News Release 09 June 1999 GOVERNOR’S QUARTERLY PRESS BRIEFING

News Release

09 June 1999

GOVERNOR’S QUARTERLY PRESS BRIEFING

Derick Latibeaudiere

Introduction

Three years ago when I took office, in my first quarterly review of the Jamaican economy, I outlined the Central Bank’s vision of Jamaica’s future. As I said then:

"We envisage sustained low single digit inflation yielding greater credibility of macroeconomic policy and of the Central Bank, and greater confidence in the Jamaica dollar yielding lower nominal and real interest rates. We anticipate a cessation of defensive and involuntary devaluation which is often driven by speculation and market manipulation. "

Against this background, I will be using this opportunity to review developments over the past three years and to outline the challenges and possibilities for the medium term.

In the formulation and conduct of monetary policy, the Bank necessarily takes a long view of the economy. This is because the full impact of any action that is taken tends to unfold over a long period, whether initiated by a c hange in the Bank’s signal interest rate or by direct adjustment to bank reserve requirements. Our quarterly reviews therefore focus on explaining the trends that have been developing over some time and the extent to which they are consistent with our expectations. Policy targets and decisions also take this longer view. The planning horizon for our inflation objective, as you know, looks two to three years ahead where they are expected to converge with those of our major trading partners.

Pivotal to the objectives of the Bank over the past three years, was the decision to return the institution to core central banking activities in accordance with its primary functions. These functions are reflected in the Bank’s mission statement which speaks to a duty to "formulate and implement monetary and regulatory policies to safeguard the value of the domestic currency and to ensure the soundness and development of the financial system."

Managerial Transparency and Accountability

The Bank of Jamaica’s Board of Directors and Senior Management take the institution’s responsibility as a public institution very seriously. The prudent management of the institution’s resources and accountability to the public at large are therefore sacrosanct. In this regard, the

Board of Directors has actively engaged in the decision making process of the Bank through monthly meetings in which policy and administrative issues are discussed and advice given. The

Board members have been supportive of measures taken to strengthen the Bank both in its

internal administration as well as its interface with external agencies. With regard to the daily operations of the Bank, the Senior Management meets weekly to discuss, review and ensure the timely implementation of policy and operational decisions. The process has worked to the extent that there tends to be no overhang of administrative issues.

The operational efficiencies that have resulted from the proactive style of management are reflected in the Bank’s balance sheet and income statement. Non-income earning advances to

GOJ have been reduced from $27 billion to $12 billion as a result of the renewed profitability of the Bank. There is now an adherence to the highest standard of accounting practices in the preparation of all financial statements, including bi-monthly balance sheets which are published in the print media.

Consequent on the improvements in the systems and controls within the Bank, there have been negligible comments or queries from the external auditors. There has also been a reduction in the time spent by the external auditors in completing the end-of-year audit and an improvement in compliance with policies and procedures.

Over the past three years there has been a general staff rationalization programme, which began in 1996 but was accelerated in 1998. This included the transfer of the debt management function to the Ministry of Finance. As a result, the staff complement was reduced from 628 at end-March

1996 to 428 by the end of December 1998. Concurrent with these developments, the recruitment process was strengthened to ensure that candidates met the specific professional and/or technical skills consistent with the strategic objectives and mission of the Bank. The savings resulting from the reduction in the staff complement is projected to be approximately $250 million over a period of 2 1/2 years from end-September 1998.

In 1996, it was felt that monetary and other economic policy issues at the forefront of the Bank’s focus were not being effectively communicated to the business and diplomatic communities or to the general public. Consequently, the Bank as an essential part of its public education programme has hosted quarterly luncheons, addressing key issues pertaining to the performance of the Jamaica economy. The Bank has also met with members of the diplomatic corps and specific sector groupings. In addition, the Bank has been contributing to improved public education through a series of seminars and workshops for practitioners in the financial sector, students and educators. This latter objective has also been served by the establishment of a website on the Internet to facilitate the dissemination of economic information to as wide an audience as possible.

Further, the Central Bank has been publishing timely information in the print media aimed at keeping the public informed on the main elements of its operations. These include the regular

publication of the Bank’s balance sheet, the stock of Net International Reserves, base money, the balance of payments and inflation.

Financial Institutions Supervision and Regulation

The Bank has driven the process of having critical amendments effected to sections of various pieces of financial legislation. The Banking Amendment Act 1997 and the Financial Institutions

Amendment Act 1997 have increased the powers of the Minister of Finance and the Central Bank to take expeditious corrective measures in "problem" financial intermediaries.

In 1995 the Bank was vested with the responsibility of supervisory oversight of building societies.

