Creating Complex Grant Budgets Presented by University Advancement and

advertisement

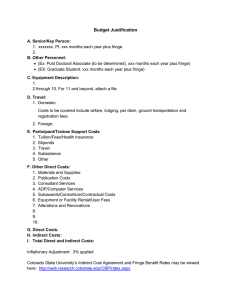

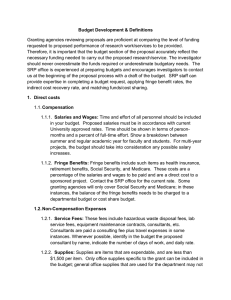

Creating Complex Grant Budgets Presented by University Advancement and the Office of Sponsored Programs November 7, 2014 Budgeting 101 Review • Direct costs include: • Salaries and wages • Fringe benefits (FY14 grant-funded rate 50.75% (FY15 projected40.15%), 7.65% for summer/existing employees/part-timers) • Consulting/stipends • Travel • Equipment/supplies/materials • Publication/mailings/telephone/advertising costs • Participation support costs (food, travel, honorarium) • Student tuition/fees • Rental fees (buildings, computer labs, work stations, etc.) • Indirect costs include: • The “invisible” costs associated with conducting a project (classroom space, lighting, heat, secretarial support) What are Indirect Costs? • Also referred to as overhead or Facilities and Administrative (F&A) costs. This is the cost of doing business. • Universities have a federally approved rate. Rowan’s current rates are: • 45% of Modified Total Direct Costs* (on-campus) • 17% of Modified Total Direct Costs (off-campus) • 21% of Modified Total Direct Costs (industry sponsors) • Most foundations/corporations do not allow (or limit the amount of) indirect costs you can request. It is up to the discretion of your chair, dean, and the Associate Provost for Research to accept indirect waivers or restrictions. • *Modified Total Direct Costs = The total project costs minus units of equipment over $5k each, student tuition remission, fellowships/scholarships, capital expenditures, patient care fees, rental costs of off-site facilities, and each portion of each subgrant and subcontract in excess of $25k. Cost Principles Cost principles are rules to account for and record costs associated with grants and contracts, determined in accordance with generally accepted accounting principles. Cost principles for educational institutions are listed in 2 CFR 200, Section B. Recipients of grants and contracts are responsible for ensuring the costs charged meet the following cost principles: 1. 2. 3. 4. Allowable Allocable Reasonable Consistently Treated What’s Allowable? Many items are conditionally allowable: they must be essential to advance the project’s objectives AND be approved in advance by sponsor (i.e. membership dues, conference travel, patent costs). • What’s NEVER allowable: • • • • • • Alcoholic beverages Contingency provisions Lobbying Alumni activities Goods or services for personal use Flow-through funds for terrorist groups If a sponsored agreement further restricts costs, this trumps 2 CFR 200: “no” means “no.” What’s Allocable? • Allocable = Capable of being assigned or charged to an award/project/function in proportion to benefit received. • Direct costs must be identified specifically with a particular sponsored project, an instructional activity, any other institutional activity or can be directly assigned to such activities with a high degree of accuracy. • Indirect costs (F&A costs) are incurred for common or joint objectives and therefore cannot be identified readily and specifically identified with a particular sponsor project, and instructional activity or any other institutional activity. • Example: Direct cost vs. Indirect costs – What’s allocable? • Acquisition of computer software or minor equipment that directly and solely furthers the purpose of the research is a direct cost. • Office supplies and furniture, such as notebooks, pencils and desks and administrative work related to proposal creation and submission are indirect costs. What’s Reasonable? • When you bought X amount of items at Y price, you: • Bought necessary items. • Acted prudently: others would have made similar decisions given facts and circumstances at the time. • Followed good business practices and applicable laws and regulations and followed the sponsored agreement terms and conditions. • Followed institutional policies (i.e. bidding, use of certain vendors). Use the newspaper headline test: Rowan University Professor Uses Federal Grant Funds to Pay for Day-Care Costs During Travel What’s Consistent? • All costs incurred for the same purpose in like circumstances are treated the same. • Related to estimation, accumulating and reporting of costs • Consistent allocation of costs incurred for the same purpose • Examples of direct cost consistency: • Support staff salaries are consistently charged • Employees are charged the same and appropriate fringe benefit rate • Similar travel costs are charged • Examples of indirect cost consistency: • Same (or very similar) office supplies costs • Routine maintenance of plant/equipment costs For some projects and