Based on equations and , the following three simple rules

advertisement

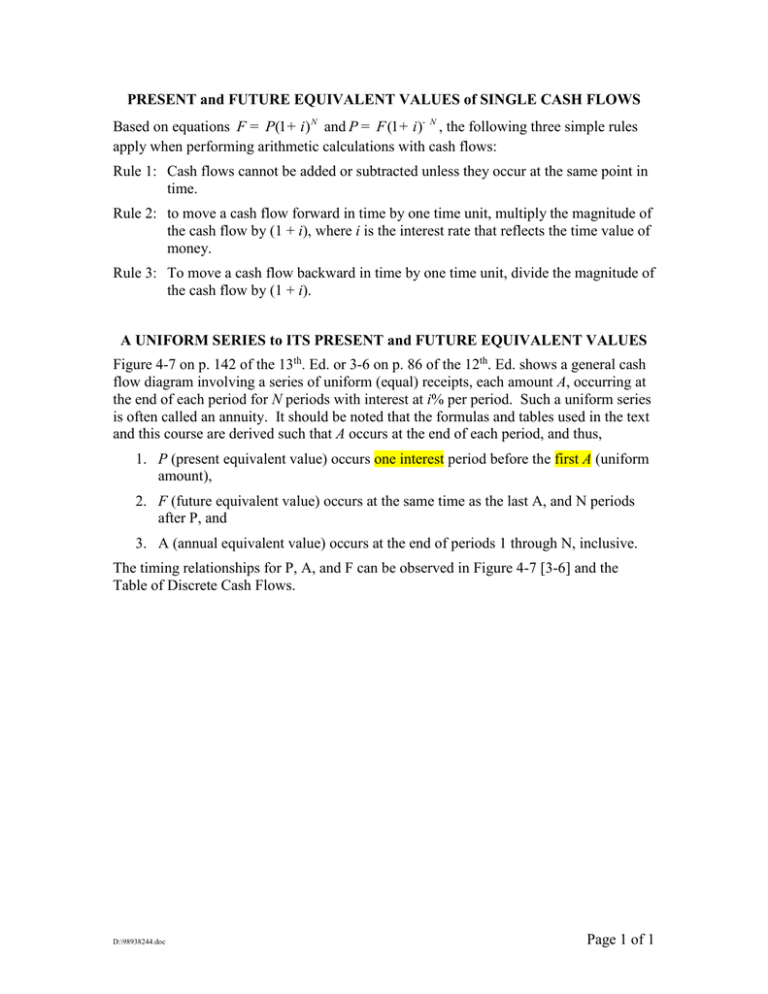

PRESENT and FUTURE EQUIVALENT VALUES of SINGLE CASH FLOWS Based on equations F = P(1 + i) N and P = F (1 + i)- N , the following three simple rules apply when performing arithmetic calculations with cash flows: Rule 1: Cash flows cannot be added or subtracted unless they occur at the same point in time. Rule 2: to move a cash flow forward in time by one time unit, multiply the magnitude of the cash flow by (1 + i), where i is the interest rate that reflects the time value of money. Rule 3: To move a cash flow backward in time by one time unit, divide the magnitude of the cash flow by (1 + i). A UNIFORM SERIES to ITS PRESENT and FUTURE EQUIVALENT VALUES Figure 4-7 on p. 142 of the 13th. Ed. or 3-6 on p. 86 of the 12th. Ed. shows a general cash flow diagram involving a series of uniform (equal) receipts, each amount A, occurring at the end of each period for N periods with interest at i% per period. Such a uniform series is often called an annuity. It should be noted that the formulas and tables used in the text and this course are derived such that A occurs at the end of each period, and thus, 1. P (present equivalent value) occurs one interest period before the first A (uniform amount), 2. F (future equivalent value) occurs at the same time as the last A, and N periods after P, and 3. A (annual equivalent value) occurs at the end of periods 1 through N, inclusive. The timing relationships for P, A, and F can be observed in Figure 4-7 [3-6] and the Table of Discrete Cash Flows. D:\98938244.doc Page 1 of 1