Document 15967153

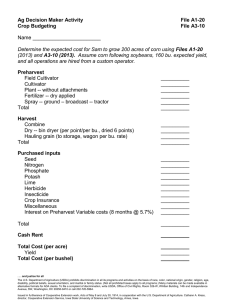

advertisement

Farm Leasing Arrangements Tim Eggers Field Agricultural Economist teggers@iastate.edu 712-542-5171 www.extension.iastate.edu/feci Agenda What Prices are Relevant? Trends in Farmland Values Farmland Leasing Practices DCP vs. ACRE Determining a "Fair" Cash Rental Rate Flexible Cash Leases Beginning Farmer Tax Credit General Farm Economy Who Pays Property Taxes Tools • ISU Extension Staff Resources • Ag Decision Maker – Decision Aids • Annual Surveys • Publications – Decision Tools • Agricultural Management e-School – Farm Leasing Arrangements course • Non ISUE resources – SoilView – WebSoilSurvey www.extension.iastate.edu/agdm Hazards for 2010 • Interest rate increases • Asset value declines • Below break-even crop insurance prices • Missing the 2009 ACRE boat • Missing the 2008 SURE boat Power Mach Cost vs Invest. Cost (Per Acre) Low $96 Mid $76 High $72 Direct Corn Expenses Direct Bean Expenses 2010 Crop Cost Estimates - Corn Following Soybeans Low Yield Medium Yield High Yield $722 $658 $594 Average Yield Cost per bushel $4.25/bu $4.11/bu $4.01/bu 2010 Crop Cost Estimates - Soybeans Following Corn Low Yield Medium Yield $487 High Yield $525 $449 Average Yield Cost per bushel $9.97/bu $9.73/bu $9.55/bu 2010 Break Even Costs by Crop Rotation & Yield December 2009 Corn Futures 2009 Rental Rate Decision Time December 2010 Corn Futures Summer 2009 Corn Futures $6.40 Dec 09 (August 2008) (don’t forget the 50 cent basis) $3.68 Dec 10 (August 2009) $3.20 Dec 09 (August 2009) November 2009 Soybeans 2009 Rental Rate Decision Time November 2010 Soybeans Summer 2009 Soybean Futures (don’t forget the 90 cent basis) $13.40 Nov 09 (August 2008) $10.91 Nov 09 (August 2009) $9.30 Nov 10 (August 2009) $4.11 $3.20 $9.73 $8.29 www.ufmcoop.com 23 fewer operational plants Not Producing April 24, 2008 July 23, 2008 December 16, 2008 10 11 19 36 38 24 33 48 48 On Hold February 13, May 1, 2009 2009 Operational 168 186 182 165 163 Planned 320 241 224 221 217 Under Construction 73 63 46 19 21 17 19 18 Cancelled Iowa Farmland Value Surveys • Iowa State University Extension – – – – conducted annually around November 1st mailed survey sent to 1,100 licensed real estate brokers usually 500-600 responses released in mid-December • Federal Reserve Bank of Chicago – quarterly survey of ag lenders by state – http://www.chicagofed.org/economic_research_and_data/ag_letter.cfm • Realtors Land Institute – semi-annual survey (March and September) – compares land classification by corn production – includes pasture and timber land – http://www.centralstatesland.com/csmlsdisplay.asp?id=ed01 Federal Reserve Bank of Chicago • 2% increase April 2008 to April 2009 • 7% decrease January 2009 to April 2009 Iowa Farm & Land Chapter #2 Realtors Land Institute Iowa State University Extension Land Value Survey November 2008 November 1, 2007 to November 1, 2008 Southwest $3,626 Up 13.0% Up $416 High $4,642 Medium $3,425 Low $2,298 Average Values All Grades 1950-2008 Percentage Change from Previous Year, 1951-2008 Percentage Change Adjusted for Inflation, 2008 Dollars 11%, 13%, 10% 1979, 1980, 1981 Who Purchased Farmland 14.1% to 16% 2008 Land Value Increases up to 12% 16.1% or more 12.1% to 14% Positive Factors Affecting Land Values Negative Factors Affecting Land Values Distribution of Iowa Farmland by Age of Owner and Year 30% 25% 20% 15% 10% 5% 0% < 25 25-34 1982 35-44 1992 45-54 55-64 2002 65-74 2007 > 75 Percent of Iowa Farmland Owned Based on Age and Gender, 2007 .29 30% 25% .18 20% 15% 10% 5% 0% <35 35 - 65 Female >65 Male Distribution of Iowa Farmland by Tenure Type 60% 50% 40% 30% 20% 10% 