INTERVIEW OF RICHARD M. BOWEN III

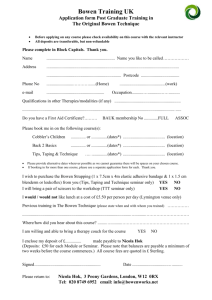

advertisement