Managing Crop Risks: A Model

Public and Private Partnership

Steven D. Johnson

Farm & Ag Business Management

Field Specialist

| Region 1: Ron Hook | Region 2: Kelvin Leibold | Region 3:

Robert Tigner | Region 4: Tom Olsen | Region 5: Steve

Johnson | Region 6: Craig Chase | Region 7: Tim Eggers

| Region 8: Bob Wells | Region 9: Jim Jensen |

Iowa State University

Extension Budget, 2003-04

Gifts

2%

User Fees

Federal

12%

19%

20%

30%

Grants

State

17%

County

Presentation Objectives

• Review the history of “Managing Crop

Risks” program

• Current program and agenda

• Program topics

• Creating “value” for clients

• Show me the “money”

• The “road ahead”

Educational Deliverables

•

•

•

•

•

•

Conference

Seminars

Workshops

Discussion Groups

One on One

Web-site:

www.ManagingCropRisks.com

• Emerging technologies: video and

MacroMedia Breeze

The Early Years

• Daylong Conference in held one

location (November and January)

– Sponsored by ISU Extension, Farm

Credit Services of America and Wallaces

Farmer (Farm Progress Companies)

– Outside speakers on a variety of

financial and market risk topics

– Registration fee of $50 with Farm Credit

guaranteeing 50 participants at $30

each

The Later Years

• Workshops scattered around Iowa

with county extension and FCS

Market Place offices coordinating

(December or January)

– Sponsored by ISU Extension and Farm

Credit Services of America

– Selected speakers on financial, market

and weather risk topics

– Registration fee of $10 with Farm Credit

inviting customers and prospects

ISU Extension Corn Train:

Managing Crop Risks

Current Program

• Risk Management Workshop in January

– Sponsored by Farm Credit Services of America in

cooperation with ISU Extension

– 2 ½ hour program with a complimentary meal

– Nineteen locations statewide

– Phone register 48 hours in advance

– Farm Credit invites customers, prospects and

Extension field staff to attend

– All programs are listed on Extension calendar

Locations for 2005 Managing Crop

Risks

Program Agenda

• “Risk Free Crop Farming” including a

video:

– “Weather Outlook for 2005” with Elwynn

Taylor

• Utilizing Crop Insurance Tools

• Outside speaker invited by Farm Credit

Services

• Meal prior to program or afterwards

• Registration and door prizes

Government

Farm

Program

$

Crop

Insurance

Products

Crop Marketing

Strategies

Four Types of Government

Farm Program Payments

• Direct payment (DP)

• Counter-cyclical payment (CCP)

• Loan deficiency payment (LDP)

or marketing loan gain (MLG)

• Subsidized crop insurance

premiums

– 38% to 59% paid by Government

Government Payments

for Corn

Total Expected Revenue-Corn

$/bu.

$3.00

$2.50

$2.00

Direct Pmt

$1.50

CC Pmt

$1.00

LDP Pmt

Harv.Price

$0.50

.7

6

$2

.6

5

$2

.5

4

$2

.4

3

$2

.3

2

$2

.2

1

$2

.1

0

$2

.9

9

$1

.8

8

$1

$1

.7

7

$0.00

Season Average Price

Source: Edwards, ISU Extension Economist

Structure of Program

Payments

for Corn

Target Price

Not

Tied

To

Prod

Prod

Req.

$2.63

Regardless

Of Market

Fixed

Payment

$0.28

$2.35

Counter-Cyclical

Payment

Loan Rate

Only If…

Loan Deficiency

Payment

$0.40

$1.95

Maximum

CCP

2004 Acres Insured in Iowa

7,000,000

6,000,000

5,000,000

4,000,000

CORN

SOYBEANS

3,000,000

2,000,000

1,000,000

0

Actual

Production

History

Crop

Revenue

Coverage

Group Risk Group Risk

Income

Plan

Protection

Income

Protection

Revenue

Assurance

Insurance Coverage by Iowa Farmers in 2004

3,500,000

3,000,000

2,500,000

2,000,000

CORN

SOYBEANS

1,500,000

1,000,000

500,000

0

50

55

60

65

70

75

80

85

90

Corn Insurance Comparison

Price Increase

MPCI

RA-HPO/CRC

150 bu/A

150 bu/A

Coverage

75%

75%

Base Price

$2.20

$2.32

Guarantee

112 ½ bu/A

$261/A

100 bu/A

100 bu/A

Harvest Price ‘05

-------

$3.50/bu

New Guarantee

-------

$393.75/A

$27.50/A

$43.75/A

APH

Harvest Yield

Indemnity

2005 Corn Strategy using Crop Revenue

Coverage or

Revenue Assurance w/HPO

X

150 bu/A APH

75% level of coverage

112 ½ bu/A Guaranteed Yield

X

$2.32/bu Dec. Corn Futures in Feb.

