Document 16034969

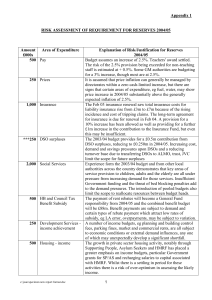

advertisement

PART 1 (OPEN TO THE PUBLIC) ITEM NO.7 REPORT OF THE STRATEGIC DIRECTOR OF CUSTOMER AND SUPPORT SERVICES TO THE BUDGET AND AUDIT SCRUTINY COMMITTEE ON WEDNESDAY, 5th JANUARY 2005 TITLE: REVENUE BUDGET 2004/05: BUDGET MONITORING RECOMMENDATIONS: Members are asked to note the contents of the report and await further information from the Strategic Director of Education and Leisure in respect of subsidised nursery places. EXECUTIVE SUMMARY: The report provides details of the current position relating to budget monitoring for the revenue budget and the implementation of the agreed revenue budget savings for 2004-2005. BACKGROUND DOCUMENTS: Various working papers and reports. (Available for public inspection) CONTACT OFFICER: Chris Hesketh Tel. 793 2668 chris.hesketh@salford.gov.uk Colin Kay Tel. No. 793 3245 colin.kay@salford.gov.uk ASSESSMENT OF RISK: Key budgetary control risks are identified in the report. SOURCE OF FUNDING: Revenue Resources LEGAL ADVICE OBTAINED: Not applicable FINANCIAL ADVICE OBTAINED: This report concerns key aspects of the Council’s revenue finances and has been produced by the Finance Division of Customer and Support Services. WARD(S) TO WHICH REPORT RELATE (S) : KEY COUNCIL POLICIES: Budget Strategy None specifically REPORT DETAIL 1 Introduction 1.1 This report advises members of the current position relating to revenue budget monitoring for 2004-2005. 1.2 Work on the revenue budget for 2005/2006 and the reassessment of the current year’s estimate to produce the 2004/05 approximate is still continuing. 1.3 This report is based on directorates’ latest budgetary control reports, the trading statements for the DLO/DSOs and an update on the progress being made on the savings proposals. 1.4 In addition, as part of the budget risks exercise, individual directorates have been asked to quantify what their current amount of risk is and details are included at appendix 1. 2 Control Totals 2.1 Control totals are used to produce budget projections and as an aid in monitoring the overall budget throughout the year. They are arrived at by amending the original base estimate to take account of known and potential variations, which are mainly outside the direct control of directorates. 2.2 The items that make up these adjustments include the settlement of any pay awards, allowances for price increases, NNDR and insurance charges, demographic changes and legislative matters. Totals are refined as firm figures for each of the items involved are determined or clearer information comes to light. 3 General Fund Services 3.1 Arts and Leisure The directorate is still projecting that 2004/05 expenditure will be contained within the overall budget at year-end. 3.2 Chief Executives The directorate is still projecting that 2004/05 expenditure will be contained within the overall budget at year-end. 3.3 Community and Social Services The underspend on the employee budget now stands at £231,000 which is 0.9% of the salaries and wages budget to November 2004. As reported last month the Children’s Outside Placements budget continues to be volatile and is now currently showing a projected overspend for the year of £156,000 (2.9% above budget). The overspend represents the average cost of 1.3 children for a year. It is anticipated that the budget pressures relating to the new placements within the Learning Difficulties Service will be managed in the current year. It is still anticipated that net expenditure will be kept within budget and close monitoring will need to continue for the remainder of the year. 2 3.4 Customer and Support Services As part of the strategic review the budget of the former Personnel and Performance directorate (Human Resources) has now been transferred to the Customer and Support Services directorate. Overall, it is still anticipated that the net expenditure for the directorate will be kept within budget at year-end. 3.5 Development Services As has been reported throughout the year the position within the Development Services directorate remains much the same with a relatively small overspend on employees continuing to be incurred. Income levels still continue to be holding up well and this should help alleviate any pressures that may occur on other budgets. 3.6. Education The additional cost of Special Education Needs pupils at Independent Special Schools has now been allocated from the central corporate budget. Since the previous report further pressures have arisen within the Lifelong Learning budget and an overspend of £140,000 relating to subsidised nursery places is now being anticipated. Some of this additional cost may be recouped from within the ISB budget as a result of pupil clawback. The above situation, together with the previously reported overspends on advertising and ICT are being partially offset by savings elsewhere in the budget. However, the directorate are now anticipating a year-end overspend in the region of £140,000 caused in the main by the additional cost of the subsidised nursery places. 