Emerging Market response to Developed Countries over recent

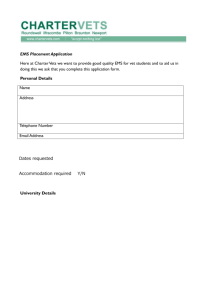

advertisement

1 Emerging Market response to Developed Countries over recent periods of US recessions and crises: What changed? 1 Regan Deonanan2 University of Notre Dame, Department of Economics, 424 Flanner Hall, Notre Dame, IN 46637, USA Preliminary - not for publication May 31st, 2011 1 Many thanks are expressed to the Department of Economics at the University Notre Dame for helpful suggestions and comments. All errors are my own. 2 The author is currently a 4th-year Economics PhD (ABD) Candidate at the University of Notre Dame, Indiana, USA. Questions/comments may be emailed to rdeonana@nd.edu. The author may also be reached at mobile number 202-299-7505. 2 Emerging Market response to Developed Countries over recent periods of US recessions and crises: What changed? Abstract Emerging markets have responded very differently towards developed countries over the 2007 financial crisis as compared to the 1981, 1990 and 2001 US recessions. Was this simply the result of a bigger crisis resulting from bigger US shocks or did the transmission mechanism change due to changes in the economies of emerging markets? This paper documents the difference in behavior between these two groups and then investigates which is a more significant explanation of the change: size of the shock or propagation? Additionally, if it is propagation, what factors are associated with the underlying structural change? Three main results are contributed. First, structural change within emerging markets played a bigger role than the size of the US shocks. Second, the structural change was oriented particularly towards the US. Third, the structural change was associated with trade factors and not financial factors. Collectively, these findings have important policy implications for countries seeking to diversify economic growth risks through particular trade partners, as well as, investors managing investment risk through portfolio diversification. Keywords: Financial Crises; Emerging Market Growth, Shocks 3 1. Introduction This paper is motivated by the observation that emerging markets (EMs) have responded very differently to developed countries (DCs) during the most recent US disturbance as compared to the previous three US disturbances. As Figure 1 shows, there was a significant increase in the modal pair-wise correlation of quarterly real GDP growth between EMs and DCs over the 2007 financial crisis versus the US recessions of 1981, 1990 and 2001. In contrast, there was little change in this EM-DC relationship over the previous three US recessions. The picture that emerges therefore is that something changed markedly in moving from the 2001 US recession period to the 2007 financial crisis period. The primary issue is then, “What’s driving this recent change in EM response?” Within this context, this paper empirically investigates the direct impact of US growth and US shocks on EM growth over the 2001 US recession and 2007 financial crisis through two main questions. Firstly, was it the size of the US shock (impulse) or change in propagation of the US shock within EMs (indicating structural change) that is driving our observation? Secondly, if the propagation mechanism is responsible, what factors underlie the structural change within EMs? This paper adds to the literature examining the impact of the 2007 financial crisis on EMs. In terms of the most closely related paper, Blanchard, Das and Faruqee (2010) seek to explain the heterogeneity of EM growth over the 2007 crisis in terms of pre-crisis macro-variables. Using 29 EM countries and a crosssectional regression of unexpected nominal gross domestic product (gdp) growth (averaged over 2008Q4 and 2009Q1) on 2007 pre-crisis variables, they conclude that the diverse pattern observed can be explained by ‘differences in trade and financial exposure’ and ‘differing growth performances of countries’ trading partners.’ The approach of this paper is very different from the current related literature. Fundamentally, it seeks the root cause of the recent different EM response from a very elementary level (impulse versus propagation) which is important because each carries different policy prescriptions for EMs. It also attempts to understand the underlying factors from both cross-sectional and time-dimensional points of view using a panel of real gdp growth of 24 EM countries over the 2001 US recession period and 2007 US crisis period. In addition to documenting the change in response behavior of EMs towards DCs over various US disturbance periods, this paper also contributes the following three main results. Firstly, structural change within EMs was the main driver of the difference in recent EM behavior. Secondly, the structural change 4 within EMs was US driven. Thirdly, the structural change enabled the US to have a bigger impact on EMs through trade channels; greater impact through financial channels was not associated with the structural change. The rest of the paper follows with Section 2 describing the data sources, Section 3 discussing the methodology employed, Section 4 interpreting the results and Section 5 providing concluding remarks. 2. Data Quarterly nominal gdp and gdp deflator (local currency) for EMs and DCs were obtained from the IFS database for the period 1980q1 through 2009q3, or as available. Quarterly real gdp (2005 base year, local currency) was calculated and seasonally adjusted as needed (using Eviews X12 function), and then used to construct real gdp growth. The panel consisted of real gdp (rgdp) growth for 24 EM countries over the period 1999Q1 through 2009Q3. 1999Q1-2004Q4 was defined as period 1 and corresponded to the 2001 US recession period. 2005Q1-2009Q3 was defined as period 2 and corresponded to the 2007 financial crisis period. The MSCI, FTSE and Dow Jones Emerging Market listings were used to identify EM countries (39 in total) – the 24 EMs included in the panel represented those with data over the periods of interest. Most of the cross-sectional data for the 24 EMs was also obtained from the IFS database but were annual series (nominal gdp, exports, imports, gross fixed capital formation, household consumption and government consumption). The pre-crisis periods used were 1999-2000 and 2005-2006. The financial openness variable used was the Chinn-Ito index (available on the websites of these authors) for the same period. Both FDI inflows and bank capital to asset ratios were obtained from the WDI database for the same periods. The aggregate G6 rgdp growth rate was calculated using an arithmetic average of the individual quarterly rgdp growth, weighted by real gdp in 2005. 5 3. Methodology 3.1 Intuition Structural VAR is the usual approach employed to identify shocks and perform impulse responses to shocks, in an effort to uncover causal factors driving crises. However, given the short periods under consideration, identification of the shocks poses a problem. To address this limitation, two assumptions are made: (1) DCs are the most important trading partners of EMs and consequently, developments in DCs are the most important drivers of EM growth rates; and, (2) EMs have no power to influence DC behavior. As a result, we can think of EM growth as being influenced in either of the following ways during US disturbance periods (subsequently referred to as ‘Case 1’ and ‘Case 2’ respectively): EM growth = Prior EM growth + US shocks + Other DC shocks + EM shocks EM growth = Prior EM growth + US growth + Other DC growth + EM shocks Given that the periods being examined are limited to the last two US disturbances, the US can be thought of as the source of a global disturbance to EMs. As such, the ‘US growth’ (or ‘US shocks’) term constitutes the direct influence of the global disturbance on EMs whereas the ‘Other DC growth’ (or ‘Other DC shocks’) represents the indirect/spillover of the global disturbance to EMs. The intuition gained from the equations above is that the direct influence term became relatively bigger over the 2007 crisis, resulting in EMs becoming more correlated with the US. At the same time, as noted by other papers in the crisis literature (Perri and Quadrini (2010)), other DCs have also become significantly more correlated with the US. These two factors combined would then account for the recent higher correlation between EMs and DCs. The primary interest of this paper is therefore identifying the most important factor behind the direct influence term becoming bigger. The two possible candidates are: Change in size of the US disturbance (impulse) Change in propagation of the US disturbance (due to structural change within EM economies) 6 3.2 Determination of the shocks Since the time periods being considered