TRUSTS & ESTATES NOTES SUMMARY I. Introduction

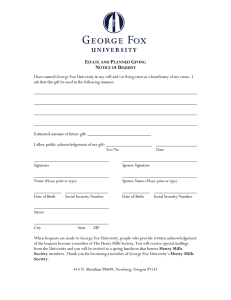

advertisement

TRUSTS & ESTATES NOTES SUMMARY I. Introduction A. The “Right” to Inheritance 1. Hodel v. Irving, 481 US. 704 (1987) p.2-13 Decedents have the right to control disposition of their property at death, and the original provision of the “escheat’ provision of the Indian Consolidation Act of 1983 effected an unconstitutional “taking” of their property w/o just compensation. 2. NO RIGHT TO RECEIVE. Restrictions upon marriage, to a particular class or faith, as a condition of inheritance are constitutional, valid & enforceable. Shapira v. Union Nat’l Bank, 39 Ohio Misc. 28 (1974) pp.24-34. The court distinguished: partial restraint on marriage -- whom beneficiary could marry [permissable] versus covenant restraining religious practice [impermissible] testamentary gift conditioned upon the religious faith of beneficiary [impermissible] versus those conditioned upon marriage to persons of particular religious faith [impermissible] test. gift conditioned on beneficiary getting divorced [impermissible] versus those conditioned on benef. marrrying “qualified woman.” The possibility that he’d marry her just to get the money, then divorce is was deemed too remote. the contingent gift to Israel in lieu of benef. goes to the conviction underlying T’s intent – not to punish the son but to perpetuate religion & ethnicity. T’ors may disinherit their č; thus a T may restrict inheritance unless contrary to public policy & void (like ban on marriage). An alternative interpretation might be that if the gift reflects the bigoted mores of the greater society, it is constitutional; if not, it is not. I wonder what court would uphold, “To my son, if he established a commitment to another man as his life partner” – esp. if that son were straight? B. The Probate Process 1. Who benefits? Why? Intestacy 1. Administrator – must post bond; chosen by a statutory process (usually relation determines); 2. File notice of proceeding w/this particular administrator 3. Letter of administration issued – authorizes administrator to act on estate’s behalf. Will 1. Executor – if you appoint one, you waive the bond requirement. 2. File original will 3. Letter testamentary issued – authorizes executor to act on behalf of estate. 2. Duties of Representative 1. Collect Assets – meaning, inventory & collect them. 2. Manage assets. 3. Receive & pay creditors’ claims. 4. Distribute the rest. 3. Why avoid probate? 1. Money. (a) Atty’s fees – sometimes executor can get atty’s fees as well as (b) executor’s commission. (c) filing fees; 2. Time 3. Uncertainty – judicial oversight can mean high risk; inexperienced, dumb judges – some of whom are not even lawyers. How to avoid probate: 1. Trusts – revocable, irrevocable, many other types 2. Life insurance 3. Retirement accounts & other pension on death k’s. 4. Joint tenancy – upon death, decedent’s share goes to survivor. 5. When the estate is small, probate may not be necessary. Universal succession – surviving spouse or child, assets and debts. Is a will needed even where probate is avoidable? There is always the chance that after setting up these instruments for improper accounting for everything owned. 4. Probate Process: Formal & Informal a. OPENING Informal Opening Must be filed w/in 3 yrs. of death. UPC 3-108 1. No notice; representative just petitions for appointment. Petition contains pertinent information about decedent & names & address of spouse, č or other heirs and if a will is involved, the devisees. 2. File original will, if there is one. 3. Executor swears that will was validly executed; no proof by witnesses required as long as (a) attestation clause showing req’s of execution met & (b) required signatures 4. Within 30 days after appointment, the personal representative must mail notice to every interested person, incl. heirs apparently disinherited by will. Formal Opening Must be filed w/in three years of death. UPC 3-108 1. Notice to interested parties. Interested party may demand formal probate. May be used to (a) block an informal proceeding; (b) probate a will; or (c) to secure a declaratory judgment. 2. b. SUPERVISING REPRESENTATIVE’S ACTIONS Court supervises. It approves: inventory & appraisal payment of debts family allowance granting options on real estate sale of real estate borrowing of funds & mortgaging of property leasing of property proration of federal estate tax commissions attorney’s fees preliminary & final distributions discharge of personal representataive UPC authorizes unsupervised administration unless any interested party demands supervised. The representative thus has the broad powers of a trustee. Files a sworn statement that he has published notice to creditors, etc. c. CLOSING THE ESTATE Rep. is expected to complete administration & distribute as promptly as possible. 2. Duties to the Client pp.59-70 A lawyer’s duty is to beneficiaries, not just to the Testator. Forseeability of harm puts duty to beneficiaries. Simpson v. Calivas (NH 1994) p.59. C. Who May Inherit – State Definitions of Family 1. Who qualifies as Surviving Spouse a. Peffley-Warner v. Bowen, Washington 1989 (handout) “Meretricious” relationship – unmarried couple who represented to others that they were married for 20 years – did not establish status of woman partner as a spouse under Washington intestate devolution. Social Security benefits are assigned to widows who qualify by: 1. Valid marriage test. 2. Intestacy devolution test – if probate laws would assign the partner the same status as wife for assigning intestate share. 3. Legal impediment test – if partner entered into relationship believing in good faith that marriage ceremony effected a valid marriage. The question became whether under the intestacy devolution test the woman partner would have inherited. The court held she would not: The court ruled that plaintiff’s reliance on a case involving an unmarried couple, where the woman partner was found entitled to property not titled in her name. Lindsey. The court distinguished that case’s holding, saying it involved an “equitable division of property” following breakup, with the aim of preventing unjust enrichment. Here, the case did not involve, as did Lindsey, jointly constructed/purchased property. b. In the Matter of the Estate of Marshall Gardner (handout): marriage between plaintiff’s father and a post-op male (J’Noel) –to-female transexual was void. (i) Determination of sex: beyond chromosomes J’Noel had a birth cert. showing “female” at birth, validly altered under Wisconsin law. The Kansas supreme court held that the legislative intent – as understood by the plain language, the leg. history, and the language of Title VII – indicates only “traditional” sexual definitions of male and female. Therefore, J’Noel’s marriage to the Testator was void, and J’Noel’s share should go to the T’s son. This case contraindicated the T’s apparent wishes in favor of “traditional” bigoted values. There was ample opportunity to find that, because the State of Kansas had seen fit to approve the marriage – and that the T had relied upon this approval in not making “safer” arrangements per his intent (the estoppel argument), that J’Noel should get a spousal share. 