3.7 Environmental Services As previously reported it is still anticipated that net expenditure will be kept within budget at yearend. 3.8 Housing General Fund A recent report to the Lead Member for Customer and Support Services outlined the problems associated with Homelessness. Unfortunately the level of homelessness is still placing severe pressure on an already revised budget and an overspend in the region of £100,000 is now anticipated by year-end subject to the clarification of the eligibility for Housing Benefit. 3.9 Marketing / Communications It is anticipated that net expenditure will be kept within budget at year-end. 3.10 Corporate Issues Debt rescheduling – previous reports have identified savings of £0.6m from rescheduling exercises. Modesole/GMex dividends - an unexpected dividend of £285,000 has recently been received with a further sum of £92,100 anticipated. Airport dividend - a dividend of £0.825m has been received, exceeding budgeted income by £0.190m. 3 4.1 NNDR refunds on Leisure Centres - £0.4m (on 1995 valuations) towards targeted contribution to reserves of £0.5m - appeals are still outstanding on 1990 valuations and Pendlebury Recreation Centre. Housing Revenue Account The previously reported adverse variation on dwelling rents is anticipated to be £700,000 at year end, the variation should be offset by a reduction in the contribution made to the bad debt provision. A reduction in interest charges to the to the HRA of £700,000 will be offset by an equivalent reduction in Government housing subsidy, giving a neutral effect overall. It is still anticipated that, subject to close monitoring net expenditure will remain within budget at year-end. 4.2 Housing Repairs Account The approval of the virement of the NPHL management fee to the revenue repairs budget should now address any potential overspend that was previously anticipated. 5 Direct Service Organisations 5.1 Details of the trading positions of the various DSOs are indicated in the table below. DSO As at 07/11/04 Budget Surplus / (Deficit) £ 132,815 Actual Surplus / (Deficit) £ 216,151 Variance Favourable / (Adverse) £ 83,336 School and Welfare Catering Building Cleaning Commercial Catering Highway Services VMM Grounds Maintenance Street Cleansing Refuse Collection 30/11/04 30/11/04 30/11/04 30/11/04 30/11/04 30/11/04 30/11/04 1,012 12,228 0 25,468 (233,916) 14,873 20,912 14,488 40,238 (24,000) 30,505 (357,022) 41,452 (29,182) 13,476 28,010 (24,000) 5,037 (123,106) 26,579 (50,094) (26,608) (67,370) (40,762) Total 5.2 Education and Leisure DSOs The Education and Leisure DSOs continue to record favourable trading positions. 5.3 Environmental Services DSOs The Street Cleansing DSO is trading profitably and the surplus is favourable to plan. The Grounds Maintenance DSO is showing a deficit at present but is anticipated to be favourable to plan at year-end. However, as the situation is very tight close monitoring will need to continue for the remainder of the year. The VMM DSO is trading to plan and is anticipated to be favourable to budget at year-end. 4 The Refuse Collection DSO is currently showing an operational deficit however additional income in respect of recycling is expected in January 2005 and the position is anticipated to be favourable to budget at year-end. 5.4 Highway Services DSO Although the DSO continues to trade at a small loss historically the trading position improves in the last quarter of the year and a satisfactory break-even position is still anticipated by year-end. 6 Progress on agreed savings 6.1 All directorates have previously reported the actual savings achieved. In cases where budgets have been adjusted and monitored these savings are still on target to be achieved. 7 7.1 8 Budget Risks A full budget monitoring exercise is undertaken each month by all directorates to ensure that any issues and corrective action are identified at an early stage. Areas that represent greater risks in budgetary control have been identified and will be subject to greater scrutiny. Individual directorates have quantified what their remaining value of risk in the current year is and details are included in Appendix 1. Summary 8.1 Once again budget monitoring has highlighted a problem area within the Education Directorate budget and this area is to be the subject of further investigation. 