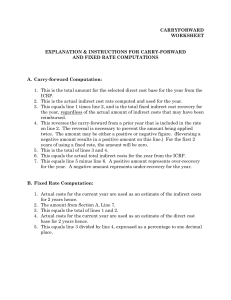

WORKSHEET 9 Page 2 of 2 EXPLANATION & INSTRUCTIONS FOR CARRY-FORWARD

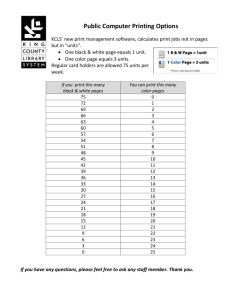

advertisement

WORKSHEET 9 Page 2 of 2 EXPLANATION & INSTRUCTIONS FOR CARRY-FORWARD AND FIXED RATE COMPUTATIONS A. Carry-forward Computation: 1. This is the total amount for the selected direct cost base for the year from the ICRP. 2. This is the actual indirect cost rate computed and used for the year. 3. This equals line 1 times line 2, and is the total fixed indirect cost recovery for the year, regardless of the actual amount of indirect costs that may have been reimbursed. 4. This reverses the carry-forward from a prior year that is included in the rate on line 2. The reversal is necessary to prevent the amount being applied twice. The amount may be either a positive or negative figure. (Reversing a negative amount results in a positive amount on this line.) For the first 2 years of using a fixed rate, the amount will be zero. 5. This is the total of lines 3 and 4. 6. This equals the actual total indirect costs for the year from the ICRP. 7. This equals line 5 minus line 6. A positive amount represents over-recovery for the year. A negative amount represents under-recovery for the year. B. Fixed Rate Computation: 1. Actual costs for the current year are used as an estimate of the indirect costs for 2 years hence. 2. The amount from Section A, Line 7. 3. This equals the total of lines 1 and 2. 4. Actual costs for the current year are used as an estimate of the direct cost base for 2 years hence. 5. This equals line 3 divided by line 4, expressed as a percentage to one decimal place.