2. Who Qualifies as a Descendant a. STATUS CATEGORIES OF CHILDREN Two primary categories: Natural aka genetic A marriage b/w parents is the stand-in for legal process to prove parentage. This is because of the legal presumption that the child is presumed to be of the husband and wife. Possible problems: * posthumous birth – after father died; it is presumed that if child is born within 280 days of father’s death it is presumed to be his child. The presumption stops at 300 days. However, a parent may attempt to rebut (as one parent did at 320 days). * artificial insemination (Woodward) – after father’s death, the In Massachussets the Woodward court held that the child was a. Marital or nonmarital. In this case, the marriage had ended by death, so the child was a nonmarital child. The court distinguished these nonmarital children from traditional nonmarital children thus: i. whether it was his sperm that impregnated her. ii. husband’s knowledge & consent: they looked at whether he consented to his sperm being used and to supporting the child. Generally, the act of intercourse is considered consent to create and support a child. The court took it upon itself to comment upon the types of evidence that could be heard. If this had been not in Mass. but in Louisiana, how would it have differed? (see Woodward) Note this is an issue of a state’s intestacy statute The successor has to exist at the time of the decedent’s death. How does this relate to Hodel? the statute governs; left the term posthumous children undefined p.4: “the devolution of real & personal property in intestacy is neither a natural nor a constitutional right. It is a privilege conferred by statute.” How does this relate to Schapira? An heir has NO RIGHT TO RECEIVE Is this broader, on p.4 – no right to transmit? it’s w/in Mass’s prerogative to abolish intestacy altogether. In general, if a child is born outside of marriage, in order to be given the status of child there needs to be a formal adjudication of paternity in some states. The UPC, which has adopted uniform heritage act, it can occur more functionally. Surrogacy – In some states, A surrogate mother, even who has no genetic relationship to child in womb, is the mother -- and her husband the father – unless the father waives paternity Intent: California holds that the intent of parties necessary Mass. doesn’t allow surrogacy – esp. for money Artificial insemination Hecht v. Superior Court (Cal. App. 1993) It is not the role of the judiciary to inhibit the use of reproductive technology when the Leg. has not seen fit to do so; any such effort would raise serious questions in light of the fundamental nature of the rights of procreation & privacy. b. Adoption Dual inheritance (from both natural and adoptive kin) is not permitted in some states, such as Maryland. o Texas allows dual inheritance. o UPC allows inheritance from natural and adoptive kin if the child is adopted by a step-parent. (i). Legal Adoption – pretty simple; family court decrees adoption; Who is denied access to that legal process? 1. Same-sex adults – some states prohibit; Len & Gene. In NY the court held that sexual relationships ; * to foreclose other claims on a will; Delaware permits it. (ii). Equitable Adoption – where a child has been led to believe that he or she isa legally adopted member of their family (p.113, dissent of Sears, quoting Crawford v. Wilson, (Ga. 1913):. [w]here one takes an infant into his home upon a promise to adopt such as his own child, and the child performs all the duties growing out of the substituted relationship of parent and child, rendering years of service, companionship, and obedience to the foster parent, upon the faith that such foster parent stands in loco parentis, and that upon his death the child will sustain the legal relationship to his estate of a natural child, there is equitable reason that the child may appeal to a court of equity to consummate, so far as it m ay be possible, the foster parent’ omission of duty in the matter of formal adoption. c. Nonmarital children 1. Uniform Parentage Act: adopted in 1/3 states (1973). The parent & child relationship extends to every parent and č, regardless of marital status of parents. If a father & č relationship is presumed to exist, an action to determine its existence may be brought at any time. If a č has no presumed father, an action to establish a parent-č R must be brought within three years after the č reaches majority. When parents do not marry or attempt to marry, a parent-č R is presumed where: a. while the č is a minor, the father receives the č into his home and openly holds out the č as his natural č, or b. the father acknowledges his paternity in a writing filed w/an appropriate court or administrative agency. II. THE DEFAULT: INTESTATE SUCCESSION UPC 2-102 [p.73] SHARE OF SPOUSE (1) Entire Estate if: i or ii: if no descendent or parent of decedent (D) survives D; or if all the D’s surviving descendents are also desc’s of surviving spouse (2) 1st $200k + ¾ balance of estate if parent of D survives D (3) 1st $150k + ½ balance of estate if all of D’s descendents are also Spouse’s descendants AND SP has descendants NOT OF D. (4) 1st $100k + ½ of balance of estate if one or more of D’s surviving desc’s are NOT descendants of SPOUSE. SHARE OF HEIRS OTHER THAN SURVIVING SPOUSE § 2-103 (p.73) Any part not going to D’s SPOUSE, or entire estate if no spouse, thus: (1) to D’s desc’s by representation (2) If no desc’s, to parents equally (or all to one) (3) if no desc or parent, to desc’s of desc’s parents or either of them by representation (4) if no surviving descendant, parent, or descendant of a parent, but Grandparents or desc’s of grandparents half of estate to dec’s paternal grandparents equally if both survive, or to the surviving paternal grandparent, or to the desc’s of the paternal and maternal grandparents, by representation; each half. If no taker, then all goes to the state. Do Estate Planning Problem. p.49. B. Share of Surviving Spouse p.74-86 1. Simultaneous death. Where simultaneous death occurs, the diagnosis of death must be made in accordance w/the usual and customary standards of medical practice. Janus v. Tarasewicz, Ill App. (1985) UPC & Uniform Simultaneous Death Act An heir or devisee or life insurance beneficiary who fails to survive by 120 hours (5 days) is deemed to have predeceased the decedent. C. Share of Descendants 1. Generally: per stirpes per capita w/representation per capita at each generation 2. Advancements: any distributions of estate given to č while decedent living must be deducted from č’s share of deceased parent’s estate, unless č establishes that gift was absolute gift. The gift is put into hotchpot, then divided by the # of č. The donee gets her share, minus the gift already received. E.g., Mary got $10k advancement. Julie and Tim are co-heirs of $50k estate. The $10k advancement gets added to the $50k estate, for a $60k hotchpot. The $60 is divided by 3, so each heir considered to get $20k. Mary already got her $10k, so she’ll get just $10k, while J & T each get $20k now. 3. Special Issues Related to Minors pp.132-40. Guardian of the person – if both parents die while child is a minor, one of the best uses of a will is for appointment of č’s GOP, and to manage the č’s property. Three alternatives for property management: a. Guardianship or conservatorship – the most “straitjacketed” – does not have title to ward’s property, usually cannot change investments w/o court order. Must perserve the specific property left the minor, and deliver at age 18 – unless court approves sale, lease or mortgage. Ordinarily, can nly use income from property to support the ward; cannot go into principal unless court aproves. conservatorship – more flexible powers, makes only an annual accounting. custodianship – person who is given property for benefit of minor under the state Uniform Transfers to Minors Act. A gift or devise is made to X “as custodian for (name) under the (state) Uniform Transfers to Minors Act. no court order no regard to duty or ability of custodian to support minor no regard to any other income or property of the minor which may be applicable or available for that purpose custodian transfers property to minor at 21, or to minor’s estate if minor is dead by 21 Oversight: custodian may manage property and reinvest it in role of fiduciary – subject to “prudent person dealing w/property of another” standard. Trusts are preferable for large amounts. Trust – most flexible; a trust can pospone possession until donor thinks č is competient to manage it. E. “Half-Bloods” are considered as whole siblings in the large majority of states & per UPC, as ½-siblings in others, such as Virginia. So in Virginia, if there are two children, A gets 2/3, A gets 1/3 (estate divided as if three č, then one gets twice as much). In a few states, incl. Mississippi, half-bloods only take when there are no whole-blood relatives of the same degree. In OK, half-bloods are excluded when there are whole-blood kindred by an ancestor & the half blood is not a descendant of the ancestor. F. Bars to Succession pp.141-57 1. Involuntary – most commonly , statutory proscription v. homicide inheritance Manslaughter – bar to inheritance? No – in Vermont. Where no slayer statute, there are three general holdings: a. No consequence to killer – allow inheritance to killer b. No title to killer – equitable principle that wrongdoer should not profit from crime c. Constructive trust – holds killer as constructive trustee of estate on behalf of heirs or next of kin of deceased. However, Probate courts do not have powers in equity 2. Voluntary – Reasons a. Wish to avoid estate taxes; gives as gift to č (if done within 9 months of receipt). b. c. d. e. avoid getting benefits’ reduced/cut off (SSI, etc.) Avoid R with decedent avoid creditors federal tax lien – used to be avoidable by disclaiming. SSI & Disclaimers: Troy v. Hart, 116 Md. App. 468 (1997) SSI recipient could disclaim but the Court held that he’d have to contact the SSA & inform them of his inheritance. The result would be a sort of constructive trust, for which the estate would have to reimburse the State. Sisters said they’d reimburse Medicaid on the “suggestion” of the court. Disclaimants descendents & longtime companion, Hernel Gruber.\ -- this likely kept estate from going to longtime companion. Hm. III. WILLS: ATTEMPTING TO MANIFEST INTENT A. Executing wills. Invalidating Wills: REASONS 1. Insane delusion 2. undue influence 3. sham (not meaning it) 4. Fraud 5. Failure to meet statutory requirements 1. Testamentary Capacity. a. Mental Capacity. i. A will that is the product of the testator’s insanity is not valid. In re Strittmater (N.J. eq. 1947). Subtext: a will that is the product of the testator’s political opinions, where contraindicative of a court’s, may be held invalid as the product of insanity. The court found her writings and testimony about her behavior to be “feminism to a neurotic extreme” and a “morbid aversion to men.” The money went to her relatives instead of the National Women’s Party (NWP). Some alternative tests: 4 prongs to consider TESTATOR ONLY HAS TO HAVE THE ABILITY TO KNOW 1. Nature & extent of testator’s property. 2. The “natural” objects of bounty – usually biological or genetic, or status-based; perhaps raitonal basis. 3. Disposition – T knows what disposition she is making. 4. how these elements relate to form an orderly plan -- as defined by community norms & judge. Average intelligence not necessary – just mind & memory relevant to these four. Must understand the significance of the act. (ii) “A few isolated acts, foibles, idiosyncrasies, moral or mental irregularities or departures from teh normal can’t destroy testamentary capacity unless: a. they bear upon the gift, AND b. they influenced the testamentary act. Estate of Wright, p.163, regarding a man who lived in a shack filled w/dirt & junk, drunk much of the time, played dead, etc. Here, though, the court may have been policy-making, because it noted that the family didn’t seem too concerned about T’s well being while alive. Insane delusion – a legal, not psychiatric, concept. Impairs testamentary capacity when T adheres to an idea against all evidence and reason to the contrary. Some courts say if any factual basis at all, T not insane. A will is invalid if an insane delusion caused or affected, or might have caused or affected, the disposition of the property. Even if disposition of property is rational, the will is valid if delusional. In re Honigman (NY Ct. App. 1960). In this case, there were probably equitable issues, b/c the wife had built a business w/husband & they had been married 40 years. Factors include Insanity Fairness Societal norms c. Undue Influence: i. TEST: “But for” someone’s control, the T’s disposition wd. have been made differently. Lipper v. Weslow (1963). In order to invalidate a will based upon undue influence, there must be proof of facts showing a plan of testamentary disposition by another as the will of the testatrix. NO CONTEST CLAUSES – provides that a beneficiary who contests will takes nothing, or a token amount, in lieu of provisions therein made. Majority rule, incl. Restatement & UPC – enforce unless there’s probable cause for the contest Minority rule --- enforced unless the contestant alleges forgery or subsequent revocation by a later will or codicil, or the beneficiary contests a provision benefitting the drafter of the will or any witness thereto. Believe that “probable cause” rule shifts in favor of litigation & pro contestants. ii. Bequests to Attorneys NY: rejected a per se rule that would create presumption of undue influence if bequest to atty. drafting. In re Henderson (1992). CAL: Leg. enacted § invalidating any bequest to a lawyer who drafts will unless the is related by blood or marriage to T. Exception: if client consults an independent lawyer who attaches a “Certificate of Independent Review” to the will, stating that reviewing lawyer concludes no due influence, fraud, or duress. Mod. R. Prof. Conduct 1.8 – “the client should have the detached advice that another laywer can provide” unless relative or insubstantial gift. iii. Sexual Relationships p.188 Presumption of undue influence could be overcome by showing that T acted upon the independent advice & counsel of one entirely devoted to her interest. In re Will of Moses, Mississippi 1969. The court in Moses found undue influence presumption not overcome b/c of alcoholic woman, disfigured from surgery, had sexual R w/her atty., 15 yrs. younger than she – despite drafting having been done by 3d party atty who said she wasn’t drunk. d. FRAUD Two types: 1. In the inducement 2. In the execution What elements needed? Mirepresentation: a. Intent to deceive; b. for the purpose of influencing T c. But for that fraud, T wd. have bequeathed otherwise. Polygamist – Estate of Alpha Carson T thought she’d really married her “husband,” a marital adventurer. The court asked whether the gift was made b/c of perceived marriage or b/c of intimate relation w/man. The jury should decide, since the couple was married for a few years. Fraud in the execution – where person misrepresents the character or contents of instrument signed by testator. p.214 “Father Divine Fraud” Latham v. Father Divine. T left all to Fr. Divine. Sje was a wealthy white woman, Divine a Black “cult” leader. The court heard testimony that T had been prevented by Fr Divine’s camp from changing her will, the original version of which had bequeathed all to Divine’s mission. Was this fraud in inducement or in execution? The court set up a constructive trust under the assumption that a 2d will would have benefited the T’s family. However, the court did not make any finding of fact, which is improper when setting up a constructive trust. A case of constructive racism – where a white woman bequeaths to a black man, it is presumptively invalid.? Tortious Interference w/Expectancy p.221 Marshall v. Marshall – Anna Nicole Smith Court found intentional interference w/ANS’s inheritance where lawyer drained assets from estate. To find this, the conduct must be tortious in itself (such as shredding docs, making fakes). Must be “but for” the tortious interference, the T’s intent wd. be met. Note: SOL for contesting will is quite short; longer for tort. e. SHAM WILLS See Fleming v. Morrison – woman induced to sleep w/T. The court held it was sham & denied probate. She could not have contested will under tortious interference b/c T was not defrauded; only the beneficiary was. f. AMBIGUOUS INTENT 417-27 The portion of any residuary estate that is the subject of a void gift to one of the residuary beneficiaries remains undisposed of by the will & passes to the heirs at law. Estate of Russell. Cal. 1968. gift to dog was