One of the Bank’s main duties in this regard was to review and recommend to the Minister of

Finance applicants to be issued with licences. Of the 34 building societies operating at the end of

1994, only 5 were eventually granted licences.

The Bank also undertook a comprehensive review of the operations of Industrial and Provident

Societies and in December 1997 was successful in having the legislation governing the operation of these societies amended in December 1997 to prohibit such entities from conducting banking business.

In its effort to strengthen the financial system the Bank also contributed significantly to the work of the Special Task Force which was mandated to develop the conceptual framework for the

Deposit Insurance Scheme in Jamaica. The Central Bank also initiated the drafting of regulations governing the qualification and obligations of external auditors for licensed financial institutions.

These regulations are scheduled to come into effect during 1999.

Since 1996, the Bank has implemented additional supervisory mechanisms to enhance its monitoring capabilities. These include:

the Electronic Data Interchange (EDI) System which enables the efficient transmission of information from licensed financial institutions to the Bank;

the development of the Regulation on Credit Classification, Provisioning and Non-Accrual

Requirements;

the introduction of a programme of quarterly performance targets encompassing capital, asset quality, profitability and liquidity;

the development and implementation of testing instruments to monitor compliance with the Money Laundering Act.

To ensure Year 2000 (Y2K) compliance in the financial institutions which it supervises, embarked on a comprehensive programme of education, monitoring and the establishment of specific conversion and re-implementation deadlines. Further, the Bank has established a Financial

Sector Y2K Steering Committee comprising representatives of the Bank and personnel of all

supervised entities. Within the Bank, the critical phases of the Bank’s internal Y2K Compliance

Programme have been completed.

Across the wider financial system specific measures were adopted to enhance the development of the money and foreign exchange markets and to facilitate the effective implementation of monetary policy. These include:

(a) closer monitoring of the performance of Primary Dealers, resulting in increased participation in primary issues of Government of Jamaica (GOJ) securities. Primary

Dealers now subscribe to some 95% of GOJ’s debt issues, compared to less than 50% in earlier years.

(b) enhanced the Bank’s flexibility in the introduction of multiple maturities for the Bank’s open market instruments, which has the implementation of monetary policy and has served to deepen the money market while creating a yield curve for domestic instruments.

(c) regular meetings with market players viz. Banks, authorized foreign exchange dealers, cambios and primary dealers, which have assisted the Bank in disseminating vital information and have fostered a better understanding of economic developments and their impact on the market.

(d) more regular and structured relations with the market, which have facilitated a more comprehensive analysis of market conditions and more timely action by the authorities.

Additionally, the Bank has increased its monitoring capability for licensed cambio dealers and instituted stringent "fit and proper" criteria which owners and managers must satisfy. The number of cambios in operation has also increased by over 50% to 134, with annual trading volumes now being in excess of US$800 million.

Macroeconomic Policy and Trends

There are three dominant macroeconomic trends that any review of fiscal year 1998/99 would pick up: - the continuing decline in inflation; improvement in the external accounts; and the underperformance of the real sector relative to early expectations. All three are connected through prices and supply/demand conditions in money and foreign exchange markets. I shall comment on these after looking more closely at the trends that are developing in inflation, the balance of payments and output.

Money and Inflation

Reduction in inflation was the main economic achievement over the period. In late 1995 the Bank moved away from an indicative management of the money supply to the daily management of base money. This mode of operation has been honed in successive years, with increased focus being placed on the daily changes in the Bank’s balance sheet. The level of open market operations is specified on a daily basis, with reserve accumulation being focused on maintaining

an adequate reserve cover to support exchange rate stability. To support the Bank’s base money management the Ministry of Finance agreed to an explicit floor being established for government balances in the Bank of Jamaica.

The success in reducing inflation over the period is a matter of record. We have seen the twelvemonth inflation rate fall from 30.8 percent in 1995/96 to 9.5 percent in 1996/97, to 8.8 percent in

1997/98 and to 6 percent in 1998/99. The most important monetary strategy used to achieve the target was the containment of base money within strictly defined limits. Control of base money has been made easier over the past two to three years by the fact that Government has raised the domestic financing that it requires from the issue of securities to private citizens and financial institutions and has not sought to borrow from the Bank of Jamaica. Foreign reserve accumulation which had been a factor in previous years, was not an issue in FY1998/99, as the relatively stable NIR remained sufficient to cover about 12 weeks of imports. The other potential reason for expanding liquidity - that of supporting illiquid banks has also waned into temporary advances that have not threatened base money control.

