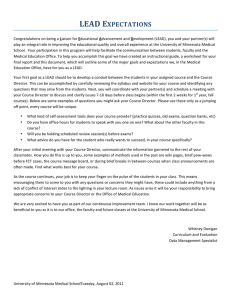

What is a Fair & Profitable Rental Agreement?

20 Location across Minnesota

David Bau

Extension Educator

Agricultural Business Management

University of Minnesota Extension

bauxx003@umn.edu

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

TODAY’S AGENDA:

• FINBIN DATA

• Increasing Input costs

• Minnesota Agricultural Statistic Information

• Farm Land Rental Rate Trends

• Land Values

• Landlord Worksheet

• Tenant Worksheet

• A Rental Rate That Works; Excel Spreadsheet

• Flexible Leases

• Rental Lease Examples

• What is a Fair Rental Agreement?

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

FINBIN DATA

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

CORN Budget

Southern MN FINBIN Data

Yield per acre (bu.)

Operators share of yield %

Value per bu.

Total product return per acre

Miscellaneous income per acre

Gross return per acre

Maximum Minimum

Value

Value

190.5

63.62

100

100

5.66

1.73

893.43

143.38

69.66

-1.81

929.62

213.04

Actual Average

Project Project Forecast

2011

2002-2011

2012

2013

2013

157.85

173.41

163

168

176

100

100.00

100

100

100

5.66

3.30

5.85

6.04

5.50

893.43

572.72

935.10

976.77

968

36.19

14.20

34.33

32.47

10

929.62

586.92

969.43 1,009.24

978

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Direct Expenses

Seed

Fertilizer

Crop chemicals

Crop insurance

Drying fuel

Fuel & oil

Repairs

Custom hire

Hired labor

Land rent

Machinery & bldg leases

Utilities

Marketing

Operating interest

Miscellaneous

Total direct expenses per acre

Return over direct exp per acre

Maximum Minimum

Value

Value

102.11

25.96

158.46

32.15

30.17

22.19

27.13

2.93

36.57

4.28

34.03

8.74

45.87

18.27

10.37

3.09

3.47

0.15

169.32

78.76

3.25

0.32

1.20

0.22

3.32

0.30

15.14

6.99

5.88

0.96

587.76

216.2

349.7

-33.01

Average

Actual

2002Project Project Forecast

2011

2011

2012

2013

2013

102.11

65.25 $106.34 $110.57

120

148.36

90.64 $154.82 $161.27

200

27.59

25.67

$27.78

$27.97

28

23.49

15.60

$24.63

$25.77

25

5.75

14.92

$5.61

$5.47

15

34.03

20.79

$35.39

$36.75

37

45.87

29.56

$47.30

$48.72

49

10.37

5.99

$10.69

$11.01

11

1.71

1.20

$1.90

$2.09

2

169.32

130.49 $174.35 $179.38

220

2.14

1.88

$2.22

$2.30

2

0.00

0.41

$0.08

$0.16

1

3.32

1.56

$3.48

$3.64

4

10.19

10.36

$10.34

$10.48

11

3.51

2.93

$3.65

$3.79

4

587.76

417.40 $608.40 $629.04

729

341.86

169.52 $361.03 $380.20

269

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Overhead Expenses

Maximum

Value

Minimum

Value

Actual

2011

Average

2002-2011

Project

2012

Project

2013

Forecast

2013

3.04

12.02

6.45

7.37

1.74

4.74

1.37

2.13

0.00

12.02

6.01

7.37

2.32

7.38

5.06

5.24

$0.04

$12.30

$6.27

$7.66

$0.07

$12.58

$6.53

$7.95

2

13

6

8

5.18

2.12

5.18

3.48

$5.34

$5.50

6

Dues & professional fees

Interest

Mach & bldg depreciation

Miscellaneous

Total overhead expenses per acre

3.40

8.28

49.09

9.09

100.11

0.42

4.10

18.05

3.91

43.6

3.40

7.97

49.09

9.09

100.11

1.67

6.92

31.16

5.94

68.08

$3.59

$8.17

$49.96

$9.29

$102.55

$3.78

$8.37

$50.82

$9.48

$105.00

4

8

51

10

108

Total dir & ovhd expenses per acre

Net return per acre

Lbr & mgt charge per acre

Net return over lbr & mgt

687.88

259.05

51.14

209.07

263.91

-81.89

24.18

-107.64

687.88

241.60

51.14

209.07

485.48

101.42

37.20

73.53

$710.97

$258.32

$52.64

$225.20

$734.05

$275.03

$54.14

$241.33

837

141

50

91

Government payments

Net return with gov’t payments

51.95

229.05

-7.85

-71.72

18.62

227.69

22.90

90.54

$18.37

$243.82

$18.12

$259.95

20

111

Custom Hire

Hired labor

Machinery & bldg leases

Farm insurance

Utilities

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Cost of Production

Total direct expense per bu.