void, so instead of giving all to beneficiary, that part went via intestate succession. The court sawed on about having to interpret in light of the circumstances, per the evidence available – including extrinsic evidence, despite the parole evidence rule. Alternative interpretation – it went to the T’s niece instead of to her paramour. Equivocation – where a description fits tow or more externam objects equally well (e.g., to Alicia, when there are two Alicias); evidence merely makes terms more specific. Misdescription of property or person – a mere falso description of property or recipient may be stricken. Malpractice – Should lawyer be liable for malprax for any costs and loss from litigation? Although an atty. is liable to testamentary beneficiaries if beneficiaries clearly designated by T lose their legacy as a direct result of that negligence, is not liable for drafting an ambiguous document. Ventura County Humane Soc. v. Holloway, 40 Cal. App. 3d 897. (1974) 2. Statutory Requirements a. Attested Wills i. Writing/Signature/Publication pl.223-27 Execution Checklist 1. Number pages 2. Staple them 3. make sure T has read will & understands it. Check for undue influence, fraud 4. Bring two, disinterested witnesses into a private room, excluding all others. UPC – not necessary that disinterested, though it’s still recommended. Further, the will is likely to be probated in a different state. UPC 1. writing 2. interested witnesses allowed WILLS ACT 1. writing 2. purging statute if interested party p.241 a) purges witness only of benefit that wd. exceed if this will had been executed; if previous will had been executed or intestacy 3) Sign at foot & at margins of pages. ii. Witnesses Estate of Parsons: Purging Statute – Probate Code §51 required two disinterested w’s. Nielsen disclaimed. Under disclaimer rule, it sis as if disclaimer predeceased. However, the court held that the purpose of disinterested witnesses is to protect AT THE TIME OF EXECUTION the T from undue influence, etc. Therefore, the disclaimer wd not take. Therefore, w/no valid witnesses the will went to intestacy. iii. Execution Self-proving affidavit – typed at the end of the will, swearing before a notary that will has been duly executed, is then signed by T and the w’s before the notary – who signs & seals. if w’s are dead or cannot be located or have moved far away, spa recites that all requirements of due execution. When a husband signs a wife’s will & a wife signs a husband’s will, can they be probated? NO. The Wills Act says that the T must sign the will; if the T is not the signator, then it is invalid. In re Pavlinko’s Estate, Penn. 1959. p.247 However, some states have moved away from this. NY, In re Snide, 1981. Harmless error (p.252) -- UPC similarly – allows courts to ignore a lack of adherence to the required formalities if there is clear and convincing evidence that a doc is intended as a decedent’s will, a change to it, or a revocation. Substantial compliance rule – the court prioritized intent of T. Ranney NJ 1991. In Ranney, the T attached a self-proving affidavit w/witness’ signature – which were not on the will itself. Restatement & UPC have adopted : A harmless error in executing a will may be excused if the proponent establishes by clear & convincing evidence that T adopted the document as his or her will.” FUNCTIONS OF WILL REQUIREMENTS 1. Ritual/cautionary 2. Evidentiary – main actor is dead & her testimony is not applicable; a reliable substitute for her testimony is needed. 3. Protective – ensure no coercion, undue influence or fraud 4. Guideline/Channeling – statute dictates how a T can, by following rules, get will to reflect their wishes.. 5. Reduce court costs & time b. Holographic Wills are recognized by about half of the US states – not by Mo. Note, however, that harmless error analysis might get a holog. will probated – the missing portion – witnesses, might be supplied by “clear & convincing evidence” that the holog. will was intended as T’s will. Handwritten by T Must bear signature, and in some jurx, the date. Rationale for accepting holographic wills: (1) Evidentiary --handwriting decreases likelihood of fraud when it is in T’s own handwriting; Even strict adherents to will regulations, as the Penn. sup. ct. in Pavlinko, allow holographic wills to stand. (The will in Pavlinko was typewritten; without the signatures, there was little to provide evidentiary aspect.) (2) Ritual function – possibly met with the signature & the unusual act of writing. (3) Protective – the amount of time necc. to write a holog. will may decrease the likelihood of fraud. (4) Allows unrepresented and penurious folks to have their T wishes met. Uneducated T – considerable leeway: IN Kimmel’s Estate, Sup. Ct. Penn. allowed considerable leeway in interpreting a letter, full of other material, to exist as a will because it found language making assignment of property to sons to whom letter was addressed (ct. found this to be testamentary). They construed that having signed it “Father,” per T’s custom, met the signature requirement b/c of his custom and his having mailed it as a finished document. material portions test – courts will often probate holographic wills where portions are typed, if the testamentary intent is evident from handwritten portions. In re Estate of Johnson. However, the court in did not find that the will met the test. 1. Strangers had the will – the court probably wondered why these strangers, including a televangelist, were among devisees and not T’s 6 č. 2. Likely the court held the will to have been a case of undue influence or fraud. 3. The size of the estate was likely considerable, a factor which the court likely considered tacitly. Weird wills – Should a will handwritten on a plaster wall be given probate? It was in T’s handwriting, dated & the plain language stated: You take care of all my belongings . . .” This will cd. be read as giving Genevieve, named in will, as executorship – not a divise. Is a will valid if it does not dispense property? A will can be a will if it: 1. Distributes property; 2. Names an executor or representative; or 3. Revokes a prior will. INTEGRATION OF WILLS Four Primary Doctrines 1. Integration – all papers intended to be considered together; signature + initials on each page handwriting in non-black ink stapled together ex toto pagination uniform font & ink uniform paper – size & color blank space avoided sentences that carry over from page to page (v. “loose leaf” will) 2. Incorporation – a document that becomes part of the will by a reference made w/in the will. Clark v. Greenhalge. Must be: (a) in existence at time of will’s execution; and (b) identified by clear & satisfactory proof as the appear referred to in the will. In Clark v. Greenhalge, however, if the writing were not in existence at the time of execution, but after, would not be given effect uless under a substantial comploiance doctrine as in Ranney, or a harmless error analysis such as in UPC § 2-503. 3. Republication – will re-executed by codicil; will has to have been properly executed, then re-executed as of date of codicil; Johnson v. Johnson (OK 1954) Court held that acodicil validly executed operates as a republication of a will no matter what defects may have been in the original. Typewritten part: unsigned & unwitnessed (invalid will, either as holograph or formal) + handwritten portion (signed). Here, the codicil: (a) showed intent to incorporate w/language: “this will shall be complete . . .” in the codicil portion; and (b) was written on the same piece of paper as typed portion “A will may be so defective, as here, that it is not entitled to probate, but if testamentary in character it is a will, nonetheless. . . “ (313). However, this doctrine is not applicable in most states, who say that in order to be a will the document must be probatable. A codicil cannot republish an document that is not valid as a will. I think this case involves a court that wanted to honor the document b/c of the court’s corruption, misunderstanding of the law, or simply wanting to favor the T’s intent at the risk of fraud. Almost every state allows incorporation by reference of holographic wills w/ typewritten portions. 