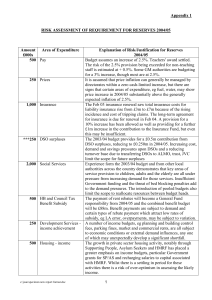

PART 1 (OPEN TO THE PUBLIC) ITEM NO. 7 REPORT OF THE CITY TREASURER TO BUDGET SCRUTINY COMMITTEE ON WEDNESDAY 2 JULY 2008 TITLE: REVENUE BUDGET 2008/09: BUDGET MONITORING RECOMMENDATION: Members are invited to consider and comment on the contents of the report. EXECUTIVE SUMMARY: This report outlines the current position of expenditure against the 2008/09 revenue budget and lists agreed revenue budget savings for the year. BACKGROUND DOCUMENTS: Service budget monitoring reports to lead members. (Available for public inspection) CONTACT OFFICERS: Tony Thompstone, tel. 793 3245 tony.thompstone@salford.gov.uk ASSESSMENT OF RISK: Key budgetary control risks are identified in this report. SOURCE OF FUNDING: Revenue Resources LEGAL ADVICE OBTAINED: Not applicable FINANCIAL ADVICE OBTAINED: This report concerns key aspects of the Council’s revenue finances and has been produced by the Finance Division of Customer and Support Services. WARD(S) TO WHICH REPORT RELATE(S): None specifically KEY COUNCIL POLICIES: 2008/09 Revenue Budget Report Detail 1 Introduction 1.1 At this time of year work in the Accountancy Division has been focused on the closure of the final accounts for the previous year and on monitoring the budget for the current year. 1.2 Both these issues are very important because, although final accounts provide information on what has already happened, they can also highlight issues which may present problems in the current and future years’ budgets. 1.3 It is anticipated that the Statement of Accounts for 2007/08 will be approved by the Accounts Committee on the 30th June 2008. 1.4 To make maximum use of the resources available, budget monitoring concentrates on an examination of the major budget heads and the budgets identified as risk areas. 1.5 In addition the overall financial position imposes a need for agreed savings targets to be met in full and emphasis is being placed on the progress being made on each of the savings proposals. 1.6 Individual directorates are now preparing or starting to prepare, in one form or another, regular monthly monitoring reports to their Lead Member. 2 General Fund Services 2.1 2.2 Chief Executive’s At this early stage in the financial year it is anticipated that net expenditure will be within budget at year-end. Community, Health and Social Care There is an underspend on the employees budget to May 2008 of £281,000 (5.0% of the total budget) including agency staff and recruitment advertising. This is due to casual vacancies in social care. As forecasted for the 2008/09 budget, the Learning Difficulties service is under pressure as a result of the reduction in Supporting People income of £500,000 and the additional cost of £1,100,000 in respect of clients moving from Children’s Services. The service is working with the PCT on a range of efficiency measures to meet the pressures within the existing budget allocation. Close monitoring will need to continue throughout the remainder of the year particularly in the pressure areas indicated. The Committee’s workplan for the year has scheduled a full report from Community Health and Social Care for its September or October meeting. 2.3 Customer and Support Services Overall the expenditure on salaries (including overtime and agency) is underspent to the end of May by £243,000. However, when outstanding bills for agency staff are received and some current vacancies in ICT are filled this underspend will reduce. 2 2.4 Housing and Planning The following Planning budgets are under pressure this year: Markets Office accommodation Building control and planning fees income Salford Innovation Forum and Salford Innovation Park. All budget headings are being closely monitored to identify any areas of underspend which may offset the pressures above. The Committee’s workplan for the year has scheduled a full report from Housing and Planning for its September meeting. 2.5 Children’s Services Overall the directorate is within budget. Close monitoring will continue throughout the year particularly in volatile areas, such as looked-after children. It is currently anticipated that the budget will be in line at year- end. The Committee’s workplan for the year has scheduled a full report from Community Health and Social Care for its September or October meeting. 