Total dir & ovhd exp per bu.

With labor & management

Total exp less govt & oth income

Est. labor hours per acre

Maximum

Value

Minimum

Value

Actual

2011

$3.72

$4.36

$4.68

$4.01

3.37

$1.53

$1.83

$1.83

$1.64

2.42

$3.72

$4.36

$4.68

$4.01

2.82

Average

2002-2011

2.40

2.80

2.87

2.71

2.81

Project

2012

Project

2013

$3.74

$4.36

$4.68

$4.06

2.80

$3.76

$4.37

$4.68

$4.10

2.58

Forecast

2013

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

4.14

4.76

5.04

4.87

2.6

Increasing Input costs

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Input Cost Trends

Input costs for corn have been increasing

at rate of 9% for corn since 2003.

Input costs for soybeans have increased at

a rate of 7% per year since 2003.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

www.finbin.umn.edu

Land Rental Rates Ranged

from $67.00 to $265.15 per acre

This is almost $200 range in 2011

What will it be in 2013 in your area?

$300 -$400

Copyright © 2011-12. University of Minnesota. All Rights Reserved.

Acceptable Price Worksheet:

Southwest Research and Outreach website

http://swroc.cfans.umn.edu/SWFM/farm_mgmt.html

Excel spreadsheet to calculate your breakevens

Ranges: $4.50 to $5.20 for corn

$10.00 to $13.00 for soybeans

Corn Cash Rental Payment

After $663 per acre expenses including $70 labor charge

Yield Per Acre

Price/Bu

130

145

160

175

190

215

$4.00

-143

-78

-13

52

117

182

247

312

377

-83

-10.5

62

134.5

207

279.5

352

424.5

497

-23

57

137

217

297

377

457

537

617

37

125

212

300

387

475

562

650

737

97

192

287

382

477

572

667

762

857

197

305

412

520

627

735

842

950

1057

$4.50

$5.00

$5.50

$6.00

$6.50

$7.00

$7.50

$8.00

Copyright © 2011-12. University of Minnesota. All Rights Reserved.

Minnesota Agricultural Statistic

Rental Information

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Minnesota Cropland and Pasture Rental Rates

Data provided by the Minnesota Agricultural Statistic Service

September 2011 and 2010 and May 2009

NASS.USDA.GOV

Cropland Rental Rates

County

Cottonwood

Jackson

Lincoln

Lyon

Murray

Nobles

Pipestone

Redwood

Rock

SOUTHWEST

Pasture Rental Rates

2012

2011

2010

2009

2008

2012

2011

2010

2009

204

178

149

174

205

185

156

184

213

183

160

155

141

146

159

170

140

178

182

159

146

155

132

146

158

148

136

156

172

149

137

146

116

132

137

141

137

144

161

139

135

145

118

121

134

134

118

138

149

NA

NA

37

50

5

58

NA

48

NA

51

49

NA

NA

NA

30.5

34.5

NA

42

42

NA

47

35

NA

43

47.5

49.5

50.5

41.5

NA

NA

47

31

28

28.5

32

29.5

40

41

43

43

37

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Minnesota Cropland and Pasture Rental Rates

