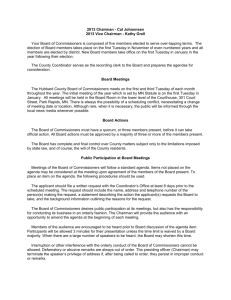

Agenda for Financial Crisis Inquiry Commission Telephonic Business Meeting of

advertisement