0% Owner operator Cash rent 1982 1992 2002 Crop share rent 2007 Percent of Leased Farmland by Lease Arrangement 80% 70% 60% 50% 40% 30% 20% 10% 0% 1982 1992 Cash rent 2002 Crop share 2007 Other Crop Share 50-50 Lease Landlord Tenant Labor Land ½ inputs ½ inputs Machinery Management ½ income ½ income us to m r er b ic id e ec tic id e tili ze d Fe Li r m t i C l i e z us e rA to m pp Pe lic st at ici io n de Ap pl ica C us tio to n m Co m bi ni ng C H In s Fe r Se e Yi el d Percent Percent of Crop Share Acres with Equal Division of Costs 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Crop Share 50-50 Lease Landlord Corn Tenant Land $139 Labor $ 29 ½ inputs $164 ½ inputs $164 Machinery $ 66 Management $ 43 ½ income $303 ½ income $303 Crop Share 50-50 Lease Landlord Soybeans Tenant Land $ 99 Labor $ 28 ½ inputs $108 ½ inputs $108 Machinery $ 47 Management $ 24 ½ income $207 ½ income $207 Distribution of Cash Rented Land by Payment Distribution 60% 50% 40% 30% 20% 10% 0% 100% 50 - 50 Thirds One third/two thirds Other Percent of Acres by Lease Type and Characteristic 80% 70% 60% 50% 40% 30% 20% 10% 0% Cash Crop Share Written Relative All Leases Fixed term Percent of Cash Rented Acres by Cash Rent Type or How the Other 10% Live 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Fixed Yield only Price only Yield and Price Putting a Lease Together • Determine the goals for each party – production with the highest potential return – fair return to each party – continuity of income year to year – minimize risk – improve communication skills • Put the agreement in writing • Both parties should be accountable to the lease arrangements established Improving Negotiation Skills • Focus on win-win situations • Introduce funny money • Don’t underestimate your position at the bargaining table • Formulate a resistance point The “New” Farm Program DCP same as before, Except: 2009-2012 83.3% instead of 85% Payment limitations Attribution The ACRE option ACRE Decision Points Choices: 1. Stay with current program 2. Enroll in ACRE in 2009 (August 14 deadline) 3. Enroll in ACRE in a later year ACRE Option 1-4 years, from enrollment to end of program Once the farm is in ACRE, it stays in until the program ends in 2012 Landowner and tenant must sign If the tenant changes it stays in ACRE If the land sells it stays in ACRE ACRE characteristics Based on loss of revenue (price x yield) Benefits calculated state-wide (trigger 1) State guarantee is recalculated each year It can’t change by more than 10% each year Must have revenue loss on farm (trigger 2) ACRE vs. CCP Corn 450 350 300 250 200 150 100 50 CCP pays Bushels per planted acre 400 No CCP payments 0 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 $ per bushel ACRE vs. CCP Soybeans 80 60 40 20 CCP pays Bushels per planted acre 100 No CCP payments 0 5 6 7 8 9 10 11 12 $ per bushel 13 14 15 16 17 18 Determining A “Fair” Cash Rent Value Leasing Opportunity Soil Type: Acres: Percent: ---------- -------- -------T370B 61.47 23.2% 248 17.72 6.7% T368 16.70 6.3% 212 11.71 4.4% T369 87.78 33.1% 133 9.69 3.7% 220 60.11 22.7% ---------- --------------Totals 265.19 100.0% CSR ----85 60 90 91 85 80 85 ----83.73 Iowa Corn Suitability Rating based yield estimation: 179 bushels per acre Supporting Information Location: Tillable Acres: Corn Yield: Soybean Yield: Corn Suitability Rating: Page County 265 Acres 179 bu/Acre 49 bu/A 84 CSR Calculating Cash Rent Values Cash Rent Market Approach ISU Extension Publication FM 1851 – Cash Rental Rates for Iowa 2008 Survey (released in June) Three Methods for Determining Cash Rent Values Typical Cash Rent Average Rent for Production Average Rent for Corn