are short and identification of the shocks emanating from the US and other DCs (henceforth taken to be the G6 countries) poses a problem, the following method was utilized to proxy for the shocks. Consider the regression of the US growth rate on lags of itself: k 4 US YtUS cons kUS YtUS k et k 1 Thinking about a shock as the unpredicted change in the growth rate, the error term is used as a proxy to the shock from the US (henceforth referred to as the US shock). This regression is run separately for two periods: 1990q1-2004q4 and 2004q1-2009q3 (to allow for different variances of the shocks) and the error terms are recovered. Each error term is then taken as the US shock over period 1 and period 2 defined in the data section. The procedure was repeated for G6 growth to recover the G6 shocks. Table 1 and Table 2 in the Appendix give the results of these regressions respectively. 3.3 Impulse or propagation? The equations described in the ‘Intuition’ section motivate the following regressions performed on a panel of EM growth of 24 countries over 1999q1 through 2009q3 (periods 1 and 2) and correspond respectively to Case 1 and Case 2 mentioned earlier: k 4 US Yi ,EM consi kEM Yi ,EM 2etUS * dumt 3dumt 4etG 6 5etG 6 * dumt i ,t t t k 1et k 1 The LHS is EM rgdp growth. The RHS consists of a constant for each EM country, 4 lags of EM rgdp growth, the US shock, the US shock interacted with the period dummy, the period dummy (‘0’ for period 1 and ‘1’ for period 2), the G6 disturbance, the G6 disturbance interacted with the period dummy and the error term. For Case 2, the US and G6 shocks are replaced with US and G6 growth rates. k 4 US Yi ,EM consi kEM Yi ,EM 2 YtUS * dumt 3dumt 4 Yt G 6 5 Yt G 6 * dumt i ,t t t k 1Yt k 1 The null hypothesis being tested here is that 2 , the additional effect in period 2 of the US growth (shock) on EM growth as compared to period 1, is statistically equal to zero. Under the null we would conclude that the US shock (or growth) in period 2 did not have a significantly different effect on EM 7 growth as compared to period 1. If the standard deviation of the shock (growth) in period two was statistically different from period 1 then the direct influence of the US shock (growth) on EMs would have been bigger because of the size of the shock (growth). The impulse argument would be favored. On the other hand, rejecting the null would imply a different effect exerted by the US on EMs and consequently interpreted as structural change within EMs (propagation argument). A statistically different US shock (growth) would also mean that the impulse argument is possible. In this case, counterfactual analyses would have to be performed to delineate the two possibilities. The results of both cases are reported in Table 3. 3.4 Impulse or propagation? – Counterfactual analysis In the above section, the determination of structural change was contingent upon observing a value of 2 statistically different from zero. In the context of those regressions, the 2 found represented a pooled value over all countries. To gain further insight on the impulse versus propagation argument as the main driving force behind recent EM behavior, both regressions in 3.3 were re-run under the following alternative specification (Case 1 and Case 2 respectively): 4 23 k 1 i 1 US Yi ,EM consi kEM Yi ,EM 2etUS * dumt 3dumt 4etG 6 5etG 6 * dumt i 5etUS * dumt * dumi 1 i ,t t t k 1et 4 US Yi ,EM consi kEM Yi ,EM 2 YtUS * dumt 3dumt 4 Yt G 6 5Yt G 6 * dumt t t k 1Yt k 1 23 i 1 i 5 YtUS * dumt * dumi 1 i ,t 23 The difference here was the inclusion of i 1 US i 5 t e * dumt * dumi 1 in the Case 1 regression and the corresponding term in the Case 2 regression (where dumi 1 equals ‘1’ for the (i+1)th EM country and zero otherwise). The purpose of this regression was to isolate the additional effect, in moving from period 1 to period 2, of the US shock (growth) on EM growth by EM country (in effect, we’re splitting up 2 by country to obtain the “individual 2 s”). The results for these regressions are shown in Table 4. Table 5 shows a ranking of the most affected by structural change to the least for both cases. 8 With the “individual 2 s” estimated the counterfactual exercise described below was then carried out over period 2: 1. EM growth was calculated by feeding in the actual data into the above estimated equations. 