Data provided by the Minnesota Agricultural Statistic Service

Cropland Rental Rates

Pasture Rental Rates

County

2012

NORTHWEST

81.5 75.5

NORTH CENTRAL

NA

NA

23.5 21.5 NA

NORTHEAST

NA

10.5

4.5

NA

118

151

SOUTHWEST

NA

128

164

60

183

SOUTH CENTRAL

216

SOUTHEAST

192

62.5

159

181

174

108

132

46

149

162

160

100

119

44.5

139

154

151

NA

NA

NA

NA

152

NA

MINNESOTA

150

135

121

113 NA

WEST CENTRAL

CENTRAL

EAST CENTRAL

2011

September 2011 and 2010 and May 2009

2010

2009

2008

2012

2011

62

61

NA

18.5 13.5

12

14

2010

2009

2012

2011

12

12.5

121

NA

13

12.5

133

NA

NA

177

155

214

NA

NA

164

NA

NA

NA

NA

207

5

8.1

38

28.5 22.5 27.5

15 15.5 19

12 13.5

12

47

47

49

NA 36.5 49

30.5 34 31.5

34

21.5

Irrigated

24

NA

23

21

NA

37

38

36

22.5

NA

200

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

NA

160

Farm Land Rental

Rate Trends

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Average Cropland Rental Rates paid in Adult Farm Management FINBIN database.

Calculated 2012 and 2013 based on FINBIN rents increased 10.2 percent from 2010 to 2011 multiplied by 2011 rates

to estimate 2012 and 15 percent from 2011 to determine 2013 rental rates

Average Rents Paid by

County

Southwest

Cottonwood

Jackson

Lincoln

Lyon

Martin

Murray

Nobles

Pipestone

Redwood

Watonwan

'01

93

98

64

79

106

81

90

76

90

95

'02

'03

'04

'05

'06

'07

93 97 96 101

101 103 105 109

69 74 85 86

80 82 85 89

108 110 114 119

82 86 87 89

91 93 97 102

78 74 81 91

89 93 92 99

93 96 101 110

107

111

83

92

121

94

103

96

98

114

108

119

107

94

133

100

117

105

104

122

' 08

143

146

120

119

158

120

132

110

122

148

'09

‘10

'11

Est.

'12

139

145

152

137

177

143

140

121

140

146

148

157

163

140

181

154

146

136

158

165

164

167

169

168

210

168

168

150

173

177

185

189

191

190

238

190

190

170

196

200

Est.

'13

204-210

208-214

211-216

209-215

262-269

209-215

209-215

187-192

216-221

221-226

Copyright @ 2011-12 University of Minnesota All Rights Reserved.

Average

2011

10th

90th

2011

2013

Est.

____

____

____

____

____

____

____

____

____

____

____

2007

2008

2009

2010

Avg

Median

Pctile

Pctile

NASS

Est.

108

119

107

100

100

117

n/a

104

n/a

133

122

143

146

120

119

120

132

n/a

122

n/a

158

148

139

145

152

137

143

140

n/a

140

n/a

177

146

148

157

n/a

140

154

146

n/a

158

n/a

181

165

164

167

n/a

168

168

168

n/a

173

n/a

210

177

152

171

n/a

154

169

156

n/a

175

n/a

189

162

116

117

n/a

101

100

108

n/a

113

n/a

137

136

207

208

n/a

207

207

237

n/a

222

n/a

242

222

160

155

141

146

159

170

140

178

182

190

176

South Central

Cottonwood

Jackson

Lincoln

Lyon

Murray

Nobles

Pipestone

Redwood

Rock

Martin

Watonwan

Copyright @ 2011-12 University of Minnesota All Rights Reserved.

Average Annual Change

in Land Rental Rates

2007-2011

Northwest

7.3%

2010-2011

13.3%

West Central

8.6%

10.9%

Central

12.1%

15.2%

East Central

n/a

n/a

Southwest

11.9%

11.1%

South Central

10.8%

12.8%

Southeast

10.3%

13.7%

State

10.2%

13.1%

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Ag Lease 101

•Home Document Library FAQ For Educators About Ag Lease 101 Contact

Ag Lease 101 helps both land owners and land operators learn about

alternative lease arrangements and includes sample written lease agreements

for several alternatives. Ag Lease 101 was created by and is maintained by the

North Central Farm Management Extension Committee.

.

http://www.aglease101.org/

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Land Values

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Corn and Soybeans County Yields

Yields from Minnesota Agricultural Statistic Service Annual Bulletins: 2011, 2010, 2009.