2 Step Process: a. Look at handwriting only to see if there is testamentary intent. If valid – b. A separate piece may be typewritten or handwritten if it is incorporated by reference. What if it’s written on the same piece of paper? (There’s more room for fraud to two pieces.) Constructively sever the will, then probate it per above. 4. Acts of independent significance – outside events affecting gift. Compare safety deposit box case – the access to box likely restricted to T, whereas notebook lying in drawer – depending on whether locked or not – may be susceptible to forgery. Also – there’s an independent nature to putting things in a safety deposit box (wanting to safeguard belongings). C. WILL CONSTRUCTION 1. Admission of Extrinsic Evidence (p.417) Traditionally – only plain meaning of will allowed; Nontraditional – judge has to look at wills subjectively to discover intent. a. Mistake in Drafting pp.409-414 “A will duly executed and allowed by the court must under the statute of wills be accepted as the final expression of the intent of the person executing it.” Therefore, no extrinsic evidence regarding T’s intent where testamentary language is clear on its face. Mahoney v. Grainger (Mass. Sup. Judicial Ct. 1933). b. Ambiguity Estate of Russell – T left holog. will to her boyfriend and to her dog. Precatory trust -- no legal enforcement; only moral one. ; decided to focus on “strict” meaning of “and” in gift to Chester Quinn & Roxy Russell (the dog), finding that the gift left the estate in equal shares to the dog. IN doing so the court rejected extrinsic evidence that T wanted Quinn to use the estate to care for her dog – not to divide it between the two. “No words of the will give the entire residuum to Quinn, much less indicate that the provision for the dog is merely precatory in nature.” c. Correcting Errors Scrivenor’s error – if misleads T into thinking will will be valid, extrinsic evidence of T’s intent admissible. 2. Changes in Conditions or Status of Beneficiaries pp.438-58 (a) ANTILAPSE STATUTE (439) under certain specified circumstances, antilapse statutes substitute another beneficiary for the predeceased devisee. i. Specific or general devise. Devise falls into the residue. Thus: T’s will bequeaths her watch (a specific bequest) to A and $10k (a general bequest) to B. The residuary devisee is C. A & B predecease T. The watch and the $10k go to C. ii. Residuary devise. if devisee(s) of residue predecease T, in most jurx the residue goes to T’s heirs by intestacy. (“no-residue-of-a-residue” rule.) iii. Class gift. If devise is to a class, and one member of the class predeceases the T, the surviving members divide the gift. iv. Void devise. Where devisee is dead at time of execution, the devise is void. Note: most states specify that if a devisee is some specified relation to T, then a predeceased devisee’s devise goes to devisee’s heirs. UPC, etc. Some limit to descendents of T, others to T’s grandparents’ kin, others to all kindred of T; some to T’s spouse’s kin. Do the words “living brothers & sisters” used in a will constitute words of survivorship such that application of the antilapse statute is precluded? YES. T’s intent is primary concern. Allen v. Talley. (b) May the words “and” and “or” be substituted for each other in arriving at a proper consstruction of a will? YES. Jackson v. Schultz (Del. 1959) – where doing so will carry out the T’s intent. (In this case, T wanted property to go to his wife, or to her heirs –but the language of the will made it sound like a class gift – to wife and to her heirs – such that an antilapse statute would apply, leaving it to T’s heirs). 446. (c) Generally, naming an individual in a bequest prevents the gift from becoming a class gift. Dawson v. Yucus (IL 1968). In a case where T had written a devise to “One half to Stewart Wilson [nephew] and one half to Gene Burtle,” another nephew. Wilson sued Burtle’s heirs, saying it was a class gift. Heirs said naming individuals made it not a class gift. The court found that the death of Burtle created a latent ambiguity such that extrinsic evidence of T’s intent allowed; evidence showed that T wanted the shares to go to either to her husband’s side of the house, or to the nephews b/c she felt esp. close to them. She was not close to others. The court found the gift to be to individuals – not to a class, and that the residue took the Burtle half. Why not a class? i. Not all members named. ii. T knew how to make a class gift & did not. iii. T gave each devisee half (a specified interest) – not leaving room for other potential class members; iv. T didn’t call it a class or use like language. Without a class, the share lapses and goes to the residuary. (Note: fragmentation of land is generally contra policy; perhaps the court felt testamentary intent should prevail here.) (d) “To A and the children of B” is a gift to an individual and to a class in the absence of additional factors. If A dies before T, then share lapses and does not pass to B’s č. Vice versa. In re Moss. 1899. To wife, for life, and after to Fowler & sister’s children – to be divided as tenants in common. A gift by will to a class properly so called and a named individual such as A equally, so that the testator contemplates A taking the same share that each member of the class will take, is prima facie a gift to a class. D. REVOKING WILLS – must have animus revocandi All states allow revocation by: (1) subsequent writing executed w/testamentary formalities or by (2) a physical act such as destroying, obliterating, or burning the will. Oral revocation not respected anywhere, and the will so attempted to be revoked will nevertheless be admitted to probate. A will cannot be revoked simply by writing ords purporting cancellation on the back of the will. Thompson v. Royall (Va. 1934). 1. Revocation in Entirety a. By Subsequent Instrument pp.276-77 A subsequent will that does not expressly revoke the prior will but makes a complete disposition of the T’s estate is presumed to replace the prior will and revoke it by inconsistency. b. By Physical Act If a person’s will is not found among her personal effects after her death, it is presumed to have been destroyed. Harrison v. Bird (Ala. 1993). Presumption is rebuttable, burden is on proponent. The idea is that if a T wants to revoke, and has a bunch of copies distributed, she can nevertheless destroy it and the other copies cannot be probated. c. By Operation Law p.298-300 Marriage -Divorce – in almost all states divorce revokes a gift to a spouse (not whole will, la Erickson). step-son – UPC § 2-804 says that divorce revokes gifts to divorced spouse’s relatives. Some state statutes treat divorce spouse as if she had predeceased. In suc a case, no mention of ex-spouse’s relatives & stepson takes. 2. Partial Revocation 284-85 UPC authorizes revocation, asking whether it refelcts an itnett o revoke, or a tentative act/musing/draft/nonfinal versin. Light pencil as tentative – In re Byrne’s Will (p.285). Some states don’t allow change to increase devise to another devisee automatically: E.g., $10k to A & B, residue to C. T later lines out B’s name. A’s gift cannot be increased this way. The $5k given to B falls into the residuary & goes to C. Holographic will partially revoked? If there’s a cross-out, is that a revocation? a codicil? a subsequent writing revocation? In LaRue v. Lee (Wva 1908) the court held it to be a subsequent writing. 3. Dependent Relative Revocation & Revival – T based revocation on mistaken assumption of law or fact, revocation ineffective if T would not have revoked had she known the truth. Rebuttable presumption arises where T marks through will. Carter v. 1st United Methodist p.286 1963 – T signed & attest w/pencil marks thourhg property disposition 1978 – will – unsigned & unwitnessed 2 issues: Whole/partial revocation? Presumed T made pencil markes in her possession; court found that she intended to revoke will entirely b/c al property dispensations marked through. Use 2d, unattested will? Assumed revocation dependent upon 1978 version’s effectiveness, b/c they were wrapped together. 