to a change in price. • An example could be the demand for insulin. Inelastic Demand • Inelastic demand is demand that responds somewhat, but not a great deal, to changes in price. Inelastic demand always has a numerical value between zero minus one. • An example would be the demand for housing or telephone service. Unitary Elasticity • Unitary elasticity is a demand relationship in which the percentage change in quantity of a product demanded is the same as the percentage change in price. • The elasticity is always equal to minus one. Elastic Demand • Elastic demand is a demand relationship in which the percentage change in quantity demanded is larger in absolute value than the percentage change in price. • The demand elasticity has an absolute value greater than one. • An example could be the demand for bananas or any other product for which there are close substitutes. Perfectly Elastic Demand • Perfectly elastic demand is demand in which quantity demanded drops to zero at the slightest increase in price. • An example could be the demand for wheat on the world market, or any other good that can only be sold at a predetermined price. Demand Curves and Elasticity P P Perfectly elastic P D D Q Q Relatively elastic D P D Q Perfectly inelastic Relatively inelastic Q Elasticity and Total Revenue • Effect of a price increase on a product with inelastic demand: P x Qd = TR • Effect of a price increase on a product with elastic demand: P x Qd = TR • Effect of a price cut on a product with elastic demand: P x Qd = TR • Effect of price cut on a product with inelastic demand: P x Qd = TR Relationship Between Elasticity and Total Revenue Determinants of Demand Elasticity • Availability of substitutes – When substitutes are not readily available, demand is likely to be less elastic. • The importance of being unimportant – When an item represents a small proportion of our total budget, demand is likely to be less elastic. • The time dimension – In the longer run, demand is likely to become more elastic, or responsive, because households make adjustments over time. Other Important Elasticities • Income elasticity of demand – Measures the responsiveness of demand with respect to changes in income • Cross-price elasticity of demand – A measure of the response of the quantity of one good demanded to a change in the price of another good Other Important Elasticities (cont.) • Elasticity of supply – A measure of the response of the quantity of a good supplied to a change in the price of that good. Likely to be positive in output markets • Elasticity of labour supply – A measure of the response of labour supplied to a change in the price of labour. Can be negative or positive Efficiency: A Refresher –An efficient allocation of resources occurs when we produce the goods and services that people value most highly. –Resources are allocated efficiently when it is not possible to produce more of a good or service without giving up some other good or service that is valued more highly. –Efficiency is based on value, which is determined by people’s preferences. 5-47 Efficiency: A Refresher •Marginal Benefit –Marginal benefit is the benefit a person receives from consuming one more unit of a good or service. –We can measure the marginal benefit from a good or service by the dollar value of other goods and services that a person is willing to give up to get one more unit of it. –The marginal benefit from a good or service decreases as more of that good or service is consumed—the principle of decreasing marginal 5-48 benefit. Efficiency: A Refresher •Marginal Cost –Marginal cost is the opportunity cost of producing one more unit of a good or service. The measure of marginal cost is the value of the best alternative forgone to obtain the last unit of the good. –We can measure the marginal cost of a good or service by the dollar value of other goods and services that a person is must give up to get one more unit of it. –The marginal cost of a good or service increases as more of that good or service is produced—the principle of increasing marginal cost. 5-49 Efficiency: A Refresher •Efficiency and Inefficiency –If the marginal benefit from a good exceeds its marginal cost, producing and consuming more of the good uses resources more efficiently. 5-50 Value, Price, and Consumer Surplus •Value, Willingness to Pay, and Demand –The value of one more unit of a good or service is its marginal benefit, which we can measure as maximum price that a person is willing to pay. –A demand curve for a good or service shows the quantity demanded at each price. –A demand curve also shows the maximum price that consumers are willing to pay at each quantity. 5-51 Value, Price, and Consumer Surplus •Consumer Surplus –Consumer surplus is the value of a good minus the price paid for it, summed over the quantity bought. –It is measured by the area under the demand curve and above the price paid, up to the quantity bought. –Figure 5.3 on the next slide shows the consumer surplus for pizza for an individual consumer. 5-52 Value, Price, and Consumer Surplus –The price paid is the market price, which is the same for each unit bought. –The quantity bought is determined by the demand curve, and the blue rectangle shows the amount paidtriangle for pizza. –The green shows the consumer surplus from pizza. 5-53 Cost, Price, and Producer Surplus •Cost, Minimum Supply-Price, and Supply –The cost of one more unit of a good or service is its marginal cost, which we can measure as minimum price that a firm is willing to accept. –A supply curve of a good or service shows the quantity supplied at each price. A supply curve also shows the minimum price that producers are willing to accept at each quantity. 5-54 Cost, Price, and Producer Surplus •Producer Surplus –Producer surplus is the price of a good minus the marginal cost of producing it, summed over the quantity sold. –Producer surplus is measured by the area below the price and above the supply curve, up to the quantity sold. –Figure 5.5 on the next slide shows the producer surplus for pizza for an individual producer. 5-55 Cost, Price, and Producer Surplus –The price is the market price, which is the same for each unit sold. –The quantity sold is determined by the supply curve, and the red area shows the total cost of producing pizza. –The blue triangle shows the producer surplus from pizza. 5-56 Is the Competitive Market Efficient? •Efficiency of Competitive Equilibrium –Figure 5.6 shows that a competitive market creates an efficient allocation of resources at equilibrium. –In equilibrium, the quantity demanded equals the quantity supplied. 5-57 Is the Competitive Market Efficient? –At the equilibrium quantity, marginal benefit equals marginal cost, so the quantity is the efficient quantity. –The sum of consumer and producer surplus is maximized at this efficient level of output. 5-58 Is the Competitive Market Efficient? •Obstacles to Efficiency – Markets are not always efficient. Obstacles to efficiency are: – Price ceilings and floors – Taxes, subsidies, and quotas – Monopoly – Public goods – External costs and external benefits 5-59