5 yr

ave

5 yr

2011 2010 2009 2008 2007 ave

County

2011 2010 2009 2008 2007

Cottonwood

165.7 180.4 183.0 170.0 164.0 172.6 43.6

46.5 47.0

43.0

48.0

45.6

Jackson

164.6 185.7 184.0 172.0 163.0 173.9 45.0

48.7 49.0

42.5

49.0

46.8

Lincoln

148.0 161.9 163.0 148.0 153.0 154.8 34.4

44.8 40.0

35.0

46.0

40.0

Lyon

150.6 168.5 174.0 159.0 150.0 160.4 34.6

48.2 41.0

37.0

47.0

41.6

Martin

175.9 188.0 192.0 179.0 165.0 180.0 48.0

49.1 50.0

45.5

49.0

48.3

Murray

168.5 186.3 183.0 170.0 153.0 172.2 45.5

50.3 47.0

42.5

46.0

46.3

Nobles

176.0 179.8 180.0 173.0 157.0 173.2 45.1

50.8 47.5

41.5

48.0

46.6

Pipestone

154.2 172.4 168.0 162.0 140.0 159.3 38.3

48.8 44.0

38.0

44.0

42.6

Redwood

151.0 184.0 187.0 173.0 156.0 170.2 37.3

51.3 45.5

42.5

47.0

44.7

Rock

180.6 189.2 179.0 182.0 160.0 178.2 48.8

54.3 49.5

47.0

51.0

50.1

Watonwan

178.5 183.1 184.0 175.0 164.0 176.9 45.0

48.3 48.0

44.0

48.0

46.7

Southwest

162.5 179.7 179.0 169.0 156.0 169.2 41.5

49.4 46.0

41.5

47.5

45.2

Minnesota

156.0 177.0 174.0 164.0 146.0 163.4 38.5

45.0 40.0 38.0 42.5

40.8

Copyright @ 2011-12 University of Minnesota All Rights Reserved.

SW MINNESOTA COUNTY FARM LAND PRICES 2001-2011

Prepared by David Bau, Jim Nesseth 2002-2003 and Erlin Weness 2001

The amounts listed below are the prices paid per acre for total farmland (not tillable acres) in each listed county. The data is from farm sales recorded from

January 1st through June 30th of the respective years. The data includes only bare land sales. No land and building combination sales are included. The information

is from actual arms length sales reported to county authorities and collected by personnel of the University of Minnesota Extension. Sales data was not weighted for

acres, each sale on a per acre basis was averaged to get the average price paid per acre. In 2005 added counties Chippewa, Lac qui Parle, Redwood and Yellow

Medicine to study.

COUNTY

CHIPPEWA

COTTONWOOD

JACKSON

LAC QUI PARLE

LINCOLN

LYON

MARTIN

MURRAY

NOBLES

PIPESTONE

REDWOOD

ROCK

WATONWAN

YELLOW MED.