2.6 Environment The directorate is currently anticipating an overspend of £380,000, which is mainly the result of delayed implementation of co-mingled recycling services, £300,000 and increases in fuel costs, £80,000. The problems experienced by the co-mingled service is a result of the late delivery of bins, which meant that additional vehicles and agency staff were required. A meeting has been arranged with the supplier for an update on when supplies are expected. A full budget review exercise has been undertaken to ensure that any issues and corrective action are identified at an early stage. This will continue throughout the financial year. 2.7 Corporate Issues Tender renewals for electricity and gas have shown substantial increases of 50% and 33% respectively against a budget provision for a 5% increase. Directorates have been requested to absorb this cost increase within existing allocations. A recent decision in a court case has enabled the Council to reclaim VAT going back to 1973 in connection with excess car parking charges, cemeteries, libraries and shop income. This will result in a windfall to the council in the region of £240k of which £86k has been received so far and an additional claim for interest of around £140k has been made. 3 Housing Revenue Account 3.1 The HRA will need reconsidering after the stock transfer. 3 4 Progress against agreed savings 4.1 Appendix 1 provides details of the approved savings included in the 2008-2009 revenue budget. 4.2 The appendix will be updated during the year and it will be included as part of the regular monthly monitoring report until the savings have been implemented and achieved. 5 Budget Risks 5.1 A full budget monitoring exercise is undertaken each month by all directorates to ensure that any issues and corrective action are identified at an early stage. Areas that represent greater risks in budgetary control have been identified and will be subject to greater scrutiny. These are detailed at Appendix 2 along with the latest risk position including, where applicable, details of potential reduction through additional income or reduced expenditure. 6 Prudential Indicators 6.1 Key indicators are detailed in Appendix 3. The capital financing requirement has not been exceeded so far this year. 7 Summary 7.1 Close monitoring will continue throughout the year to ensure that there is an early warning of pressure areas so that, action plans can be put into place to ensure that expenditure is contained within budget by the year end. 7.2 The 2008/09 budget depends on the successful implementation of a number of savings. The savings will be monitored throughout the year to ensure that they are fully achieved. 7.3 The Committee’s workplan for the year anticipates full reports from Community Health and Social Care, Children’s Services and Housing and Planning. In light of developments with Environment, members may also wish to make similar plans for them to make a full report in the Autumn. 8 Recommendation 8.1 Members are asked to consider and comment on the contents of report. John Spink City Treasurer 4 Appendix 1a Savings (Summary) £000 Chief Executive 192 Children's Services 751 Community Health and Social Care 945 Customer and Support Services 945 Environment 347 Housing and Planning 496 Procurement 1,023 Think Efficiency 450 External Efficiency Review 2,000 Grand Total 7,149 5 2008/09 REVENUE BUDGET Appendix 1b SUMMARY OF SERVICE EFFICIENCIES AND INCOME PROPOSALS 2008/09 Ref Proposal 2008-09 2009-10 2010-11 £000 £000 £000 Chief Executive CE1 Deletion of vacant trainee Economic Development Officer post CE2 Review of directorate structure - deletion of vacant posts Community Safety Unit - reduced printing and advertising costs via efficiencies Overview and Scrutiny - reduction in provisions and hire of facilities costs CE3 CE4 CE5 CE6 Policy and Improvement Teams - use of different media for BVPP, management of supplies Regeneration Team - restructure of team 28 28 28 116 116 116 3 3 3 8 8 8 15 15 15 22 22 22 192 192 192 Children’s Services CS1 (inc) Reduction in Salford Skills Centre budget 80 80 80 CS2 Restructure of the Resources Team 11 11 11 CS3 (inc) School SLA Income 22 22 22 CS4 Transfer of cost of Health Needs Coordinator for Looked After Children to PCT Cancellation of requirement to pay council tax on children’s homes Used to fund research projects to support operational practice in social work Reduced use of agency staff (achieved through redeployment of