For the first half of 1998/99, growth in base money was 0.7 percent and with a 4.7 percent decline in the second half, the monetary base fell by 4 percent for the fiscal year. As has been widely discussed, the reduction in base money since August has been the outcome of a series of reductions in the statutory cash reserve requirement of commercial banks. Much of those funds that were released were invested by the institutions in interest-bearing securities mainly through the Bank’s open market window. The cash reserve requirement was further reduced in May to 17 percent. In the absence of these adjustments in the statutory cash reserve ratio, however, base money would not have increased significantly.

As the banking system moves towards higher standards of efficiency and competitiveness, our intention is to support this process by first removing any obstacles that would impede the merger of small institutions and to continuously review and minimize the requirement to hold prudential reserves beyond international norms.

Money supply has also conformed to expectations. In the first half of the year, the conversion of some non-bank accounts and insurance products into bank deposits accounted for a spike in money holdings by the private sector of some 9.5 percent in the six months to September. Since then, however, growth in money supply has normalized and was 11.2 percent for the fiscal year.

It is also noteworthy that while there was periodic switching between US dollar and Jamaica dollar deposits during the year, the net change in foreign exchange accounts was an increase of

5.3 percent for the year to March .

Given the conservative approach to monetary management, it is not surprising that core inflation, a measure that isolates the impact of monetary expansion from that of supply shortages or

taxation and other administered price changes, is estimated to have been only 2.9 percent for the fiscal year. Some of the one-time influences on the prices of some items, principally food, which would have been affected by shortages before Christmas were subsequently reversed.

Headline inflation for the first 4 months of 1999 has been slightly negative. The continued reduction in monthly inflation accentuated the steady progress being made to make high inflation a thing of the past. Recent tax measures are likely to affect a range of consumer items but the final impact will be dampened by the absence of monetary expansion to fuel successive rounds of price adjustment. We look forward to making regular reports to you on the progress towards the target for the current fiscal year of 4 - 6 percent.

Foreign Exchange Earnings, Payments and Capital Flows

The second trend is the steady improvement in the current account of the balance of payments.

For the fiscal period April 1998 to February 1999 for which we have full data coverage, the deficit on current account was US$207.4 million, representing an improvement of US$232.1 million over the corresponding period of FY1997/98. This reduction in the deficit was attributable to improvements across a number of categories of earnings and payments.

On the merchandise account, the trade deficit contracted by US$57.2 million to US$999.2 million.

Although there was a substantial decline of US$125.5 million in the value of exports this was fully offset by a larger reduction of US$182.7 million in the value of imports. A major factor in the performance of exports has been the reduction in the value of alumina earnings, as prices remain low on commodity markets. A decline of US$34.2 million in the non-traditional exports was mainly influenced by garment exports, which fell by US$32.3 million or 15.7 percent for the fiscal period.

The garment sector has been adversely affected by the relocation of a number of companies to

Mexico. In both of these product groups the fallout is not likely to persist as increases in the volume of mineral exports are being reported for the January to March 1999 quarter. Reports from the garment sector do not suggest the likelihood of further relocation or retrenchment.

On the import side, the decline was concentrated in raw materials and capital goods and to a lesser extent, consumer goods and free zone imports. Imports of raw materials declined by

US$114.6 million, of which US$83.3 million was due to a contraction in the value of fuel imports.

Capital goods declined by US$69.1 million reflecting in the main a US$70.0 million fall in transportation and equipment associated with the non-importation of airplanes as was done in the comparable 1997/98 period. Consumer goods declined by US$13.7 million, with a US$36.8 million reduction in motor vehicle imports being largely offset by increases in other durable commodities and food imports.

The other area in the current account where there was a notable trend was the services account.

For the fiscal period to February 1999 there was a net surplus of US$325.2 million, compared to

US$260.9 million in the corresponding 1997/98 period. This improvement resulted from lower net payments on the transportation account, coupled with a substantial growth in net travel receipts.

Gross travel inflows were augmented by US$83.1 million, resulting from a 2.8 percent increase in total visitor arrivals for the period. An increase in gross travel outflows of US$23.7 million in the current fiscal period reflected the demand for travel by Jamaican residents.

There was an improvement of US$3.1 million on the capital account to US$15.9 million, while the financial account showed a surplus of US$191.5 million. While net private investments continued to increase, these were partially offset by net outflows of official payments which led to a deficit of

US$101.9 million. These developments resulted in a drawdown of US$16.6 million in the net international reserves (NIR) position of the Bank of Jamaica up to February.

During March, the BOJ accounts reflected an increase in the NIR of US$3.1 million suggesting continued improvement in the current account and in particular, tourism receipts in that month.

For the full fiscal year, the net change in the NIR was a reduction of US$13.5 million. In the context of the effect of the emerging markets crisis on Jamaica’s capacity to borrow the additional

US$150 million as programmed, this is indeed an excellent performance.