AVERAGE

2002

NA

$1467

$1930

$1032

$1029

$1144

$1930

$1501

2003

NA

$1625

$1790

$1220

$1223

$1676

$2091

$1672

2004

NA

$1854

$2111

$1461

$1172

$1878

$2476

$2039

2005

$2481

$2439

$2671

$1742

$1509

$2012

$2871

$2183

2006

$2582

$2853

$2969

$1933

$1624

$2303

$3092

$2286

2007

$2615

$3005

$3332

$2217

$2401

$2207

$3478

$2500

2008

$3776

$4423

$4425

$2474

$2343

$3912

$3783

$3523

2009

$3,932

$2,798

$3,999

$3,138

$2,917

$2,908

$4,446

$3,700

2010

$3,605

$3,699

$4,100

$3,326

$2,830

$3,373

$4,634

$3,919

2011

$3,892

$5,424

$6,453

$4,052

$3,464

$5,057

$4,509

$3,859

$1762

$1168

NA

$2066

$1858

NA

$1535

$1928

$1334

NA

$1926

$1842

NA

$1666

$2238

$1851

NA

$2139

$2193

NA

$1947

$2411

$1880

$2705

$2369

$2337

$2055

$2262

$2882

$2127

$2743

$2992

$3112

$2537

$2574

$3393

$2409

$2880

$3912

$3103

$2429

$2849

$4126

$3386

$3759

$5052

$3642

$3203

$3702

$3,939

$3,680

$4,158

$5,221

$4,000

$3,425

$3,733

$5,037

$3,511

$4,259

$4,783

$4,107

$3,595

$3,913

$4,850 $6,109

$4,433 $5,615

$5,445 $7,479

No Sales $7,839

$4,983 $6,349

$4,515 $5,481

$4,687 $6,245

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

2012

$6,024

$7,807

$5,981

$4,174

$4,253

$6,284

$8,359

$5,678

Minnesota Farmland Sales 2011 and 2010

Average Farmland Sales from Minnesota Land Economics

Steve Taff, University of Minnesota http://www.landeconomics.umn.edu/

County

Cottonwood

Jackson

Lincoln

Lyon

Martin

Murray

Nobles

Pipestone

Redwood

Rock

Watonwan

Average 2010 Number of

Per-Acre Price Sales 2011

3934

4317

2914

4003

5384

3935

5196

3511

4179

4506

4056

9

9

6

19

9

15

12

4

9

4

5

Average 2011

Per-Acre Price

5454

5870

3037

4437

5085

3552

4878

4611

5367

5592

4577

Minimum 2011

Per-Acre Price

4378

3545

1712

1832

2553

1172

2832

2026

3843

3007

3562

Maximum 2011

Per-Acre Price

6510

7325

4166

6452

6499

5074

6998

6950

6451

7911

5553

Copyright @ 2011-12 University of Minnesota All Rights Reserved.

Landlord Worksheet

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Landowner’s Cash Rent Worksheet

Example Your Farm

(A) Farm Size in Acres (tillable acres)

(B) Value per Acre

(C) Total Farm Value (A x B)

(D) Desired Return on Investment (C x 3.5%)

(E) Real Estate Taxes (A x $28.00)

(F) Liability Insurance

(G) Other Cash Costs (repairs, pump, Etc.)

(H) Total Desired Return (D+E+F+G)

DESIRED RENT PER ACRE (H/A)

156 ___76______

$6,500 __ $7000___

$1,014,000 __$560,000_

$35,490 __$19,600__

$4,480 ___$2,240__

$200 ____$200___

0 _____0_____

$40,170 __$22,040___

$257.50 __$282.50*__

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Tenant Worksheet

Operator’s Cash Rent Worksheet

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

OPERATOR’S CASH RENT WORKSHEET

Prepared by: David Bau – Regional Extension Educator, Ag Business Management (August, 2012)

FARM FACTS

(A) Corn Acres

(B) Soybean Acres

(C) TILLABLE ACRES

(A + B)

EXAMPLE

100

100

200

GOVERNMENT PROGRAM

YOUR FARM

CROP BUDGET

(D) Direct Payment

(E) Expected Counter-cyclical Payment

(F) EXPECTED PAYMENT (mid D & E)

(G) ADDITIONAL PAYMENTS

CORN

EXAMPLE

EXAMPLE

0

0

0

0

YOUR FARM

SOYBEANS

YOUR FARM

EXAMPLE

YOUR FARM

INCOME (per acre)

(H) Crop Yield

(I) Crop Price

(J) TOTAL INCOME (H x I)

170

5.50

$935

46

11.50

$529

- Seed

- Fertilizer

- Chemicals & Insecticides *

- Crop Insurance

- Fuel and Oil

- Repairs

- Crop Drying

- Machine Lease/Hire

- Hired/Custom Labor

- Crop Marketing

- Miscellaneous Crop Expenses

- Operating Interest

(K) TOTAL DIRECT EXPENSES

110

180

28

25

37

49

25

8

28

4

5

11

$510

55

25

30

25

24

32

0

6

17

2

4

8

$228

- Utilities

- Farm Insurance

- Miscellaneous Farm Expenses

- Interest

- Non-Cash Depreciation

- Operator Labor/Management

(L) TOTAL OVERHEAD EXPENSES

(M) TOTAL EXPENSES (K + L)

6

8

10

8

51

70

$153

$663

4

6

7

6

34

70

$127

$355

(N) NET RETURN (per acre) (J – M)

$272

$174

EXPENSES (per acre)

RENT CALCULATION

(O) TOTAL CROP RETURN - CORN (A x N)

- SOYBEANS (B x N)

(P) EXPECTED GOVERNMENT PAYMENT (F)

(Q) ADDITIONAL PAYMENTS (G)

(R) TOTAL RETURN (O + P + Q)

AVAILABLE FOR RENT PER ACRE (R / C)

EXAMPLE

27,200

17,400

0

0

$44,600

$223

YOUR FARM

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

A Rental Rate

That Works

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

In a fair and profitable rental

agreement the farmer makes a

profit and the landlord receives a

fair rental payment.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Flexible Leases

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Table 1. Average Southern Minnesota Cash Rent as a Percentage of Gross Revenue