Suitability Rating (CSR) Calculating Cash Rent 1.Typical Cash Rent Select the Area of the State/County Area 10 County Page Determine Overall average $ 159 High Quality Third = $ 184 Middle Quality Third = $ 159 Low Quality Third = $ 135 Calculating Cash Rent 2 a. Average Rents Per Unit – Corn Yield Select the Area of the State/County Determine Average Rent for Corn Farm’s Average Corn Yield (bu/A) Times rent per bushel of Corn yield Equals the Average Rent for Corn Acre 179 $ 1.05 $ 188 Calculating Cash Rent 2 b. Average Rents Per Unit – Soybean Yield Select the Area of the State/County Determine Average Rent for Soybeans Farm’s Average Soybean Yield (bu/A) 49 Times rent per bushel of Soybean yield $ 3.39 Equals the Average Rent for Soybean Acres $166 Calculating Cash Rent 2. Average Rents Per Unit – Corn & Soybeans Add the Average Rent for Both Corn Average Rent Soybean Average Rent $ 188 $ 166 Average Rent Corn & Soybeans $ 177 Using Corn Suitability Rating (CSR) 3. Average Rents Per CSR Index Point Select the Area of the State/County Determine the Average Cash Rent using CSR Farm’s Average Corn Suitability Rating 84 Times rent per CSR index point $ 2.16 Equals the Average Rent for all Row Crop Acres $ 181 Source: ISU Extension Publication FM- 1851 Overall Average Average all 3 Methods Method 1: Typical Cash Rent $ 184 Method 2: Average Rents per Unit $ 171 Method 3: Average Rents per CSR Index Point $ 181 Average $181 /A $181/A X 265 Tillable Acres = $47,965 Split Payments of $23,983 and $23,982 Source: ISU Extension Publication FM- 1851 Cash Lease Calculations Gross Income Method Tenant Residual Method Crop Share Method Return on Investment Method Assumptions • • • • 265 crop acres 179 bushel corn yield 49 bushel Soybean yield Direct Government Payments – 2002-07 average $22.00 / acre • DCP change is 83.3% instead of 85% ($0.45 less) • ACRE change is 20% less ($4.75 less) – plus the $0-159 ACRE payment if triggers are tripped Share of Gross Income CORN: (179 bu X $3.20) + $22 = $595 SOYBEANS: (49 bu X $8.29) + $22 = $428 Iowa cash rents typically are equal to about 30 to 40 percent of the gross income from producing corn, and 35 to 45 percent of the gross income from producing soybeans. Cash Rental Rate CORN: $ 595/ac x 35% = $ 208 SOYBEANS: $ 428/ac x 40% = $ 171 Average $ 190 Tenant Residual Method CORN: $ 595 - $445 = $ 149 SOYBEAN: $ 428 - $304 = $ 124 Average: $ 137 Crop Share Method 50-50 Share Corn: 50% of gross minus owner’s costs $297 - $165 = $132 Soybeans: 50% of gross minus owner’s costs $214 - $108 = $106 Average: $119 (1) The owner is assumed to pay 50 percent of the costs for seed, fertilizer, lime, pesticides, crop insurance, interest and miscellaneous, and drying and storage. Expected Rent: (3.8%) X $4,500 / acre = $171 / acre Corn Soybeans Cash Rent Survey Per Bushel Yield Per CSR Point Gross Income Tenant Residual Crop Share Return on Investment $184 $188 $181 $208 $149 $132 $171 $184 $166 $181 $171 $124 $106 $171 Average $173 $158 July 2009 July 2008 July 2007 July 2006 $165 --- 30% decrease $237 --- 27% increase $186 --- 43% increase $130 61 CSR 164 Corn 45 Beans Crop Share $98.46 Tenant’s Residual $94.81 58 CSR 160 Corn 44 Beans Crop Share $84.46 Tenant’s Residual $93.23 49 CSR 137 Corn 34 Beans Crop Share $54.74 Tenant’s Residual $7.38 Flexible Cash Leases Desire: Terminated tenants want cash rent leases to be renewed by September 1 for the following year Current Reality: Prices and yields are very unpredictable Solution: Flexible lease contract Advantages Price and production risk shared as well as profit opportunities Actual rent adjusts as production or price change Owner does not have to be involved