existing staff resource) Cease to use wake night staff at 262 Liverpool Road Children’s Home MAPAS 32 32 32 3 3 3 5 5 5 27 27 27 24 24 24 20 20 20 27 111 111 751 335 335 CS5 CS6 CS7 CS8 CS9 (inc) CS10 (inc) CS11 Barton Moss use of surpluses 500 Children's Homes extension - reduction of outside placements 6 SUMMARY OF SERVICE EFFICIENCIES AND INCOME PROPOSALS 2008/09 Ref Proposal 2008-09 2009-10 2010-11 £000 £000 £000 Community Health and Social Care CHS C1 (inc) CHS C2 (inc) CHS C3 (inc) CHS C5 CHS C6 (inc) CHS C7 (inc) CHS C8 (inc) CHS C9 (inc) CHS C10 (inc) CHS C11 Increase in contributions to residential care in line with benefit increases 160 160 160 Review Staff support structures at Crompton House 50 50 50 Charging policy income 85 170 170 Community Support – standardise rates and refocus service to re-enablement Apply to replacement for NRF to increase funding of Community Services Neighbourhood Mgt 100 100 100 300 300 300 Increase target for Independent Living Fund income to part meet cost of care packages 50 50 50 Adjustment to charging policy for short stay accommodation 43 43 43 Amendment to property disregard effective date for permanent residential accommodation 50 50 50 PCT contribution re funding of alcohol detox placement beds for service users 77 77 77 SCL efficiencies 30 30 30 945 1,030 1,030 7 SUMMARY OF SERVICE EFFICIENCIES AND INCOME PROPOSALS 2008/09 Ref Proposal 2008-09 2009-10 2010-11 £000 £000 £000 Customer and Support Services CSS 1 CSS 2 (inc) CSS 3 CSS 4 CSS 5 (inc) CSS 6 CSS 7 CSS 8 CSS 9 CSS 10 (inc) CSS 11 CSS 12 CSS 13 (inc) Law and Admin – reduce staffing and increase productivity Law and Admin – new/increased income in Registrars and Legal 65 65 65 21 21 21 Human Resources – reduce staffing 36 36 36 Customer Services – reduce staffing 10 10 10 Customer Services – increased benefit subsidy and overpayment income 150 150 150 Finance – accounting adjustments for bad debts and insurance/risk management Finance – reduce staffing 187 187 187 54 54 54 Finance – efficiencies in supplies and services expenditure Finance – energy savings from PCs 76 76 76 20 20 20 Finance – new charges/income for SAP, pensions and purchase card rebate 48 48 48 ICT – reduce staffing 132 132 132 ICT – reduce supplies and services 126 126 126 20 20 20 945 945 945 19 19 ICT – increased external income Environmental Services ES1 Enterprise Act Funds 19 ES2 Bulb Planting 40 ES3 Reconfiguration of the Skip Service 43 43 43 ES4 VMM Restructure Proposals 19 19 19 ES5 Subscriptions - reduce 4 4 4 ES6 Bereavement - reduce supplies budgets 10 10 10 ES7 Bereavement – Grounds Maintenance service configuration Increase fees and charges by 5% 42 42 42 170 170 170 347 307 307 ES8 (inc) 8 SUMMARY OF SERVICE EFFICIENCIES AND INCOME PROPOSALS 2008/09 Ref Proposal 2008-09 2009-10 2010-11 £000 £000 £000 Housing and Planning HP1 HP2 HP3 (inc) HP4 (inc) HP6 HP8 Salix regeneration services – 3% annual efficiencies 57 114 171 Highways depot overheads reduction 50 50 50 26 26 26 50 50 50 310 310 310 3 3 3 496 553 610 Increase car parking charges by 10% Increase recharges to capital UV management fee Membership and levy fees - NW Housing Forum Executive & Northern Housing Consortium Procurement P1 Print review 30 60 60 P2 Consultancies 50 100 100 P3 Multi-functional printers 148 197 197 P4 CCTV 13 27 27 P5 Home to school transport 49 97 97 P6 Taxi and private hire vehicles 25 50 50 P7 Business travel and accommodation 58 116 116 P8 Care provision 500 1,100 1,100 P9 Security 150 316 316 1,023 2,063 2,063 Think Efficiency HR1 Admin Review 350 600 600 HR2 Agile Working 100 200 200 450 800 800 Procurement quick wins 881 881 881 Managing third party relationships 942 1,884 3,384 0 1,101 1,762 184 1,729 2,943 54 472 726 External Efficiency Review (KPMG) Streamlining management Consolidating common functions Rationalising administration Less : Less : Workforce management 674 898 1,035 Streamlining customer access 293 1,463 2,092 3,028 8,428 12,823 -690 -690 -690 -338 -338 -338 2,000 7,400 11,795 7,149 13,625 18,077 Reduction for double-counting of efficiencies already in budget plans Procurement recurring staffing costs required to manage third party relationships Total 9 Appendix 2 PROVISIONAL RISK ASSESSMENT OF REQUIREMENT FOR GENERAL RESERVES 2008/09 For info 2007/08 Provision Minimum Desirable £000s 500 £000s 1,000 0 250 1,000 2,000 RISK ASSESSMENT OF RESERVES FOR 2008/09 