Average Cash Rent

Average Gross Revenue,

Average Cash Rent as %

Corn

Soybean

Paid Per Acre

Dollars per Acre

of Gross Revenue

Price

Price

Year

Southern

Corn

Soybeans

Corn

Soybeans

Minnesota

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Average

84.51

91.17

94.89

97.04

95.61

98.31

97.89

101.57

103.74

105.90

110.40

114.83

125.44

146.55

158.86

168.25

169.32

$330.47

$329.89

$321.49

$287.29

$269.76

$267.31

$228.38

$344.09

$358.05

$351.40

$375.47

$511.27

$611.21

$681.06

$716.55

$884.41

$929.62

$246.69

$282.20

$272.32

$254.93

$228.68

$237.56

$208.52

$258.52

$246.81

$228.30

$300.10

$316.05

$472.76

$432.32

$474.32

$564.02

$493.04

26%

28%

30%

34%

35%

37%

43%

30%

29%

30%

29%

22%

21%

22%

22%

19%

18%

28.11%

34%

32%

35%

38%

42%

41%

47%

39%

42%

46%

37%

36%

27%

34%

33%

30%

34%

36.72%

$2.74

$2.46

$2.37

$1.77

$1.73

$1.75

$1.75

$2.18

$2.23

$2.00

$2.03

$2.90

$3.68

$3.89

$3.74

$4.68

$5.66

$5.78

$6.84

$6.37

$5.15

$5.10

$5.11

$5.15

$5.31

$6.85

$5.45

$5.65

$6.05

$9.52

$9.65

$9.66

$10.87

$11.40

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Flexible Rents based on gross revenue:

This is a rental agreement where rental payments are based on gross revenue of the farmland. It can include a

base payment in the crop year and a final payment after the actual yield and price are determined.

Base rents plus a bonus:

This is a rental agreement where a base rent is paid and then a bonus may or may not be paid determined if yields

exceed a base goal. Then these additional bushels would be shared between landlord and tenant. The bonus can

also be determined by yield and price together or price alone as well.

Flexible rent based on yield only:

This is a rental agreement where the landlord receives a set base number of bushels with additional bushels if

yields are higher than was determined for the base payment. This can also be done with a cash payment based on

yield and then price at an elevator.

Flexible rent based on price only:

This is a rental agreement where the rental payment is based on crop prices. Often it is an average price of the

previous twelve months or a quarterly price which is multiplied times the bushels agreed to. Rental payments can

be made at the quarterly price setting times or half and half or after harvest.

Profit sharing flexible rent agreements:

This is a rental agreement where the landlord and the tenant share the profit from the farmland. This agreement is

similar to a 50-50 crop share lease where they share crop yields 50% to landlord and 50% to the tenant and some

of the expenses are paid by each party.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Worthington Yearly Average Cash Prices

Calendar Year

2011

2010

2009

2008

2007

2006

2005

2004

2003

Average

Corn

$6.62

$3.84

$3.40

$4.92

$3.38

$2.15

$1.68

$2.32

$2.10

$2.38

Soybeans

$12.83

$10.01

$9.89

$11.59

$7.78

$5.39

$5.80

$7.53

$6.07

$6.27

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

2013 Corn Using 67% of Net

Income before Rent & Labor

Assumes corn input costs of $567 per acre

Cash Price

$ 5.00

$ 5.50

$ 6.00

$ 6.50

$ 7.00

170

$190

$247

$304

$360

$417

175

$206

$265

$324

$382

$441

180

$223

$283

$344

$404

$464

185

$240

$302

$364

$426

$488

190

$257

$320

$384

$448

$511

200

$290

$357

$424

$491

$558

Copyright © 2011-12. University of Minnesota. All Rights Reserved.

2013 Soybean Using 67% of Net

Income before Rent & Labor

Assumes soybean input costs of $268 per acre

Cash Price

$ 10.50

$ 11.50

$ 12.50

$ 13.50

$ 14.50

40

$102

$129

$155

$182

$209

43

$123

$152

$181

$209

$238

46

$144

$175

$206

$237

$267

49

$165

$198

$231

$264

$296

52

$186

$221

$256

$291

$326

55

$207

$244

$281

$318

$355

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

2013 Corn and Soybean Average Using

67% of Net Income before Rent & Labor

Soybean and Corn Yields

40,170 42,175

$146

$165

$188

$208

$229

$252

$271

$296

$313

$340

44,180

$184

$229

$275

$320

$366

46,185

$203

$250

$297

$345

$392

48,190 50,200

$221

$249

$271

$301

$320

$353

$369

$405

$418

$456

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Rental Lease Examples

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

2013 Crop Budgets for Southwest Minnesota Prepared by David Bau, Regional Extension Educator, Ag Business Management August 2012

