Chapter 2

advertisement

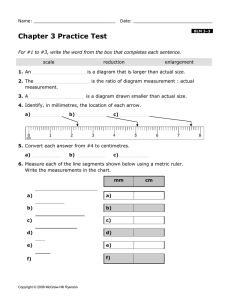

T2.1 Chapter Outline Chapter 2 Financial Statements, Taxes, and Cash Flow Chapter Organization 2.1 The Balance Sheet 2.2 The Income Statement 2.3 Cash Flow 2.4 Taxes 2.5 Capital Cost Allowance 2.6 Summary and Conclusions CLICK MOUSE OR HIT SPACEBAR TO ADVANCE copyright © 2002 McGraw-Hill Ryerson,Ltd. T2.2 The Balance Sheet (Figure 2.1) copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 2 T2.2 The Balance Sheet Components Assets (Current & Long-Term) Liabilities (Current & Long-Term) Owners Equity Key concepts Liquidity Net Working Capital • Current Assets minus Current Liabilities Debt vs. Equity Market vs. Book Value copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 3 Debt v.s. Equity Generally, when a firm borrows it gives the bondholder first claim on the firm’s cash flow and assets....equity holders receive the residual value or whatever is left after the creditors are paid. Thus, shareholders equity is the residual difference between assets and liabilities. The use of debt financing is called financial leverage - debt financing can magnify returns (gains and losses) to shareholders or equity holders increases the potential return also increases the risk factor copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 4 Market Value vs Book Notes Balance sheet values are book values GAAP requires assets to be shown at historical cost current asset book values can be very close to market value fixed assets can and often have major differences between historical cost and market value GAAP Accounting principles of objectivity and conservatism are the drivers behind historical cost. • No argument about historical cost and because book is usually less than mkt. - they are also conservative( if mkt values fall along way below book - assets will be written down - good examples of this are the recent writedowns of assets by the likes of Nortel Cisco and many other high tech. firms copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 5 T2.3 Income Statement Components Revenues Expenses • Cash and non-cash • Operating and non-operating Net Income Earnings per share Dividends 3 important concepts for Finance GAAP & Accrual Accounting & Matching Non-cash items Time and Costs copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 6 Cash Flow Key concept in the study of Corporate Finance liquidity is about turning assets into cash investment analysis and capital budgeting is about discounted cash flows valuation of securities is about future discounted cash flow at some rate of discount e.g bonds - future interest payments and principle repayments discounted back at a certain rate copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 7 T2.4 Cash Flow Cash flows are essential to valuation In Finance, one of the main concern is the timing of cash flows. (another being the discount rate) Since the income statement includes non-cash items, we will have to adjust it to get information on cash flows Balance sheet activity plays an important role in the determination of the cash balance (e.g.) Collections on accounts receivable Borrowing on accounts payable Work with reported financial statements to determine historical cash flow. copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 8 Cash Flow Cash flow from an historical perspective - calculated from financial statements - our focus in this chapter how to calculate projected cash flow - look at in later chapters as we move into the question of valuation of investments and securities copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 9 T2.4 GAAP versus Cash Flow Time Line Revenue recognized and matched expenses Sale of goods on credit Time Pay for raw goods Payroll checks issued Pay utilities Collect accounts receivable Cash flow Cash flow Cash flow Cash flow copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 10 T2.5 Cash Flow Example Balance Sheet Beg End Beg End $100 $150 A/P $100 $150 A/R 200 250 N/P 200 200 Inv 300 300 C/L 300 350 C/A $600 $700 LTD $400 $420 NFA 400 500 C/S 50 60 R/E 250 370 $300 $430 $1000 $1200 Cash Total $1000 $1200 Total copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 11 T2.5 Cash Flow Example (continued) Income Statement Sales $2000 Costs 1400 Depreciation 100 EBIT 500 Interest 100 Taxable Income 400 Taxes 200 Net Income Dividends Addition to R/E $200 $_____ _____ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 12 T2.5 Cash Flow Example (continued) Income Statement Sales $2000 Costs 1400 Depreciation 100 EBIT 500 Interest 100 Taxable Income 400 Taxes 200 Net Income Dividends Addition to R/E $200 80 $120 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 13 T2.5 Cash Flow Example (concluded) A. Cash flow from assets 1. Operating cash flow = = = EBIT + _____________ – Taxes $500 + 100 – 200 $_____ 2. Change in NWC = = = ___________ – ___________ $350 – $_____ $_____ 3. Net capital spending = = = $_____ + Dep – _____ $500 + 100 – 400 $_____ 4. Cash flow from assets = = = OCF – chg. NWC – Cap. sp. $400 – 50 – 200 $150 B. Cash flow to creditors and stockholders 1. Cash flow to creditors = = = Int. paid – _________________ $100 – 20 $80 2. Cash flow to stockholders = = = Div. paid – ________________ $80 – 10 $70 Check: $___ from assets = $___ to Bondholders + $___ to Stockholders copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 14 T2.5 Cash Flow Example (concluded) A. Cash flow from assets 1. Operating cash flow = = = EBIT + Depreciation – Taxes $500 + 100 – 200 $400 2. Change in NWC = = = Ending NWC – Beginning NWC $350 – 300 $50 3. Net capital spending = = = Ending NFA + Dep – Beginning NFA $500 + 100 – 400 $200 4. Cash flow from assets = OCF – chg. NWC – Cap. sp. = $400 – 50 – 200 = $150 B. Cash flow to creditors and stockholders 1. Cash flow to creditors = = = Int. paid – Net new Borrowing $100 – 20 $80 2. Cash flow to stockholders = = = Div. paid – Net new Equity $80 – 10 $70 Check: $150 from assets = $80 to bondholders + $70 to stockholders copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 15 T2.6 Cash Flow Summary I. The cash flow identity Cash flow from assets = Cash flow to creditors (bondholders) + Cash flow to stockholders (owners) This is based upon the balance sheet identity: Assets = Liabilities + Equity The equivalent cash flow statement is: cash flow to creditors Cash flow from assets = + cash flow to stockholders copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 16 T2.6 Cash Flow Summary (cont’d) II. Cash flow from assets Cash flow from assets = Operating cash flow – Net capital spending – Additions to net working capital (NWC) where Operating cash flow = Earnings before interest and taxes (EBIT) + Depreciation – Taxes Net capital spending = Ending net fixed assets – Beginning net fixed assets + Depreciation Change in NWC = Ending NWC – Beginning NWC III.Cash flow to creditors Cash flow to creditors = Interest paid – Net new borrowing IV. Cash flow to stockholders Cash flow to stockholders = Dividends paid – Net new equity raised copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 17 Taxes - key concepts Earnings and cash flow are on an after tax basis - taxes represent real costs and cash requirements for firms Taxes can be a major factor in investment decisions including mergers and acquisitions. Tax ‘pools’ of the acquired company can be used in the new entity to shelter income - the value of these pools to the acquiring company needs to be established Financial management considerations - corporate taxation is a complex and specialized field.....good communication between tax experts and other financial staff is important as the after tax impact of business decisions needs to be established. copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 18 T2.7 Taxes Key issues: What is an average tax rate? What is a marginal tax rate? Why do we pay attention to marginal tax rates? What are corporate tax rates? What are individual tax rates? How does the difference between corporate and individual tax rates affect corporate finance? How do tax rates relate to the goal of corporate finance? copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 19 T2.7 Individual Tax Rates FEDERAL Taxable Income $ 1 Tax $ Rate on Excess -- 17% 32,000 5,440 24 64,000 13,120 29 Provincial generally applied as a % of the Basic Federal Tax Alberta - 44% copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 20 T2.7 Marginal versus Average Tax Rates copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 21 T2.7 Individual Tax Rates SELECTED PROVINCIAL (Table 2.5) Resident of Percentage of Basic Federal Tax Alberta 44% Newfoundland 62 Prince Edward Island 57.5 Saskatchewan 48 Northwest Territories 45 Yukon Territory 50 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 22 Taxes on Investment Income taxes on dividends and capital gains dividends two clear goals • avoidance of double taxation with corporations paying dividends from after tax income and full taxation in the hands of shareholders -> dividend tax credit • this tax shelter applies to dividends paid by Canadian Corporations thus encouraging Canadian investors to invest in Canadian firms Capital Gains rates are coming down with 50% of the gain now being taxed down from 75% tax deferral from only realized gains being taxed results in lower ‘effective tax’ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 23 T2.8 ILLUSTRATION OF DIVIDEND TAX CREDIT FOR ALBERTA RESIDENTS Marginal Tax Rate 17% Dividends Gross up at 25% Grossed up dividends Federal Tax on dividends 24% 29% $1,000 $1,000 $1,000 250 250 250 1250 