2. EM growth was calculated assuming the US shock (growth) had no additional effect in period 2 (that is, the corresponding ‘ 2 ’ for each country was made zero in the above estimated equations) holding everything else fixed. 3. EM growth was calculated assuming the US shock (growth) had the same standard deviation in period 2 as it did in period 1 (that is, the volatility of only the US shock (growth) term was adjusted to match the previous period’s volatility) holding everything else fixed. A graphical comparison of the three alternatives is meant to provide a relative measure of how EM growth was affected by the increase in impulse size as compared to the increase in effect over the 2007 crisis for each country. Figure 2 and Figure 3 show these results under Case 1 and Case 2. 3.5 Factors associated with the Structural change within EMs If structural change within EMs was deemed to be an important factor in accounting for their recent response to DCs, what exactly was the change they underwent? The “individual 2 s” estimated in the previous section represented the additional effect the US exerted on each EM as a result of the structural change within each EM. Said differently, EMs that had the biggest ‘ 2 s’ underwent the most structural change. Given this interpretation, the 2 s were considered an index of the degree of structural change among EMs and used as the dependent variable in cross-sectional regressions aimed at identifying possible factors associated with the structural change that occurred. Given that only 24 observations at most were available, any investigation of associated factors would have to be very simple. As such, three broad hypotheses were tested: (1) the structural change was trade related, (2) the structural change was associated with financial factors, and (3) the structural change was related to both trade and financial variables. For hypothesis 1, the independent variables used were Imports Exports , NGDP NX , NGDP Trade , NGDP GFCF , NGDP NGDP . For hypothesis 2, the independent variables used were the Chinn-Ito index of financial openness, FDI inflows as a share of nominal GDP and bank capital to assets ratio. 9 For hypothesis 3, the independent variables used in hypothesis 1 and the Chinn-Ito index of financial openness were utilized. The independent variables were all annual observations averaged over 2005 and 2006. Results for both Case 1 and Case 2 are reported in Tables 6-11. 4. Discussion of Results The primary question raised was: ‘Impulse or propagation?’ The empirical strategy employed in Section 3.3 constituted the first attempt to gain some insight into this problem. However, as Table 3 shows, these regressions actually uncover the richest results of this paper. Four main results stand out and are reflected in both the shock case and the growth case (Case 1 and Case 2). First, prior to period 2 the US had a very small and insignificant effect on EM growth. Second, G6 behavior was highly influential on EM growth prior to period 2, as reflected in the large size and significance of 4 . Third, the relationship between EMs and the G6 did not change over the period 1 and period 2, shown by the small and insignificant 5 coefficient. Fourth, and most interesting, the US played a dramatically more influential role on EM growth over period 2 and even surpassed the influence of the G6. These results point to the conclusions that EMs certainly did undergo some form of structural change and that the EM structural change was oriented specifically to the US. A two-sided t-test of the null hypothesis that the standard deviation of the US shock (and US growth) was the same across the two periods led to the rejection of the null (with a lower one-sided F-statistic of 0.004 in the case of the US shock and 0.000 in the case of US growth). Not surprisingly, the takeaway here was that the shocks were indeed bigger over the 2007 crisis as compared to the 2001 recession. Hence, either explanations of impulse or propagation being the more important driver were certainly plausible based on these results alone. As a means of delineating these two possibilities, the counterfactual exercises undertaken in Section 3.4 were indeed informative. In looking at Figures 2 and 3, two observations appear to define the range of individual EM experiences. In period 2 prior to the onset of the 2007 crisis, EM growth was higher as a direct consequence of the larger effect of