specific funding, there are exceptions related to consistency of costs. • For example, some programs will allow for office supplies and other indirect costs (i.e. phone calls) to be charged directly. What Should I NOT do? • Attend a conference and charge your grant for costs associated with an extended vacation or family member’s expenses • Rent a Lexus and/or provide gas receipts after the car has been returned • Charge your grant for effort (salary) you did not actually expend • Charge costs associated with a retirement party for a faculty member or researcher • Charge travel costs that are restricted in the award terms and conditions, even though the travel supports the project’s objective or disseminates findings • Buy extra supplies with your grant funds for departmental use or use on another sponsored project Core Questions to Ask • How does this purchase/expenditure help accomplish the project’s objectives? • Is this purchase permitted in the award terms/conditions? • Is prior approval necessary? (From the sponsor? From Purchasing?) • Is this a reasonable purchase? • Can this purchase/expenditure be used in a personal manner or for other activities other than the proposed research? Use your budget justification to document how the purchase advances the project’s objectives. If you are requesting an expensive item, do your homework know the requirements for getting/providing quotes. Cost Sharing • Cost sharing, or cost-match, is defined as the portion of the project costs that are not borne by the sponsor, and instead borne by the university or a third-party. • Can include: • • • • • • Cash, supplies, equipment donations Use of space/facilities Cost of renovating the space Indirect costs (if sponsor does not allow us to collect these) Salaries/fringe Volunteered time/services (students, staff, professionals) • The term “in-kind” refers to donated services or materials to a sponsored program in which there is no exchange of cash (see handout). Cost Sharing Regulations • Must be approved by chair and dean. Cost-sharing must be documented on the IPAF. • Costs must be verifiable. Time sheets/time logs, estimate of fair market value for donations, paystubs, invoices, Effort Reporting logs, printouts from Banner, etc. • If you have a federal grant, you cannot use those funds as a costmatch to another federal program. These funds often can be used to match private awards. Always check with the Office of Sponsored Programs or University Advancement. Cost sharing can be mandatory, voluntary, or disallowed by sponsor. Personnel Costs • Key Personnel include those who shape or impact the programmatic aspect of the project. Can include: • • • • • Faculty and Staff Project Managers Post-docs Graduate students (sometimes) Collaborators “Effort” (in months) is usually associated with key personnel. Use actual salaries to calculate costs based on the amount of effort personnel will provide (in months). Contact OSP if you need personnel salaries. Course Release/Buy-Out • Faculty are currently on a 12-12 load. Course releases are determined by the adjusted load process at your college. • Refer to Course “Buy-Out” Policy Example: Dr. Jones has been approved for a 3-credit course release. She would like to request buy-out on a sponsored project budget for an additional 3 credits. She cannot budget at the adjunct rate, so her salary request would be: $7,773 for a 3-credit buy-out $594 for fringe (7.65%) $8,368 cost to replace 3-credits Personnel Costs Continued “Other” Personnel: • Students • Lab technicians, other staff members (general secretarial support is considered an “indirect” cost if the secretary performs other duties) • Counselors • Program Assistants Usually, “other” personnel do not need an associated “effort” (in months). Undergraduate wages vary from $11-$15/hr. Graduate stipends vary from $7,000-$15,000 per year. Contact Dr. Pourkay Forouza at Division of Global Learning & Partnerships for graduate stipend guidance. Tuition and fees are often requested for Graduate Assistants. This estimate should be based on actual per-credit rates and fees for your school. STEM thesis-track grad programs have a special tuition rate. Personnel Costs Regulations Faculty • The AFT union 2011-2015 agreement (Article XX) allows faculty to receive academic-year (Sept-June) compensation from sponsored programs for up to 30% of base salary, or $18,000, whichever is greater. Anticipated same for future contract. • The AFT union agreement does not cap the amount of money summer salary faculty can request or earn. Staff • Staff members can be fully grant funded. Do not overbudget effort! You cannot budget anyone for more than 12 months in a year, no matter how long/fast s/he works! Personnel Fringe Costs • If requesting salary, you must remember to request the associated fringe costs (or can cost match). Fringe rate is determined yearly by the State of New Jersey. FY14 full fringe rate includes: Pension 11.29% Health Benefits 30.06% Workers Comp 1.15% Unemployment Ins .16% Temp Disability Ins .27% Unused Sick leave .17% FICA 7.65% - part-time, summer, existing TOTAL 50.75% • There is no fringe applied to undergrad or graduate student wages. Personnel Fringe Costs • Example 1: Dr. Jones is requesting 1 month summer support at $10,000. Since she is not under contract in the summer, she only needs to request FICA fringe at 7.65%. Her total request, salaries and fringe, will equal $10,765. • Example 2: Dr. Jones is hiring a post-doc for $45,000. She should also budget 50.75% fringe to fully cover associated employment costs. Her total request, salaries and fringe, will equal $67,838. • Example 3: Dr. Jones is requesting funds to support for a part-time lab technician. Because the employee is only part time, Dr. Jones only has to request 7.65% FICA fringe on the tech’s salary request. Subawards • Subawards are portions of awarded funds issued to another agency to advance the project’s objectives. • Example: Rowan University is awarded $500,000 for an outreach project. $145,000 of this amount will be issued to Penn State for their critical role in the project. • Subawards MUST be budgeted in the proposal if they are ESSENTIAL to the project. Otherwise, use a vendor (see handout). • Subaward budgets should be created in collaboration with the other institution. The subawardee will use their negotiated fringe and F&A rate since work is being performed there. • Subaward researchers are key players. Often will need to document why you are choosing him/her (can’t just be buddies). Provide a CV to indicate why s/he is the best choice. • Be careful- you are ultimately responsible for a subawardee’s actions and non actions! • Remember, only the FIRST $25k of each subaward is included in the F&A calculation. Consultants • Consultants are expert individuals who can provide a service. • Service could include testing, evaluation, assessment, advisement. • A consultant is paid a flat fee based on actual work performed. Ask for the person’s standard hourly rate (or market rate) and estimate the amount of hours the person will work. This flat rate will include ALL costs, including travel, expenses, and overhead. • Same as subawards-justify why this person is the right person to hire. • Many federal sponsors expect an external evaluator/assessment consultant. • Rowan employees who serve as consultants are still paid via payroll: must include 7.65% fringe! Participant Support Costs • You can request support costs for participants in your project. This could include trainees, meeting/workshop participants, human subjects, or other project participants. • Registration fees, travel allowances, manuals and supplies, honorarium, incentives, subsidence, and stipends may be regarded as participant support costs. • These costs MUST advance the project’s objectives and be necessary. If participants attend an 8-hour training workshop, food costs may be justifiable (check with sponsor). Remember, alcohol is never allowed. • Estimate your costs carefully—this is one category that often cannot be easily modified after an award is received. • These costs are budgeted for independently (i.e. don’t lump participant travel costs with your own travel costs). • You should know how many participants you will support. Help! For help forming budgets, contact: Stephanie Lezotte, Acting Director Office of Sponsored Programs lezotte@rowan.edu x4124 (state, federal, industry clinic grant applications) Deanne Farrell, Director Corporate and Foundation Relations farrelld@rowan.edu x5418 (corporate, foundation grant applications) For post-award budget questions, contact: Kristy Carpenter, Post-Award Specialist Office of Sponsored Programs carpenterk@rowan.edu x5497 What Do You Think? • Dr. Mason wants to buy a customized freezer to store samples acquired during the award period. His department is running out of space and he has been asked to allocate ½ of the freezer space to departmental purposes. • Allowable cost? What Do You Think? • Helen has a grant to encourage increased representation of minority students in STEM fields. An important element is networking events, which involve food. • Helen is not charging the cost of food to the sponsor, but wants to use the cost to meet mandatory cost-sharing. • Allowable cost? What Do You Think? • Syndey wants to buy a $5000 secure server using grant dollars. • Was not in the budget narrative • Will only be used to store field research (i.e. will not be his office server) • Allowable cost?