Uniform Guidance: 9 Ways Revised Regulations May Affect Your Federal Grants Presented by

advertisement

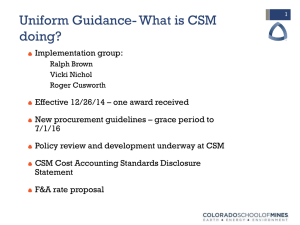

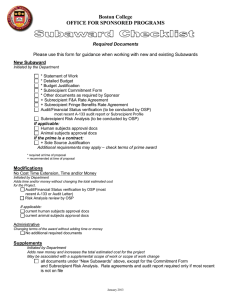

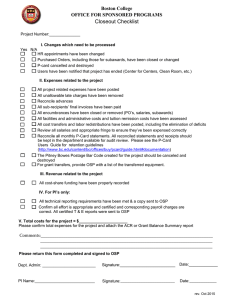

Uniform Guidance: 9 Ways Revised Regulations May Affect Your Federal Grants Presented by Stephanie Lezotte Office of Sponsored Programs lezotte@rowan.edu x4124 UG = 2 CFR 200 = Revised Guidelines for Federal GRANTS Start Budgeting! Why: Eliminate Duplication and Conflict Why: Eliminate Duplication and Conflict Now: UG Challenges and Impacts How UG affects your existing federal grants Issued prior to 12/26/14 Issued on/after 12/26/14 • Follows existing Terms and • Automatically follows UG Conditions UNLESS a • Fed agencies are revising modification is issued that their policies based on changes the Terms their interpretation of UG • Yearly increments MAY follow UG • OSP will notify PI of any unanticipated Term changes 9 things you should know about UG #9: Subawards – More prescriptive requirements • OSP must perform a risk assessment of the subrecipient – Audit findings, F&A rate, debarment/suspension, previous experience • Add subaward flow-down terms and conditions • Establish a monitoring plan for the subrecipient - review financial and progress reports (PI/OSP) – Must use subrecipient’s negotiated F&A rate or provide a 10% MTDC “de minimis” rate – Fixed fee subawards under cost-reimburseable grants are allowed up to $150k BL: Possibility of delays in issuing subawards or reimbursing sub recipients #8: Clerical/admin salaries “The salaries of administrative and clerical staff should normally be treated as indirect (F&A) costs. Direct charging of these costs may be appropriate only if all of the following conditions are met: 1. 2. 3. 4. Administrative or clerical services are integral to a project or activity; Individuals involved can be specifically identified with the project or activity; Such costs are explicitly included in the budget or have the prior written approval of the Federal awarding agency; and The costs are not also recovered as indirect costs.” BL: PIs may include these costs in proposal budgets now with a strong justification. Approval is NOT automatic. #7: Procurement • Significant changes to procurement and property • Requires use of specific procurement methods – Highly prescriptive • Micro-purchase – exempt from competitive bid if purchase is $3,000 or less • Sole Source - Covers unique purchases (subs) • One year grace period before implementation • BL: Possible future procurement delays #7 Procurement “Bearclaw” #6: Computing Devices Computing devices means machines used to acquire, store, analyze, process, and publish data and other information electronically, including accessories (or “peripherals”) for printing, transmitting and receiving, or storing electronic information. (200.20) • In the specific case of computing devices, charging as direct costs is allowable for devices that are essential and allocable, but not solely dedicated, to the performance of a Federal award. (200.453) BL: PIs can include these costs in proposal budgets as supplies with a justification • -A supply is an item with an acquisition cost less than $5,000. Subject to F&A. #5: Prior Approvals Examples where prior approval is required: – Unrecovered F&A as cost sharing – Fixed price subawards – Charging administrative salaries – Participant support costs changes – Unusual cost items BL: New emphasis on agency prior approvals may slow down research activities – Not clear that Federal agencies have adequate staffing to respond quickly #4 Financial Reporting Clear directive/more pressure for funding agencies to relate financial data to performance requirements of the federal award – Look out! DATA Act coming BL: Start thinking in terms of project milestones and costs. Touch base with OSP when necessary so there are no delays in final financial reports #3 Cost Share Restrictions on voluntary committed cost share: • No more statements of cost sharing being “encouraged” • If required, CS must be explicitly described in merit criteria BL: If cost share is not part of the merit review, don’t volunteer it. #2 F&A Rates • Agencies must accept approved negotiated rates with a few exceptions, including where prohibited by law • Exceptions must be posted to OMB site – How does this get applied in practice? – How does this affect federal flow-thru funding? – Will the 8% training rate be abolished? • Participant support costs are now exempt from F&A -Formerly only NSF #1 Effort Reporting • Flexibility in how this is done • Requires adherence with internal controls – But no specific guidance on acceptable standards for "internal controls" • Any significant changes will require auditor input over time BL: Rowan will be evaluating its Effort Certification process and keeping a close eye on what other schools do Open Issues: Stay Tuned • • • • • Agency deviations – how will these be policed? Conflict of Interest–agency plans Procurement – could be most significant new burden Subrecipient Monitoring–could be second most significant Effort Reporting - where do we go from here and when? How OSP Prepared for 12/24/14 • Streamlined compliance reviews for proposals and grants • Created subaward recipient monitoring checklist and risk assessment • Worked with Accounting Services to add additional account codes in Banner to accurately track expenditures • Attended online and in-person trainings delivered by White House officials and professional groups • Revising existing policies to reflect UG Questions? Answers are in the Crystal Ball….