4. Revival. 296-98 a. Common law – (only a few states) original will in effect b. Majority – no revival – revocation is immediately effective, so even if a subsequent will is revoked, a prior revoked will remain revoked. Intestacy will result. c. UPC – hybrid. Court attempts to ascertain what T intended at the time revoked 2d. E. RESTRICTIONS ON THE POWER OF DISPOSITION: FAMILY PROTECTION 1. Protection of the Spouse. a. Community property (8 states – w/Latin heritage: NM, AZ, TX, LA, CA, WA, ID, NV +AK, if elected by couple. ) All earnings and property acquired from earning during marriage. Exceptions: (1) all prop. acquired before marriage and kept separately during marriage; (2) inheritance; and (3) gifts. Both spouses own CP EQUALLY. At the death of spouse, the survivor owns a half interest of the whole estate. The decedent spouse’s property passes via decedent’s T power. If intestate, the surviving spouse can take spousal share. Right of alienation – each spouse has authority to sell property, but spouse can challenge. b. Separate Property: each spouse keeps his/her own property; statutory 1/3 share goes to spouse, except in Georgia, which demands only support. Pertains to probate & nonprobate property. Elective Share Sullivan v. Burkin. Husband brought assets to marriage & kept control of property. Upon his death, wife sued for 1/3 of his property and lost. I. Bright line rule – an inter vivos trust that is a. revocable b. created during marriage c. where creator maintains power over assets is included in the augmented estate. cf. OTHER TESTS: II. Illusory transfer a. Motive matters; where found that inter vivos trust set up to hide assets from spouse it’s part of estate. b. where T has control of assets. III. Intent to defraud test – look at a. subjective intent b. others look for objective evidence of intent – control retained by transferor, amount of time b/w transfer & death, degree to which surviving spouse is left w/o an interest in the decedent’s property, or other means of support. IV. Others look at present donative inent to transfer a present interest in the property – looking not at what transferor retained, but on whether the transferor inteded to make a present gift. STATUTES UPC (p.507) – achieves results closer to community property; Add up all the property of both spouses & split it according to a percentage based o the length of the mariage. Augmented estate retains only transfers made during marriage, as well as transfers from before and during marriage where D retained substantial control of the property. It also includes property or powers received from others. NY (p.512) - replaced illusory transfer test w/scheme for subjecting some nonprobate transfers to elective share. Surviving spouse gets $50k or 1/3 net estate, whichever is greater. Includes: a. gifts made w/in one year before death, excepts gifts not exceeding $10k/person. b. property payable on death to a person other than D. c. Lifetime tx’s in which D retained possession or life income or “aa power to revoke such disposition or a power to consume, invade, or dispose of the principal thereof.” d. any property over which D had a general power of appointment enabling him to appoint the property to whomever he pleases. An inter vivos trust in which D retained a limited power of appointment constitutes a testamentary substitute in violation of surviving spouse’s right of election. I n re Reynolds, NY 1996. iii. WAIVER Pre-nup: Parties may waive their right to elect against eh D’s estate in a prenuptial agreement. In re Estate of Garbade. Must be entered into: a) freely; b) knowledgeably, ,and (c) without exertion of undue influence or duress. Even 3 weeks before marriage, it may be duress. However, the NY court found no duress even though agreement was presented only a few hours prior to marriage. (Maybe b/c wife was unemployed at marriage.) e. MULTI-STATE COUPLES I. Classic conflicts of laws rules are used to determine which state law governs: a) land – governed by law of situs; however, situs state may choose to apply the law of the marital domicile. b) The law of the marital domicile at the time personal property is acquired controls the characterization of the property (as separate or community); c) the law of the marital domicile at the death of one spouse controls the survivor’s marital rights. II. Moving from Separate to Community Property State (p.526) POZOR to spouse – if all property was acquired in sep. property state, and they move to community property state (where no elective share), then the spouse may be royally screwed. hence, quasi-community property developed == property a pouse acquired while domiciled elsewhere, which would have been domiciled in the community property state when the property was acquired. During marriage – treated as separate property; At death – one half of the quasi-community property belongs to surviving spouse. If nonacquiring spouse dies first, acquiring spouse owns absolutely. III. Moving from Community Property to Separate Property State Generally does not change existing property rights. CP continues as CP. Any couple moving CP into separate property state should be careful to preserve its community nature. If CP is sold and proceds use to purchase other assets, title to new property should be taken in the name of both spouses as community property. If resistance met, execute written agreement that property retained as CP. don’t advise joint tenancy – for income tax advantages will be lost & liable. community property w/right of survivorship – the purpose is to avoid probate costs on the passage of the D’s half of CP to surviving spouse – in effect making community property w/right of survivorship nonprobate property. f. Spouses Omitted from Premarital Wills The omitted spouse wd. take only probate property – no augmented estate. Presumed that T wanted spouse to have more than elective share, where no evidence that T intentionally omitted spouse. Disinheritance clause – in a will does not apply to T’s subsequently acquired spouse w/o showing intentional disinheritance. Estate of Shannon (Cal. 1990). 2. PROTECTION OF CHLDREN . A parent can disinherit a č in most states, except in Louisiana, which has a legitime for č < 23y.o. or who are disabled. Other states disinherit at will, though presumption is in favor of č. Afterborn č if not in will are presumptively included in most states. or, if not named & preborn, some states presume included or mistakenly believed to be dead. A č must be born after the making of a will or the last codicil in order to be a pretermitted č. Azcunce v. Estate of Azcunce, FL App. 1991. Here, T’s 2d codicil republished wills on which Π had been pretermitted, yet w/republication was no longer. NOTE: disinherited č has no standing to sue who neg. drafted will & codicils leaving č out. Espinoza v. Sparber, FL 1993. BE AWARE of testamentary libel! pp.550-51. IV. WILL SUBSTITUTES: NONPROBATE TRANSFERS A. Contracts w/Payable-on-Death Provisions (pp.331-44) A payable on death designation in a k of deposit is an invalid testamentary disposition. B. Multiple Party Bank Accounts pp.344-50 Three types of purposes, and courts are often forced to figure out which type it is. A, depositor; B other account holder. A may intend: 1. that either A or B is to have power to draw on the account and the survivor owns the balance of the account (“true joint tenancy account); 2. that B is not to have power to w/draw on the account during life, but is entitled to the balance upon A’s death (a POD account disguised as joint account); 3. that B is to have power to draw on the account during A’s life, but is not entitled to th e balance at A’s death (an agency account disguised as a joint account). C. Joint Tenancies 350-351 A common way of avoiding probate. Three features to mention: 1. JT’s have equal interests upon creation. During life, neither can revoke nor transfer the other’s interest. 