Area of Expenditure Explanation of Risk/Justification for Reserves Pay Budget assumes an increase of 2.5% for all staff in 2008/09. There is a risk that union pressure will force the actual settlement higher at 3% or 3.5%. Prices Budget assumes that price inflation can be managed by directorates within a zero cash-limited increase or specific inflation allowances built into the budget. Higher allowances have been made for expected above-inflationary increases, such as 11% for waste disposal and 12.5% for water bills. The scope for other price increases having an impact is therefore limited, with most risk likely to be around the care services sector. Social Care Experience from previous budgets and from other local authorities across the country demonstrates that key areas of service provision to adults and the elderly can come under pressure from increasing demand for those services. Insufficient Government funding and the threat of bed blocking penalties add to the demand pressures, although the latter is under control at present. The introduction of pooled budgets also limits the scope to reallocate resources between budget 10 2007/08 Reserves requirement Minimum Desirable £000s 500 £000s 1,000 0 250 1,500 2,500 Latest Risk Assessment A 2.45% pay offer made by Employers has been rejected by the Unions and strike action is being considered. Increases in fuel prices are affecting the Environment budget. 0 0 Planning income achieveme nt 0 250 Housing – income 0 0 Housing Stock Transfer heads. There is now growing pressure upon care for adults with learning difficulties as a consequence of longer life expectancy and children in care with such difficulties transferring to the adult service. Additional funding of £600k was provided in the 2007/08 budget to mitigate the risk, but further demands have resulted in a £1m overspend in 2007/08 on the learning difficulties service. Whilst this can be mitigated by largely one-off measures in 2007/08, these demand pressures will continue into 2008/09. The Community Health and Social Care directorate has identified the means of funding this spending pressure, but demographic pressures on this service continue, with a risk that the budget may be exceeded. A number of income budgets, e.g. planning and building control fees, parking fines, market and commercial rents, are all subject to economic conditions or external demand influences, any one of which may unexpectedly develop a significant shortfall. Income continues to be buoyant and therefore there is not considered to be a risk at present. The threat of adverse housing market conditions may cause planning applications to slow down. Previous concerns about the adequacy of income sources, notably Supporting People grant, have diminished as the level of funding has flattened out. (a) There is a new risk that the transfer of housing stock to City West in 2008 could lead to cost pressures upon certain General Fund services, e.g. grounds maintenance, call 11 0 250 0 0 250 500 This risk still remains the same as the SLA negotiations are ongoing. centre, support services. Whilst any transfer of service to City West or a new external provider appointed by City West would lead to a loss of income to the General Fund there would be a transfer of staff under TUPE regulations and hence a corresponding reduction in direct salary costs. However, it may not be possible to reduce fixed costs and overheads proportionately, leading to a possible cost being borne by the Council. (b) The planned date of the stock transfer is 28th July 2008. This is still subject to detailed negotiations with the DCLG and may be subject to delay. Each month’s delay could incur an additional £400k of capital financing costs to the General Fund budget 1,000 2,000 Children in Care There is a continual risk that demand pressures from a potential increase in the number and cost of child care placements will exceed budget provision despite current budget provision being based on known commitments and forecast trends. The base budget for 2007/08 was increased by £1m to recognise the growing demands, but further demands have resulted in a £200k overspend in 2007/08. Whilst this can be managed within budget in 2007/08 and steps can be taken to mitigate the impact for 2008/09, demographic pressures on this service continue, with a risk that the budget may be exceeded. 