Federal Income Tax Outline

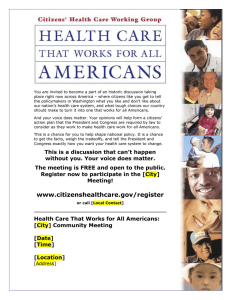

advertisement