the US on their economies. Once the crisis hit however, EMs 10 experienced larger declines because of this elevated US effect. In the case of the US shock, deviations from original growth were much smaller. These observations point towards structural change as the underlying cause behind the change in EM behavior. In terms of identifying the actual structural change, the cross-sectional regressions utilized in Section 3.5 yielded the overall result that the structural change was associated with trade variables – on the other hand, no significant relationship could be found linking the structural change to financial factors. As can be seen from Table 6, the proportion of trade, imports, exports and gross fixed capital formation (as a proxy for capital accumulation) in GDP were all positively and significantly related to how much of an effect was felt from the US. The results for trade and export share reinforce the findings of previous papers examining the channels through which emerging markets and other developing countries were affected. However, the result obtained for GFCF (gross fixed capital formation) share has not been articulated explicitly in the current literature. From the viewpoint of the previous findings of this paper, this result is not surprising – the structural transformation within EMs meant greater investment in capital. 5. Conclusion This paper has documented the fact that the response of EMs to DCs over the recent crisis changed significantly when compared to their response over the 1981, 1990 and 2001 US recession periods. It then proceeded to investigate the underlying cause of this change in behavior. Through the perspective that the shocks emanating from the US during US downturns represent global shocks that directly impact EMs, the hypothesis that ‘the change was driven by bigger shocks arising from a bigger crisis versus some fundamental change in the economic landscape of EMs that left them more vulnerable to US disturbances’ was tested (shock versus effect). The empirical analysis yielded three main results. First, structural change within EM economies played a greater role in explaining the change in behavior observed. Second, the structural change was particularly oriented towards the US. Third, structural change left EMs more vulnerable to the US through trade and not through financial channels. In interpreting the results, the following story is advanced. Prior to the 2000s, EM growth activity was more broadly focused. They relied on a wider group of countries including the G6 countries and as such, 11 were not very dependent on the US. However, in the early to mid-2000s, a period over which the US was experiencing strong and positive rgdp growth, EMs focused their own growth efforts on the US with the objective of faster growth. Given that exports already played an important role in EM economies, this ‘focusing of growth efforts on the US’ naturally took the form of greater export activity particularly geared towards US demand. The structural change they underwent was therefore directly associated with this increased export-led growth activity. The plan worked - before the 2007 crisis, EMs experienced higher growth as a direct result of their closer relationship with the US and as such, had little reason to change their growth strategy. Quite the opposite, they continued to invest heavily in capital for instance. When the crisis hit in 2007, EMs were heavily dependent on the US, certainly much more than during any previous US disturbance period. It was particularly this increased orientation of their economic activity towards the US that left them vulnerable to the direct impact of these global shocks emanating from the US. Unable to offer sufficient resistance as they may have in the past, EM growth rates closely followed the decline in US growth. Given that many other DCs also closely followed the US downturn the net effect was this drastic increase in growth correlations being observed. 