12 800 1,200 1,000 2,000 250 500 Children – SEN Transport 250 500 Recycling 100 200 Environme nt - budget pressures 250 500 Nonachieveme nt of savings There is a continual risk of demand pressures from a potential increase in the number of special needs children requiring transport provision. Additional funding of £600k provided in the 2007/08 budget mitigated the risk, but additional costs are re-emerging and the 2007/08 budget could be overspent by £200k. Whilst this can be managed within budget in 2007/08 and steps can be taken to mitigate the impact for 2008/09, demographic pressures on this service continue, with a risk that the budget may be exceeded. The risk of failing to achieve recycling targets and thus minimise waste disposed to landfill, with the result that the Council is penalised through the mechanism of the waste disposal levy, which is now based on household waste tonnage disposed of, has now diminished as a result of the future budget provision made for increases in the waste levy. The risk that the withdrawal of the cross subsidy to trade waste from the household waste levy would result in customer resistance to the resultant increase in charges and lead to a shortfall in trade waste income has now been addressed in the budget and has diminished It is envisaged that most efficiency proposals built into the budget plans are capable of being delivered on time and that directorates have the capacity and flexibility to meet any shortfall from within their own allocations, but there is a risk of some savings not being delivered on time or not at all and compensating savings not being found. This is considered to be a potentially 13 250 500 0 0 0 0 500 1,000 Risk still remains the same. 250 500 3,600 7,700 Other unforeseen expenditure/incom e shortfall Total higher risk than previously because of more challenging targets. There is a risk that unexpected events may occur which require expenditure to be incurred or income to be foregone, which have not been budgeted for. 14 500 500 5,300 9,700 Risk still remains the same. Appendix 3 Prudential Indicators a) Authorised Limit for External Debt, Forward Estimates 2008/09 2009/10 2010/11 £m £m £m Total Authorised Limit for 659 662 538 External Debt Actual Gross External Debt as at 561 13/06/08 This limit represents the total level of external debt (and other long term liabilities, such as finance leases) the council is likely to need in each year to meet all possible eventualities that may arise in its treasury management activities. b) Operational Boundary for External Debt 2008/09 2009/10 2010/11 £m 562 £m 437 £m 476 2008/09 2009/10 2010/11 % 100 % 100 % 100 50 50 50 Total Operational Boundary for External debt Actual Gross External Debt as at 561 13/06/08 This limit reflects the estimate of the most likely, prudent, but not worse case, scenario without the additional headroom included within the authorised limit. The operational boundary represents a key benchmark against which detailed monitoring is undertaken by treasury officers. c) Limits on Interest Rate Exposure Upper Limit on Fixed Interest Rate Exposure Upper Limit on Variable Interest Rate Exposure Current exposure to variable rate d) (All years) maturity structure for fixed rate borrowing Under 12 months 12 and within 24 months 24 months and within 5 years 5 years and within 10 years 10 years and above Variable rate debt maturing in any one year (local indicator) 0 Upper Limit Lower Limit % 50 50 50 50 100 % 0 0 0 0 40 Current Maturity Profile % 0.0 11.2 0.0 23.8 65.0 30 0 4.3 15 Appendix 3 contd Prudential Indicators contd e) Limits on Long-Term Investments Upper limit for investments of more than 364 days Current total investment in excess of 364 days 2008/09 £m 30 2009/10 £m 30 2010/11 £m 30 13 13 13 f) Comparison of Net Borrowing and Capital Financing Requirement In order to ensure that, over the medium term, net borrowing will only be for a capital purpose, the Council should ensure that the net external borrowing does not, except in the short term, exceed the total of the capital financing requirement in the preceding year plus the estimates of any additional capital financing requirement for the current and the next two financial years. This forms an acid test of the adequacy of the capital financing requirement and an early warning system of whether any of the above limits could be breached. To date this indicator has been met. The current capital financing requirement is £515m and the net borrowing requirement £485m. Details are set out in the table overleaf. 