Evaluation in the CMA Natalie Timan, Director of Economics 19 November 2014

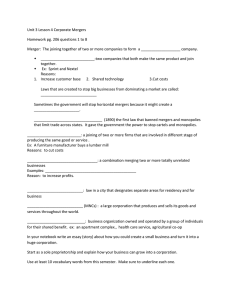

advertisement

Evaluation in the CMA Our mission is to make markets work well for consumers, businesses and the economy Natalie Timan, Director of Economics 19 November 2014 1 Contents ● Promoting competition: the benefits of competition and how they can be realised - What is competition and why does it matter? Benefits of competition How benefits can be realised ● Evaluation in the CMA - Essential features Positive impact in competition law enforcement, mergers, market investigations and consumer policy Ex-post evaluation ● Indirect benefits 2 Promoting competition: the benefits of competition and how they can be realised 3 What is competition and why does it matter? Vigorous competition provides firms with incentives to deliver what consumers want as efficiently and innovatively as possible Consumers play a key role in activating vigorous competition between firms 4 Benefits of competition 1. Lower prices 2. More choice 3. Better quality 4. Innovation 5 Competition, innovation and growth ● Link competition to innovation and growth key way of promoting competition policy and reforms ● CMA’s missions statement: make markets work well for consumers, businesses and the economy ● How competition increases innovation and growth - Output = f [natural resources, capital, labour] technology, management - Prioritise interventions that lift restrictions on e.g.: Land (natural resource); Finance (capital) Markets associated with labour participation and higher education (labour) Innovation intensive sectors e.g. Pharmaceuticals Tackling public restrictions on competition -> managers not sheltered from impact of competition 6 But how do we get all these benefits? Markets have to be competitive to realise benefits for consumers ● Sufficient firms in the market to ensure rivalry ● Ease of market entry and exit ● No barriers to expansion for firms in the market ● Widespread availability of information about the market 7 Why might markets not be competitive? Competition problems… …Leads to... • • • Capacity constraints High concentration Lack of substitutes Market power • • • Intrinsic barriers Strategic barriers Regulatory barriers Barriers to entry, expansion & exit • • • • Price fixing Share markets Allocate customers Firms follow each other Coordinated conduct • • Foreclosure Dampened competition Vertical relationships • Limited shopping and switching Weak customer response …and ultimately risk of.. Poor outcomes for consumers 8 Barriers to entry in the pharmacy industry ● In 2003 OFT recommended entry controls for community pharmacies be abolished altogether ● In 2005 DH introduced a criterion of consumer choice and created exemptions from control of entry test ● What impact? - £16.4m-£24.5m in travel time savings - £3.3m in reduced waiting times - £5m in consumer savings on medicines - increase of 8.8 per cent in the number of pharmacies in England ● What would have happened? - None of the above - Regulatory costs to businesses and the NHS of £12.5m 9 What roles can government play in markets? Government can play 4 roles in markets …influencing the market without participating directly itself through market shaping/regulat ions through taxes and subsidies …directly participating in the market through acting as a buyer through acting as a supplier The impact government can have on firm incentives is a theme that runs across these different roles 10 Evaluation in the CMA 11 The CMA uses a range of tools to make markets work better for consumers Unfair Contract Terms Anti-competitive agreements Abuse of dominance Market Studies and Investigations Unfair Commercial Practices Other consumer legislation Merger control Advocacy Guidance CONSUMER ENFORCEMENT COMPETITION ENFORCEMENT As an independent authority we use our prioritisation principles to determine where to focus our resources and tools Education Guidance Compliance SOFTER NON-ENFORCEMENT TOOLS 12 CMA’s approach to evaluation ● Our approach to evaluation has three strands: - Estimating the impact of each project as it completes Evaluating projects to identify the costs and benefits, and lessons learned Exploring further how best to assess the CMA’s wider impact on economic growth including through deterrence or improving the prospects for exit, entry and innovation in markets ● The aim of our evaluation work is two-fold: - External accountability: to evaluate whether the CMA delivers its objectives and does so cost effectively and to demonstrate this externally Internal management and prioritisation: to inform future CMA work regarding how we prioritise, conduct and follow-up our work to ensure we maximise our impact. This is an assessment of the accuracy of our predictions about markets and the effectiveness of our interventions. A separate internal evaluation of our procedures and efficiency is carried out after each project 13 Essential features (i) ● Any evaluation or impact