12 Table 1: Determination of US shocks Dep Var: US rgdp growth 1990q1 – 2004q4 2004q1-2009q3 Lag 1 0.18 0.68** 0.267 0.037 0.28* -0.05 0.059 0.907 -0.11 -0.13 0.399 0.759 0.05 0.02 0.699 0.955 0.50*** 0.12 0.003 0.600 0.152 0.391 Lag2 Lag 3 Lag 4 Constant R-squared Notes: (1) p-value provided below coefficients. (2) ***, ** and * indicates significance at the 1, 5 and 10 percent levels of testing. (3) This convention applies to all subsequent tables Table 2: Determination of G6 shocks Dep Var: G6 rgdp growth 1990q1 – 2004q4 2004q1-2009q3 Lag 1 0.26* 0.54* 0.074 0.064 0.003 0.24 0.979 0.696 0.19 0.08 0.166 0.912 -0.12 -0.90 0.169 0.220 0.29*** 0.36 0.001 0.234 0.104 0.367 Lag2 Lag 3 Lag 4 Constant R-squared 13 Table 3: Impulse or propagation? Dep Var: EM rgdp growth Case 1: US and G6 shocks 0.25 Case 2: US and G6 growth 0.12 0.000 0.12 0.027 0.08 0.009 0.01 0.056 0.02 0.762 0.09 0.672 0.08 0.241 -0.15 0.219 -0.07 0.366 1.16*** 0.659 0.83** 3 0.002 -0.20* 0.017 -0.20 4 0.077 0.85*** 0.333 0.77*** 5 0.000 -0.17 0.000 -0.09 dumt 0.429 -0.20* 0.689 -0.20 Constant 0.077 0.61*** 0.333 0.51*** R-squared overall Obs Countries 0.000 0.272 933 24 0.001 0.328 933 24 1EM 2 EM EM 3 EM 4 1 2 Yi ,EM consi t Yi ,EM consi t i 1, k 4 i 1, k 1 i 1, k 4 i 1, k 1 EM US iEM 2etUS * dumt 3dumt 4etG 6 5etG 6 * dumt , k Yi ,t k 1et i 24, k 4 i 2, k 1 iEM , k Yi ,t k i ,t EM US iEM 2 YtUS * dumt 3dumt 4Yt G 6 5Yt G 6 * dumt , k Yi ,t k 1Yt i 24, k 4 i 2, k 1 iEM ,k Yi ,t k i ,t 14 Table 4: Regression results - structural change by country Dep var: EM gr Case 1: US and G6 shocks Case 2: US and G6 growth Coef P-value Coef P-value 1EM 0.27*** 0.000 0.09* 0.096 2 EM 0.12** 0.011 0.09* 0.054 3EM 0.00 0.992 0.00 0.936 4EM 0.07 0.299 0.06 0.358 1 2 3 -0.16 0.368 -0.05 0.741 2.25*** 0.000 1.86*** 0.000 -0.19* 0.084 -0.18 0.381 4 0.84*** 0.000 0.77*** 0.000 5 -0.16 0.455 -0.07 0.749 6 -1.65*** 0.000 -1.57*** 0.000 7 -2.26*** 0.000 -1.83*** 0.000 8 -1.40*** 0.000 -1.12*** 0.000 9 -1.77*** 0.000 -1.50*** 0.000 10 -2.14*** 0.000 -2.19*** 0.000 11 -2.26*** 0.000 -1.84*** 0.000 12 -1.21*** 0.000 -1.45*** 0.000 13 -0.48*** 0.000 -0.79*** 0.000 14 -1.05*** 0.000 -0.74*** 0.000 15 -1.81*** 0.000 -2.15*** 0.000 16 -1.26*** 0.000 -1.11*** 0.000 17 -1.72*** 0.000 -1.65*** 0.000 18 -1.36*** 0.000 -1.40*** 0.000 15 19 -1.79*** 0.000 -1.58*** 0.000 20 -1.33*** 0.000 -1.38*** 0.000 21 -1.37*** 0.000 -0.81*** 0.000 22 -1.28*** 0.000 -1.08*** 0.000 23 0.14 0.213 0.17 0.199 24 -1.45*** 0.000 -1.70*** 0.000 25 1.43*** 0.000 1.06*** 0.000 26 0.16*** 0.007 0.26*** 0.000 27 -0.20*** 0.000 -0.30*** 0.000 28 -0.39*** 0.000 -0.25*** 0.000 Constant 0.62*** 0.000 0.57*** 0.000 0.316 0.387 Obs 933 933 Countries 24 24 R-squared overall 16 Table 5: Ranking by degree of structural change experienced in going from period 1 to period 2 Case 1: Using US & G6 shocks Case 2: Using US & G6 growth 1. LAT 3.20 KOR 2.44 2. LIT 2.55 MAL 2.17 3. EST 2.39 THAI 2.13 4. RUS 2.26 MOR 1.97 5. SLO 1.79 TUR 1.94 6. ROM 1.79 RUS 1.94 7. MAL 1.57 CHI 1.83 8. KOR 1.34 INDON 1.80 9. MEX 1.14 ROM 1.76 10. ARG 1.10 SLO 1.75 11. THAI 0.98 JOR 1.73 12. PER 0.95 COL 1.72 13. TUR 0.88 PER 1.47 14. JOR 0.85 POL 1.46 15. CZE 0.83 ISR 1.43 16. BRA 0.70 MEX 1.40 17. CHI 0.65 CZE 1.29 18. HUN 0.60 EST 1.23 19. POL 0.59 SAFRICA 1.17 20. SAFRICA 0.57 ARG 1.06 21. MOR 0.44 LIT 0.96 22. COL 0.31 HUN 0.94 23. INDON 0.24 BRA 0.87 24. ISR 0.03 LAT 0.69 17 Table 6: What is the structural change? – Hypothesis 1, Case 1 Dep var: Degree of structural change, 2 Exp NGDP CS reg 1 CS reg 2 CS reg 3 CS reg 4 CS reg 5 0.010* 0.082 0.009* Imp NGDP 0.091 0.005* Trade NGDP 0.079 -0.001 NX NGDP 0.947 0.054* GFCF NGDP Constant Adj r-squared Obs 0.600 0.054 0.096 23 0.625 0.040 0.088 23 0.589 0.057 0.099 23 1.07 0.000 -0.047 23 0.093 -0.168 0.817 0.087 23 18 Table 7: What is the structural change? – Hypothesis 1, Case 2 Dep var: Degree of structural change, 2 Exp NGDP CS reg 1 CS reg 2 CS reg 3 CS reg 4 CS reg 5 0.008 0.191 0.006 Imp NGDP 0.246 0.004 Trade NGDP 0.207 0.003 NX NGDP 0.841 0.027 GFCF NGDP Constant Adj r-squared Obs 0.412 0.175 0.036 23 0.461 0.126 0.019 23 0.422 0.169 0.031 23 0.764 0.000 -0.046 23 0.402 0.147 0.843 -0.012 23 19 Table 8: What is the structural change? – Hypothesis 2, Case 1 Dep var: Degree of structural change, CS reg 1 CS reg 2 CS reg 3 2 FO 0.078 0.482 0.023 FDI inflow NGDP 0.498 0.021 Bank Cap Bank Asset Constant Adj r-squared Obs 0.991*** 0.000 -0.023 23 0.922*** 0.001 -0.026 22 0.767 0.866 0.197 -0.045 22 Table 9: What is the structural change? – Hypothesis 2, Case 2 Dep var: Degree of structural change, CS reg 1 CS reg 2 CS reg 3 2 FO 0.059 0.588 0.004 FDI inflow NGDP 0.902 0.042 Bank Cap Bank Asset Constant Adj r-squared Obs 0.705*** 0.001 -0.033 23 0.735*** 0.007 -0.049 22 0.543 0.380 0.552 -0.030 22 20 Table 10: What is the