8.2 As a consequence of the favourable variations previously reported it is still anticipated that General Fund expenditure will be kept within budget at year-end. It is important however, that close monitoring continues for the remainder of the year. 8.3 Most of the agreed savings for the year have been achieved whilst the majority of the remainder are still on target to be achieved. 9 Recommendations 9.1 Members are asked to note the contents of the report and await further information from the Strategic Director of Education and Leisure in respect of subsidised nursery places. Alan Westwood Strategic Director of Customer and Support Services 5 Appendix 1 RISK ASSESSMENT OF REQUIREMENT FOR RESERVES 2004/05 Amount £000s 250 500 BUDGET REPORT 2004/05 - FEBRUARY 2004 COUNCIL – LATEST QUANTIFICATION OF RISKS AS AT NOVEMBER 2004 Area of Expenditure Explanation of Risk/Justification for Reserves Latest Risk Assessment 2004/05 Pay Budget assumes an increase of 2.5%. Teachers' award settled. 2.75% accepted – Additional costs met from within existing The risk of the 2.5% provision being exceeded for non-teaching budgets. staff is estimated at + 0.5%. Some GM authorities are budgeting for a 3% increase, though most are at 2.5%. Prices It is assumed that price inflation can generally be managed by Inflation allowance distributed to directorates and outturn directorates within a zero cash-limited increase, but there are budgets being managed. No unforeseen price increases have signs that certain areas of expenditure, e.g. fuel, water, may come to light so far. show price increase in 2004/05 substantially above the generally expected inflation of 2.5%. Insurance The Feb 03 insurance renewal saw total insurance costs for The February 2004 exercise complete within budget. A liability insurance rise from £3m to £7m because of the rising reassessment of outstanding liability claims by the loss incidence and cost of tripping claims. The long-term agreement adjusters in October 2004 has reduced the risk of the fund for insurance is due for renewal in Feb 04. A provision for a provision being exceeded. 10% increase has been allowed as well as providing for a further £1m increase in the contribution to the Insurance Fund, but even this may be insufficient. DSO surpluses The 2003/04 budget provides for a £0.5m contribution from The outturn DSO trading results for 2003/04 showed a surplus DSO surpluses, reducing to £0.250m in 2004/05. Increasing of £500,000 would be provided to General Fund reserves. No cost, demand and savings pressures upon DSOs and a reason to believe the contribution for 2004/05 of £250,000 will reducing turnover base due to transferring DSOs to ALMO, not be achieved at this stage. trust, JVC limit the scope for future surpluses Social Services Experience from the 2003/04 budget and from other local Learning Difficulties - The increase in demand and cost of authorities across the country demonstrates that key areas of packages of care service provision to children, adults and the elderly are all Residential Care Home rate price increases for residential under pressure from increasing demand for those services. and nursing placements outside the Authority Insufficient Government funding and the threat of bed blocking Hospital discharges - The level of delayed discharges and penalties add to the demand pressures. The introduction of the impact of fines pooled budgets also limit the scope to reallocate resources Home Care - Potential growth in demand to support people between budget heads. independently at home Supporting People - potential reductions in income Recruitment for Children's Services - Impact on the level of agency payments necessary to cover the delivery of the service Children and Families - The cost of outside placements and Amount £000s Area of Expenditure Explanation of Risk/Justification for Reserves 2004/05 Latest Risk Assessment agency foster care Staff recruitment and potential rewards costs Increasing Legal Costs for Children Looked After court cases These risks are currently being satisfactorily managed within the budget provision. HB and Council Tax Benefit Subsidy 250 Development Services - income achievement The payment of rent rebates will become a General Fund responsibility from 2004/05 and the combined benefit budget will be £88m. Benefit payments are subject to demand and certain types of rebate payment which attract low rates of subsidy, e.g. LA error, overpayments, may be subject to variation. A number of income budgets, e.g. planning and building control fees, parking fines, market and commercial rents, are all subject to economic conditions or external demand influences, any one of which may unexpectedly develop a significant shortfall. Benefit payments and eligibility to subsidy still subject to close scrutiny, but a detailed assessment indicates no adverse position to report at present. Highways Works budget - it is expected that the budget