estimation will have the following common, essential features: - A ‘Theory of harm’ Understanding what the action/reform was intended to do Test changes in the market resulting from the action/reform to evaluate the impact the action/reform has had on welfare ● An understanding of how competition works in a market is an important step towards establishing these features ● CMA’s knowledge of the market stems from case teams’ in-depth investigations 14 Essential features (ii) ● Identify those markets that are directly affected by a policy and those indirectly affected through knock-on effects ● For each affected market determine: - the size of the market who are the major players? is the market local, regional, nation, or international? are there any barriers to entry or exit in the market? 15 Essential features (iii) ● Explore the implications for firms by asking does the reform: - directly or indirectly expand the number or range of suppliers? increase the ability of suppliers to compete? increase supplier’s incentives to compete vigorously? ● Explore the implications for consumers by asking if the reform: - reduces barriers to accessing and assessing information? makes it more/less obvious what other consumers are doing in a market/that others could be getting a better deal? improves the ability for consumers to switch providers? ● Consider how firms and consumers interact! 16 Positive Impact 17 Positive Impact Evaluation Background ● Positive Impact Evaluation aims to quantify the benefits delivered to consumers from CMA work ● As part of its Performance Management Framework with BIS, the CMA is required to demonstrate the delivery of £10 of benefit to UK consumers for every £1 the organisation costs. The target relates only to direct financial benefits to consumers ● Calculations are made using assumptions formed after the case closes to estimate increases in consumer welfare arising from CMA interventions ● Figures are intended to be lower bound estimates and presented as three year rolling averages due to uneven caseloads across years ● Previously, where market studies/investigations or mergers were looked at by both the OFT and the CC, the benefit was split 80/20 Why do it? ● To demonstrate the value for money delivered to UK consumers ● For the benefit of staff to see the results of hard work ● To track performance and maintain our position as a world class competition authority 18 Historical Performance Annualised Benefits (OFT) Estimated average annual consumer savings 2010-13 Mergers £13m Consumer Protection Enforcement £77m Market studies, reviews of orders and undertaking, and market investigation references Competition Enforcement £195m Total Benefits £422m Total OFT costs (averaged over 2010-12) £48m Ratio 8.7:1 £136m 19 Competition Law Enforcement Method ● Competition Law Enforcement relates to anything which remedies Chapter I (Anticompetitive agreements/Cartels) or Chapter II (Abuse of Dominance) infringements ● The positive impact is estimated as set out in the formula below. Ideally price changes and duration of infringement will have been calculated during the investigation or can be calculated from information specific to the case. Otherwise we apply a rule of thumb based on international evidence. Rules of Thumb • • 𝑎 = annual impact t = turnover of goods p = price increase (%) 𝑎 = 𝑡𝑝 𝑎𝑡 = 𝑐 𝑎 𝑠=1 (1+𝜌)𝑠 𝑎𝑡 = total impact c = no. years operational 𝜌 = social discount rate • 𝟏 In absence of better information and based on international best practice and academic research • c = 6 years • 𝜌 = 3.5% • Overcharge = 15% (fully passed on) ● This should represent a lower bound estimate and ignores any price increases which may have arisen from competitors not involved in the anti-competitive behaviour ● For Chapter I, the turnover is taken to mean the turnover of parties involved in the anticompetitive behaviour in the relevant market(s). For Chapter II, the case teams can typically provide the appropriate turnover figures. 1 OECD recommend: c = 3 years, overcharge = 10%/5% (Cartel/AoD) 20 Competition Law Example – Napp Pharmaceuticals (2001) ● Napp is a leading supplier of pain medication and held a dominant position in the market for sustained release morphine to hospitals and communities ● In order to maintain its dominant position in the larger community market, Napp was offering large discounts (up to 90%) in the gateway hospital market ● The OFT intervened and found Napp guilty of predatory pricing. They were fined £2.2m (after appeal) and were limited to offering hospital discounts of less than 80% ● To calculate the positive impact, case teams came up with an estimate • ● ● Assuming an overall price decrease of x%, a y year duration and a 3.5% discount rate This calculation was followed up with ex post, in depth analysis looking at actual price data from each market: • Community: competition improved and prices decreased by 25%. This was compared to a counterfactual which assumed prices remained at pre intervention