2. JT cannot devise his/her share by will. He must sever the JT during life if he wants someone other than co-tenant to take it, converting it into a tenancy in common. 3. Creditors’ rights – a creditor must seize the joint tenant’s interest during life. At death that tenant’s interest vanishes. One claiming adversely to an agreement creating a joint tenancy has the burden of establishing the donor’s lack of intent by clear and convincing evidence. Franklin v. Anna Nat’l Bank, 140 IL App. 1986. p.345. CREATION OF A TRUST p.567 The sole question is whether the grantor manifested an intention to create a trust R. “To A for the use & benefit of another” sufficiently manifests such intent. 1. Valid Purpose from state planning to providing beneficiaries for their needs, or running even vast business or charitable enterprises, or for pensions. Private Express Trust – gratuitously created for the benefit of individual beneficiaries. Revocable Inter Vivos Trust – most flexible of all will substitutes; the donor can draft the dispositive provisions and the administrative provisions precisely to donor’s liking. In the deed of trust the settlor transfers legal title to the property to a trustee, pursuant to a writing in which the settlor retains the power to revoke, alter, or amend the trust and the right to trust income during lifetime. a. At settlor’s death, the trust assets are to be distributed to or held in further trust for other beneficiaries. b. Settlor may also reserve an income interest and a testamentary power of appointment. Revocable Declaration of Trust – settlor declares self as trustee, with remainder to pass to others at his death. 2. Terms: declaration of trust – settlor as trustee; settlor declares that she holds certain property in trust. Settlor must merely manifest an intention to hold personal property in trust. Real estate requires a writing. deed of trust – settlor transfers property to trustee for the benefit of a beneficiary. 3. Trustee: 1. Must maintain records showing how money invested. 2. Beneficiary may sue trustee & achieve a constructive trust for money wrongfully intested. Jimenez v. Lee. Trustee can be joint tenant w/beneficiary/ies. Jimenez v. Lee, 274 OR 1976 Trust created with the simple request by grantors that money be used for plaintiff’s educational needs. Doctrine of merger, where legal and equitable title would merge, did not terminate trust when checking account and bond were in plaintiff’s name alongside the trustee’s (father). 4. Intent – no particular words necessary – “for the use and benefit” of another may work. 5. Property. a. A trust cannot exist without property. b. Property must be known and identifiable. Unthank v. Rippstein, Tex. 1964. “I hereby and herewith bind my estate to make the $200 monthly payments provided for.” This did not clearly show intenet to create a trust; w/o such an expression, court wd. not infer one. Lesson: to make sure future payments are made from estate, create a trust document or create a trust in a will to which the money to satisfy the gift is paid by the estate to the trustees to disburse. c. Property must be known, identifiable, and in existence before trust created. Brainard v. Commissioner, 7th Cir. 1937. Here, there was the settlor’s (a) oral declaration of trust creation in 1927. (b) preoperty identified as stock trading profits from 1928. Issue: was property in existence when declaration was made (1927) or upon the creation of the profits? (1928) holding – not until profits realized was the trust created. Settlor must re-declare intent once property comes into existence. In the meantime, settlor is responsible for taxes on the property. A person can, however, bind himself to create a trust in the future so long as valid k elements are there: consideration, etc. 6. Beneficiary. p.561-62, 597-608. There must be someone to whom trustee owes fiduciary duties. The beneficiaries, though, may be unborn or unascertained when trust is created. However, if when the trust becomes effective the beneficiaries are too indefinite to be ascertained, the attempted trust may fail for want of ascertainable beneficiaries.s A beneficiary has to be definite and identifiable, with legal standing to hold trustee to her/his legal duties. a. To my friends – to be identified by trustee – too indefinite & trust fails. Clark v. Campbell. Since there is no statutory meaning, and no case law defining “friend,” the trust fails. Concurring Arguments 1. Clarity privileged --- “friends” is too messy, there’s too much potential for litigation. Contra arguments 1. The Court privileges status over function. Beneficiaries functioned as friend. Why privilege statutory definitions? The trustee determines the friends. Extrinsic evidence would show who a friend is. b. Trust where trustee to benefit dog? A precatory trust, not a legal trust. The honorary trust are generally held valid in three situations: 1. taking care of 2. “” animals specified in trust 3. to say Masses. The court can appoint an enforcer, or use the person named. 7. WRITING The normal legal devise for trust is in writing. A testamentary trust needs to conform to the Wills Act and hence, writing required. An inter vivos trust must conform to the Statute of Frauds, hence real property must be granted in writing; personal property may be orally granted. Exceptions – resulting & constructive trusts arise by operation of law, and are therefore not subject to the Statute of Frauds. 1. Resulting Trust – a trust that arises by operation of law, in one of two situations. a. Where an express trust fails or makes an incomplete disposition b. Where one person pays the purchase price for property, and causes title to the property to be take in the name of another person who is not the natural object of the purchaser’s bounty. Hieble v. Hieble, p.609 tx’d real prop. to son & dtr. temporarily, in joint tenancy w/them. Dtr. reconveyed interest to mom. Mom got promises from son to (a) reconvey land Oral promise to reconvey land? Ct. found constructive trust, irrespective of SDF. The lesson is that an oral agreement may give rise to a constructive trust in land, despite the SOF. Secret trust – so constructive trust, the only means of previous unjust enrichment. The constructive trust imposed to prevent unjust enrichment. Olliffe v. Wells. p.614. Trust failed b/c no definite beneficiaries where language “to distribute [property] the same & such manner as in his discretion shall appear best calculated to carry out [my] wishes. . . .” semi-secret trust – invalid b/c beneficiary not identified. C. SPECIAL TYPES OF PRIVATE EXPRESS TRUSTS 1. Discretionary Trusts, p.617-31 the trustee has discretion over payment of either hte income or the principal or both. a. Three lessons: i. The trustee of a support trust is required to inquire as to the needs of the beneficiary. Marsman v. Nasca (Mass. Ct. App. 1991). Even for a spoiled rich brat, “lifestyle to which [beneficiary] has been accustomed” means meeting that standard of luxury. Further: ii discretion of trustee is not absolute; must be exercised w/prudence & within reason. Finally, iii. exculpatory clause – if it is not overreaching or due to undue influence – is not per se invalid. 