ADMINISTERING YOUR GRANT AWARDS

advertisement

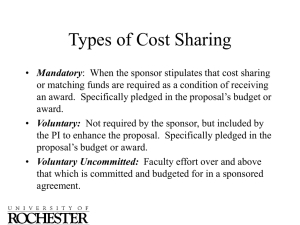

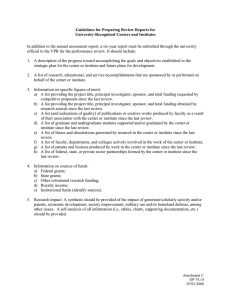

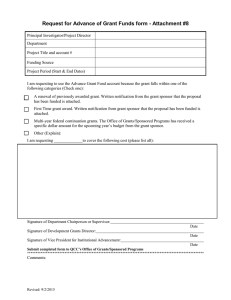

ADMINISTERING YOUR GRANT AWARDS OFFICE OF UNIVERSITY ADVANCEMENT OFFICE OF SPONSORED PROGRAMS THE BASICS 1) Who manages grants? 2) What is the difference between purchasing for grants vs. departmental purchasing? 3) Does grant management differ by sponsor or sponsor type? 4) Who do I contact with financial questions? • Kristy Carpenter WHAT IS GRANTS MANAGEMENT? • Effective grants management is a process of monitoring federal/state/private awards including project resources, activities, and results. • What is the purpose of Grant Management? • Accountability • Ensuring grant activities are in line with the scope of the project WHY DO WE HAVE TO MONITOR GRANTS? • Provides oversight as required by agency • What are they doing? • What are they planning to do? • What did they say they would do? WHEN DOES GRANT MANAGEMENT BEGIN? • When we receive the award letter • A fund # is created by Kristy after I receive paperwork from our Pre-Award staff • Your grant accountant will set up the budget for the year in Banner using a detailed budget form based on the sponsorapproved budget. If they do not have this info, they will contact you. • The PI is e-mailed with the fund number • How do I get myself and my staff access to the grant account? e-mail: finsecurity@rowan.edu UNDERSTANDING BUDGET SCREENS UNDERSTANDING BUDGET SCREENS UNDERSTANDING BUDGET SCREENS UNDERSTANDING BUDGET DETAIL UNDERSTANDING BUDGET DETAIL NEED TO KNOW WHO GOT PAID? Access for salary detail is not granted to Project Investigator (PI’s) and their staff *Call or e-mail Kristy for Salary Detail Reports PUTTING IT INTO EXCEL ALLOWABLE COSTS • Must advance project objectives • Are the costs incurred specifically for the award? • Costs cannot be shifted from another award • Costs must be in the sponsor-approved budget • Never: • • • • • Alcohol Contingency funds Lobbying costs Alumni Activity Goods/services for personal use • Differs per sponsor. If a sponsor agreement says “no” – this trumps Cost Principals: no means no. Check with OSP or University Advancement. MY COST IS ALLOWABLE: CAN I CHARGE IT? • Cost must be Allocable- clearly defined for one project (i.e.- printer paper is not usually allocable) • Cost must be Reasonable- buyer used prudence and like buyers would do the same in like circumstances • Cost must be Consistent- across University, other accounts, project periods OMB CIRCULARS Assistance to Colleges and Universities Administration Of Grants A-110 • http://www.whitehouse.gov/omb/circulars_a110 Cost Principles A-21 (Allowable Costs) • http://www.whitehouse.gov/omb/circulars_a021_2004 THE COST PASSES THE TESTS; NOW WHAT? • • • • • Travel Requests and Vouchers Salary Vouchers Student employment forms Full-time (grant-funded) employment forms MDV Purchases • Reminder: If you are using grant funds to hire, employees are required to complete Responsible Conduct of Research training. Contact Eric Gregory for more info. OOPS – THE CHARGE WENT ON THE WRONG ACCOUNT! WHAT DO I DO? • If charged to wrong line item within the correct grant: • Complete a budget transfer form and have the PI sign it and send to your grant accountant. Red flag for auditors! • If charged to your departmental account: • OSP does not have access to view dept. accounts, so we will never know. Monitor charges closely and alert us if you find a cost that should have been charged to a grant account. MY GRANT INCLUDES COST SHARING. WHAT IS THAT? • Cost sharing, or cost match, is the portion of the project not borne by the sponsor and instead borne by the University or a third party. Pre-approved at the proposal stage by chair, dean, and university. • Can include: • • • • • • Cash, supplies, equipment donations Use of space/facilities Cost of renovating space Indirect costs (if sponsor does not allow us to charge these) Salaries/fringe Volunteered time/services (student, staff, professionals) DOCUMENTING COST SHARE… WHO IS RESPONSIBLE? • Costs must be verifiable. Time sheets/ time logs, estimate of fair market value for donations, paystubs, invoices, Effort Reporting logs, printouts from Banner, etc. • The term “in-kind” refers to donated services or materials to a sponsored program in which there is no exchange of cash. In-Kind It is your responsibility to track in-kind cost sharing • non-cash such as donated time and effort • IRS Form 8283, completed by the donor, is used to track donated goods. UA will work with you to process the form. Cash Cost Share It is our responsibility to track cash cost sharing • from individuals or other organizations or departments • federal funds may not be used to match other federal funds A-133 AUDIT • KPMG • January through March • Examines financial operation of all funding • Review of non-financial compliance with applicable laws and regulations • Evaluation of effectiveness in achieving program results A-133 AUDIT (CONT.) Financial Audit: • Reports on whether an entity’s financial information is presented fairly, implementation of proper internal controls, and compliance with laws and regulations. • Inspection of financial management covers all section operations: • • • • • • Budgeting Fund management Payments Payroll Allowances Cost Share GRANT FINANCIAL REPORTING • Award letter indicates due dates • Federal and State Awards usually due quarterly • These are completed by your grant accountant and may be sent to the PI for review • Some require PI’s signature Financial reports should NEVER be created or submitted by a PI! CONTACT INFO • Our office handles all Post Award functions for ALL grants now! • Federal, State, Private, & Foundation • Kristy Carpenter • Post Award Specialist • carpenterk@rowan.edui