$

261/A Guaranteed Revenue

Probability of Cash Corn Price Outlook

2005 – 06 Marketing Year

$2.55/bu

18%

Source: Wisner, Iowa State Univ. Extension Economist, 4-1-05

Probability of Cash Corn Price Outlook

2005 – 06 Marketing Year

$2.05/bu

60%

$2.55/bu

18%

Source: Wisner, Iowa State Univ. Extension Economist, 4-1-05

Cash Corn Price Outlook Probability

‘05 – ‘06 Marketing Year

$2.05/bu

60%

$2.55/bu

18%

$2.00/bu

22%

Source: Wisner, Iowa State Univ. Extension Economist, 4-1-05

Pre-Harvest

Crop

Marketing

Plan

$

Crop

Insurance

Revenue

Tools

Execution of

Your Marketing

Plan

Show me the money

• Revenue Generation at $36/hour

– Conceptualization and Development – 1 hour per

site

– Travel – 3 hours per site

– Set-up and presentation – 5 hours per site

– Office staff time of 2 hours per site @ $25/hour

– Campus support of $50 per site for video and

development

• Total of $400 per site for development and

training

• Revenue Generation of $300 sent to ISU

Cross Promote other

Extension Programs

Ag Management e-School

(AMES) Non-Credit Web

Courses

www.extension.iastate.edu/ames

•

•

•

•

•

•

Advanced Grain Marketing

Financial Decision Making

Farmland Ownership

Farm Leasing Arrangements

Farm Machinery Economics

Advanced Livestock Marketing

AgDM Home Page

Iowa State University Extension

What’s New

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Authors

Topics

Crops

Cost & Return

Markets

Machinery

Other

Livestock

Cost & Return

Markets

Other

Whole Farm

Cost & Return

Leasing

Land Values

Financial

Legal & Taxes

Transfer

Value-Added Ag

Other

What

Whatisisitit

How to use it

Search

Help with a Business

Problem

Update Notification

Questions about

AgDM

Dedication

Non-Discrimination &

Information Disclosures

Welcome to Ag Decision Maker (AgDM). The information and

analysis provided at this web site will help you find solutions to

many of the business, economic, and financial decisions facing

farmers and agribusinesses.

Update government bases and yields

Copyright 2002

Iowa State University Extension

Don Hofstrand, dhof@iastate.edu, 641-423-0844

All rights reserved

Web site design by Liisa Jarvinen

This site is Bobby Approved and Disability Accessible. The site

has passed P-1 accessibility standards.

The Road Ahead

• Iowa programs in January 2006

• Nebraska and South Dakota programs

in December 2005

• Similar theme, agenda and use of web

site

• Beyond 2006

– Driven by the Market Place

– Must continue to “add value” to clients

– University role as objective 3rd party

Small Group Discussions

Group Interaction

Ask the “Expert”

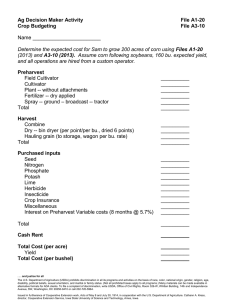

Sample Farm

• APH = 150/bu A Corn

• Use Revenue Assurance w/HPO at 75% level of

coverage

• Total Production Cost = $350/A

• Marketing Plan

– Sell 50% of new crop corn in the spring

– Average futures price of $2.50/bu

– Average basis at harvest of $ .25/bu under

• No Marketing Plan

– Average cash price of $2/bushel at harvest on all

bushels

• Compare APH Yields vs. High Yield vs. Low Yield

150 bu/A Average Corn Yield

(Marketing Plan)

Copyright© 2004 with Permission

150 bu/A Average Corn Yield

(No Marketing Plan)

Copyright© 2004 with permission.

180 bu/A Average Corn Yield

(Marketing Plan)

Copyright© 2004 with permission.

180 bu/A Average Corn Yield

(No Marketing Plan)

Copyright© 2004 with permission.

131 bu/A Average Corn Yield

(Marketing Plan)

Copyright© 2004 with permission.

131 bu/A Average Corn Yield

(No Marketing Plan)

Copyright© 2004with permission.

“Train the Trainer”

Thank You!

Steven D. Johnson

Farm & Ag Business Management

Field Specialist

ISU Polk County Extension

5201 NE 14th Street, Suite A

Des Moines, IA 50313

(515) 261-4215

sdjohns@iastate.edu

www.extension.iastate.edu/polk/

farmmanagement.htm