Yield Bushel/Acre

Price $/Bushel

Gross $/Acre

USDA Transition Payment

Total Counter-cyclical Payment

Total Income Per Acre

Corn

Estimate

Your Farm

180

________

$ 5.50

$________

$ 990

$________

$

0

$________

$

0

$________

$ 990

$________

Seed

Fertilizer

Herbicide/Insecticide

Crop Insurance

Drying Fuel

Fuel/Oil

Machinery Repairs

Machine Leases/Machine hire

Interest on Operating

$

$

$

$

$

$

$

$

$

110

180

28

25

25

37

49

10

12

$________

$________

$________

$________

$________

$________

$________

$________

$________

$

$

$

$

55

25

30

25

$ ________

$ ________

$ ________

$ ________

$

$

$

$

24

32

8

8

$ ________

$ ________

$ ________

$ ________

Overhead Expenses

Operator Labor

Hired Labor

Depreciation on Machinery

Other Expenses

Total Expenses per Acre

$

$

$

$

$

70

25

51

41

663

$________

$________

$________

$________

$________

$

$

$

$

$

70

17

34

35

363

$ ________

$ ________

$ ________

$ ________

$ ________

$

327

$________

$

237

$ ________

Net Return to Land or the

Amount Available to Rent

Estimate

48

$ 12.50

$

600

$

0

$

0

$

600

Soybeans

Your Farm

________

$ ________

$ ________

$ ________

$ ________

$ ________

Ave:$282

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

What is a Fair

Rental Agreement?

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

$360

$90

$240

$120

$390

$270

What is a fair rental rate?

$150

$510

$300

$330

$420

$450

$480

$180

$210

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

In a fair and profitable rental

agreement the farmer makes a

profit and the landlord receives a

fair rental payment.

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Initially: Base Rent with a flexible

component, farmer makes a profit and the

landlord receives a fair rental payment.

Then: Devise an agreement where share

extra based on yield, price, gross, net.

You decide what works for both parties

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

What is a Fair & Profitable

Rental Agreement?

Please give us you feedback on today’s Extension program. Your comments will help us evaluate this program and improve future

programming. Thank you.

1.

Please rate today’s program

2.

Please respond to the following statements:

Poor

Fair

Neutral

Good

Excellent

Disagree

Neutral

Agree

Strongly

Agree

Strongly

Disagree

After today’s workshop …

a.

I better understand corn and soybean input costs

for 2013 and places to find county information.

b.

I better understand how to calculate breakeven

prices for 2013.

c.

I better understand farm land rental rates and

where to find information.

d.

I better understand farm land values and where to

find county information.

e.

I better understand how to use a flexible farm

rental agreement.

f.

I better understand how to negotiate a fair and

profitable farm land rental agreement.

Tell us about yourself.

3. My age falls in

4. County in

the following

which I live:

group:

___________

__Under 20

__21 – 30

__31 – 40

__41 – 50

__51 – 60

__61 – 70

__71 +

My Zip Code:

___________

Total Acres

Rented/Farmed

_____________

5. Gender:

___ Female

___ Male

6. Occupation:

___ Farmer/Operator

___ Landowner

___ Ag Professional

___ Other

7. What monetary value

would you place on the

information obtained at this

meeting?

___ None

___ $0 - 50

___ $51 - 100

___ $101 - 500

___ $501 - 1,000

___ $1000 +

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

•

•

•

•

•

•

Over 1200 people attend workshops

Roughly 1/3 farmer and 2/3 landlords

Rated workshop 4.22 on 1-5 scale.

Farmers averaged 793 acres

Landlords 177 acres Group Total 387,226 acres

This accounts for over 2.5% of corn and beans

planted in Minnesota in 2011.

• Attendees stated average value of workshop

$139 for total of $158,738

Copyright @ 2012-13 University of Minnesota All Rights Reserved.

Questions??

David Bau

Regional Extension Educator

Agricultural Business Management

University of Minnesota Extension

bauxx003@umn.edu

Copyright @ 2012-13 University of Minnesota All Rights Reserved.