Real Sector Performance

Published estimates of Gross Domestic Product (GDP) for 1998 point to an overall reduction in activity of 0.7 percent. This followed steeper declines in the two previous years. The Bank’s assessment of indicators of sectoral trends suggest that the overall decline tapered off in the last quarter of 1998 and points to several positive trends going into 1999.

In the financial sector, for example, which has been a drag on the economy for the past two years, there have been substantial improvements in the indicators of financial health and profitability. The resources put into the sector and the efforts of individual institutions to enhance the efficiency of their operations have led to a substantial revamping of the banking and insurance sectors. New attitudes towards risk assessment and management and the earnings from holdings of Government backed securities will help to sustain the growth momentum in those areas.

As is being reflected in the balance of payments, the mining sector has implemented various strategies to improve efficiency and output. These investments are spread across all the companies and are supported by the Memorandum of Understanding among the players in the industry to optimize performance. Other positive trends are apparent in the tourism and domestic agricultural sectors, as major resort and infrastructural projects are continuing. We continue to have concerns about manufacturing but are encouraged by the outstanding success of those enterprises that have taken the bold steps to restructure and modernize their companies. Heavy

demand for funding available through specialized agencies has also eased those bottlenecks which were related to the cost and availability of working capital.

Interest Rates and the Exchange Rate

The pace of economic recovery, the maintenance of macroeconomic stability and a sustainable balance of payments all hinge somewhat on the path of interest and exchange rates. The role of the Bank is to keep these important prices in a zone that satisfies these outcomes while adhering to the overriding objective of maintaining low inflation. In doing so, however, we recognize that it is in no one’s interest, certainly not the public sector’s, to keep interest rates higher than is necessary.

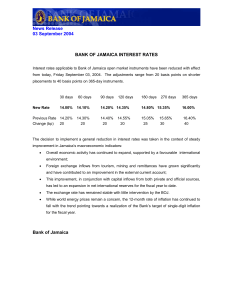

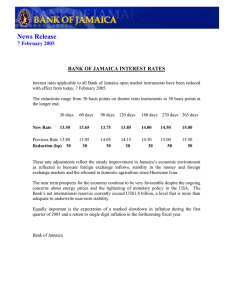

Nominal BOJ reverse repo interest rates have fallen over the course of the fiscal year from 29 percent to 20.75 percent at March and have subsequently dropped to 18.85 percent since then.

Treasury bill and other short- term rates have generally followed suit.

The Bank has operated in tandem with the market in these adjustments seeking to lower real interest rates as inflation continues to fall. Wealth-holders have been slow to incorporate the emerging perspective on inflation into their expected interest earnings but competition among institutions and products is reinforcing the trend towards sustainably low interest rates.

The recent confusion regarding the application of the withholding tax appears to have been followed by resistance and a search for alternatives that would avoid taxation. Two points need to be made in this connection.

First, there is nothing in the withholding tax on various instruments that is unfair or inequitable. It is possible to think of impositions where protest or resistance is justifiable given the incremental burden it may represent. This is not one of those cases. It levels the playing field across a wide cross section of the economy that earns substantial interest income.

Secondly, tax avoidance is one certain way of undermining macroeconomic stability. The downward trend in interest rates has to be supported by a reduction in Government’s need to borrow from the domestic market. Government will be fully justified in being resolute and circumspect in the effort to collect taxes across the board.

In the meantime, an increase in demand for foreign exchange is accommodated by the BOJ, supplementing the supply to the market as necessary. The Central Bank will continue to intervene in the market either selling or buying as the need arises, to facilitate orderly adjustments in the exchange rate. However, the current demand pressures in the foreign exchange market are likely to be short-lived as large inflows are programmed to be sold to the market before the end of the quarter. These include divestment proceeds, project funding and planned foreign borrowing.

Given the extent to which the Government’s borrowing needs for the rest of the year will be biased towards foreign borrowing, one challenge will be to avoid any sharp appreciation in the exchange rate as these flows materialize.

Conclusion

The last three years have had more challenges than any other period in recent memory. The international environment has been through turbulent changes with large sections of the world economy experiencing financial crises and the consequent retardation of their economies. Here at home, we have faced the challenge of rebuilding a major sector of the economy while seeking to attain the stability that was our primary objective. In large measure, we have been equal to the task. We are justifiably proud.

The Bank of Jamaica has transformed its own internal structures through the strengthening of systems and controls. It has led the way in the reform of the financial sector through its supervisory and regulatory improvements. The Bank has set and achieved its inflation objective in every year since 1996 and continues to build on its experience in managing a very complex economy. We look forward to continued support of all well thinking citizens in our quest for stability and growth.