levels. This gave savings of £1.7 million per year or £15.1 million from 2001-2009 • Hospital: due to the restrictions on discounts, the benefits from the community market had to be offset against extra costs in the hospital segment. Hospital prices increased by £200k to £225k per year • In the interests of calculating a conservative estimate, we took the £225k figure which gave overall savings of £1.5m per year or £13m (2001-2009) The estimate from the impact estimation was lower than the ex post evaluation. This example underlies our belief that impact estimation is usually conservative 21 Mergers Method ● How much consumer detriment was avoided from the blocking of anti-competitive mergers? ● Previously, we used Cournot or Betrand merger simulation. However, due to a large amount of assumptions and the time involved in such methods, we now use a new approach ● GUPPI (Gross Upward Pricing Pressure Index) gives a measure of the incentives of a merged firm to rise prices (%) ● Equation: 𝐷12 (𝑃2 −𝐶2 ) 𝐷12 = pre-merger diversion ratio from Product 1 to Product 2 ( ∆𝑄2 ) ∆𝑄1 • 𝐺𝑈𝑃𝑃𝐼1 = • Multiplying this percentage by the revenues of the relevant products, gives the gross price increase expected from an anticompetitive merger. This is based on the assumed pass through rate of 100% (ie all upward pricing pressure is realised in actual price increases). 𝑃1 P C = pre-merger price levels = costs (which, with P, gives an idea of the margin) ● Most case teams will have all required information for the calculation while some will have estimated the ratio in the course of their work ● Where insufficient information is available to calculate GUPPI ratios, we work closely with case teams to make accurate assumptions about potential prise increases ● In some cases, on the advise of case teams, we may adopt a more bespoke approach to assessing the positive impact of a merger decision (see example 2 below) 22 Mergers Example 1 – Jewson / Build Centre (2012/13) ● Jewson agreed to sell 22 branches as UiL for merger with Build Centre ● OFT looked at GUPPI ratios and revenues to find impact for each branch before these figures were added together to estimate total positive impact ● Diversion ratios were calculated from survey data asking respondents who shopped at either Jewson or Build Centre to indicate where they would purchase specific items if they were no longer available in their preferred shop. These were then combined with information from company accounts on prices and costs to establish the GUPPI percentage. ● For example, area one: • • Total revenue of Build Centre = £am GUPPI (Build Centre to Jewson) = b% Multiply together (assume 100% pass through) gives detriment = £ck Total revenue of Jewson = £dm GUPPI (Jewson to Build Centre) = e% Detriment = £fk Total positive impact for area one = £gk This same method is applied to all 22 affected areas giving estimated total avoided detriment from the UiL of £hm per year Assuming discount rate of 3.5%, inflation of 3% and duration of 2 years; can work out Present Value and NPV positive impact 23 Mergers Example 2 – Akzo / Metlac (2013/14, CC) ● CC blocked the merger of Akzo and Metlac due to substantial lessening of competition in the supply of metal packaging coatings for beer and beverage cans in the UK ● Through close work with the case team, the following conclusions were made regarding the impact of the blocked merger ● Customers complained that Metlac was an important price competitor to Akzo and the rest of the market ● The relevant market was estimated as the £xm B2E segment ● The assumed price rise was set at α% which was conservative due to the fact that Metlac was not seen as a constraint over the entire market ● ● α% of £xm £ym of avoided detriment to customers With an assumed duration of β years and discount rate of 3.5%, NPV was £y𝑚 calculated as £zm (£ym + 1.035 = £zm) 24 Market Investigations Method ● Quantifying the positive impact from investigations into nonfunctioning markets is difficult and, due to the variety of activities, there is no generic approach ● Case teams are crucial as their expertise on the case at hand is key to forming realistic assumptions about the positive impact of the investigations. In some cases, a detailed detriment calculation will have been made during the investigation and this information should provide a good basis for calculating the positive impact. ● Often, this information is expanded with observations on developments after the remedy and occasional in depth evaluations some time after the intervention 25 Consumer Policy Method ● Consumer policy covers a wide range of enforcement activity which seeks to change trader behaviour which contravenes consumer protection legislation and promotes competitive practices ● Formerly, the positive impact calculation was based on complaints from consumers. Looking at the number of complaints received in a 12 month period before and after the intervention and assigning each complaint a monetary value allows estimation of the positive impact the CMA has had. Thus, complaints are equated to actual infringements ● Now, the calculation is more similar to the Market Investigations and Competition Enforcement methods listed above. We work closely with case teams to establish key assumptions and often use the same formula described under Competition Enforcement. 