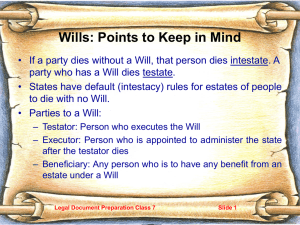

TRUST & ESTATES OUTLINE FALL 2002: Rosenbury I. INTRODUCTION

advertisement