in decision making about inputs or marketing Disadvantages Owner and producer share in risks Not as well understood as traditional cash lease or crop share More difficult to calculate Owner benefits from tenant’s management skills Tenant loses windfall profit potential from high prices Types of Flexible Cash Leases • Rent varies with both price and yield – Matches tenant’s ability to pay • Rent varies with yield only – Could have high yields, low prices • Rent varies with price, only – Could have low yields, high prices A Flexible Cash Lease is a Cash Lease < April 2007 cash lease, crop share lease, or scheme or device April 2007 – December 2008 Either a cash or a crop share lease > December 2008 Flexible cash leases are recognized as cash leases in federal register clarification of FCE 2008 Agricultural Asset Transfer Tax Credit Iowa Agricultural Development Authority 505 5th Avenue, Suite 327 Des Moines, Iowa 50309-2322 Ph: 515-281-6444 Fax: 515-281-8618 Email: iada@iowa.gov A Division of the Treasurer of the State of Iowa State Income Tax Credits • Non refundable • Can carry unused credits forward 5 years • No carry back What Is An Ag Asset? • Agricultural land • Agricultural improvements • Depreciable agricultural property – Breeding livestock – Machinery/Equipment • Does not have to be traditional cow & plows. Key Provisions Taxpayer • Owner of record of the asset • Eligible to own land under corporate farming laws • Not at fault for terminating a prior lease • Not a party to pending administrative or judicial action relating to violation of CAFO’s • Not classified a habitual violator by DNR • Can have more than 1 tax credit/lessee • At fault termination, repay redeemed credits Key Provisions Beginning Farmer • Net worth less than $300,000 • Have sufficient education, training and/or knowledge • Have access to working capital • Actively participate in management and labor of the operation and assume financial risk • 18 years or older Other Provisions • • • • • Two – Five Year Lease Term Credit Good For Term of Lease Renewable at Expiration(with qualification) 5% of Gross Income = Cash Contract 15% of Gross Income = Commodity Share Agreement • Lease value not substantially higher/lower than market Other Provisions • • • • • Began with 2007 tax year Cash or Crop Share Leases Related party transactions OK Can’t rent from owned entity “Rent to own” is not eligible Other Provisions • Leases Can Be Non-Traditional (if reasonable) • Crop Share – Income determined by county average – Monthly average of county posted price – No Yield Monitors • Submit FSA Form 156 – Documents Acres & Ownership Application/Approval Procedures • Obtain application from IADA – Taxpayer application – Beginning farmer application • Submit applications & copy of lease to IADA • Applications due 15th of month • Considered @ board mtg. (4th Wednesday) For Additional Information IOWA AGRICULTURAL DEVELOPMENT AUTHORITY 505 5TH Ave., Suite 327 Des Moines, IA 50309 515/281-6444 iada@iowa.gov www.iada.state.ia.us What the Records Show Make sure the data doesn’t get in the way of seeing the problem. FINBIN Key Ratios Definition Current Ratio Liquidity Working Cap to Gross Ability to pay today’s bills Available dollars to total revenue Solvency Debt to Asset Ratio Profitability (cost) ROA Return on all assets ROE Return on net worth Repayment Efficiency Owed vs Owned Term Debt Coverage Ability to pay notes this year Oper Expense Ratio % of total revenue used for operations By Net Farm Income 2008, Minnesota Crop Farms Crop Farms Low 20% High 20% Current Ratio 1.39 2.50 Working Cap to Gross 22 % 51 % Solvency Debt to Asset Ratio 52 % 43 % Profitability (cost) ROA 1% 18 % ROE -6 % 26 % Repayment Term Debt Coverage 0.9 4.7 Efficiency Oper Expense Ratio 81 % 59 % Liquidity By Age, Minnesota, 2008 Crop Farms Crop Farms 51-60 Yr <31 Yr Old Old Current Ratio 1.66 2.06 Working Cap to Gross 26 % 43 % Solvency Debt to Asset Ratio 64 % 43 % Profitability (cost) ROA 15 % 12 % ROE 27 % 17 % Repayment Term Debt Coverage 3.2 3.0 Efficiency Oper Expense Ratio 68 % 64 % Liquidity By Crop Acres, Minnesota, 2008 Crop Farms Crop Farms 251 – 1,000 A > 2,000 A Current Ratio 2.02 1.95 Working Cap to Gross 40 % 40 % Solvency Debt to Asset Ratio 45 % 48 % Profitability (cost) ROA 12 % 15 % ROE 18 % 23 % 2.9 3.8 62 % 65 % Liquidity Repayment Term Debt Coverage Efficiency Oper Expense Ratio FINBIN Key Ratios by Crop Acres, 2008, Minnesota Hog Farms Hog Farms < 100 Acres >100 Acres Current Ratio 0.96 1.67 Working Cap to Gross -1 % 19 % Solvency Debt to Asset Ratio 71 % 53 % Profitability (cost) ROA -13 % 1% ROE -62 % -4 % Repayment Term Debt Coverage -2.3 0.6 Efficiency Oper Expense Ratio 105 % 93 % Liquidity By Crop Acres, Minnesota Hog Farms Hog Farms < 100 Acres <100 Acres 2008 2006 Current Ratio 0.96 1.77 Working Cap to Gross -1 % 14 % Solvency Debt to Asset Ratio 71 % 50 % Profitability (cost) ROA -13 % 15 % ROE -62 % 24 % Repayment Term Debt Coverage -2.3 2.2 Efficiency Oper Expense Ratio 105 % 87 % Liquidity By Crop Acres, 2008, Minnesota Dairy Farms Dairy Farms < 100 Acres > 100 Acres Liquidity Current Ratio 1.36 1.82 Working Cap to Gross 5% 14 % Solvency Debt to Asset Ratio 52 % 47 % Profitability (cost) ROA 12 % 8% ROE 21 % 11 % Repayment Term Debt Coverage 1.9 1.7 Efficiency Oper Expense Ratio 80 % 76 % By Gross Farm Income, 2008, Minnesota Beef Farms Beef Farms < $500,000 > $500,000 Current Ratio 1.78 1.50 Working Cap to Gross 39% 27 % Solvency Debt to Asset Ratio 42 % 53 % Profitability (cost) ROA 2% 9% ROE -2 % 13 % Repayment Term Debt Coverage 1.1 2.4 Efficiency Oper Expense Ratio 76 % 76 % Liquidity Iowa Property Taxes The Iowa property tax is primarily a tax on "real property," which is mostly land, buildings, structures, and other improvements that are constructed on or in the land, attached to the land, or placed upon a foundation. Typical improvements include a building, house or mobile home, fences, and paving. http://www.iowa.gov/tax/educate/78573.html Following Five Classes are Assessed • • • • • residential agricultural commercial industrial utilities/railroad [This class is assessed at the state level.] How is property tax rate determined? 1. The value of property is established. 2. The assessments of all taxable properties are added together. 3. The Department examines total assessed values and equalizes them. • A process called "equalization" is applied every two years. • The "assessment limitation" or “rollback” is applied every year. 4. Budgets are established. 5. A tax rate is established. 6. Credits are subtracted. Equalization In Step 3 above, the Iowa Department of Revenue is responsible for "equalizing" assessments every two years. The Department compares the assessors’ abstracts to a "sales assessment ratio study" it has completed independently of the assessors. If the assessment (by property class) is 5 percent or more above or below the sales ratio study, the Department increases or decreases the assessment. There is no sales ratio study for agricultural and industrial property. Equalization occurs on an entire class of property, not on an individual property. Also, equalization occurs on an assessing jurisdiction basis, not on a statewide basis. Equalization is important because it helps maintain equitable assessments among classes of property and among assessing