26 Ex-post evaluation 27 Ex-post evaluation ● What is ex-post evaluation? - An ex-post assessment of the actual impact of our interventions in enforcement cases. Primary purpose: measure the net benefits to consumers of any intervention. Secondary purpose: examine wider benefits (usually unquantifiable), such as the effect on consumer confidence and deterrence. Typically compares the quantified net benefit to the cost incurred by the OFT in the initial intervention. ● How do we evaluate? - Can involve: (i) desk-based research on prices and other market data, (ii) surveys of consumers, businesses and other stakeholders. Usually conduct two to three evaluations a year. Can be conducted immediately after a case is completed, but typically there is a delay, potentially up to several years, whilst recommendations are implemented. 28 Ex-post evaluation ● Formal techniques: - Simulations and structural models Event studies Difference in Difference techniques ● Reality: - Identify changes in market characteristics (price, quality, choice etc) Identify changes in consumer behaviours (shopping habits, awareness and understanding, product selection) 29 Indirect impact 30 Indirect impact ● Positive impact is measured as a direct impact but it underestimates overall impact: - Indirect impacts exist beyond the scope of direct impact evaluation Certain areas may be delivering higher (lower) benefits than this evaluation suggests • - In particular, mergers seem to be undervalued which might be redressed if indirect impacts are taken into account This is important when it comes to prioritisation of cases ● Increases in enforcement activity are not always associated with the effectiveness of a competition authority - In fact, a well functioning regime should be able to minimise its enforcement through effective deterrence ● CMA has begun surveying relevant literature, focussing on the bottom up method - In order to properly account for the impact of different competition tools, a bottom up approach is preferable Top down studies give a good estimate of the overall impact a competition authority is having on macro variables but does little to apportion this between direct and indirect and even less to split the impacts into different competition areas 31 Cartels and deterrence (I) Population of Cases Undeterred Deterred Undetected Detected Type II Errors (unobservable) Direct Impact (observable) Indirect Impact (unobservable) 32 Cartels and deterrence (II) ● Indirect Impact refers to the amount of deterred harm in an economy. The possibility of Type II errors mean it is also worth looking at the amount of undetected harm as well. ● In addition, deterred harm may not only come from reducing cartel formation but also from reduced overcharge by existing but undetected cartels. ● Deterred harm can be looked at in three ways: ● ● ● - Surveys - Looking at the effect of enforcement on profitability of cartels - Estimating the effect of policy on the population of cartels by drawing inferences from the population of discovered cartels The papers look at: - Ratios of latent to observed cartels - Magnitude of overcharge - Average duration Methods include: - Conditional probability of detection - Natural (econometric) experiments - Profitability of price fixing Key shortcoming - Unobservable population - Sample selection bias 33 Merger and deterrence ● Literature on deterrence of mergers much more limited than that of cartels ● Indirect benefits from merger control arise in two forms: - Frequency based deterrence- potential mergers do not go ahead due to the possibility of scrutiny by the merger control regime - Composition based deterrence- mergers are modified to avoid the scrutiny of the merger control regime ● Some literature has focussed on survey based methods ● Other academics have focussed on empirical and theoretical work which looks at the effect of merger enforcement on the number/composition of (future) mergers notified to the competition authority ● Most work assumes that merger enforcement has a greater deterrent effect on anticompetitive (rather than pro-competitive) mergers and the literature suggests that increasing numbers of enforcement decisions do lead to fewer notified mergers ● There is, however, disagreement on the types of actions that have the greatest deterrence effect ● Type I and II errors are also worth considering ● Deterrence is most likely at the bottom and top of the anticompetitive harm distribution; mergers with small anticompetitive effects are likely to be deterred by the admin costs whilst the most anticompetitive mergers are deterred by the prospects of being blocked 34 Questions? 35