will continue to come under pressure during the current year. The budget is to be closely monitored with a view to managing any overspends from favourable budgets elsewhere within the directorate. Decriminalised Parking Enforcement - the approval of Budget Scrutiny Committee of a virement from favourable income budgets will help to cover any shortfall in the current year Quaywatch Scheme – possible shortfall in income. Homelessness Asylum Seekers Monitoring costs of new structure 100 Housing - income Education - SEN The growth in private sector housing activity, notably through Supporting People, Asylum Seekers and HMRF has placed a greater emphasis on income budgets, particular Government grants for SP/AS and recharging salaries to capital associated with HMRF. Whilst there is a settling in period for these activities there is a risk of over-optimism in assessing the likely income. Demand pressures from a potential increase in the number and cost of out-of-district placements (linked with Social Services demands) and transport. £500k shortfall met from central additional £100k may be incurred. contingencies budget Extra District / Earmarked - There is an expectation that this area will overspend due to the high level of support required for pupils and the increased costs of placements which are above inflation. A detailed explanation of the reason for overspending in 2004/05 has been produced by the Assistant Education Officer SEN. £400k overspend met from central contingencies budget. Amount £000s 640 Area of Expenditure Non-achievement of savings Unforeseen expenditure /income shortfall Explanation of Risk/Justification for Reserves 2004/05 There is a risk that some proposals built into the budget plans cannot be delivered on time or at all. There is a risk that unexpected events may occur which require expenditure to be incurred or income to be foregone, which have not been budgeted for. Latest Risk Assessment No shortfall in savings anticipated at year-end. Chief Executive Matched funding requirements External Government funding trends Staff turnover and retention and 6% vacancy factor Future funding opportunities Corporate / Leadership Costs Marketing and Communications budget Corporate Services Funding of IT Projects - Enterprise XP, UPS, SANs and Document Imaging Licensing - changes in legislation SLAs with schools, NPHL and SCL E-government targets I.T.Net Planning and Management software tool Relocation of Data Centre Members IT provision Community Committees Arts & Leisure Lottery funded capital schemes in some of our leisure centres will require the full or partial closure of these centres whilst work is carried out which will lead to a net loss of income after some savings in running costs have been accounted for. It has been agreed in principle that SCL will be compensated centrally via their management fee in these circumstances should there be an overall shortfall at outturn. Education Advertisements - There is insufficient budget provision for recruitment advertising due to the increases in the cost of individual adverts and the reduction made in budget a number of years ago as a result of corporate budget savings. ICT - The overspend on ICT equipment and licences is due to insufficient budget provision. Amount £000s Area of Expenditure Explanation of Risk/Justification for Reserves 2004/05 Latest Risk Assessment Lledr Hall - Lottery funded capital scheme will result in the centre being closed/partially closed which will result in an underachievement of income for 2004/05. It has been agreed in principle that the centre will be compensated centrally for this loss. This will also affect the 2005/06 financial year. Influx of additional 250 pupils attending private nursery provision in receipt of subsidised places (£140,000). Environmental Services Greater Manchester waste strategy - 25 year contract Contaminated land Waste management and recycling targets PSA achievement Income management Industrial relations Security of assets Treasury Management Capitalisation of revenue 1,740 Total Investment returns may under-achieve budget assumptions or borrowing costs may exceed budget assumptions as a result of rising interest rates. Assessed risk is of a 0.5% underachievement on assumed investment return of 4% and a 1% increase on assumed borrowing costs of 5% on £20m of new borrowing. Budget plans are for £4m to be capitalised in 2003/04, reducing to £3m in 2004/05 and £2m in 2005/06. There is a risk that insufficient expenditure can be identified within the revenue budget that can be legitimately categorised as revenue. No longer a risk - £500,000 additional savings received on debt rescheduling Education Corporate Services Revenue capitalisation – exercise in progress to identify revised target of £3.2m.