structural change? – Hypothesis 3, Case 1 Dep var: Degree of structural change, 2 Exp NGDP CS reg 1 CS reg 2 CS reg 3 CS reg 4 CS reg 5 0.010 0.114 0.009 Imp NGDP 0.133 0.005 Trade NGDP 0.113 0.002 NX NGDP 0.908 0.052 GFCF NGDP FO Constant Adj r-squared Obs 0.033 0.764 0.586* 0.066 0.055 23 0.017 0.884 0.622** 0.046 0.044 23 0.022 0.845 0.585* 0.066 0.056 23 0.082 0.488 0.989*** 0.000 -0.073 23 0.116 0.055 0.610 -0.171 0.816 0.054 23 21 Table 11: What is the structural change? – Hypothesis 3, Case 2 Dep var: Degree of structural change, 2 Exp NGDP CS reg 1 CS reg 2 CS reg 3 CS reg 4 CS reg 5 0.007 0.236 0.006 Imp NGDP 0.312 0.004 Trade NGDP 0.261 0.005 NX NGDP 0.731 0.025 GFCF NGDP FO Constant Adj r-squared Obs 0.025 0.819 0.404 0.198 -0.009 23 0.018 0.878 0.459 0.137 -0.029 23 0.019 0.866 0.418 0.185 -0.016 23 0.069 0.549 0.698*** 0.001 -0.078 23 0.449 0.048 0.667 0.144 0.849 -0.053 23 22 Figure 1: Pair-wise correlations of rgdp growth among EM and DC over US recession and crisis periods 23 Figure 2: Growth Counterfactuals – Case 1 [yellow=orig, red=lower sd US shock,blue=no P2 effect) Col 2005q3 2006q3 2007q3 2008q3 2 0 -2 -1 -4 0 -2 1 0 2 4 2 3 6 Chi 4 Bra 2009q3 time BRA_Orig BRA_Shock 2005q3 BRA_Effect 2006q3 2008q3 2009q3 2005q3 2006q3 2007q3 Indon 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 3 Hun 2 time -4 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Isr Kor Mal 0 2 0 -5 -4 -1 0 -2 1 2 5 4 2006q3 3 2005q3 0 -6 -4 -2 1 0 -2 2 0 2 4 Cze 2007q3 time 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Mex Mor Per -2 -2 -6 -4 0 0 -2 0 2 2 2 4 4 2006q3 4 2005q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 24 2007q3 2008q3 2009q3 1 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Thai Tur Arg 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time Est Jor Lat 0 -10 -20 1 -15 -5 2 -10 3 -5 0 4 0 5 time 5 2006q3 5 2005q3 -2 -6 -5 -4 0 -2 0 0 2 2 5 4 2006q3 4 2005q3 -2 -15 -1 -1 -10 0 0 -5 1 0 2 2 SAfrica 5 Rus 3 Pol 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Lit Rom Slov 2005q3 2006q3 2007q3 time 2008q3 2009q3 -10 -10 -15 -10 -5 -5 -5 0 0 0 5 5 5 2005q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 25 Figure 3: Counterfactuals – US and G6 growth (Case 2) Col 2006q3 2007q3 2008q3 2009q3 -4 2005q3 -4 -4 -2 -2 -2 0 0 0 2 2 2 4 Chi 4 Bra time BRA_Orig BRA_Shock 2005q3 BRA_Effect 2006q3 2008q3 2009q3 2005q3 2006q3 2007q3 Hun Indon 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time Isr Kor Mal 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Mex Mor Per -6 -4 -4 -4 -2 -2 -2 0 0 0 2 2 2 4 4 2005q3 -10 -6 -4 -4 -3 -5 -2 -2 0 -1 0 2 0 5 time 4 2006q3 1 2005q3 -4 -6 -6 -3 -4 -4 -2 -2 -2 -1 0 0 0 1 time 2 2 Cze 2007q3 time 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 26 SAfrica 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time Thai Tur Arg 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 2008q3 2009q3 -10 -10 -4 -2 -5 -5 0 0 0 2 4 time 5 2006q3 5 2005q3 -6 -4 -15 -10 -4 -2 -5 -2 0 0 0 5 Rus 2 Pol 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Est Jor Lat 10 2006q3 5 0 -5 -10 -4 -10 -2 -5 0 0 2 5 4 2005q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 2008q3 2009q3 2005q3 2006q3 2007q3 time time time Lit Rom Slov 10 2006q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 -10 -10 -10 -5 -5 -5 0 0 0 5 5 5 2005q3 2005q3 2006q3 2007q3 time 2008q3 2009q3 2005q3 2006q3 2007q3 time 27 References 1) Aguiar, M., and G. Gopinath, “Emerging Market Business Cycles: The Cycle is the Trend,” Journal of Political Economy 115 (2007), 69-102 2) Alessandria, George, Joseph P. Kaboski, and Virgiliu Midrigan. 2009. “The Great Trade Collapse of 2008–09: An Inventory Adjustment?” Working Paper No. 10-18. Federal Reserve Bank of Philadelphia. 3) Backus David K., Patrick J. Kehoe and Finn E. Kydland, 1995, “International Business Cycles: Theory and Evidence,” in C. Plosser ed., Frontiers of Business Cycle Research, Princeton University Press, pp. 331–357. 4) Bernanke Ben S., Jean Boivin, and Piotr Eliasz, 2005, “Measuring the Effects of Monetary Policy: A Factor-augmented Vector Autoregressive (FAVAR) Approach”, Quarterly Journal of Economics, Vol. 120, pp. 387-422. 5) Blanchard, Olivier J., Das, Mitali and Faruqee, Hamid, 2010, ‘The Initial Impact of the crisis on Emerging Market Countries,’ Brookings Papers on Economic Activity, Spring 2010 6) Bordo, Michael D., and Thomas Helbling, 2004, “Have National Business Cycles Become More Synchronized?” in Macroeconomic Policies in the World Economy, ed. by H. Siebert (BerlinHeidelberg: Springer Verlag). 