1250 1250 212.50 300.00 362.50 Less Dividend Tax Credit (13.333% x $1,250) (166.67) (166.67) (166.67) Federal Tax Payable 45.83 133.33 195.83 Provincial Tax at 44% of Federal Tax 20.17 58.67 86.17 Total Tax 66.00 192.00 282.00 Effective Combined Tax Rates 6.6% 19.2% 28.2% NOTE: Marginal tax rates apply to incomes of less than 32,000 (17%), more than 32,000 but less than 64000 (25%), and more than 64,000 (29%) copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 24 T2.9 Corporate Tax Rates FEDERAL ONTARIO COMBINED Basic Corporations 27% 14.82% 42.12% Manufacturing and Processing 21 12.82 34.12 All Small Corporations 12 (Taxable Income below $200 thousand) 7.32 19.72 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 25 Taxable Income taxable income is different from net income net income needs to conform to GAAP taxable income is calculated according to tax rules established by the various taxing authorities e.g. book depreciation vs capital cost allowance • book depreciation attempting to match revenues earned from the use of a tangible depreciable asset with the costs associated with the asset • capital cost allowance - allowable deductions associated with various types of assets - patchwork of tax rules that often have stemmed from government budget and economic development objectives. Income is taxed differently across various industries with the ‘rules’ continually changing copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 26 Capital Cost Allowance Key concepts and terms: Classes of assets Asset purchases and sales • net acquisitions are used if multiple purchases • one half year rule applies to net acquisitions • sale - the balance in the pool is reduced by the lesser of sale price or original cost Termination of asset pool • terminal loss occurs when there is remaining UCC after the last asset disposal - this amount is fully tax deductible • recaptured CCA occurs with a negative UCC after the last asset disposal - this amount is fully taxable copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 27 T 2.10 Capital Cost Allowance - Depreciation for tax purposes Class Rate Assets 1 4% Buildings acquired after 1987 8 20% Furniture, photocopiers 10 30% Vans, trucks, tractors and computer equipment 13 Straight-line Leasehold improvements 16 40% Taxicabs and rental cars 22 50% Pollution control equipment 43 30% Manufacturing equipment copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 28 T2.11 CCA Example Depreciation on $22,000 Photocopier (CCA Class 8) Year UCC t CCA UCC t+1 1 11,000 2,200 $8,800 2 19,800 3,960 15,840 3 15,840 3,168 12,672 4 12,672 2,534 10,138 5 10,138 2,028 8,110 6 8,110 1,622 6,488 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 29 T2.12 Hermetic, Inc. Balance Sheet as of December 31 ($ in thousands) Assets 1998 1999 Current assets Cash $ 45 $ 50 Accounts receivable 260 310 Inventory 320 385 Total $ 625 $ 745 985 1100 $1610 $1845 Fixed assets Net plant and equipment Total assets copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 30 T2.12 Hermetic, Inc. Balance Sheet (concluded) Liabilities and equity 1998 1999 $ 210 110 $ 320 $ 260 175 $ 435 205 225 Stockholders’ equity Common stock and paid-in surplus Retained earnings Total 290 795 $1085 290 895 $1185 Total liabilities and equity $1610 $1845 Current liabilities Accounts payable Notes payable Total Long-term debt copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 31 T2.13 Hermetic, Inc. Income Statement ($ in thousands) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest Taxable income Taxes Net income Dividends Addition to retained earnings copyright © 2002 McGraw-Hill Ryerson, Ltd $710.00 480.00 30.00 $200.00 20.00 180.00 53.45 $126.55 26.55 $100.00 Slide 32 T2.14 Hermetic, Inc. Cash Flow from Assets Cash flow from assets: Operating cash flow: EBIT + Depreciation – Taxes Change in net working capital: Ending net working capital – Beginning net working capital Net capital spending: Ending net fixed assets – Beginning net fixed assets + Depreciation Cash flow from assets: copyright © 2002 McGraw-Hill Ryerson, Ltd $ 200.00 + 30.00 – 53.45 $ 176.55 $ 310.00 – 305.00 $ 5.00 $ 1,100.00 – 985.00 + 30.00 $ 145.00 $ 26.55 Slide 33 T2.14 Hermetic, Inc. Cash Flow from Assets (concluded) Total cash flow to creditors and stockholders: Cash flow to creditors: Interest paid $ – Net new borrowing 20.00 – 20.00 $ 0.00 $ 26.55 Cash flow to stockholders: Dividends paid – Net new equity raised Cash flow to creditors and stockholders copyright © 2002 McGraw-Hill Ryerson, Ltd 0.00 $ 26.55 $ 26.55 Slide 34 T2.15 Chapter 2 Quick Quiz The taxable income of Harrold Schwarz, an Ontario resident, is $63,000. Calculate Schwarz’s (a) dollar tax liability, (b) average tax rate, and (c) marginal tax rate. (a) Dollar tax liability = [Federal] [Ontario] .17(_______) + .24(_______) + .29(_______) + .0637(________) + .0962(________) +.1116(________) (b) Average tax rate = ________/__________ = ___ (c) Marginal tax rate = ___ Why should financial decision-makers be concerned about the firm’s marginal rate? Its average rate? copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 35 T2.15 Chapter 2 Quick Quiz The taxable income of Harrold Schwarz, an Ontario resident, is $63,000. Calculate Schwarz’s (a) dollar tax liability, (b) average tax rate, and (c) marginal tax rate. (a) Dollar tax liability = [Federal] [Ontario] .17(32,000) + .24(31,000) + .29(0) + .0637(30,004) + .0962(29,996) +.1116(3,000)=18,012 (b) Average tax rate = 18,012/63,000 = 28.6% (c) Marginal tax rate = 35.16% Why should financial decision-makers be concerned about the firm’s marginal rate? Its average rate? copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 36 T2.16 Solution to Problem 2.12 The December 31, 1999 balance sheet Pearl Jelly, Inc. showed long-term debt of $2 million, and the December 31, 2000 balance sheet showed long-term debt of $2.9 million. The 2000 income statement showed interest expense of $700,000. What was cash flow to creditors during 1999? Cash flow to creditors = Interest paid – Net new borrowing Interest paid = $700,000 Net new borrowing Cash flow to creditors = $_______ – 2 million = $_______ = $700,000 – (_______) = _______ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 37 T2.16 Solution to Problem 2.12 The December 31, 1999 balance sheet Pearl Jelly, Inc. showed long-term debt of $2 million, and the December 31, 2000 balance sheet showed long-term debt of $2.9 million. The 2000 income statement showed interest expense of $700,000. What was cash flow to creditors during 1999? Cash flow to creditors = Interest paid – Net new borrowing Interest paid = $700,000 Net new borrowing Cash flow to creditors = $2.9 million – 2 million = $900K = $700,000 – 900,000 = –$200,000 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 38 T2.17 Solution to Problem 2.13 The December 31, 1999 balance sheet Pearl Jelly, Inc. showed $500,000 in the common stock account, and $6.6 million in the additional paid-in surplus account. The December 31, 1999 balance sheet showed $550,000 and $7.0 million in the same two accounts. If the company paid out $300,000 in cash dividends during 2000, what was the cash flow to stockholders for the year? Cash flow to stockholders = Dividends paid – Net new equity Dividends paid = ________ Net new equity = (________+________) – ________ + ________) Cash flow to stockholders = ________– ________ = ________ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 39 T2.17 Solution to Problem 2.13 The December 31, 1999 balance sheet Pearl Jelly, Inc. showed $500,000 in the common stock account, and $6.6 million in the additional paid-in surplus account. The December 31, 1999 balance sheet showed $550,000 and $7.0 million in the same two accounts. If the company paid out $300,000 in cash dividends during 2000, what was the cash flow to stockholders for the year? Cash flow to stockholders = Dividends paid – Net new equity Dividends paid = $300,000 Net new equity = ($550,000 + 7m) – ($500,000 + 6.6m) = $450,000 Cash flow to stockholders = $300,000 – 450,000 = –$150,000 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 40 T2.18 Solution to Problem 2.14 Given the information for Pearl Jelly, Inc. in problems 12 and 13, suppose you also know that the firm’s net capital spending during 2000 was $500,000, and that the firm reduced its net working capital investment by $135,000. What was the firm’s 2000 operating cash flow, or OCF? Cash flow from assets (CFA) = Cash flow to creditors + Cash flow to stockholders Cash flow to creditors = – $200,000 Cash flow to stockholders = –$150,000 So, Cash flow from assets = –$200K + (–)150,000K = –$350K. And, CFA = OCF - chg. in NWC – capital spending Solving for OCF: OCF = CFA + chg. in NWC + capital spending OCF = _______ + _______+ _______ OCF = $ _______ copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 41 T2.18 Solution to Problem 2.14 Given the information for Pearl Jelly, Inc. in problems 12 and 13, suppose you also know that the firm’s net capital spending during 2000 was $500,000, and that the firm reduced its net working capital investment by $135,000. What was the firm’s 2000 operating cash flow, or OCF? Cash flow from assets (CFA) = Cash flow to creditors + Cash flow to stockholders Cash flow to creditors = – $200,000 Cash flow to stockholders = –$150,000 So, cash flow from assets = –$200K + (–)150,000K = –$350K. And, CFA = OCF – Chg. in NWC – Capital spending Solving for OCF: OCF = CFA + Chg. in NWC + Capital spending OCF = –$350K + (– 135,000) + 500,000 OCF = $15,000 copyright © 2002 McGraw-Hill Ryerson, Ltd Slide 42