2. SPENDTHRIFT TRUSTS Two important components: beneficiaries cannot voluntarily alienate their interests creditors cannot reach the beneficiaries’ interests. Exceptions: a) Cannot be self-settled. b) Child Support & Alimony – in the maj. of states c) Furnishing necessary support – a person who has furnished necessary services & support can reach a beneficiary interest in a spendthrift trust d) Excess over amount needed for support – several states – the beneficiary’s creditors can reach that part of the spendthrift trust income in excess of the amount needed for the support and education of the beneficiary e) Percentage Levy – creditor allowed to reach a certain percentage of the income f) Tort creditors – not settled yet whether they can reach. Though creditors can’t reach spendthrift trust, can it be reached for č support or alimony? YES. Public policy requires that the spendthrift provisions of a trust be overridden for that portion of the trust realizable by the beneficiary. Shelley v. Shelley – the court here made an emergency provision for ex-wife, who would have ended up on welfare, and for the č. The court further counseled the č to go to ct. equity for t’ee’s abuse of discretion. Federal law permits the IRS to levy all property and rights to property, whether real or personal. However, creditors such as the IRS, who stand in the beneficiary of a discretionary trust’s shoes, have no remedy against the trust unless & until the trustee makes a distribution. U.S v. O’Shaughnessy (MN 1994). Three important considerations w/discretionary trusts, per O’Shaughnessy: Any attempt by trustees to violate the intent of the settlor, even using their unbridled discretion, is an abuse of that discretion. However a trustee cannot withhold money in order to defraud creditors. Nevertheless, if the rust allows distributions to be made for the benefit of the beneficiary, rather than to the beneficiary himself, creditors cannot reach those distributions. D. MODIFICATION & TERMINATION OF TRUSTS If the settlor and all the beneficiaries consent, a trust may be modified or terminated. p.651. 1. Terms of trust may not be modified after death of settlor unless modification prevents the purpose of the trust from being substantially impaired due to circumstances that arise after settlor’s death and which were unknown to settlor at time trust was created. In re Trust of Stuchell, Or. Ct. App. 1990. 2. Trust may be terminated if all beneficiaries agree AND a. no beneficiary is under a legal disability b. modification does not frustrate the trust’s purpose. In re Trust of Stuchell. c. all material purposes of the trust have been achieved. In Re Estate of Brown. d. 3. Drafting advice. When drafting a trust that will last into the unforeseeable future, consider giving a beneficiary – either the life tenant or a remainderman – or an independent 3d party the power to modify or terminate the trust. May in the form of a special power of appointment. Special power has no adverse tax consequences to donee, b/c IRS doesn’t consider donee the owner inasmuch as the donee cannot benefit herself. 4. Changing trustee – the settlor reposed special confidence in the designated trustee; the court will not change trustees merely b/c beneficiaries want it to. E. POWERS OF APPOINTMENT 665-73; 676-88 1. Donor creates power of appointment. Donee holds power of appointment. Objects – persons in whose favor the power may be exercised, when power is exercised person becomes appointee. Instrument creating power may provide for takers in default of appointment if the donee fails to exercise th power. a. General power is exercisable in favor of the donee. b. Special power is not exercisable in favor of donee. 2. No title or interest in a thing vests in donee until the power is exercised. In Indiana, this means that creditors can’t get to property untill donee exercises that power. Irwin Unin Bank & Trust v. Long, Ind. App. 1974 & Restatement of Property § 13.2. However, this rule has been changed in may states by statute. 3. A contract to exercise a testamentary power is void. however, a k under which the power is released will normally be enforced since, once release, the holder can no longer exercise it. F. CHARITABLE TRUSTS p.859 1. Acceptable Charitable Purposes: a. poor/need b. education c. advancement of religion d. promotion of health e. government or municipal purposes f. other purposes to benefit a community i. To be upheld as a trust, the settlor’s dominant intention must be charitable (see above), not just benevolent. Shenandoah Valley National Bank v. Taylor, VA 1951. 2.. Modification: CY PRES A. When a donor has a general charitable purpose for a gift or devise, cy pres doctrine may be exercised to modify the fit if original intention impracticable or illegal. In re Neher, NY Ct. App. 1935. When th eVillage of Red Hook didn’t have the resources to establish and maintain a hospital, and hospital rendered unnecessary b/c of newly built one nearby, cy pres was exercised to use the land so bequeathed for charitable purposes. Neher, cont’d. p.870 The court in In re Neher considered: a) the will didn’t specify a certain type of hospital or med. facility b) didn’t provide for management of a med. facility, except naming trustees of Red Hook as Board c) no express language about the particular use of the hospital in the will B. But see limits of cy pres: No law requires a T to make a gift which the trustees deem efficient or to constitute effective philanthropy. Moreover, calculating “benefit” involves inherently subjective determinations; thus what is “effective” or “efficient” will vary, depending on the interests and concerns of the person or persons making the determination. Cy pres does not authorize a court to vary the terms of the bequest merely b/c the variation will accommodate the desire of the trustee.” The trial court in Buck Trust, reprinted in 21 U.S.F. L. Rev. 691 ... Relative need is not an appropriate basis for modifying the terms of a testamentary trust. 3. SUPERVISION Donors do not have standing to enforce the terms of a gift where there was no express reservation of control over the disposition of the gift. Herzog Foundation v. U. of Bridgeport, Ct. 1997. p.883. Uniform Trust Act – 1999 draft – provides that a court may apply cy pres if particular charitable purpose becomes “unlawful, impracticable, impossible to fulfill, or wasteful.” (877) Barnes Foundation I. Montgomery Co. Ct. of Common Pleas G. RULE AGAINST PERPETUITIES 1. Class Gifts pp.807-18 All or nothing rule (a) class must close; and (b) all conditions precedent for every member of class must be satisfied, if at all, within the perp. period. T to A for life, then A’s č for life, then to A’s grandč. Void.A life interst valid. A’s č valid. A’s č get a contingent R that could vest 21 years after A’s life. 2. Rule of convenience – the class will close when any member of the class is entitled to immediate possession & enjoyment. O to A, then to grandč. Grandč alive at time is G. G can therefore vest, and the gift is valid. If O had no grandč, then void. A for life, then to A’s č who reach 25. Fails. 3. Class gifts that may vest too remotely with respect to even one member of the class will be void as to the entire class. Ward v. Van der Loeff, A.C. 1924. 4. Saving Clauses p.829-30 “Notwithstanding any other provisions in this instrument, this trust shall terminate, if it has not previously terminated, 21 years after the death of the survivor of the beneficiaries of the trust living at the date this instrument becomes effective. In case of such termination the then remaining principal and undistributed income of the trust shall be distributed to the ten income beneficiaries in the same proportions as they were, at the time of termination, entitled to receive the income.” There may be substantial estate tax or generation-skipping transfer tax advantages for keeping the trust going for the max. perpetuities period by each generation exercising special powers of appointment prolonging the trust. 5. PERPETUITIES REFORM a. Cy Pres – a court might insert a saving clause adapted to the particular possibility that causes the gift to be invalid & thus interfere as little as possible w/T intent. unborn widow – some courts presume that a gift to a spouse is a gift to a person in being. fertible octagenarian – may be dealt with by presumption that a woman is incapable of bearing č after 55 & swears not to adopt. b. Wait and See (Penn., Restatement (2d) adopted) waiting and seeing what actually happens, not voiding an interest b/c of the possibility that something might happen. 6. Charitable Trusts are generally exempt from RAP.