7) Bordo, Michael D., and Thomas Helbling, 2010, “International Business Cycle Synchronization in Historical Perspective,” in Macroeconomic Policies in the World Economy, NBER Working Paper No: 16103. 8) Brei, Michael, and, Buzaushina, Almira, 2009, ‘International Financial Shocks in Emerging Markets,’ Bonn Econ Discussion Papers 02/2009. 9) Brunnermeier, M.K. (2009). ‘Deciphering the 2007–08 liquidity and credit crunch’, Journal of Economic Perspectives, 23(1), 77–100. 10) Dooley, Michael, and Hutchison, Michael, 2009, ‘Transmission of the U.S. Subprime Crisis to Emerging Markets: Evidence on the Decoupling-Recoupling Hypothesis,’ Paper prepared for JIMF/Warwick Conference on April 6, 2009. 11) Gregorio, Jose D., and Valdes, Rodrigo O., 2006, “Crisis Transmission: Evidence from the Debt , Tequila, and Asian Flu Crises.’ The World Bank Economic Review, Vol. 15, No. 2 289-314. 12) Kaminsky, Graciela L., Saúl Lizondo, and Carmen M. Reinhart (1998) "Leading Indicators of Currency Crises” International Monetary Fund Staff Papers, 45(1), 1–48. 13) Kaminsky, Graciela and Carmen M. Reinhart (2000) “On Crises, Contagion, and Confusion,” Journal of International Economics 51, 145‐168. 28 14) Kaminsky, Graciela L., Carmen M. Reinhart, and Carlos A. Vegh (2003) “The Unholy Trinity of Financial Contagion” Journal of Economic Perspectives 17(4), 51‐74. 15) Kose, M. Ayhan, Christopher Otrok, and Prasad, Eswar S., 2008, “Global Business Cycles: Convergence or Decoupling?” IMF Working Paper No: 14292. 16) Kose, M. Ayhan, Eswar S. Prasad, and Marco Terrones, 2003, “How Does Globalization Affect the Synchronization of Business Cycles?” American Economic Review-Papers andProceedings, Vol. 93, pp. 57–62. 17) Kose, M. Ayhan, Eswar S. Prasad, and Marco E. Terrones, 2009. “Does financial globalization promote risk sharing?” Journal of Development Economics, Volume 89, Issue 2, July 2009, Pages 258-270 18) Kose, M. Ayhan, Christopher Otrok, and Charles Whiteman, 2008, “Understanding the Evolution of World Business Cycles,” forthcoming, Journal of International Economics. 19) Neumeyer, Pablo A. & Perri, Fabrizio, 2005. "Business cycles in emerging economies: the role of interest rates," Journal of Monetary Economics, Elsevier, vol. 52(2), pp. 345-380, March. 20) Levchenko, Andrei A., Logan T. Lewis, and Linda L. Tesar. 2009. “The Collapse of International Trade during the 2008–2009 Crisis: In Search of the Smoking Gun.” Working Paper no. 16006. Cambridge, Mass.: National Bureau of Economic Research. 21) Perri, Fabrizio, and Quadrini ,Vincenzo, 2011, ‘International recessions,’ Working paper, April 2011, www.fperri.net/PAPERS/irecessions_latest.pdf 22) Reinhart, Carmen and Kenneth Rogoff, 2008, “This Time is Different: A Panoramic View of Eight Centuries of Financial Crises,” American Economic Review Papers and Proceedings 98, pp.339-344. 23) Reinhart, Carmen and Kenneth Rogoff, 2009, “The Aftermath of Financial Crises,” American Economic Review Papers and Proceedings 99, pp.466-472. 24) Rose, Andrew K. and Mark. M. Spiegel (2009) “Cross‐Country Causes and Consequences of the 2008 Crisis: Early Warning” CEPR Discussion Paper #7354. 25) Stijn Claessens, M. Ayhan Kose and Marco E. Terrones, ‘Recessions and Financial Disruptions in Emerging Markets.’ Preliminary version, November 2009. 26) Stock, James H., and Mark W. Watson, 1989, “New Indexes of Coincident and Leading Economic Indicators,” NBER Macroeconomics Annual 1989, (Cambridge: The MIT Press, 1989), 351-394. 27) Stock, James H. and Mark W. Watson, 2005, “Understanding Changes in International Business Cycles.” Journal of the European Economic Association, Vol. 3:5, pp. 968-1006 28) Stock, James H., and Mark W. Watson, 2007, “Forecasting in Dynamic Factor Models Subject to Structural Instability.” Mimeo, Harvard and Princeton Universities. 29 29) Yi, Kei-Mu, Rudolfs Bems, and Robert C. Johnson. 2009. “The Role of Vertical Linkages in the Propagation of the Global Downturn of 2008.” Paper presented at a conference on Economic Linkages, Spillovers and the Financial Crisis, organized by the International Monetary Fund and the Banque de France chair of the Paris School of Economics, Paris, January 29. ww.imf.org/external/np/res/seminars/2010/paris/.