jurisdictions. This contributes to a more fair distribution of state aid, such as aid to schools. It also helps to equally distribute the total tax burden within the area. Rollbacks More than 20 years ago, residential property values were rising quickly. To help cushion the impact of high inflation, the Legislature passed an assessment limitation law called rollback. Increases in assessed values for residential and agricultural property are subject to this assessment limitation formula. If the statewide increase in values of homes and farms exceeds 4 percent due to revaluation, their values are "rolled back" so that the total increase statewide is 4 percent. Rollback is also available for industrial and commercial property when necessary. This does not mean that the assessment on your home will increase by only 4 percent. The rollback is applied on a class of property, not an individual property. This means that the statewide total taxable value can increase by only 4 percent due to revaluation. Assessment Residential, commercial and industrial real estate assessed at 100 percent of market value Agricultural real estate assessed at 100 percent of productivity and net earning capacity value. The assessor considers the productivity and net earning capacity of the property. Agricultural income as reflected by production, prices, expenses, and various local conditions is taken into account. For further property tax information • • • • • http://www.iowa.gov/tax/locgov/proptax120707.pdf www.iowa.gov/tax/taxlaw/PTC-Feb5-04.pps http://www.iowa.gov/tax/locgov/PolkCoRule.pdf http://www.iowa.gov/tax/educate/78573.html http://www.iowa.gov/tax/locgov/iowa-propertytax.html Hazards for 2008 – July 2007 • Lower crop insurance prices • Higher input costs – rent, fuel, fertilizer, seed, machinery, and drying • Yields – low or at insurance coverage levels • Price – average or below break even • Increased world supplies or low ethanol prices Hazards for 2009 – July 2008 • Economic Profits Hangover • Lower Crop Insurance Prices • Farm Bill implementation –ACRE confusion • Estate and general tax issues to be addressed with new legislature in 2009 Other Resources • Materials from this meeting – • Online Courses – Ag Management e-School – • http://www.extension.iastate.edu/pubs/ Articles and spreadsheets – • http://dbs.extension.iastate.edu/calendar/ Publications – rental survey, land value survey, etc. – • http://www.extension.iastate.edu/ames Workshops, meetings, conferences – • http://www.extension.iastate.edu/feci/Leasing/vflm.html http://www.extension.iastate.edu/agdm/ Private Consultation – http://www.extension.iastate.edu/ag/fsfm/fsfarmmg.html Farm Lease Arrangements Land Leasing Confidence A.M.E.S. Agricultural Management e-school An ISU Extension Outreach Institute • • • • • • • • • • Introduction to Farm Leases Cash Rent Leases Crop Share Leases Custom Farming Renting Buildings Renting Hay and Pasture Land Legal and Tax Considerations Conservation and Environmental Considerations USDA Agencies and Programs Owner and Operator Relations Farmland Ownership Purchase Plan A.M.E.S. Agricultural Management e-school An ISU Extension Outreach Institute • • • • • Land Value Trends Using Soils Information Appraisal Techniques Financing Considerations Feasibility of a Land Purchase Thank You! Tim Eggers Field Ag Economist ISU Page County Extension 311 East Washington Clarinda, Iowa 51632 (712) 542-5171 teggers@iastate.edu www.extension.iastate.edu/feci Our Mission ISU Extension builds We believe in . . . partnerships and provides • Quality research-based learning • Access opportunities to improve • Diversity quality of life in Iowa • Accountability