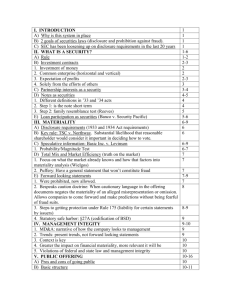

Securities Outline Regulating the Market through Disclosure I. Regulating Securities

advertisement