16 Appendix 3 contd Prudential Indicators contd Date 01/04/2008 02/04/2008 03/04/2008 04/04/2008 05/04/2008 06/04/2008 07/04/2008 08/04/2008 09/04/2008 10/04/2008 11/04/2008 12/04/2008 13/04/2008 14/04/2008 15/04/2008 16/04/2008 17/04/2008 18/04/2008 19/04/2008 20/04/2008 21/04/2008 22/04/2008 23/04/2008 24/04/2008 25/04/2008 26/04/2008 27/04/2008 28/04/2008 29/04/2008 30/04/2008 01/05/2008 02/05/2008 03/05/2008 04/05/2008 05/05/2008 06/05/2008 07/05/2008 08/05/2008 09/05/2008 10/05/2008 11/05/2008 12/05/2008 13/05/2008 14/05/2008 15/05/2008 16/05/2008 17/05/2008 18/05/2008 Comparison of Net Borrowing and CFR Debt Temporary Net Outstanding Investments Borrowing £'000 571,715 570,315 569,815 571,115 571,115 571,115 571,315 570,815 571,115 574,215 574,215 574,215 574,215 568,215 568,215 565,415 564,515 564,915 564,915 564,915 561,415 562,315 564,315 566,415 561,315 561,315 561,315 563,215 563,515 566,815 564,015 560,615 560,615 560,615 560,615 558,415 560,315 556,915 553,615 553,615 553,615 553,515 555,715 558,615 555,215 560,215 560,215 560,215 £'000 70,565 70,565 71,065 70,565 70,565 70,565 71,065 71,065 71,065 71,065 71,065 71,065 71,065 71,765 72,665 72,850 72,850 72,850 72,850 72,850 72,850 72,850 72,850 72,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 73,850 75,850 75,850 75,850 75,850 Capital Finance Requirement Authorised Limit £'000 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 £'000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 £'000 501,150 499,750 498,750 500,550 500,550 500,550 500,250 499,750 500,050 503,150 503,150 503,150 503,150 496,450 495,550 492,565 491,665 492,065 492,065 492,065 488,565 489,465 491,465 493,565 487,465 487,465 487,465 489,365 489,665 492,965 490,165 486,765 486,765 486,765 486,765 484,565 486,465 483,065 479,765 479,765 479,765 479,665 481,865 484,765 479,365 484,365 484,365 484,365 17 Capital Finance Requirement Head Room £'000 13,380 14,780 15,780 13,980 13,980 13,980 14,280 14,780 14,480 11,380 11,380 11,380 11,380 18,080 18,980 21,965 22,865 22,465 22,465 22,465 25,965 25,065 23,065 20,965 27,065 27,065 27,065 25,165 24,865 21,565 24,365 27,765 27,765 27,765 27,765 29,965 28,065 31,465 34,765 34,765 34,765 34,865 32,665 29,765 35,165 30,165 30,165 30,165 Authorised Limit Head Room £'000 90,285 91,685 92,185 90,885 90,885 90,885 90,685 91,185 90,885 87,785 87,785 87,785 87,785 93,785 93,785 96,585 97,485 97,085 97,085 97,085 100,585 99,685 97,685 95,585 100,685 100,685 100,685 98,785 98,485 95,185 97,985 101,385 101,385 101,385 101,385 103,585 101,685 105,085 108,385 108,385 108,385 108,485 106,285 103,385 106,785 101,785 101,785 101,785 19/05/2008 20/05/2008 21/05/2008 22/05/2008 23/05/2008 24/05/2008 25/05/2008 26/05/2008 27/05/2008 28/05/2008 29/05/2008 30/05/2008 31/05/2008 01/06/2008 02/06/2008 03/06/2008 04/06/2008 05/06/2008 06/06/2008 07/06/2008 08/06/2008 09/06/2008 10/06/2008 11/06/2008 12/06/2008 13/06/2008 560,515 557,715 556,115 556,115 558,115 558,115 558,115 558,115 553,915 554,215 554,115 553,215 553,215 553,215 551,115 544,415 544,615 544,915 545,615 545,615 545,615 547,415 550,915 551,415 550,615 560,615 75,850 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,350 77,550 77,550 77,550 77,550 77,550 77,550 77,550 77,550 77,750 77,750 74,750 484,665 480,365 478,765 478,765 480,765 480,765 480,765 480,765 476,565 476,865 476,765 475,865 475,865 475,865 473,765 466,865 467,065 467,365 468,065 468,065 468,065 469,865 473,365 473,665 472,865 485,865 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 514,530 18 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 662,000 29,865 34,165 35,765 35,765 33,765 33,765 33,765 33,765 37,965 37,665 37,765 38,665 38,665 38,665 40,765 47,665 47,465 47,165 46,465 46,465 46,465 44,665 41,165 40,865 41,665 28,665 101,485 104,285 105,885 105,885 103,885 103,885 103,885 103,885 108,085 107,785 107,885 108,785 108,785 108,785 110,885 117,585 117,385 117,085 116,385 116,385 116,385 114,585 111,085 110,585 111,385 101,385

0

0

advertisement

Download

advertisement

Add this document to collection(s)

You can add this document to your study collection(s)

Sign in Available only to authorized usersAdd this document to saved

You can add this document to your saved list

Sign in Available only to authorized users